This version of the form is not currently in use and is provided for reference only. Download this version of

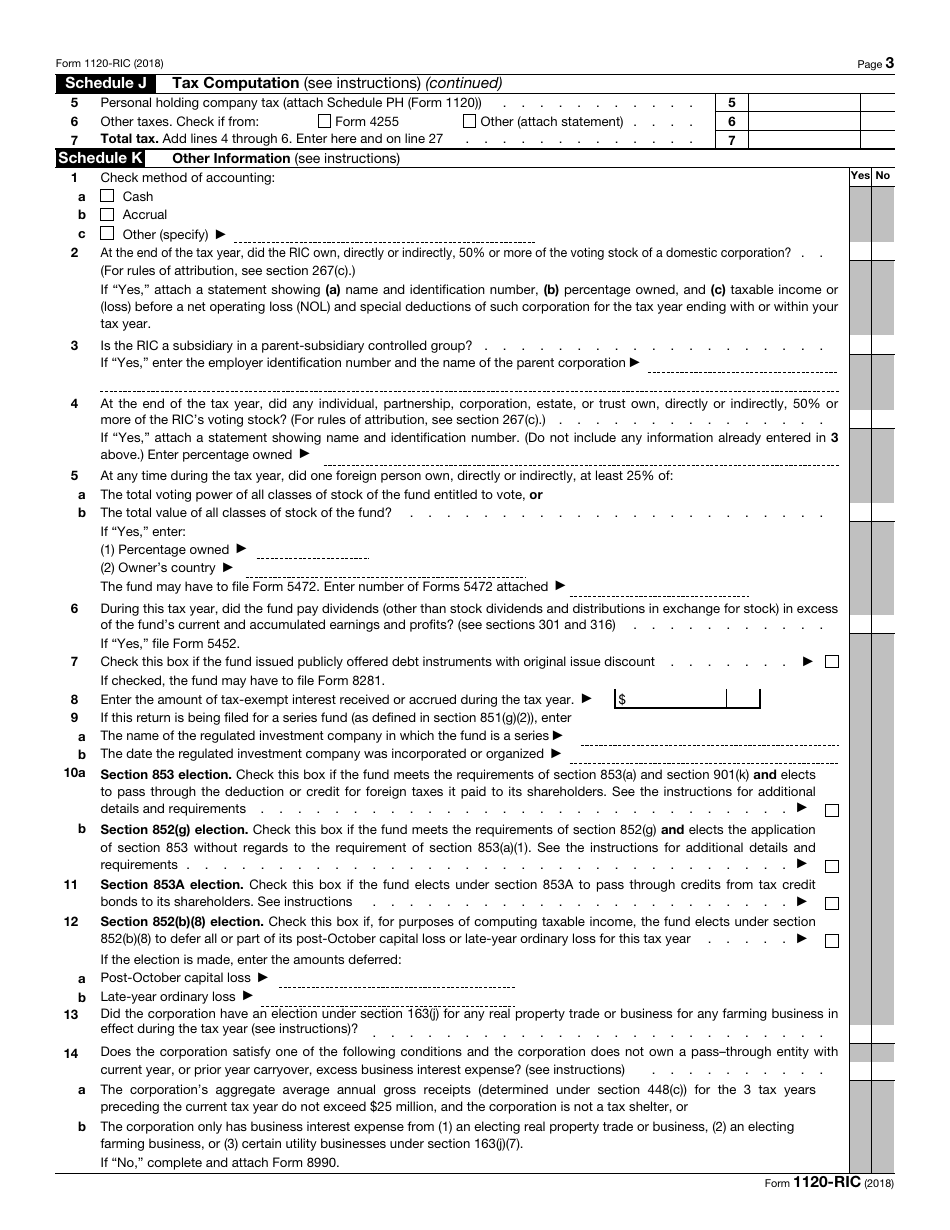

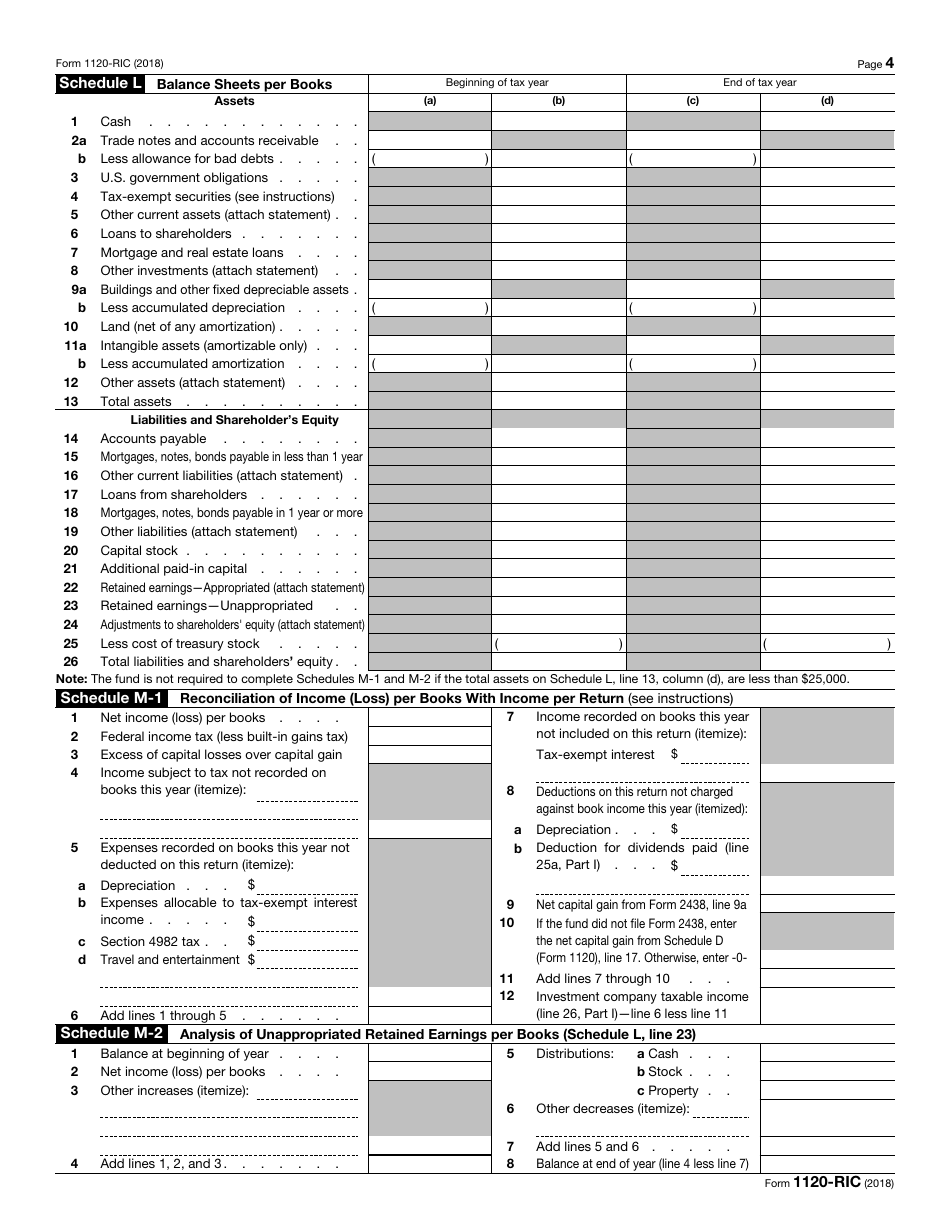

IRS Form 1120-RIC

for the current year.

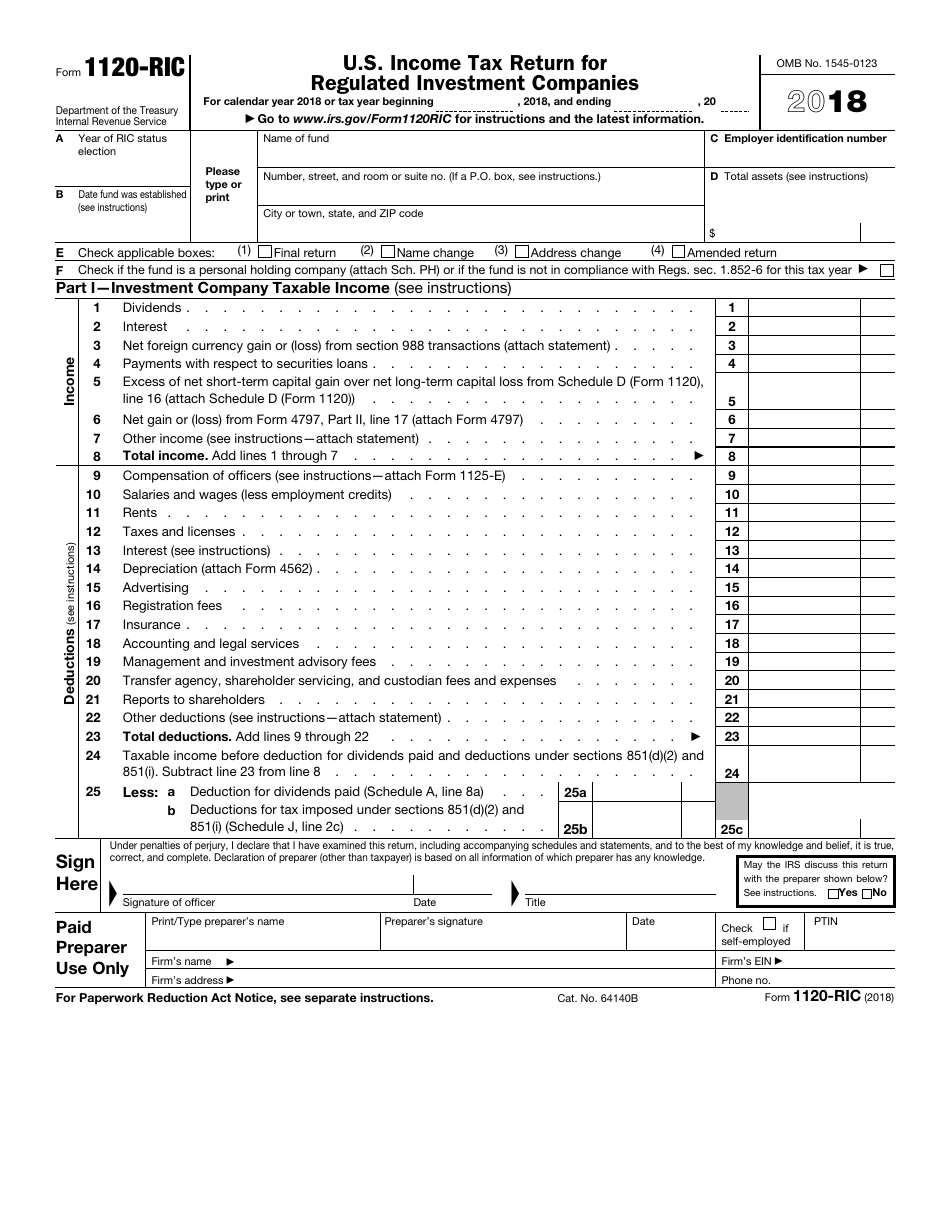

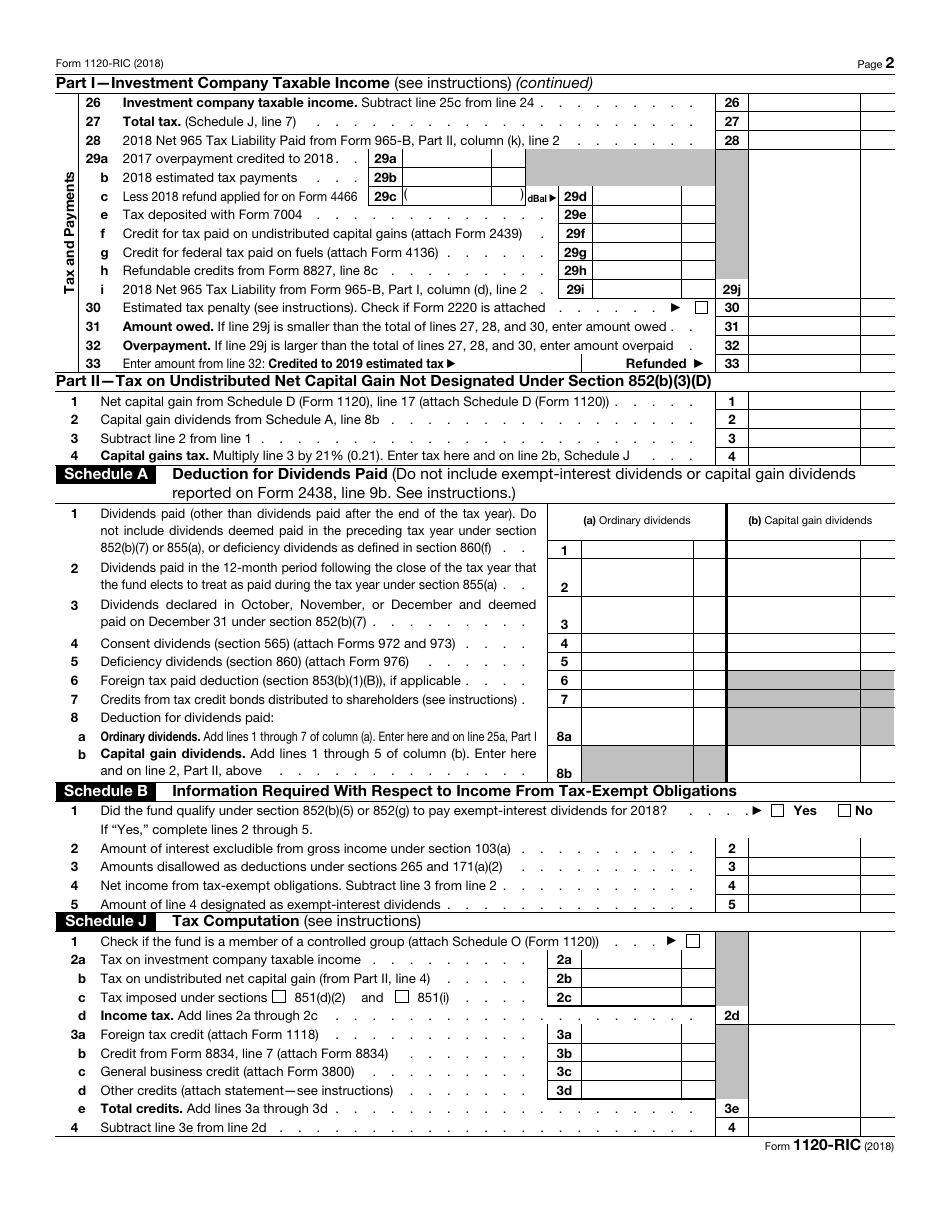

IRS Form 1120-RIC U.S. Income Tax Return for Regulated Investment Companies

What Is IRS Form 1120-RIC?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-RIC?

A: IRS Form 1120-RIC is the U.S. Income Tax Return specifically designed for Regulated Investment Companies (RICs).

Q: Who needs to file IRS Form 1120-RIC?

A: RICs, or Regulated Investment Companies, are required to file IRS Form 1120-RIC.

Q: What is a Regulated Investment Company (RIC)?

A: A Regulated Investment Company (RIC) is a type of investment company that meets certain requirements set by the IRS.

Q: What is the purpose of filing IRS Form 1120-RIC?

A: The purpose of filing IRS Form 1120-RIC is to report income, expenses, and other tax-related information for the taxable year.

Q: When is the deadline for filing IRS Form 1120-RIC?

A: The deadline for filing IRS Form 1120-RIC is typically March 15th.

Q: Are there any penalties for late filing of IRS Form 1120-RIC?

A: Yes, there may be penalties for late filing of IRS Form 1120-RIC. It is important to file the form by the deadline to avoid penalties.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-RIC through the link below or browse more documents in our library of IRS Forms.