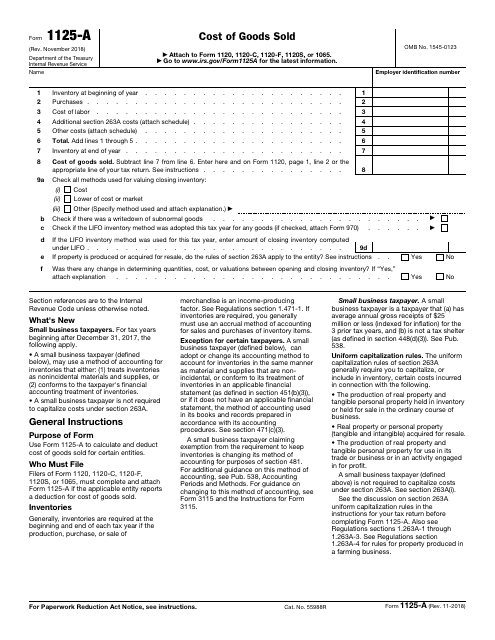

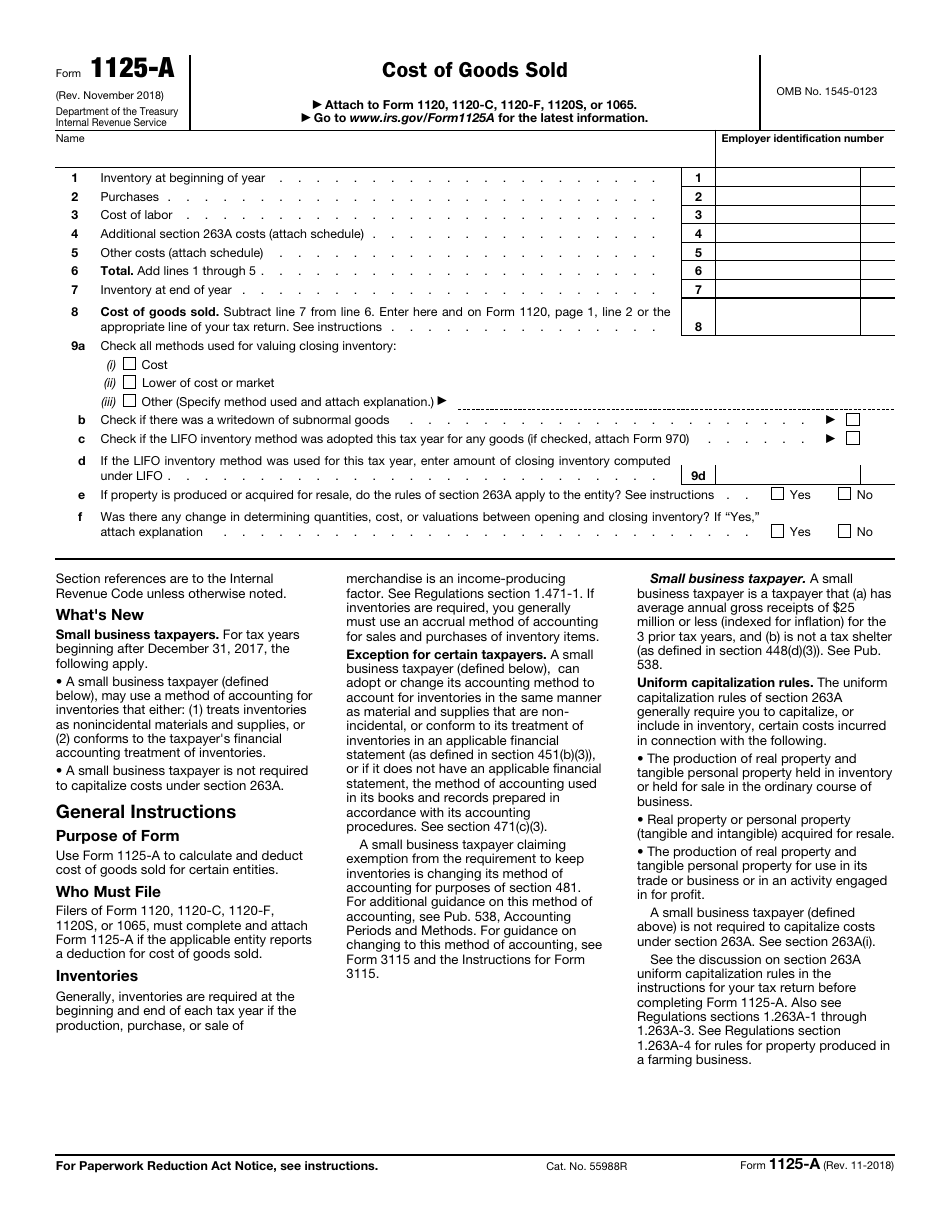

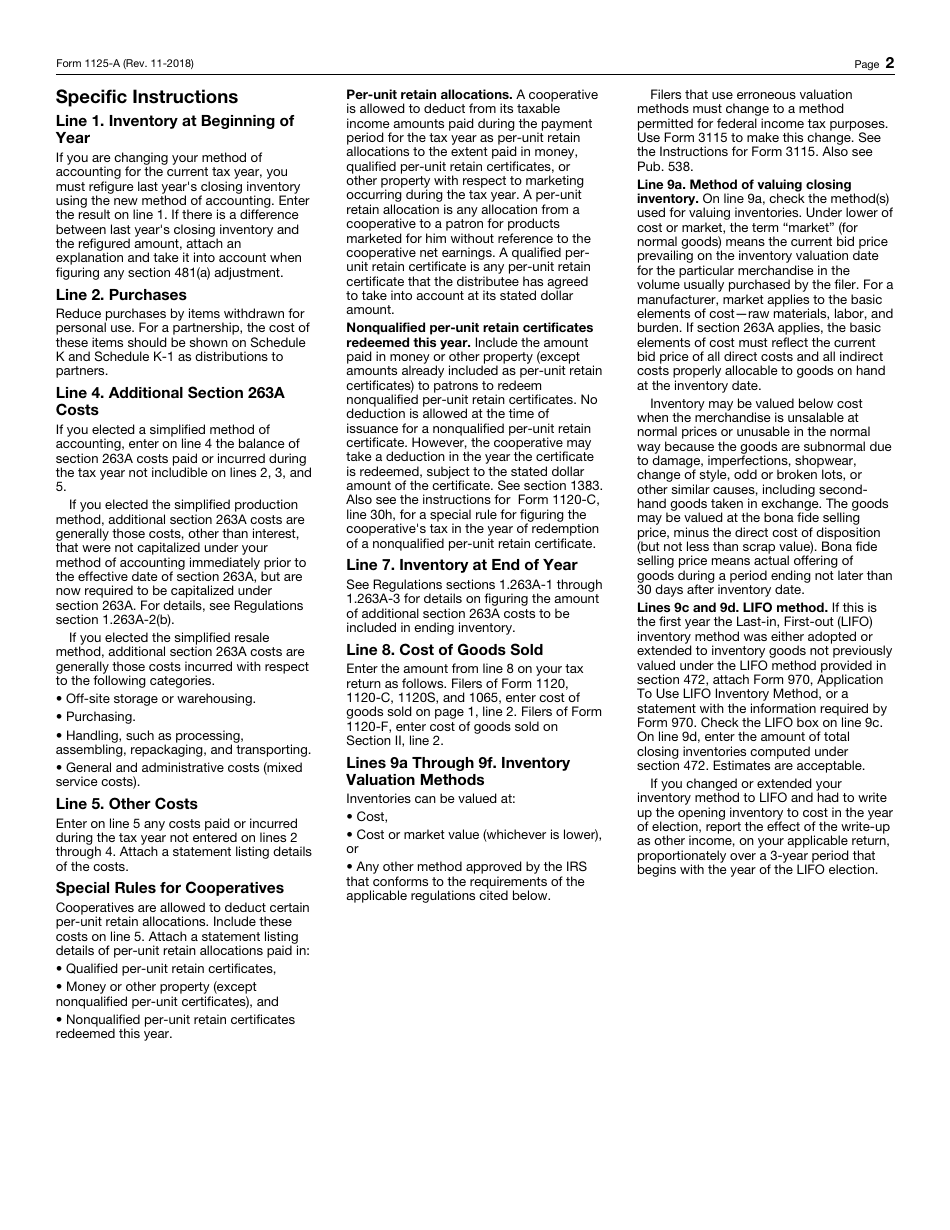

IRS Form 1125-A Cost of Goods Sold

What Is IRS Form 1125-A?

IRS Form 1125-A, Cost of Goods Sold , is a document that was developed by the Internal Revenue Service (IRS) in order to calculate and deduct the cost of goods sold for certain entities. The form may be filed by domestic corporations, cooperative associations, foreign corporationsdoing business in the U.S., and partnerships.

When to Use IRS Form 1125-A?

IRS Form 1125-A is supposed to be used as an attachment to other documents related to reporting income, losses, and deductions. For example, when a domestic corporation files IRS Form 1120, U.S. Corporation Income Tax Return, and reports deductions for the cost of goods sold, they must complete a Cost of Goods Sold Form and attach it to Form 1120.

IRS Form 1125-A and the application it accompanies must be sent to the IRS within the due date stated for the primary form, for most of them it's after the end of the fiscal year (еhe 15th day of the fourth month). The form was last revised on November 1, 2018 , and is available for download below.

IRS Form 1125-A Instructions

The document can be approximately divided into several parts. In the first part, the filer must fill out the name and the Employer Identification Number (EIN) of the reporting organization. After that, the filer is offered to designate tax information, including:

- Inventory at beginning of the year.

- Purchases.

- Cost of labor.

- Additional section 263A costs.

- Other costs.

- Total.

- Inventory at end of the year.

- Cost of goods sold.

When these numbers are filled in, the taxpayer must go through the checkboxes dedicated to the methods for valuing closing inventory if the property is produced or acquired for resale, etc.

Not what you were looking for? Check out these related topics: