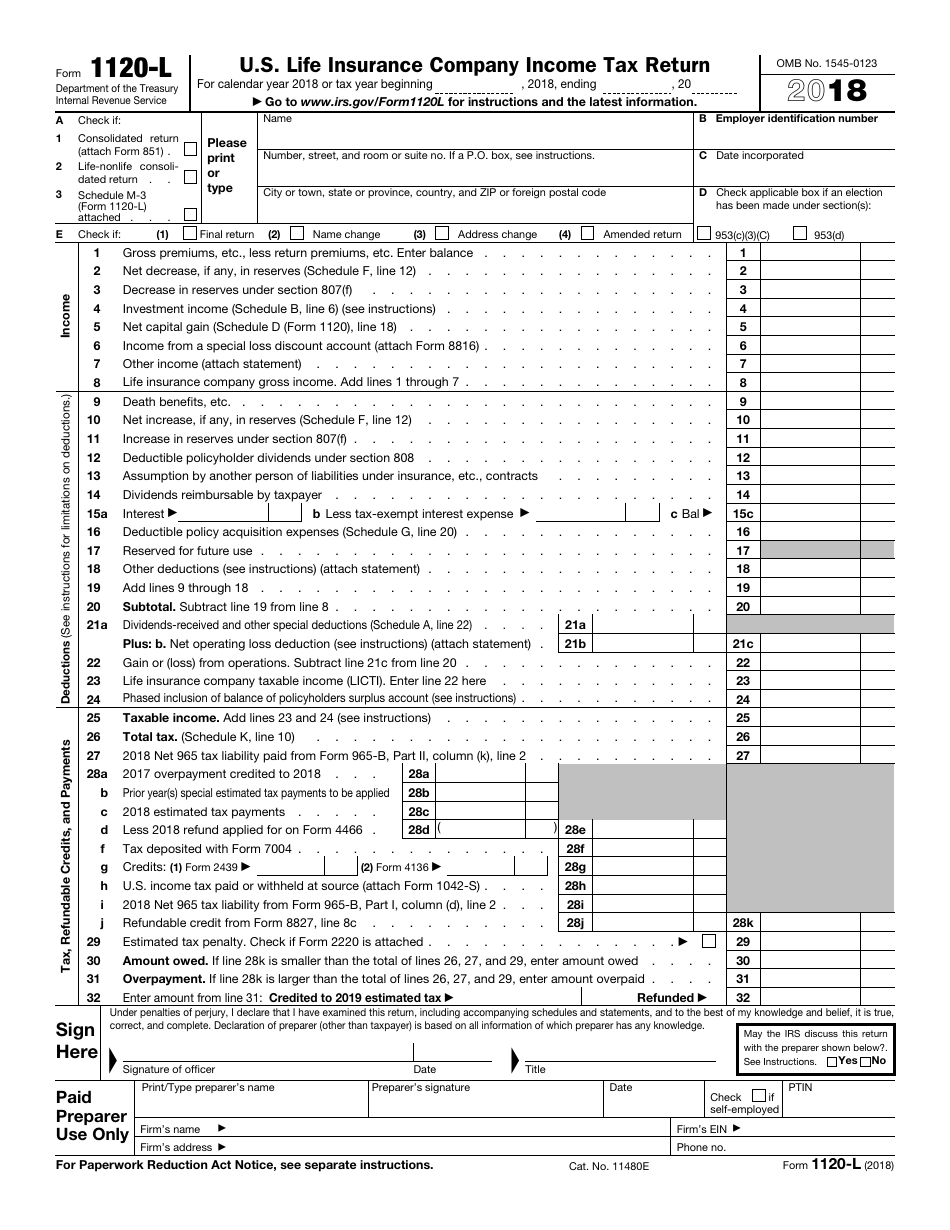

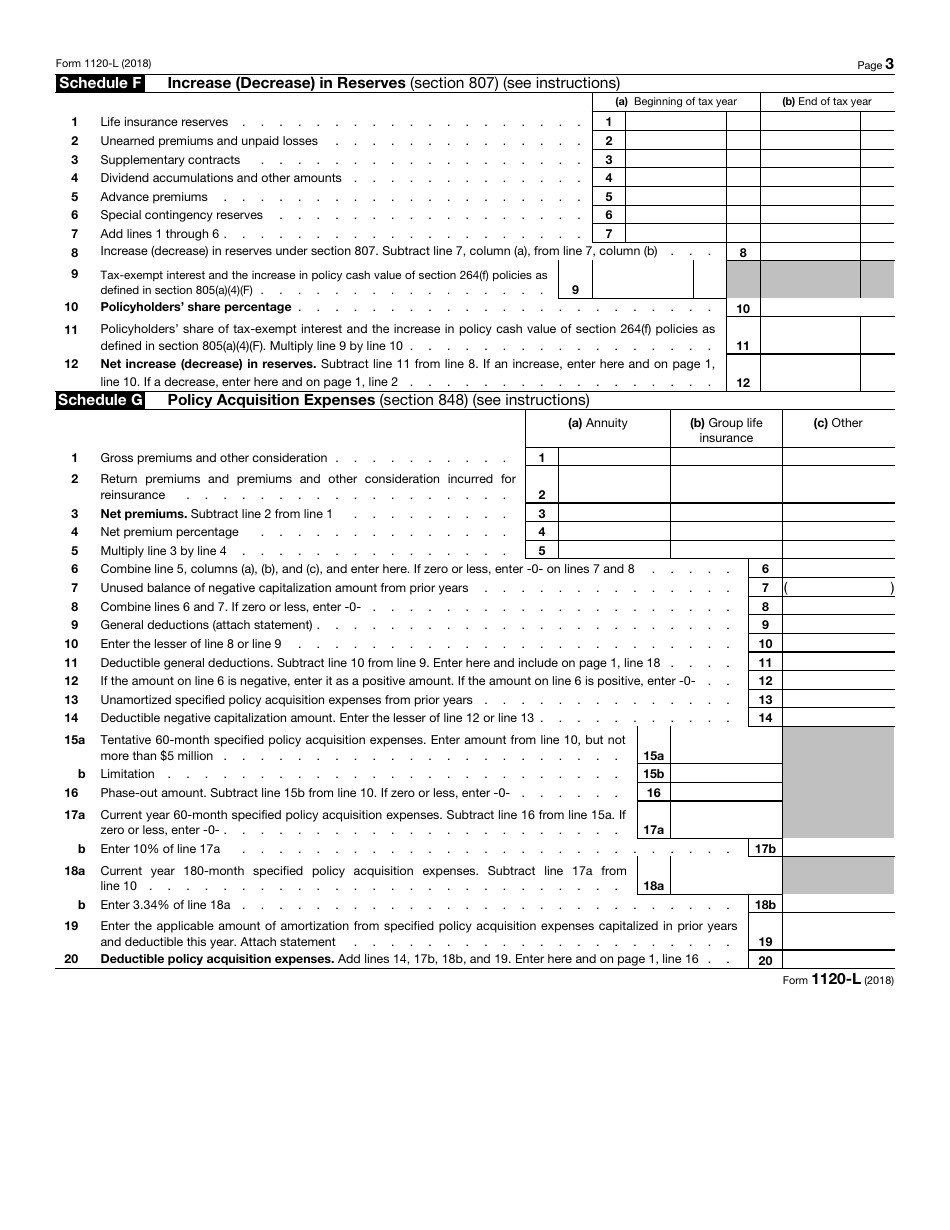

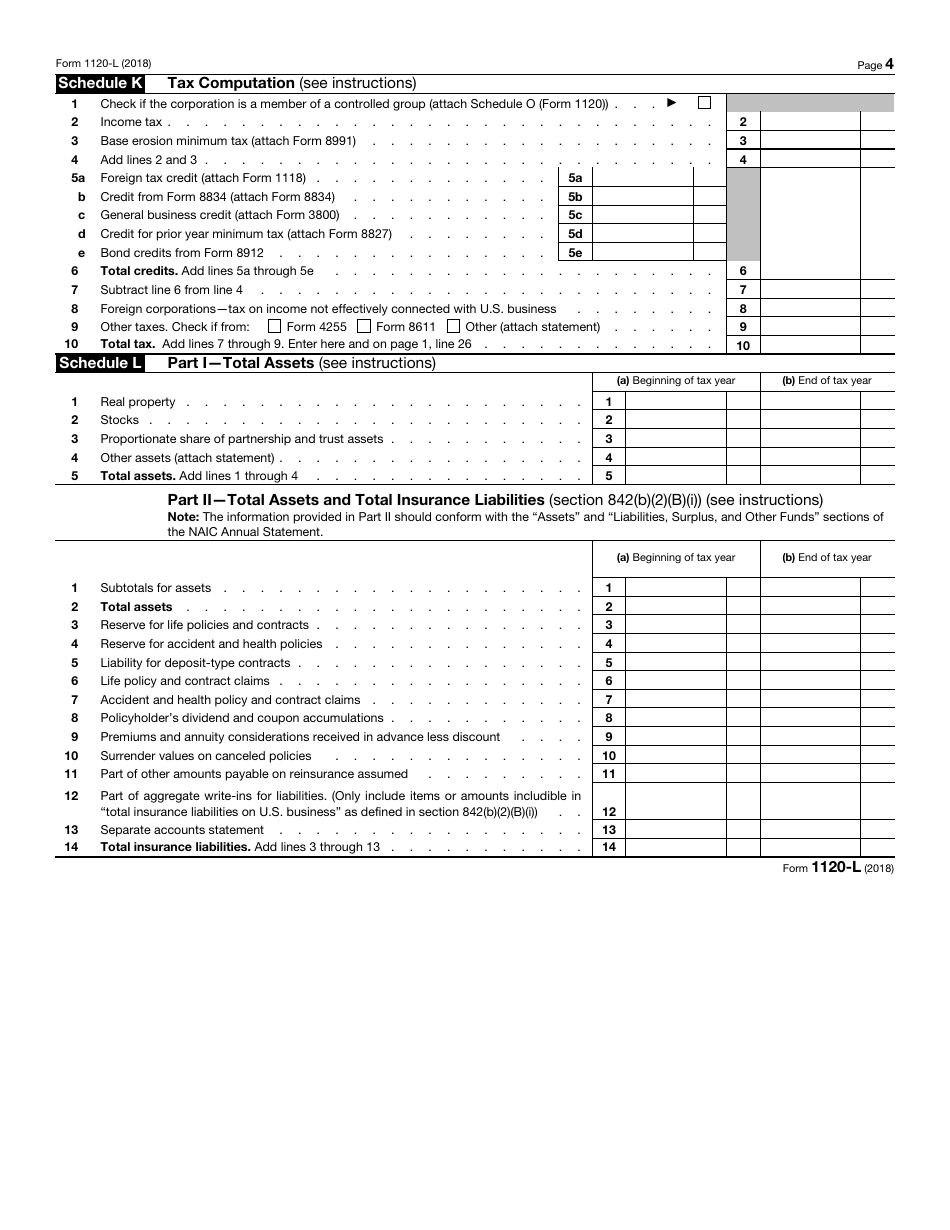

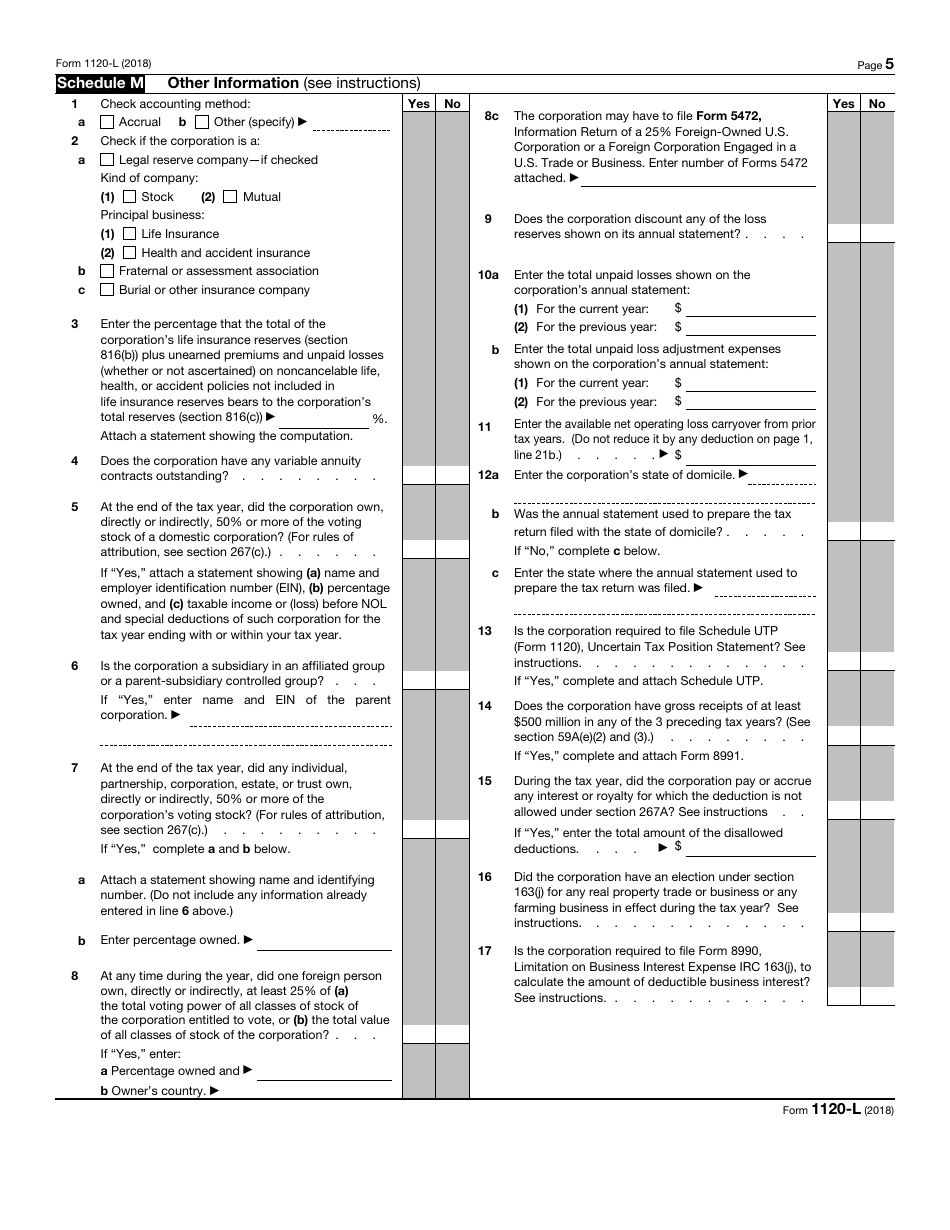

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1120-L

for the current year.

IRS Form 1120-L U.S. Life Insurance Company Income Tax Return

What Is IRS Form 1120-L?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-L?

A: IRS Form 1120-L is the U.S. Life Insurance Company Income Tax Return.

Q: Who needs to file IRS Form 1120-L?

A: Life insurance companies registered in the United States need to file IRS Form 1120-L.

Q: What is the purpose of IRS Form 1120-L?

A: The purpose of IRS Form 1120-L is to report the income, deductions, and tax liability of U.S. life insurance companies.

Q: When is IRS Form 1120-L due?

A: IRS Form 1120-L is generally due on March 15th of the year following the tax year.

Q: Are there any penalties for late filing of IRS Form 1120-L?

A: Yes, there are penalties for late filing of IRS Form 1120-L. It is important to file the form on time to avoid these penalties.

Q: What if I need an extension to file IRS Form 1120-L?

A: You can request an extension to file IRS Form 1120-L by filing Form 7004. This will provide an additional six months to file the return.

Q: Can I e-file IRS Form 1120-L?

A: Yes, you can e-file IRS Form 1120-L if you meet the requirements for electronic filing.

Q: What other forms may need to be filed with IRS Form 1120-L?

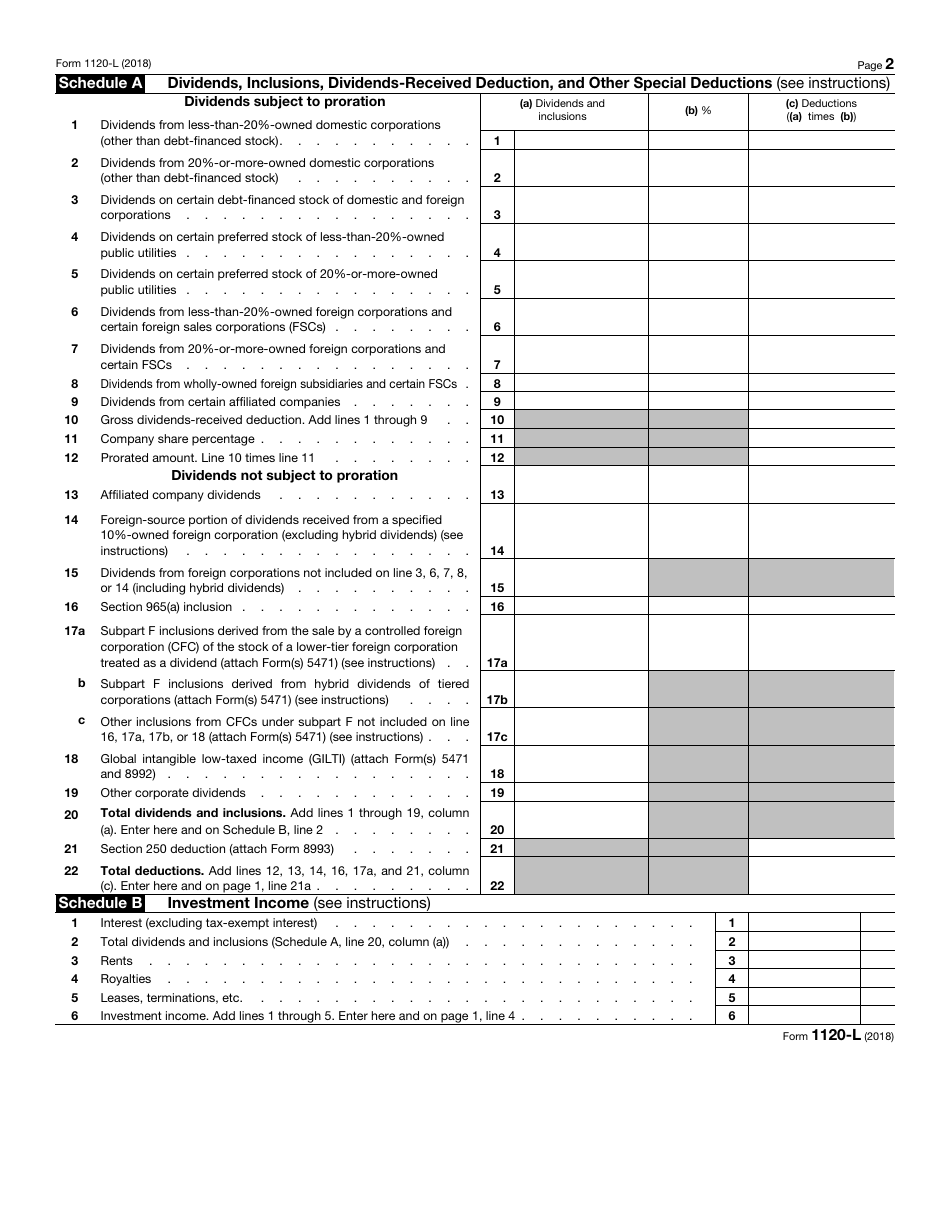

A: Depending on the specific circumstances of the life insurance company, additional forms may need to be filed, such as Schedule M-3 or Schedule UTP.

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-L through the link below or browse more documents in our library of IRS Forms.