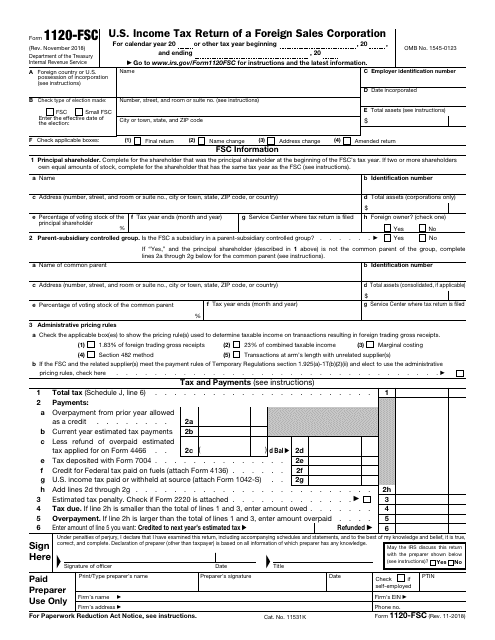

IRS Form 1120-FSC U.S. Income Tax Return of a Foreign Sales Corporation

What Is IRS Form 1120-FSC?

IRS Form 1120-FSC, U.S. Income Tax Return of a Foreign Sales Corporation , is a fiscal document filled out by entities that export goods produced in the United States to inform tax organizations about the income they generated during the year, the deductions they qualify for, and the tax they are supposed to pay.

Alternate Name:

- Tax Form 1120-FSC.

Foreign corporations need to complete this form to confirm they are entitled to be exempt from certain tax obligations and report the taxable income they have earned through their operations.

This instrument was issued by the Internal Revenue Service (IRS) on November 1, 2018 , making previous editions of the tax return obsolete. Download an IRS Form 1120-FSC fillable version below.

Check out the 1120 Series of forms to see more IRS documents in this series.

Form 1120-FSC Instructions

The IRS Form 1120-FSC Instructions are as follows:

-

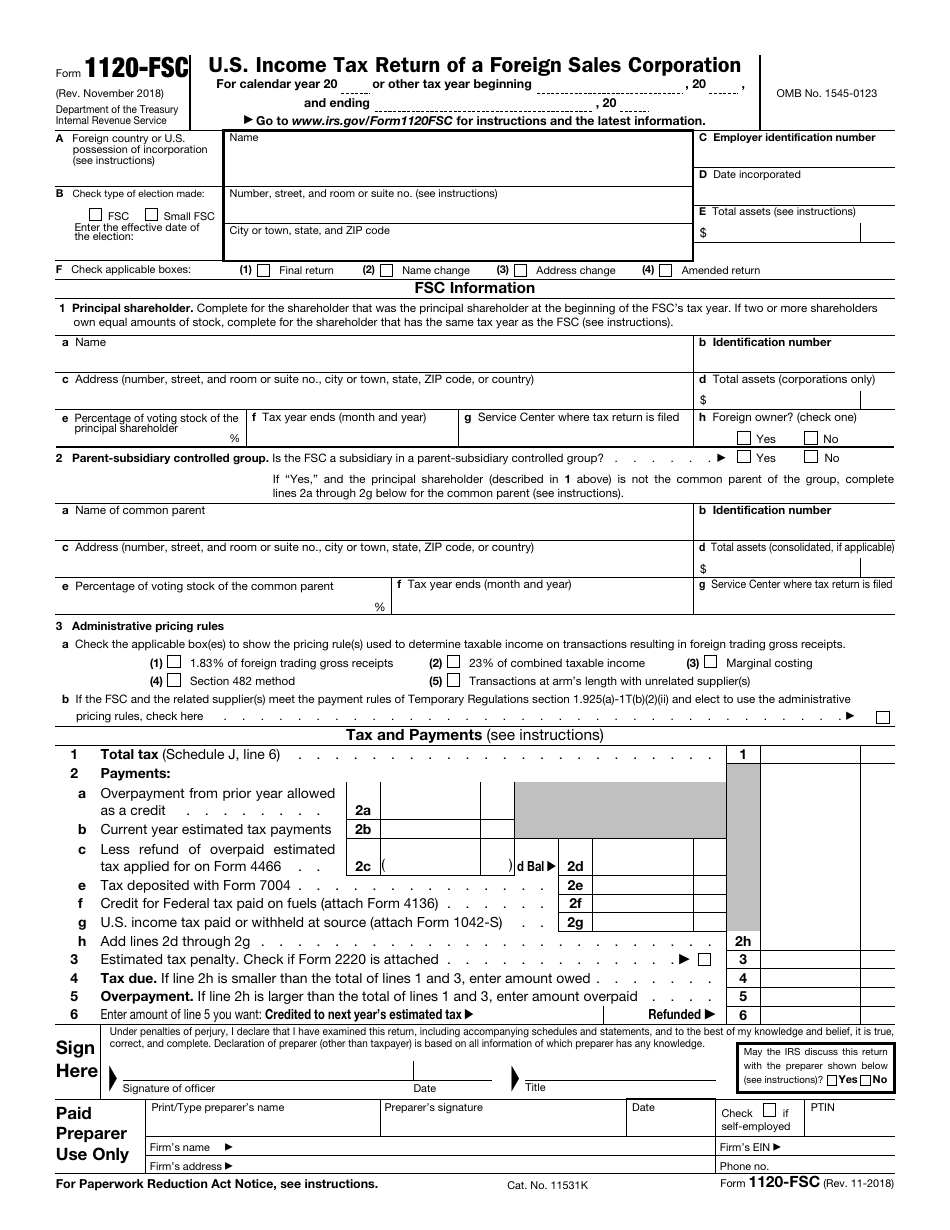

Specify the beginning and the end of the tax period you are outlining in the form . List the details of your corporation - the place of incorporation, the name of the entity, its employer identification number, the date the incorporation took place, the correspondence address, and the total amount of assets. Indicate whether you are filing the papers on behalf of a regular corporation or a small one. Check the box to confirm you have prepared the last ever return for the corporation, you need to inform the IRS about the name or address change, or you are amending a previously filed return.

-

Identify the principal shareholder of the corporation by their name, taxpayer identification number, and address . State how many assets belong to them, what their voting stock percentage is, and whether they are a foreign owner. Record the information about the corporate group that controls the corporation if necessary and clarify what pricing rules apply to your tax calculations. Compute the tax and list all the payments you owe. It is possible the calculations show overpayment - you may ask for a refund or agree to apply it to the next year's return.

-

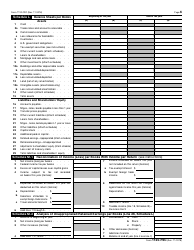

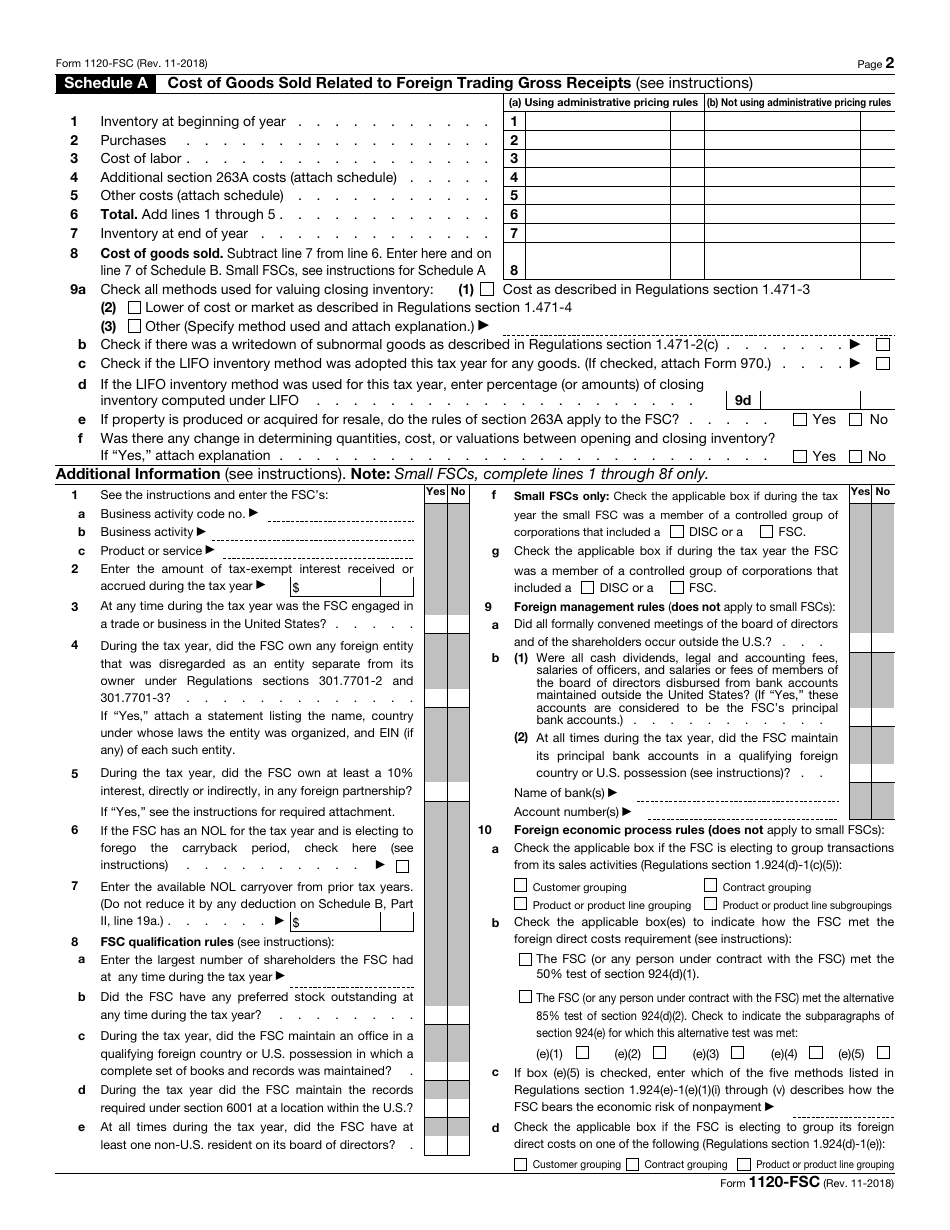

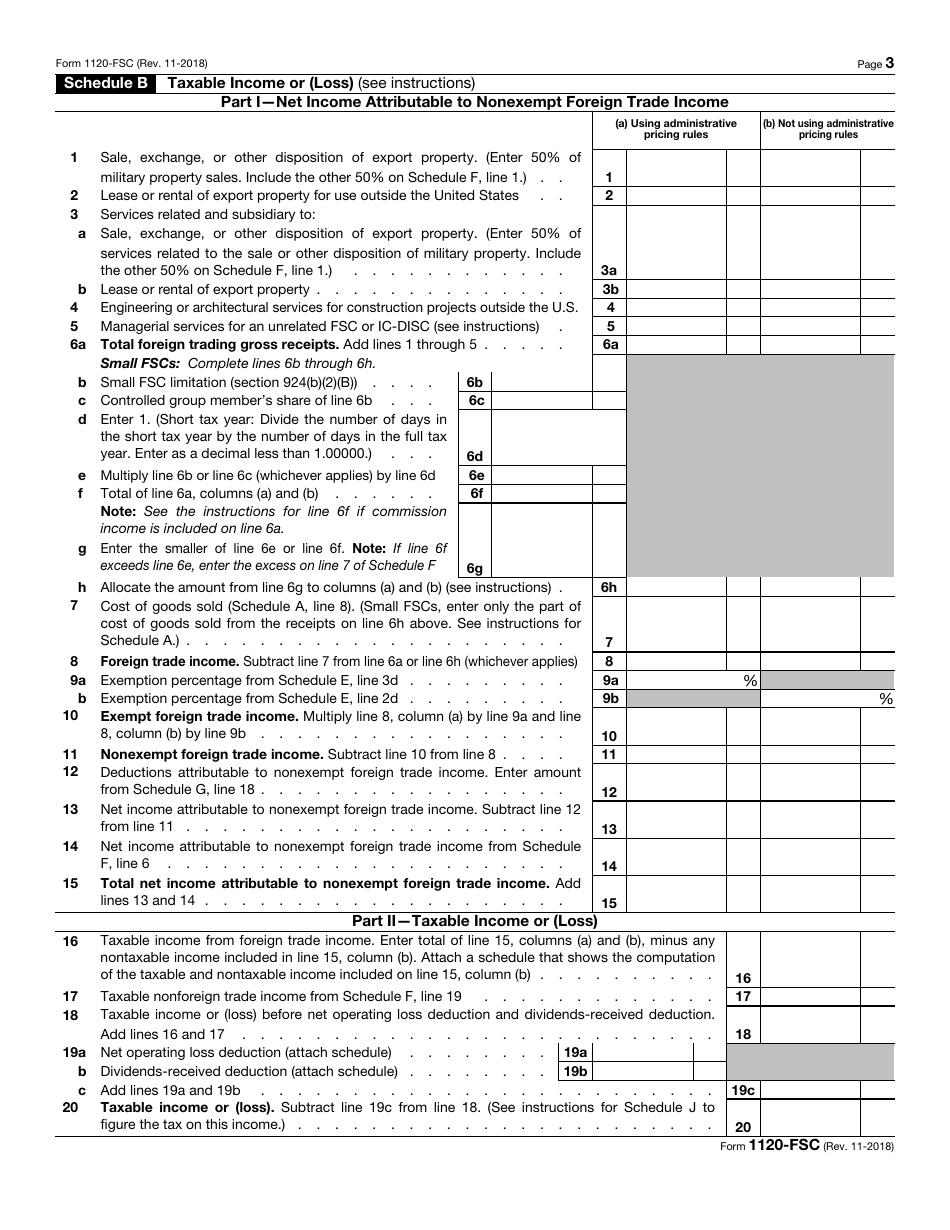

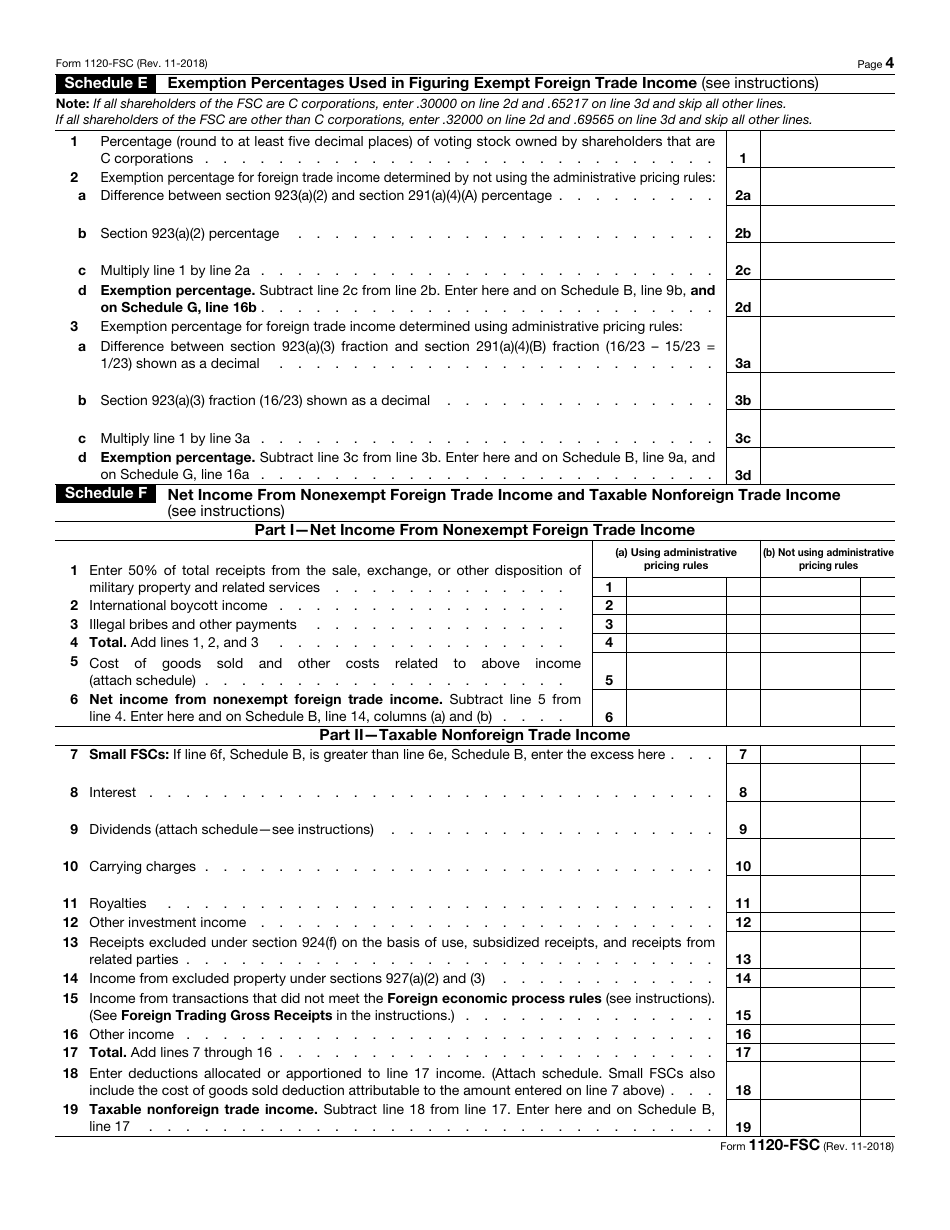

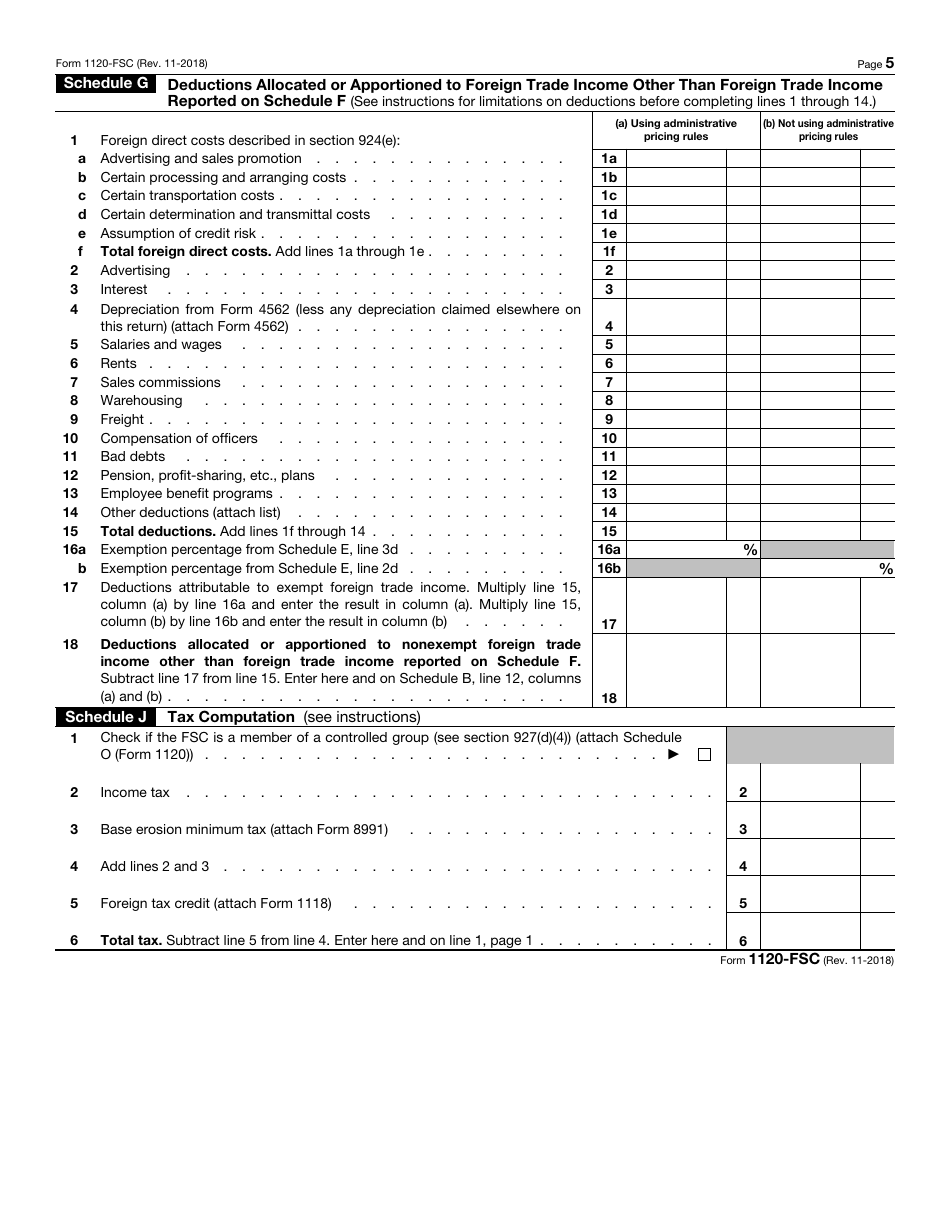

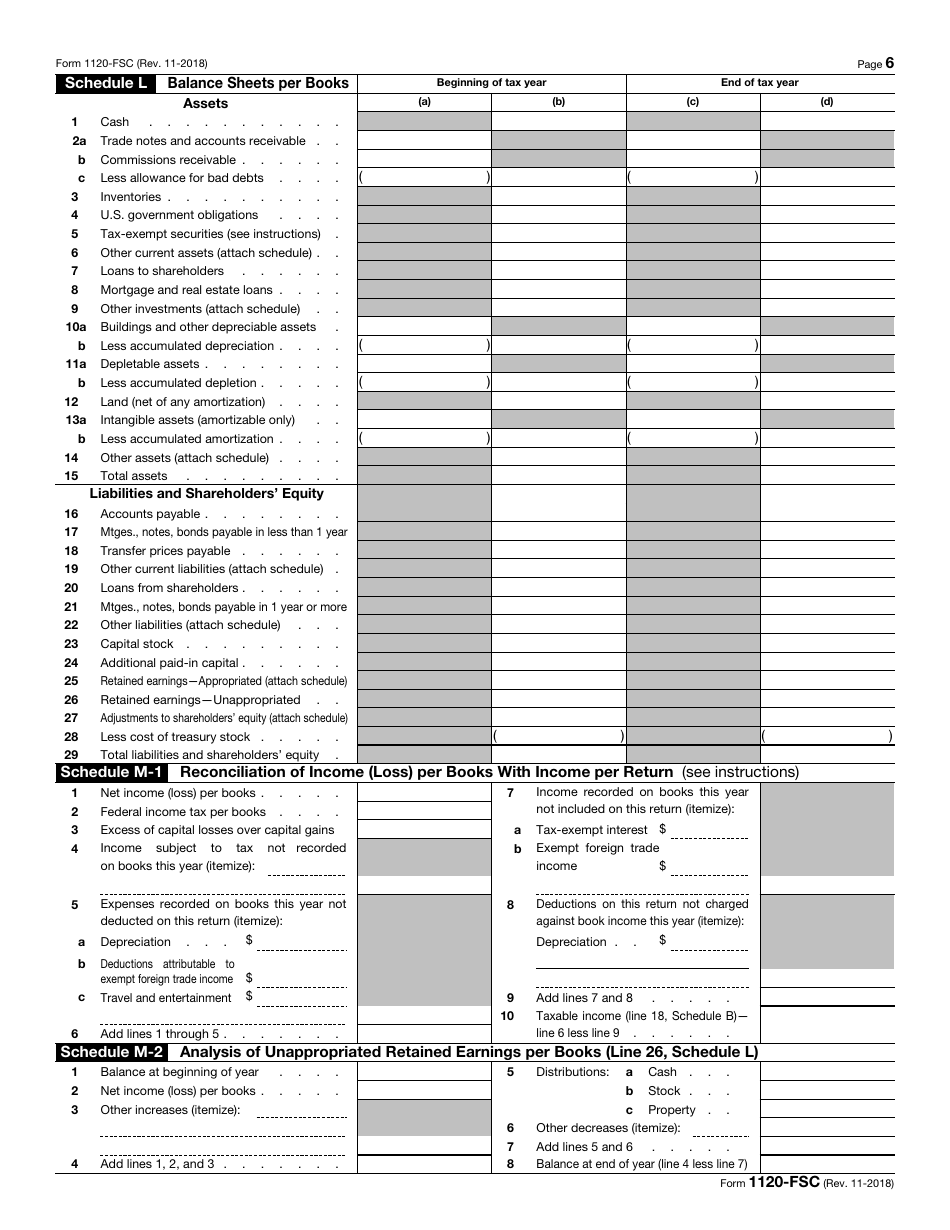

Fill out schedules that allow filers to provide information about the goods they have sold, income subject to tax, rates you need to apply to determine income from foreign trade that is supposed to be exempt from taxation, and deductions you are allowed to claim . Calculate the total amount of tax you have to pay, list the entity's assets, liabilities, and the net worth of your company, reconcile the income taking into account the data from your books and records, and elaborate on profits you were able to retain while not setting them aside for a particular purpose.

-

Certify the instrument - note that a tax professional you hire to help with the form must provide their signature as well . Send the paperwork to the Internal Revenue Service Center, P.O. Box 409101, Ogden, UT 84409. The deadline for Tax Form 1120-FSC is the fifteenth day of the fourth month that follows the year you describe in writing.

IRS 1120-FSC Related Forms:

- 1120, U.S. Corporation Income Tax Return. Domestic corporations file this document to report their income, gains, losses, deductions, and credits, and to figure their income tax liability.

- 1120-C, U.S. Income Tax Return for Cooperative Associations. Corporations that operate on a cooperative basis use this form to report their income, gains, losses, deductions, and credits, and to calculate their income tax liability.

- 1120-F, U.S. Income Tax Return of a Foreign Corporation. This form is filed by foreign corporations to report their income, gains, losses, deductions, and credits, and to figure their United States income tax liability.

- 1120-H, U.S. Income Tax Return for Homeowners Associations. A homeowners association files this form to exclude the Exempt Function Income from its gross income.

- 1120-L, U.S. Life Insurance Company Income Tax Return. Life insurance companies use this form to report the income, gains, losses, deductions, and credits, and to figure their income tax liability.

- 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons. Nuclear decommissioning funds file this document to report the income earned, contributions received, the administrative expenses of fund operation, the tax on modified gross income, and Section 4951 taxes.

- 1120-S, U.S. Income Tax Return for an S Corporation. This is a form used to report the income, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation.

- 1120-IC-DISC, Interest Charge Domestic International Sales Corporation Return. This form is filed by interest charge domestic international sales corporations (IC-DISCs), former DISCs, and former IC-DISCs.

- 1120-POL, US Income Tax Return for Certain Political Organizations. This form is filed by political organizations and certain exempt organizations to report their political organization taxable income and income tax liability under Section 527.

- 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return. This form is filed to report the income, gains, losses, deductions, and credits, and to figure the income tax liability of insurance companies, separately from life insurance companies.

- 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts. Corporation, trusts, and associations electing to be treated as Real Estate Investment Trusts file this form to report their income, deductions, credits, gains, losses, certain penalties, and income tax liability.

- 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies. Regulated investment companies (RIC) file this form to report their income, deductions, gains, losses, credits, and to calculate their income tax liability.

- 1120-SF, U.S. Income Tax Return for Settlement Funds (Under Section 468B). Qualified settlement funds file this form to report transfers, income, deductions, distributions, and a designated or qualified settlement fund income tax liability.

- Form 1120-W, Estimated Tax for Corporations. Corporations use this form to estimate their tax liability and to figure their estimated tax payments.

- Form 1120-X, Amended U.S. Corporation Income Tax Return. This document is used by corporations to correct previously filed Form 1120 (or Form 1120-A), a claim for refund, or an examination, as well as to make certain elections after the prescribed deadline.