This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1120-L Schedule M-3

for the current year.

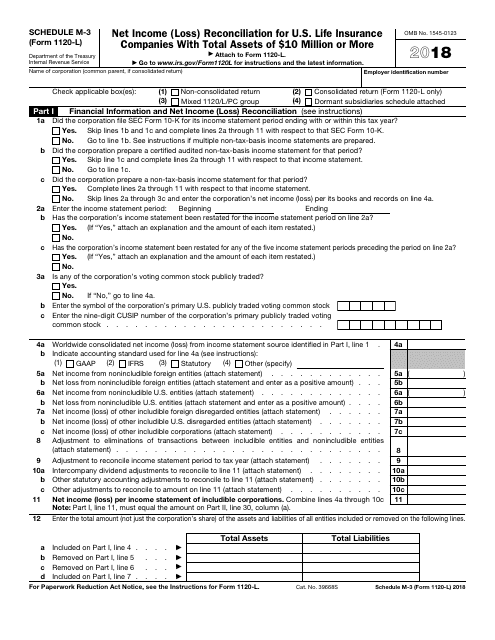

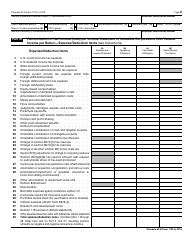

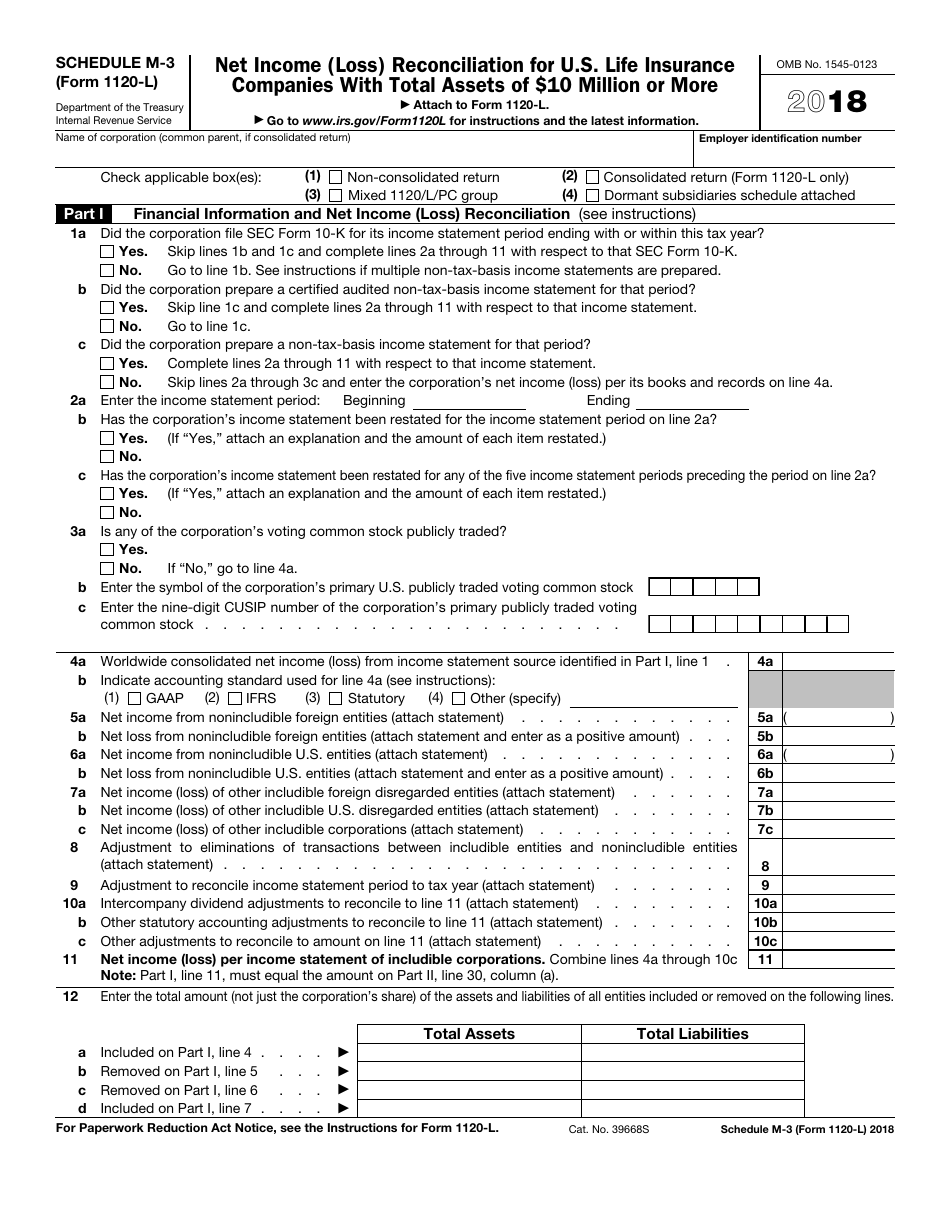

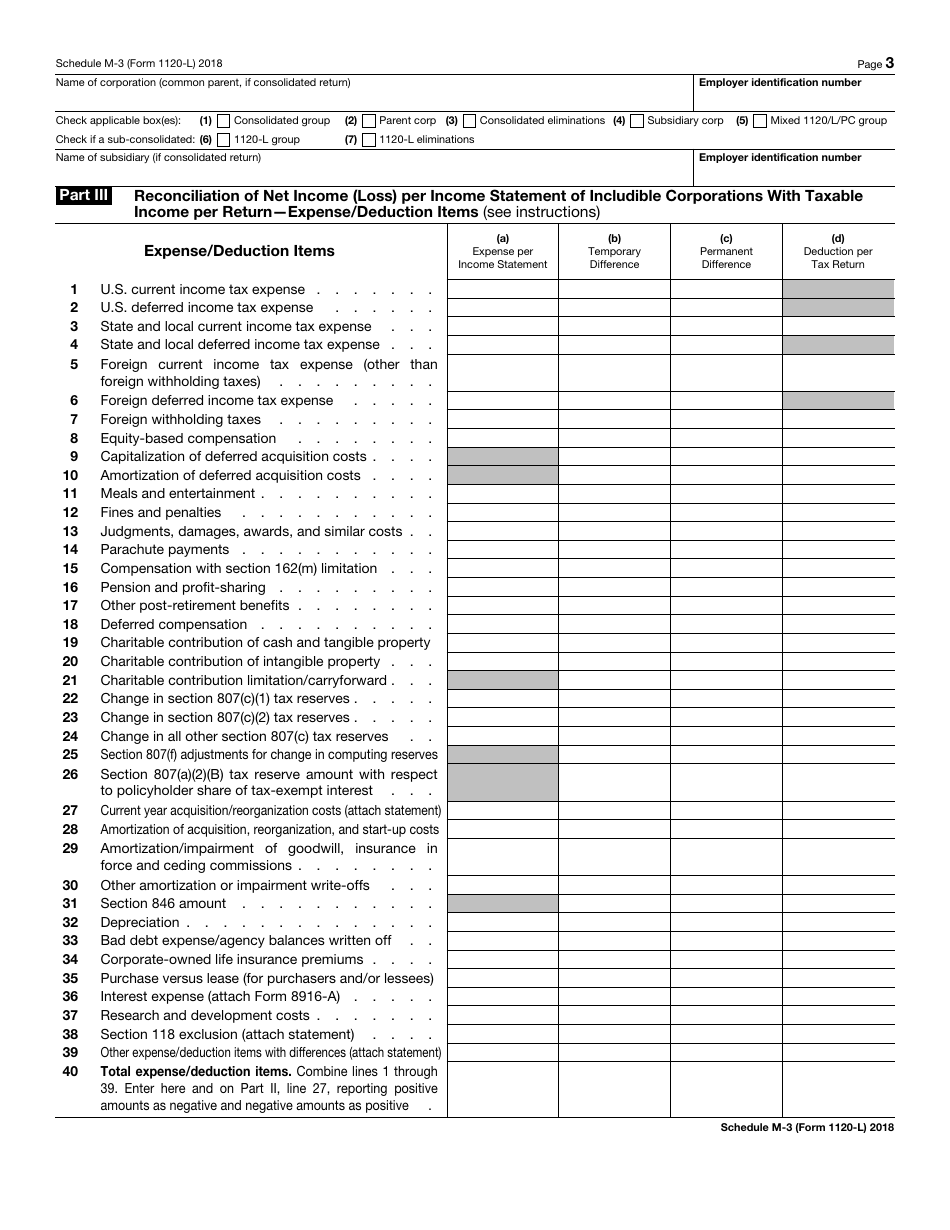

IRS Form 1120-L Schedule M-3 Net Income (Loss) Reconciliation for U.S. Life Insurance Companies With Total Assets of $10 Million or More

What Is IRS Form 1120-L Schedule M-3?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-L, U.S. Life Insurance Company Income Tax Return. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form 1120-L Schedule M-3?

A: Form 1120-L Schedule M-3 is a document used by U.S. life insurance companies with total assets of $10 million or more to reconcile net income (loss).

Q: Who needs to file Form 1120-L Schedule M-3?

A: U.S. life insurance companies with total assets of $10 million or more need to file Form 1120-L Schedule M-3.

Q: What is the purpose of Form 1120-L Schedule M-3?

A: The purpose of Form 1120-L Schedule M-3 is to reconcile the net income (loss) reported on the company's return with the net income (loss) determined under the applicable tax laws.

Q: When is Form 1120-L Schedule M-3 due?

A: Form 1120-L Schedule M-3 is due on the same date as the company's income tax return, typically March 15th or April 15th.

Q: Are there any penalties for not filing Form 1120-L Schedule M-3?

A: Yes, failure to file Form 1120-L Schedule M-3 or filing it with incomplete or inaccurate information can result in penalties imposed by the IRS.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-L Schedule M-3 through the link below or browse more documents in our library of IRS Forms.