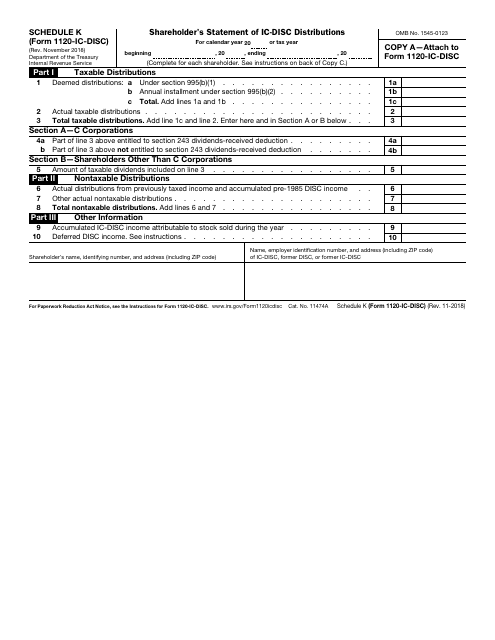

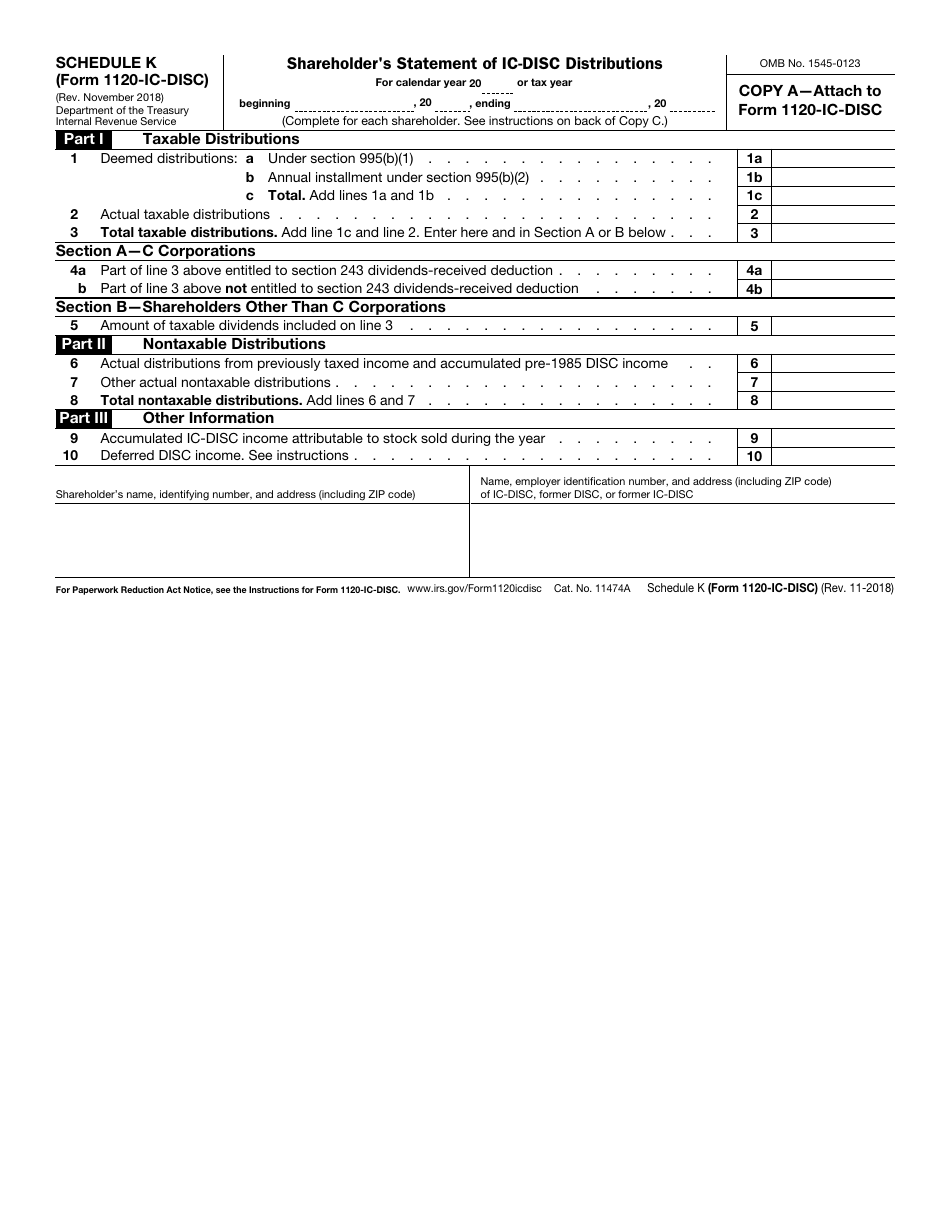

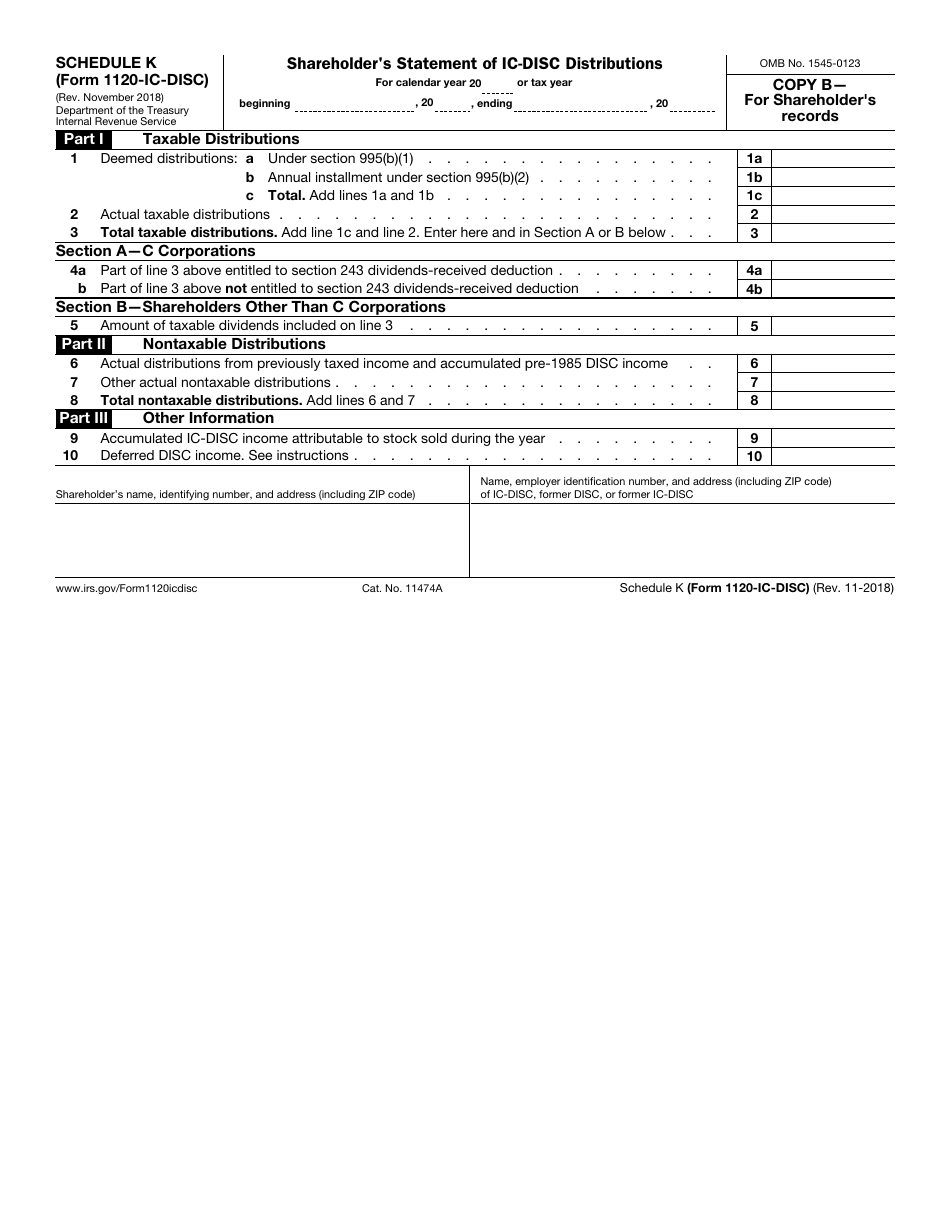

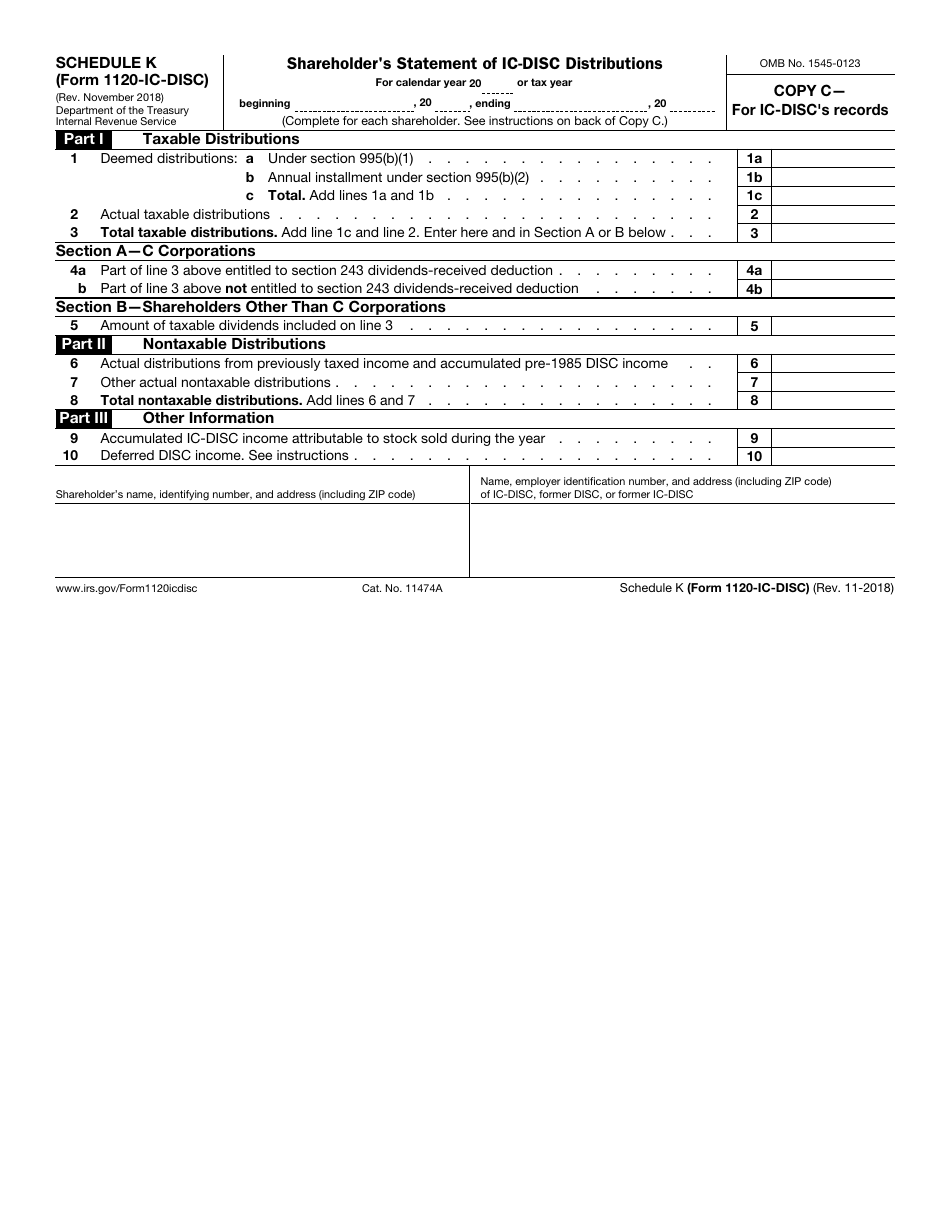

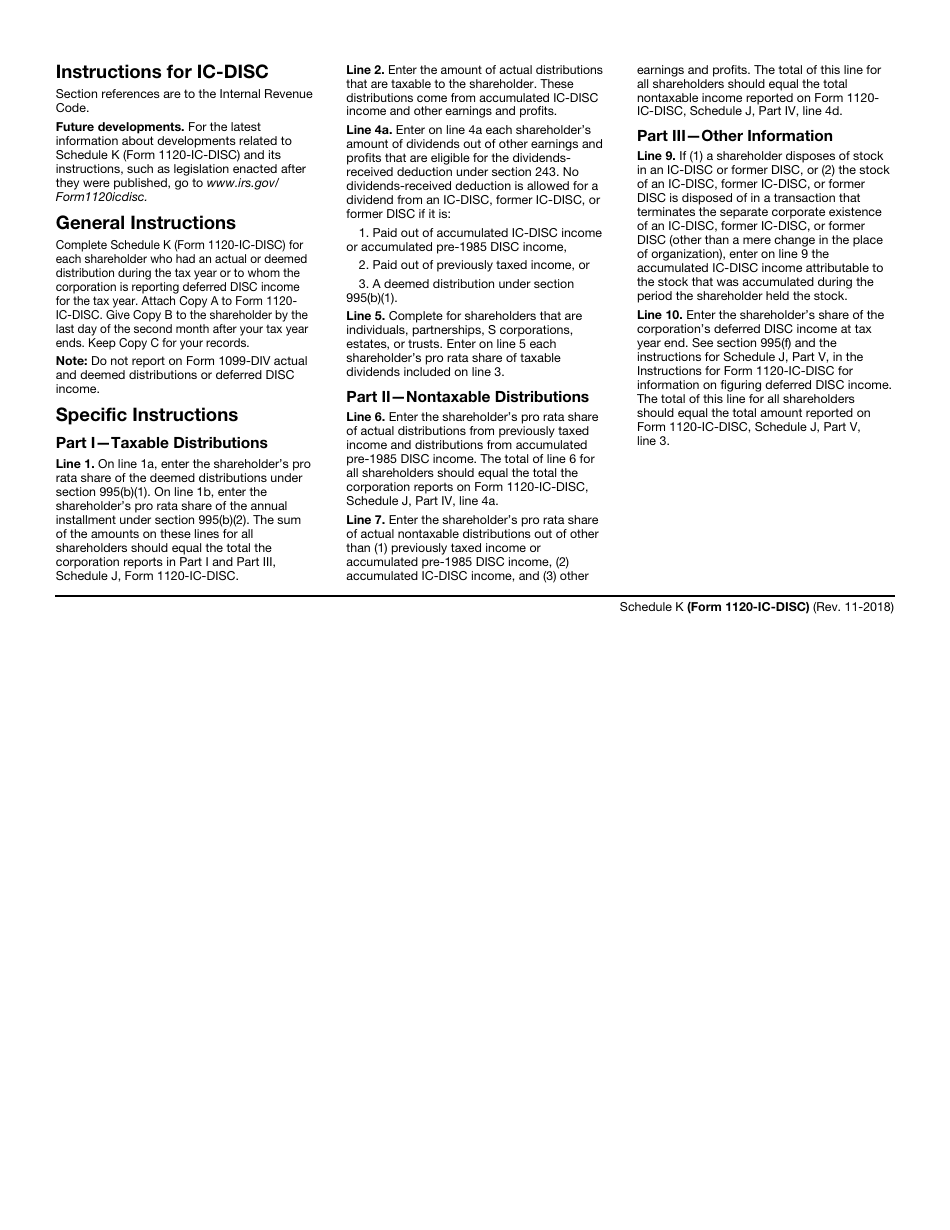

IRS Form 1120-IC-DISC Schedule K Shareholder's Statement of Ic-Disc Distributions

What Is IRS Form 1120-IC-DISC Schedule K?

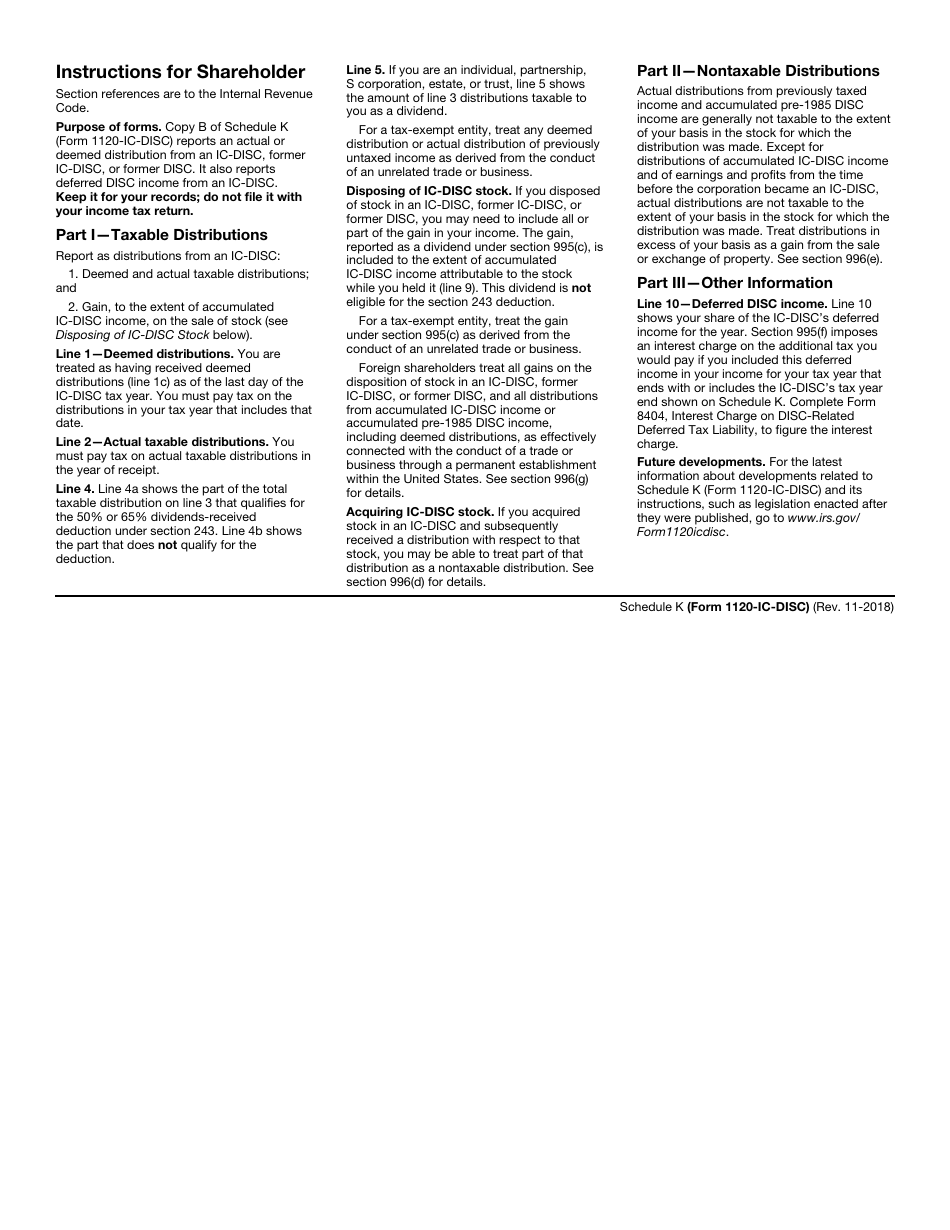

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2018. The document is a supplement to IRS Form 1120-IC-DISC, Interest Charge Domestic International Sales Corporation Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1120-IC-DISC?

A: IRS Form 1120-IC-DISC is a tax form used by a domestic corporation to report the income and deductions of an "interest charge domestic international sales corporation" (IC-DISC).

Q: Who should use IRS Form 1120-IC-DISC?

A: IRS Form 1120-IC-DISC should be used by domestic corporations that have elected to be treated as an IC-DISC.

Q: What is Schedule K?

A: Schedule K is a statement that shareholders of an IC-DISC use to report their share of the IC-DISC's distributions.

Q: What are IC-DISC distributions?

A: IC-DISC distributions are payments made by the IC-DISC to its shareholders as a result of the IC-DISC's export activities.

Q: Why are IC-DISC distributions important?

A: IC-DISC distributions are important because they may qualify for favorable tax treatment, such as being taxed at capital gains rates.

Q: What information is required on Schedule K?

A: Schedule K requires shareholders to provide their name, social security number, the amount of distributions received, and other relevant details.

Q: Are there any specific instructions for completing Schedule K?

A: Yes, the instructions for Schedule K are provided by the IRS and should be followed to accurately report IC-DISC distributions.

Q: Is Schedule K required to be filed separately?

A: No, Schedule K must be filed as an attachment to Form 1120-IC-DISC when filing with the IRS.

Q: Is there a deadline for filing IRS Form 1120-IC-DISC and Schedule K?

A: Yes, the deadline for filing IRS Form 1120-IC-DISC and Schedule K is generally the 15th day of the 3rd month after the end of the corporation's tax year.

Form Details:

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-IC-DISC Schedule K through the link below or browse more documents in our library of IRS Forms.