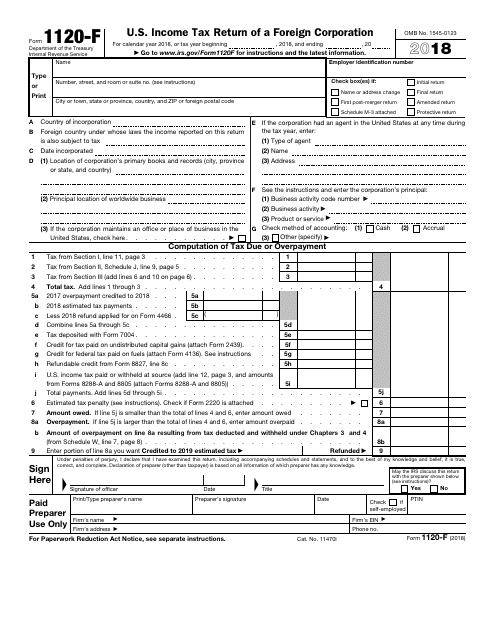

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1120-F

for the current year.

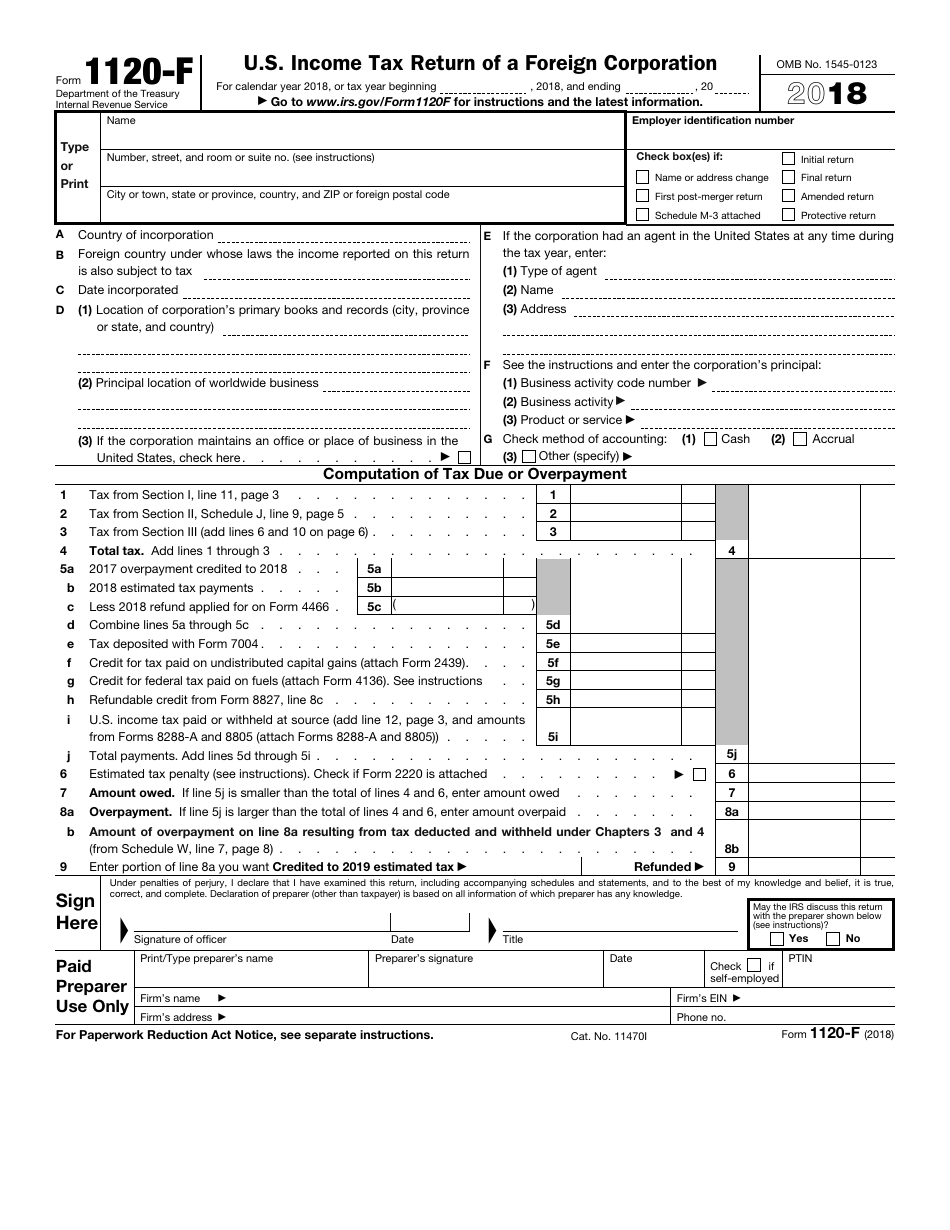

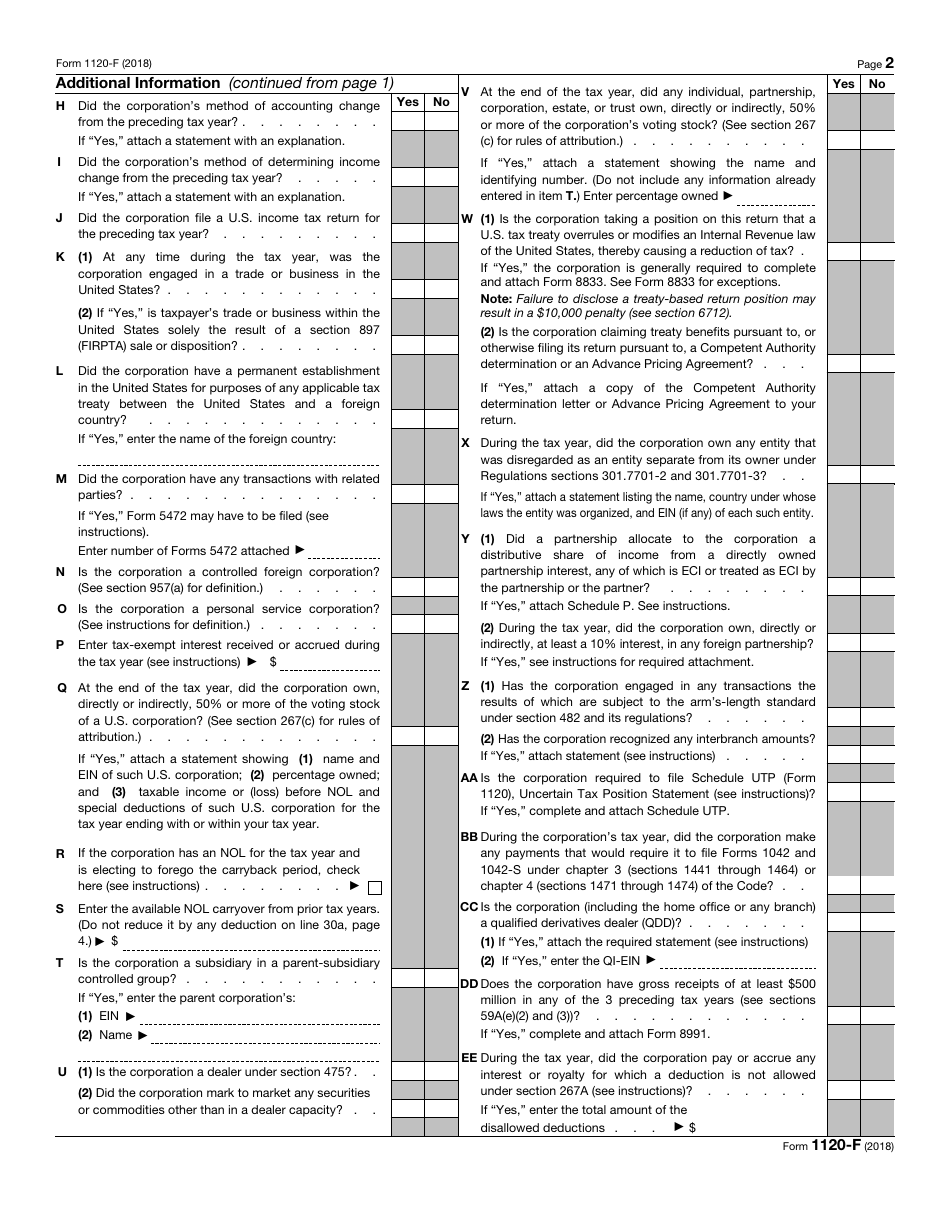

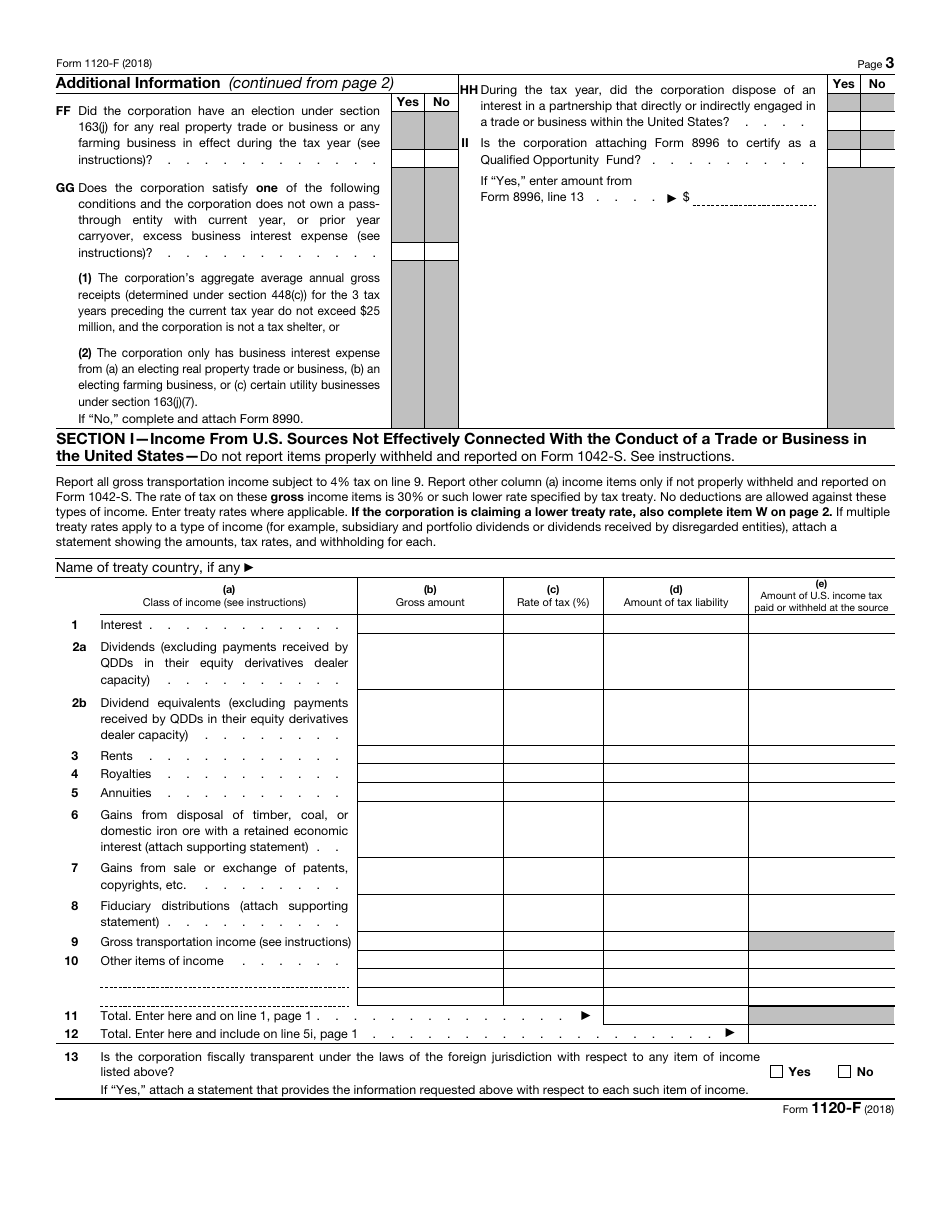

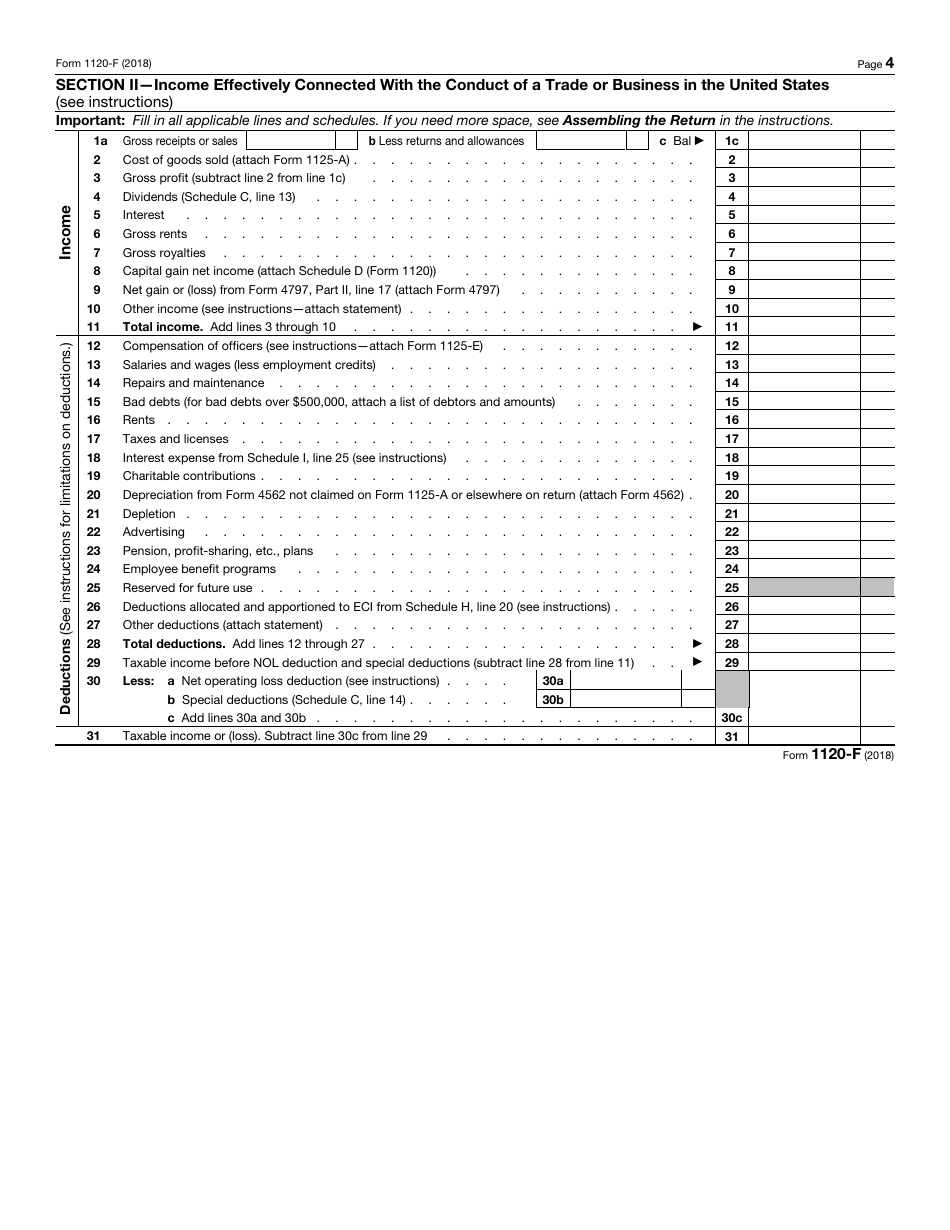

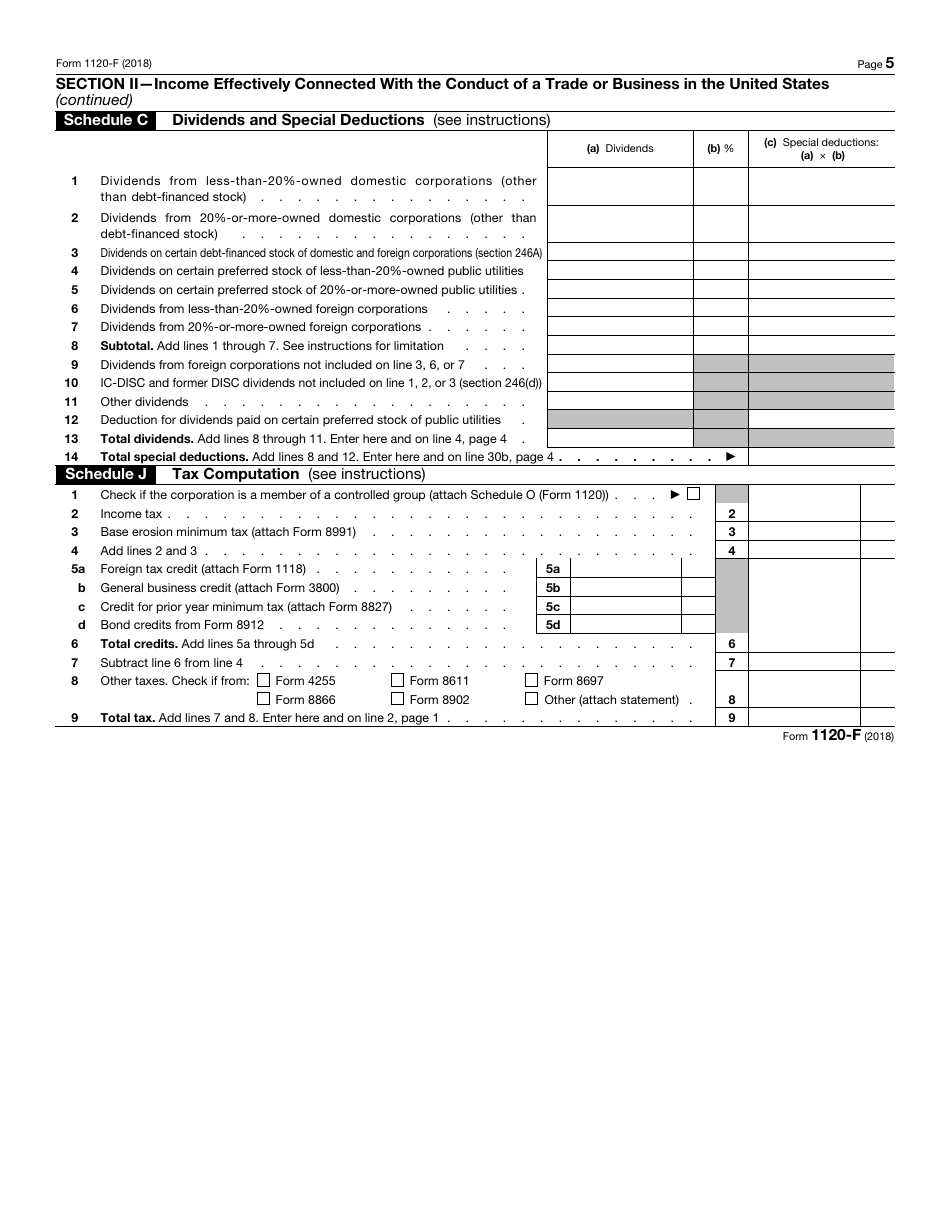

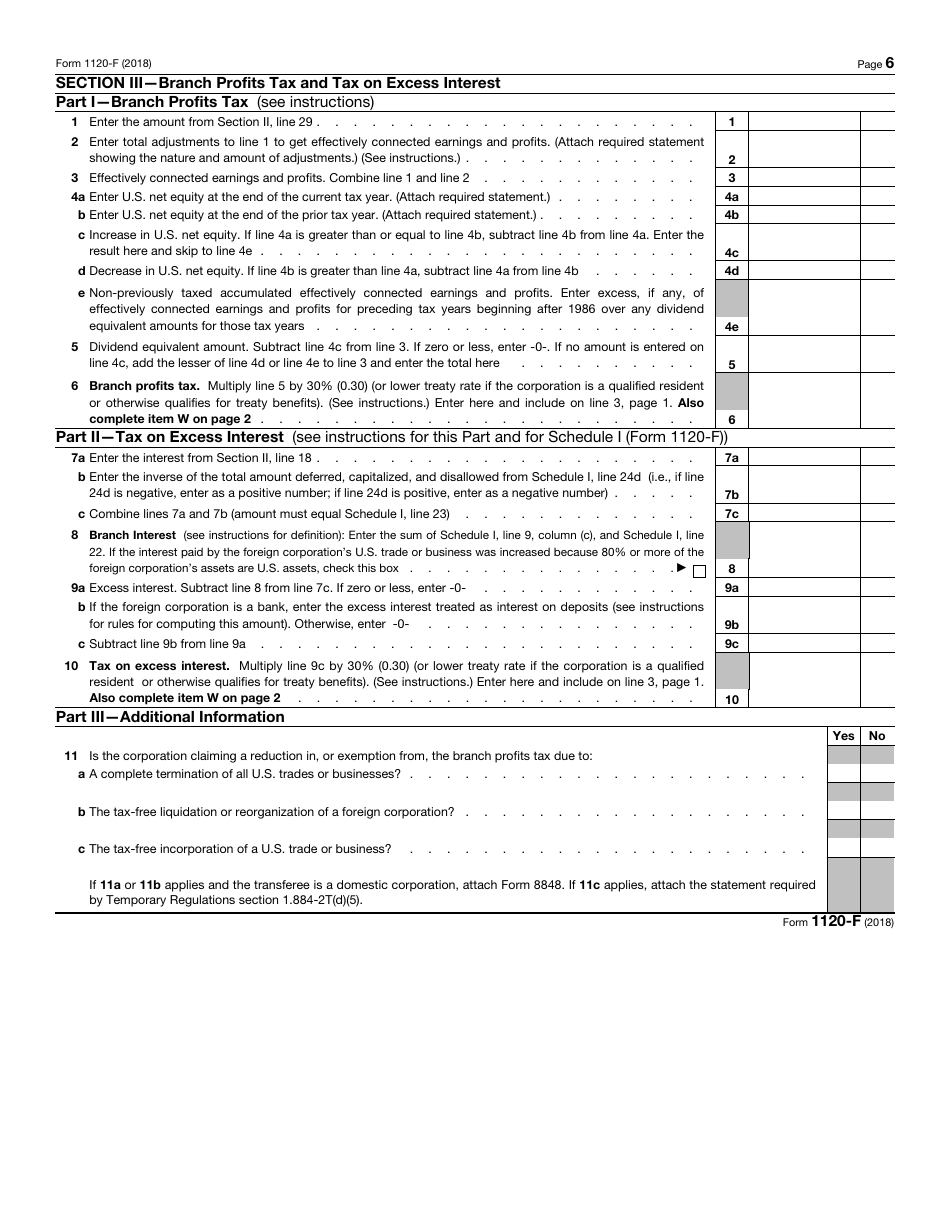

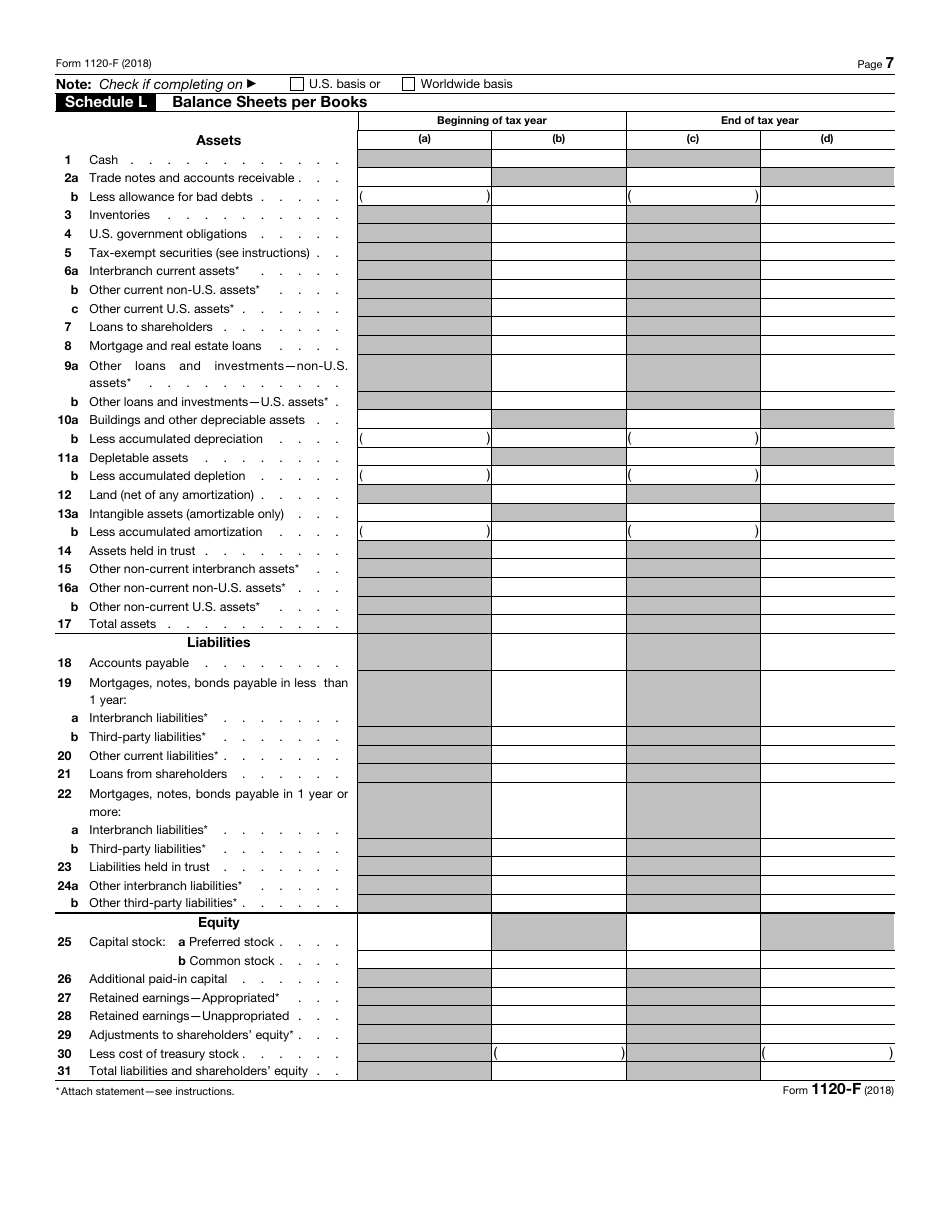

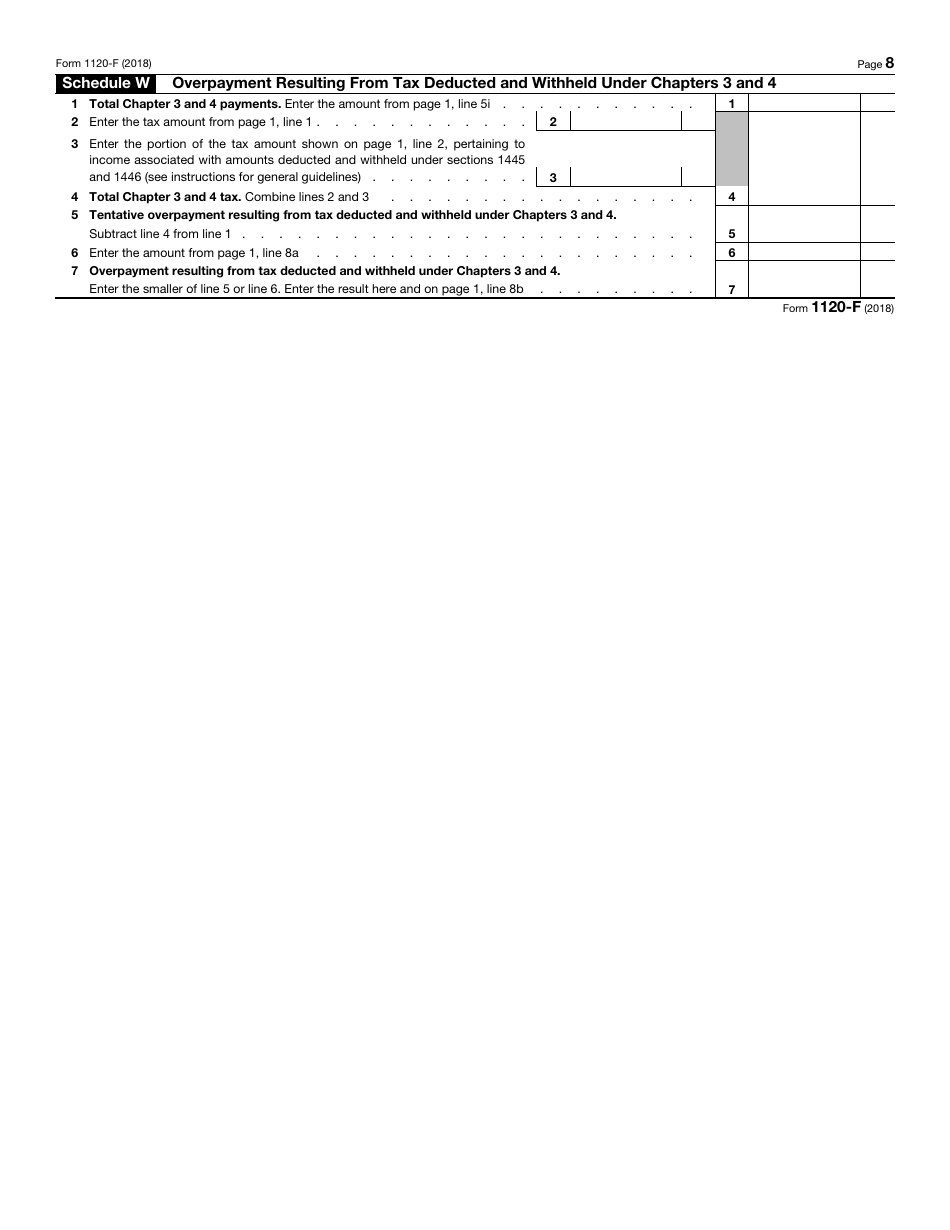

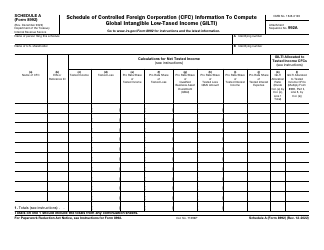

IRS Form 1120-F U.S. Income Tax Return of a Foreign Corporation

What Is IRS Form 1120-F?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-F?

A: IRS Form 1120-F is the U.S. Income Tax Return for a Foreign Corporation.

Q: Who needs to file IRS Form 1120-F?

A: Foreign corporations that are engaged in a trade or business within the United States need to file IRS Form 1120-F.

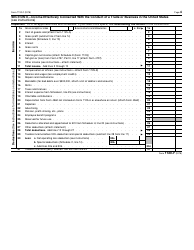

Q: What information is required on IRS Form 1120-F?

A: IRS Form 1120-F requires information about the foreign corporation's income, deductions, credits, and any tax owed.

Q: When is the deadline to file IRS Form 1120-F?

A: The deadline to file IRS Form 1120-F is generally the 15th day of the 3rd month after the end of the corporation's tax year.

Q: Are there any penalties for not filing IRS Form 1120-F?

A: Yes, there can be penalties for not filing IRS Form 1120-F, including fines and interest on any taxes owed.

Q: Can I file IRS Form 1120-F electronically?

A: Yes, you can file IRS Form 1120-F electronically using the IRS e-file system.

Form Details:

- A 8-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-F through the link below or browse more documents in our library of IRS Forms.