This version of the form is not currently in use and is provided for reference only. Download this version of

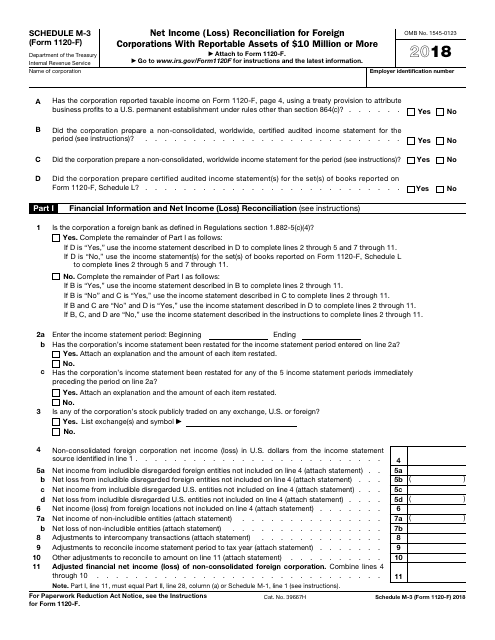

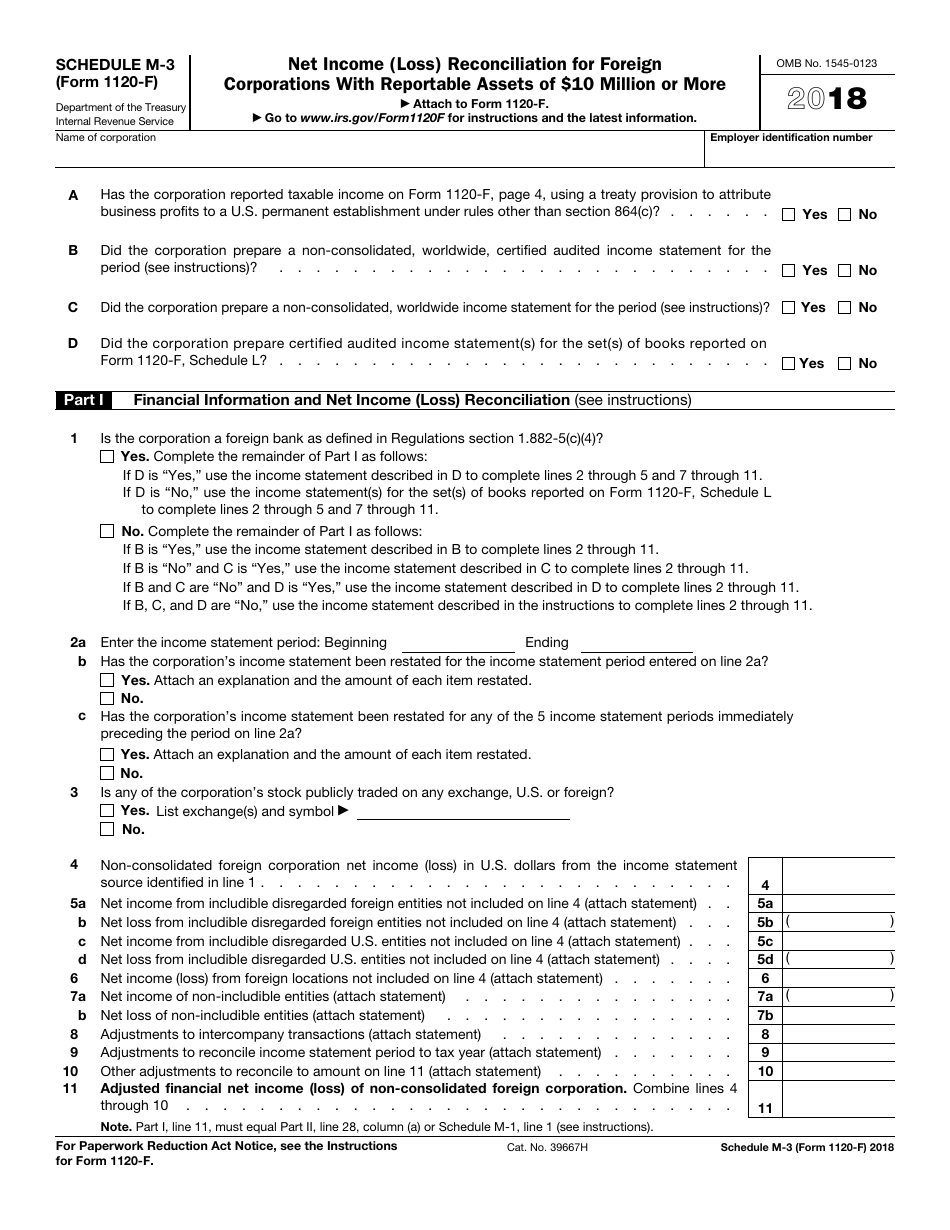

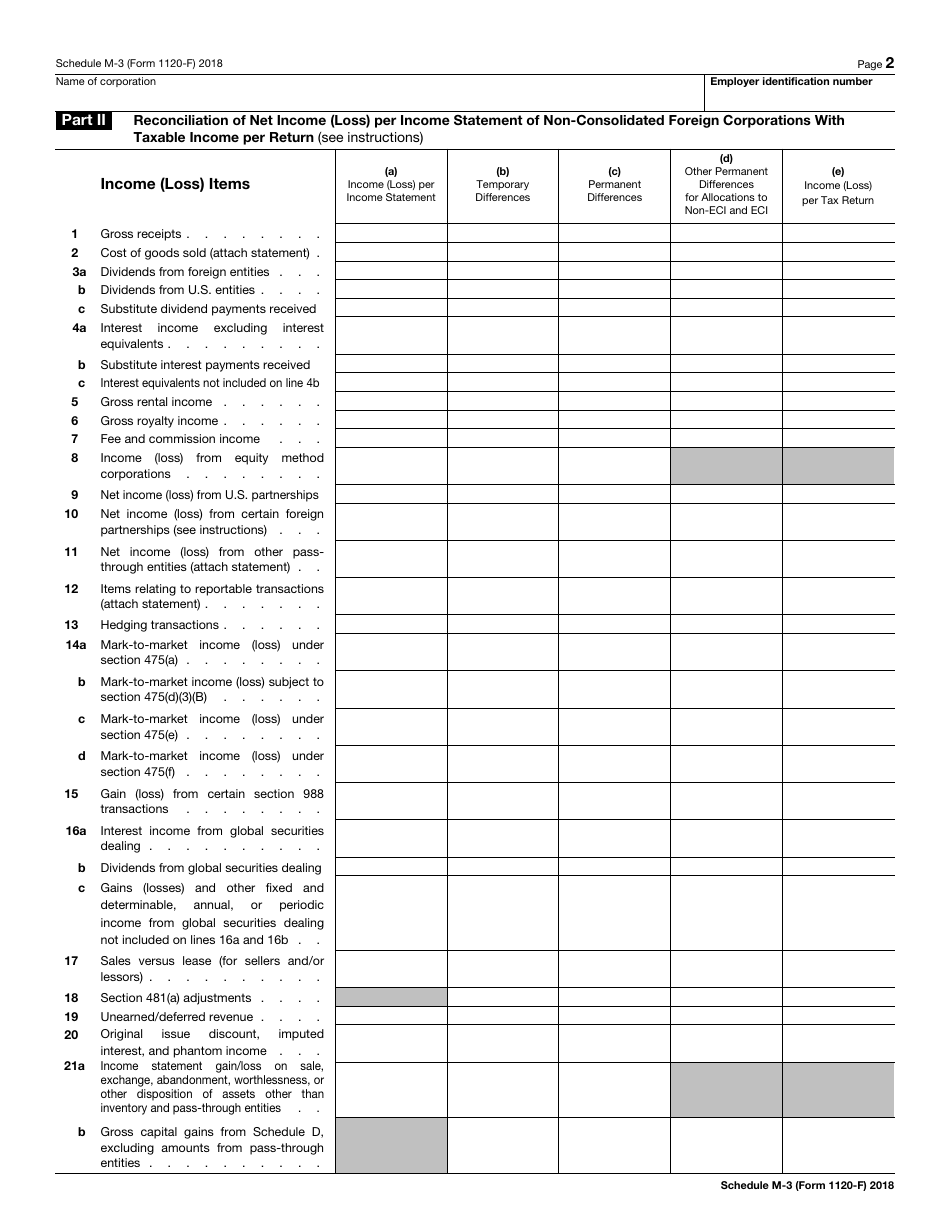

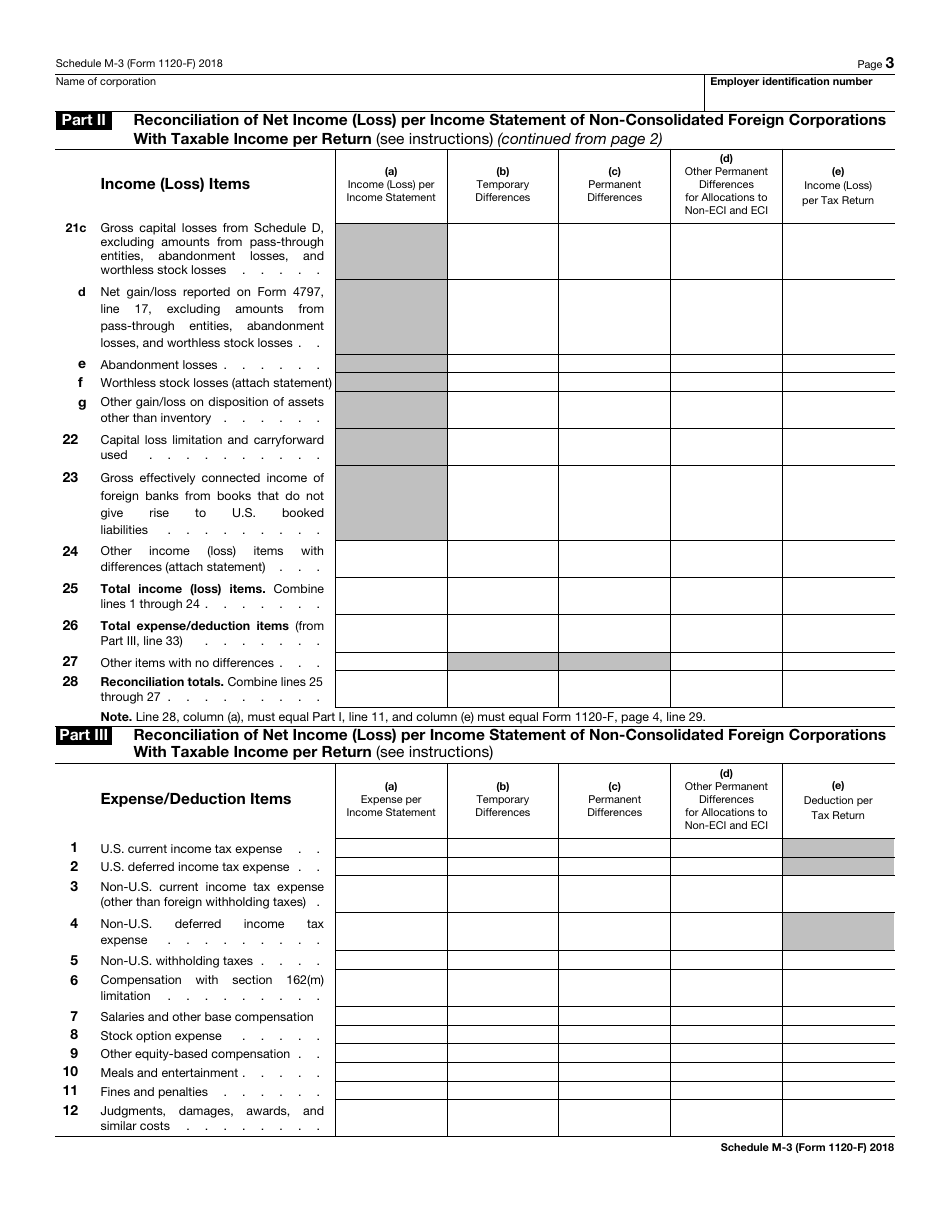

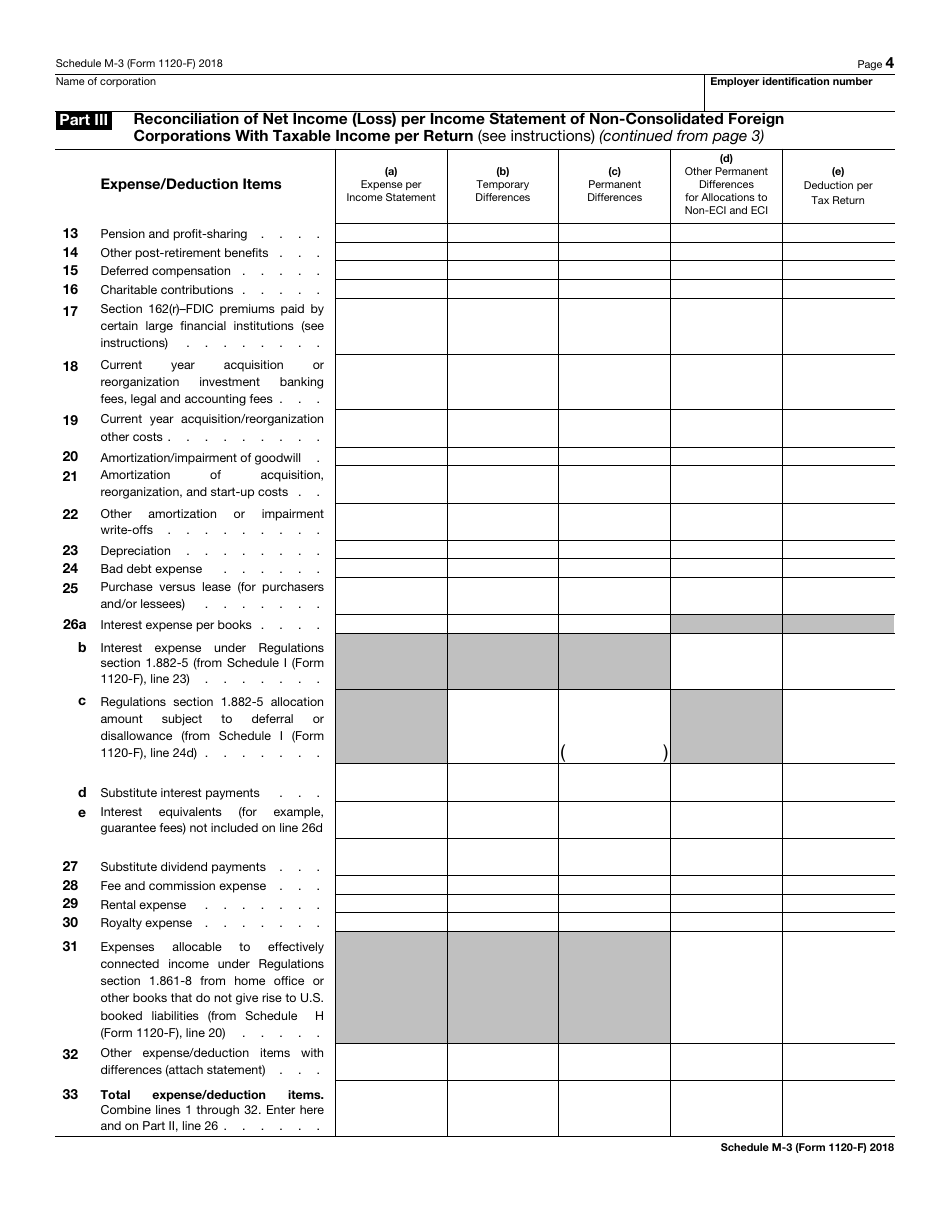

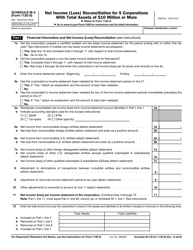

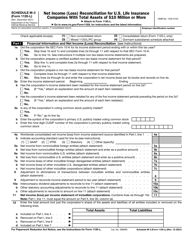

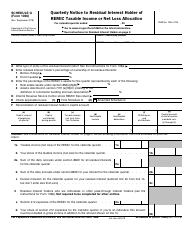

IRS Form 1120-F Schedule M-3

for the current year.

IRS Form 1120-F Schedule M-3 Net Income (Loss) Reconciliation for Foreign Corporations With Reportable Assets of $10 Million or More

What Is IRS Form 1120-F Schedule M-3?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-F, U.S. Income Tax Return of a Foreign Corporation. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-F?

A: IRS Form 1120-F is a tax form used by foreign corporations to report their income, deductions, and credits in the United States.

Q: What is Schedule M-3?

A: Schedule M-3 is a part of IRS Form 1120-F that foreign corporations need to complete to reconcile their net income (loss) for tax purposes.

Q: Who needs to file Form 1120-F?

A: Foreign corporations with income, deductions, or credits sourced in the United States need to file Form 1120-F.

Q: What is the purpose of Schedule M-3?

A: Schedule M-3 is used to provide a detailed reconciliation of net income (loss) for financial accounting purposes and tax purposes.

Q: When is Form 1120-F due?

A: Form 1120-F is generally due on the 15th day of the 3rd month after the end of the corporation's tax year.

Q: What are reportable assets?

A: Reportable assets are assets owned by a foreign corporation that meet or exceed $10 million, and they need to be reported on Schedule M-3 of Form 1120-F.

Q: What if my reportable assets are less than $10 million?

A: If your reportable assets are less than $10 million, you are not required to complete Schedule M-3 on Form 1120-F.

Q: What information is included in the Net Income (Loss) Reconciliation on Schedule M-3?

A: The Net Income (Loss) Reconciliation on Schedule M-3 includes adjustments to reconcile net income (loss) for tax purposes, such as book-tax differences and temporary differences.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-F Schedule M-3 through the link below or browse more documents in our library of IRS Forms.