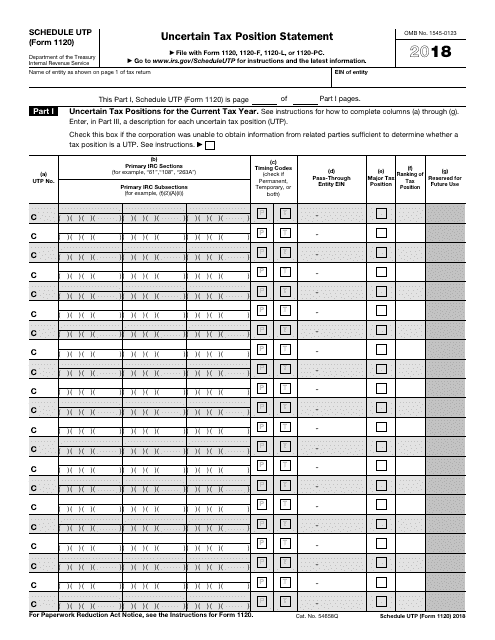

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1120 Schedule UTP

for the current year.

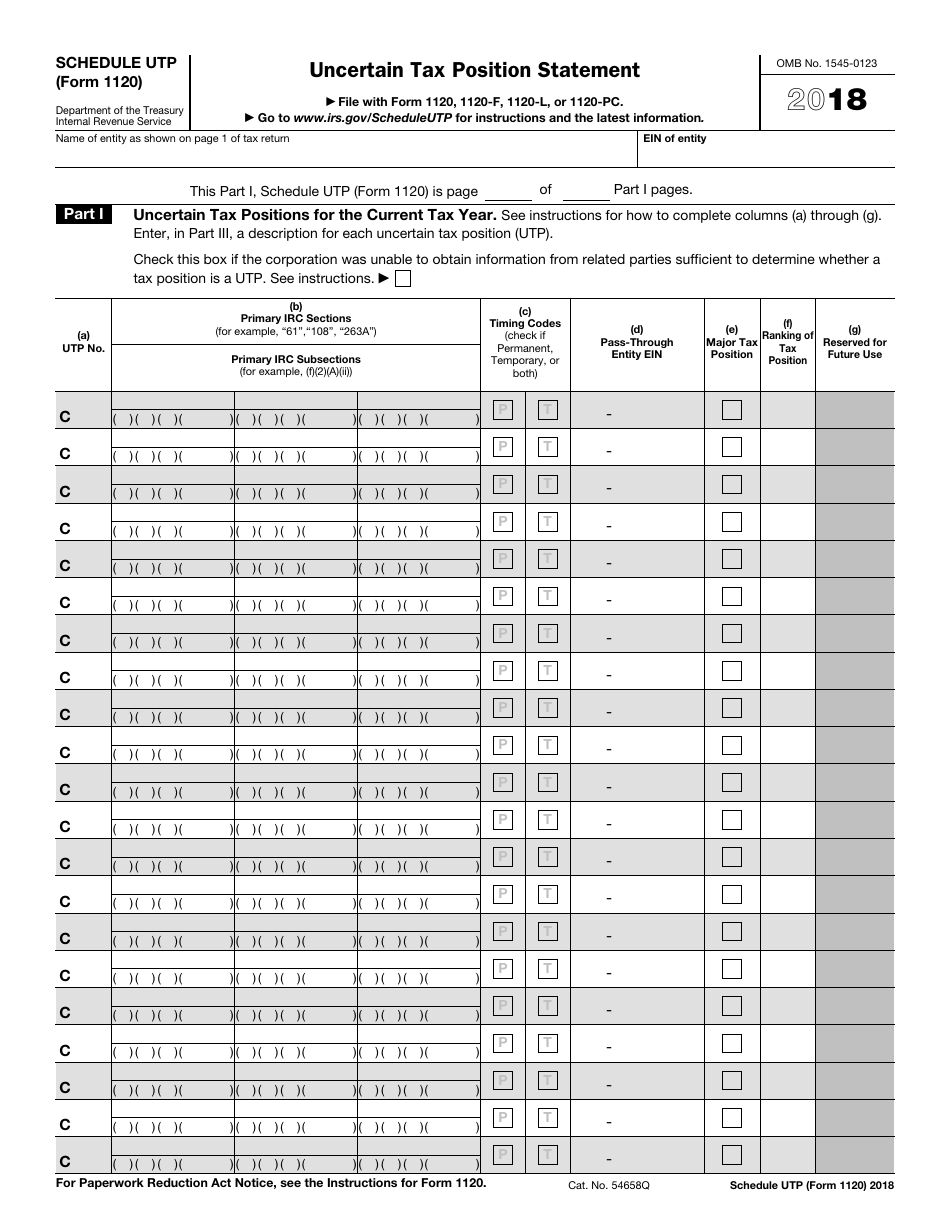

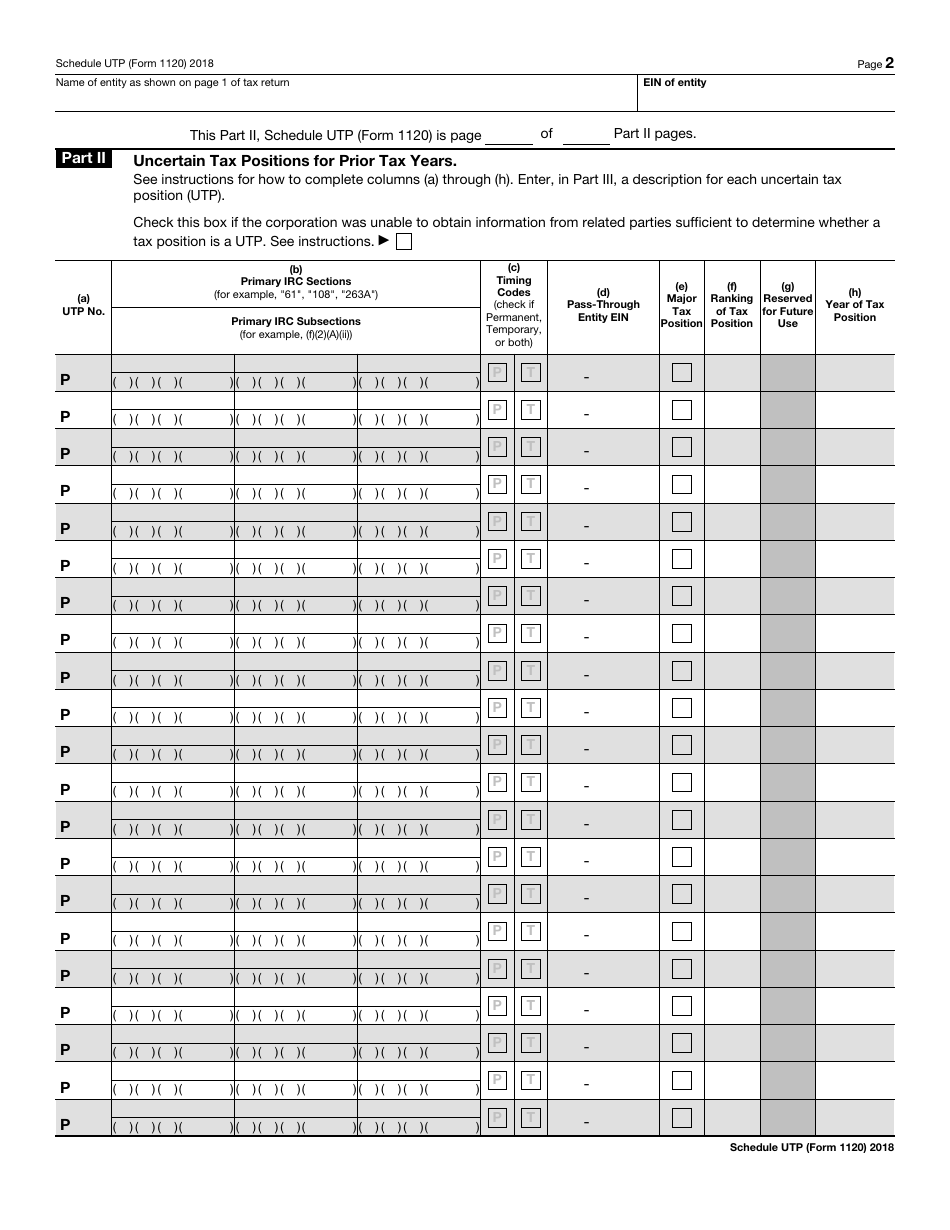

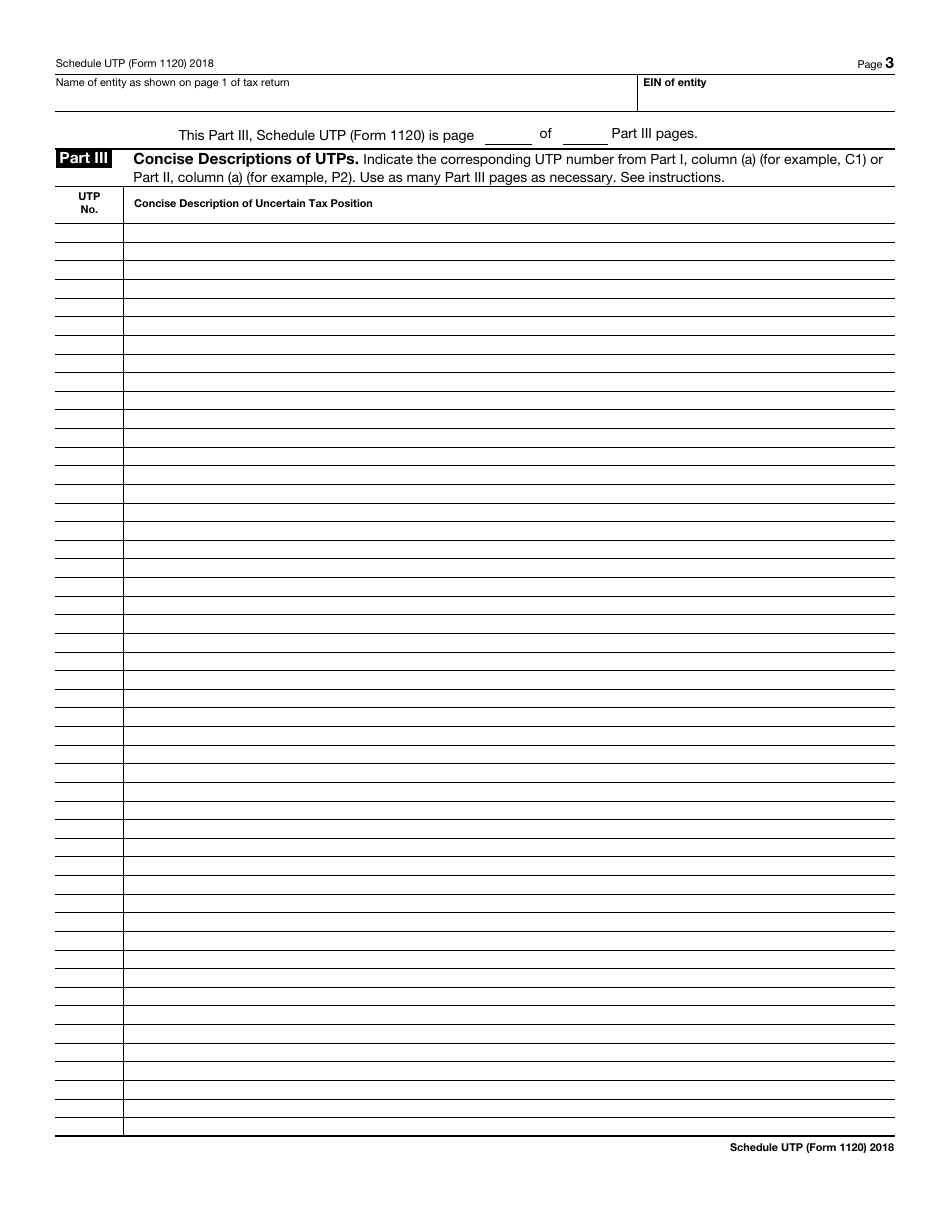

IRS Form 1120 Schedule UTP Uncertain Tax Position Statement

What Is IRS Form 1120 Schedule UTP?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120, U.S. Corporation Income Tax Return. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form 1120 Schedule UTP?

A: Form 1120 Schedule UTP is a statement used by businesses to disclose uncertain tax positions.

Q: Why would a business need to file Form 1120 Schedule UTP?

A: Businesses need to file Form 1120 Schedule UTP to provide transparency to the IRS regarding any uncertain tax positions they have taken.

Q: What is an uncertain tax position?

A: An uncertain tax position is a position taken on a tax return that the taxpayer is uncertain will be upheld by the IRS.

Q: What information is required on Form 1120 Schedule UTP?

A: Form 1120 Schedule UTP requires businesses to disclose the nature of the uncertain tax positions, the tax years affected, and the potential tax impact.

Q: Who needs to file Form 1120 Schedule UTP?

A: Certain businesses, including corporations with total assets exceeding $10 million, are required to file Form 1120 Schedule UTP.

Q: When is the deadline to file Form 1120 Schedule UTP?

A: The deadline to file Form 1120 Schedule UTP is generally the same as the deadline to file the business's tax return, which is usually March 15th for calendar year taxpayers.

Form Details:

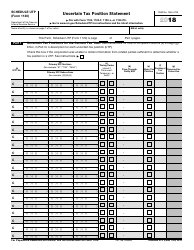

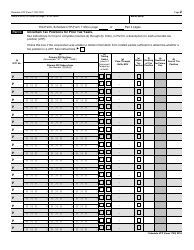

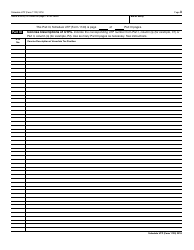

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120 Schedule UTP through the link below or browse more documents in our library of IRS Forms.