This version of the form is not currently in use and is provided for reference only. Download this version of

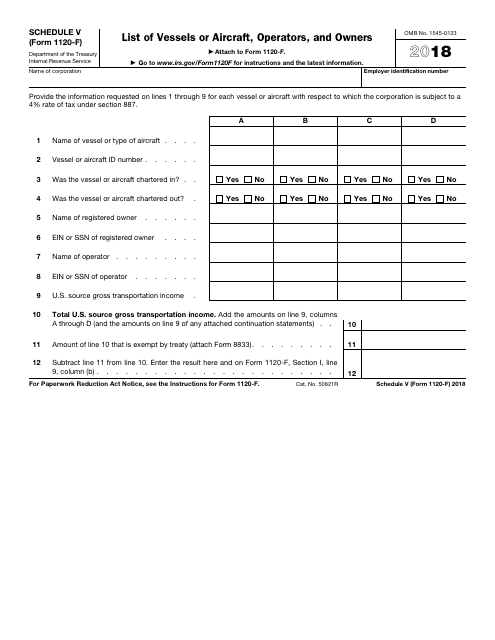

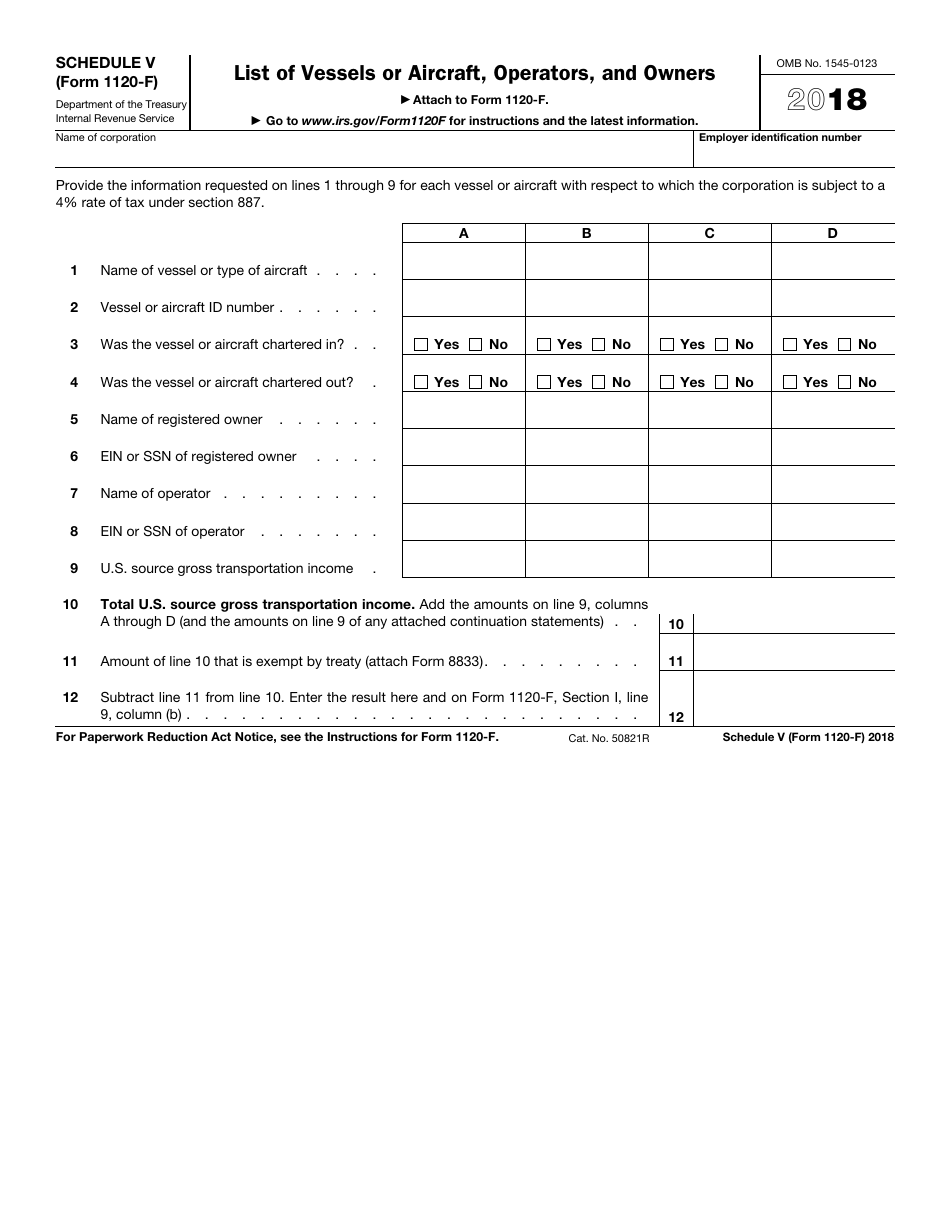

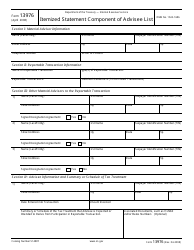

IRS Form 1120-F Schedule V

for the current year.

IRS Form 1120-F Schedule V List of Vessels or Aircraft, Operators, and Owners

What Is IRS Form 1120-F Schedule V?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-F, U.S. Income Tax Return of a Foreign Corporation. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-F Schedule V?

A: IRS Form 1120-F Schedule V is a form used to list vessels or aircraft, operators, and owners for tax purposes.

Q: What is the purpose of IRS Form 1120-F Schedule V?

A: The purpose of IRS Form 1120-F Schedule V is to provide information about vessels or aircraft, operators, and owners for tax reporting.

Q: Who is required to file IRS Form 1120-F Schedule V?

A: Those who need to report information about vessels or aircraft, operators, and owners for tax purposes are required to file IRS Form 1120-F Schedule V.

Q: What information is required on IRS Form 1120-F Schedule V?

A: IRS Form 1120-F Schedule V requires information such as the name of the vessel or aircraft, operator's name, operator's address, the owner's name, and the owner's address.

Q: Is there a deadline for filing IRS Form 1120-F Schedule V?

A: Yes, the deadline for filing IRS Form 1120-F Schedule V is usually the same as the deadline for filing the associated tax return, which is typically March 15th for calendar year filers.

Q: Are there any penalties for not filing IRS Form 1120-F Schedule V?

A: Yes, there may be penalties for not filing IRS Form 1120-F Schedule V or for filing the form with incorrect or incomplete information. It is important to ensure the form is filed accurately and on time.

Q: Can I e-file IRS Form 1120-F Schedule V?

A: No, IRS Form 1120-F Schedule V cannot be e-filed. It must be filed by mail to the designated IRS address.

Q: Do I need to file IRS Form 1120-F Schedule V if I don't own a vessel or aircraft?

A: No, if you don't own a vessel or aircraft, you don't need to file IRS Form 1120-F Schedule V. This form is specifically for reporting information about vessels or aircraft, operators, and owners.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-F Schedule V through the link below or browse more documents in our library of IRS Forms.