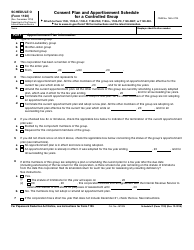

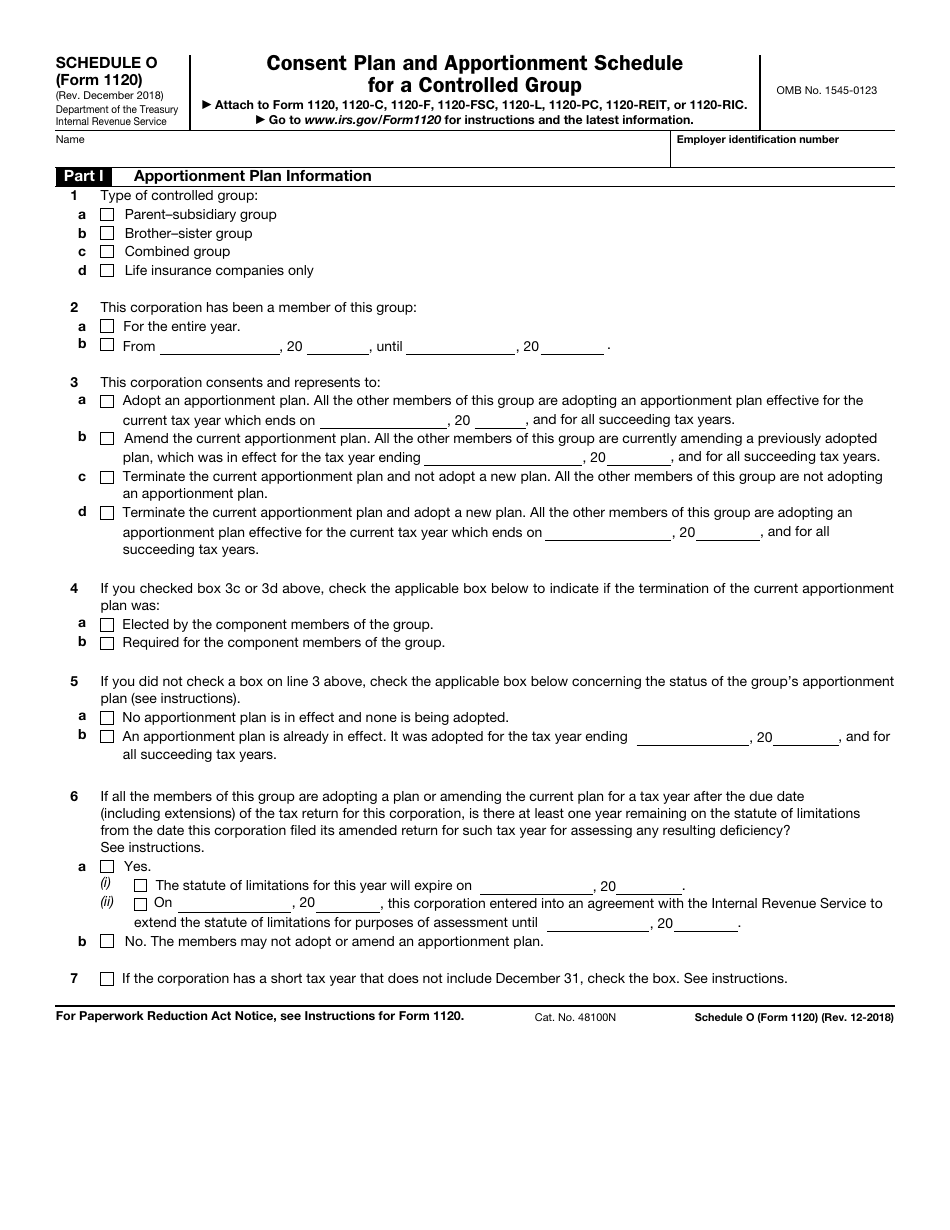

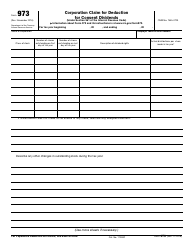

IRS Form 1120 Schedule O Consent Plan and Apportionment Schedule for a Controlled Group

What Is IRS Form 1120 Schedule O?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120 Schedule O?

A: IRS Form 1120 Schedule O is a form used to report the consent plan and apportionment schedule for a controlled group.

Q: What is a controlled group?

A: A controlled group is a group of corporations that are connected through ownership and meet certain criteria set by the IRS.

Q: What is the purpose of IRS Form 1120 Schedule O?

A: The purpose of IRS Form 1120 Schedule O is to report the consent plan and apportionment schedule for a controlled group.

Q: What is a consent plan?

A: A consent plan is a plan that outlines the consent of each member of a controlled group to be included in the consolidated group for tax purposes.

Q: What is an apportionment schedule?

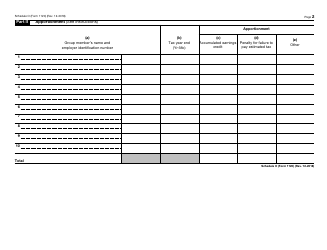

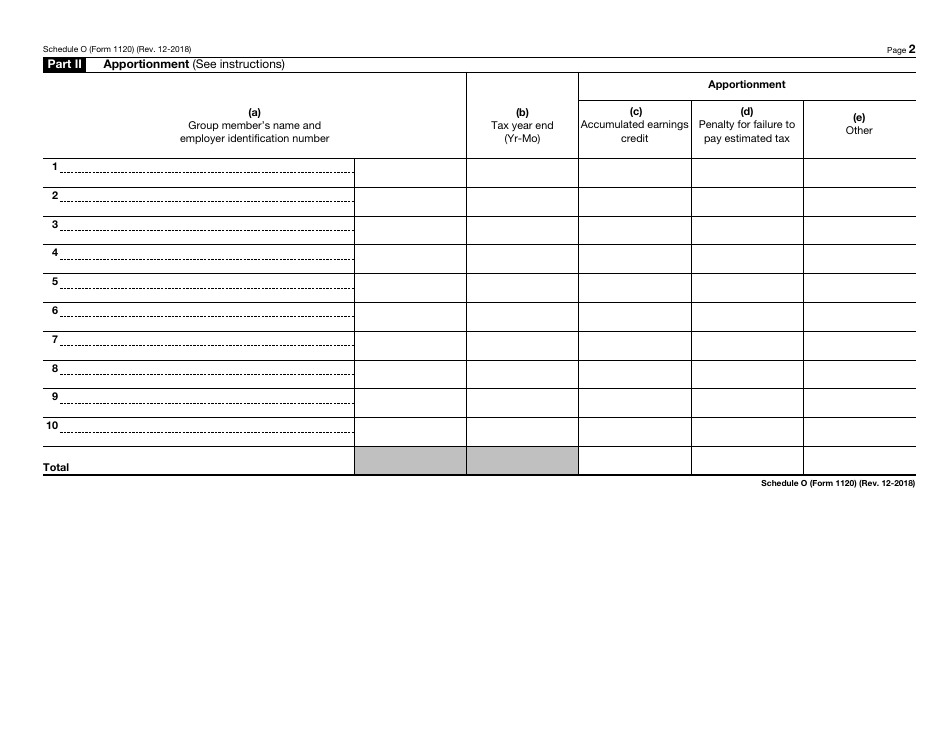

A: An apportionment schedule is a schedule that allocates income, deductions, and credits among the members of a controlled group.

Q: Who needs to file IRS Form 1120 Schedule O?

A: Any controlled group that wants to file a consolidated tax return needs to file IRS Form 1120 Schedule O.

Q: Are there any specific requirements for filing IRS Form 1120 Schedule O?

A: Yes, there are specific requirements for filing IRS Form 1120 Schedule O, including having a consent plan and an apportionment schedule in place.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120 Schedule O through the link below or browse more documents in our library of IRS Forms.