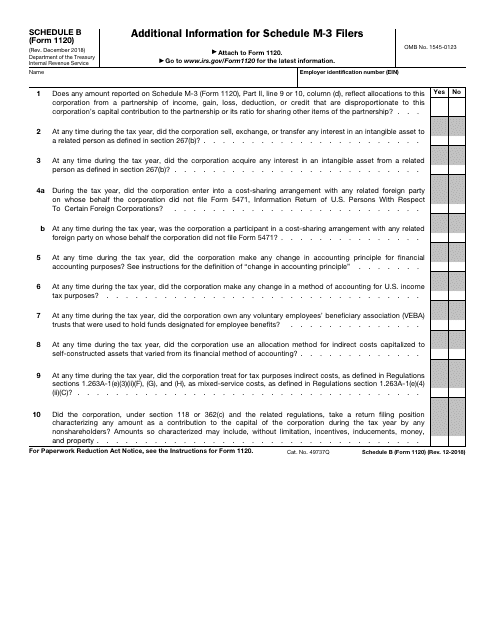

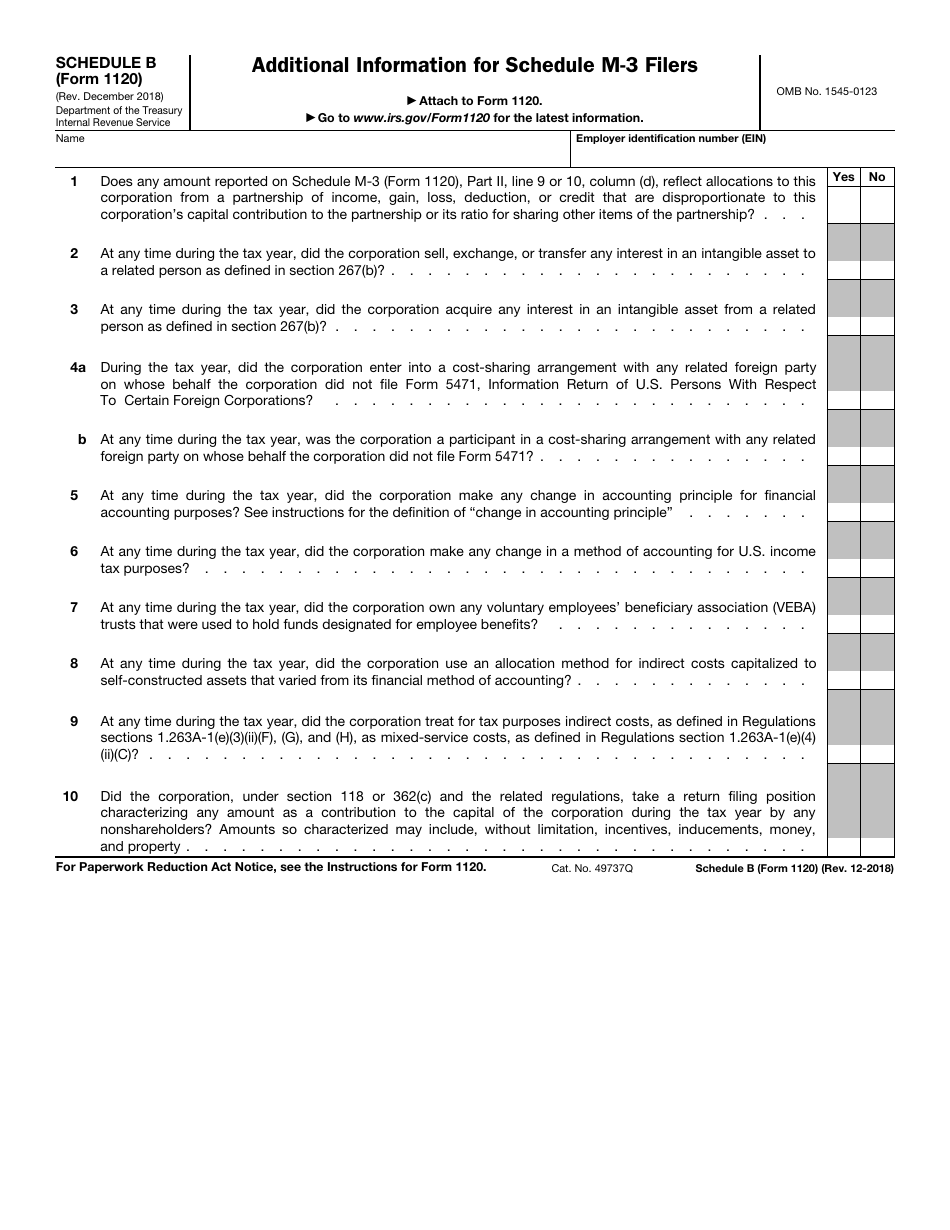

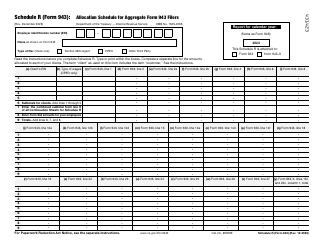

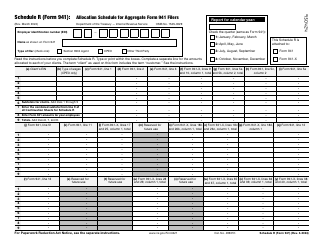

IRS Form 1120 Schedule B Additional Information for Schedule M-3 Filers

What Is IRS Form 1120 Schedule B?

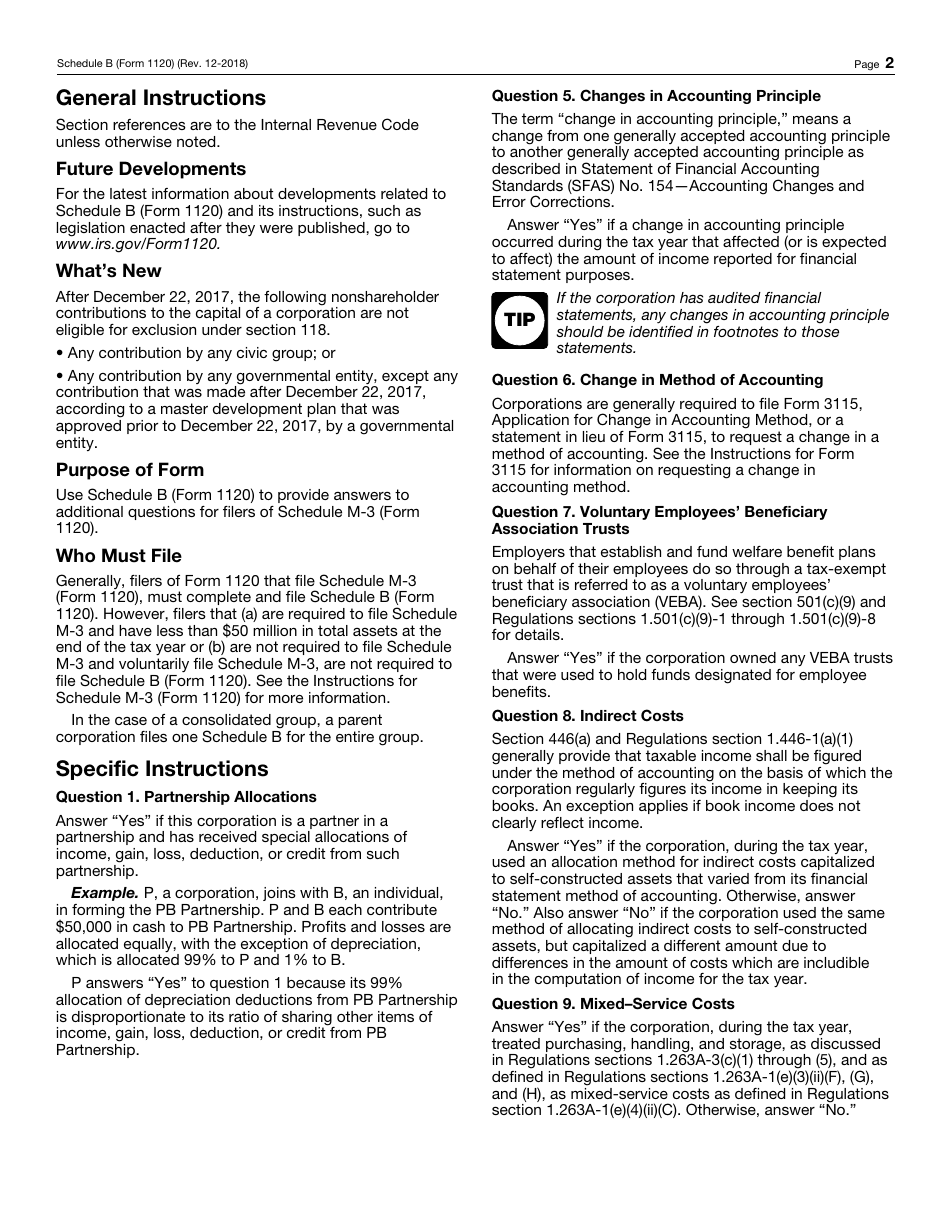

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1120?

A: IRS Form 1120 is the U.S. Corporation Income Tax Return.

Q: What is Schedule B?

A: Schedule B is a supplementary form used to provide additional information for Schedule M-3 filers.

Q: Who needs to file Schedule B?

A: Schedule B is required for corporations that file Schedule M-3, which includes corporations with total assets of $10 million or more.

Q: What information is required on Schedule B?

A: Schedule B requires information such as the corporation's name, employer identification number, and a breakdown of certain balance sheet items.

Q: When is the deadline to file IRS Form 1120 Schedule B?

A: The deadline to file IRS Form 1120 Schedule B is the same as the deadline for filing IRS Form 1120, which is generally March 15th for calendar year corporations.

Q: Is there a penalty for not filing Schedule B if required?

A: Yes, there may be penalties for not filing Schedule B when required. It's important to comply with all IRS filing requirements to avoid penalties and potential audits.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120 Schedule B through the link below or browse more documents in our library of IRS Forms.