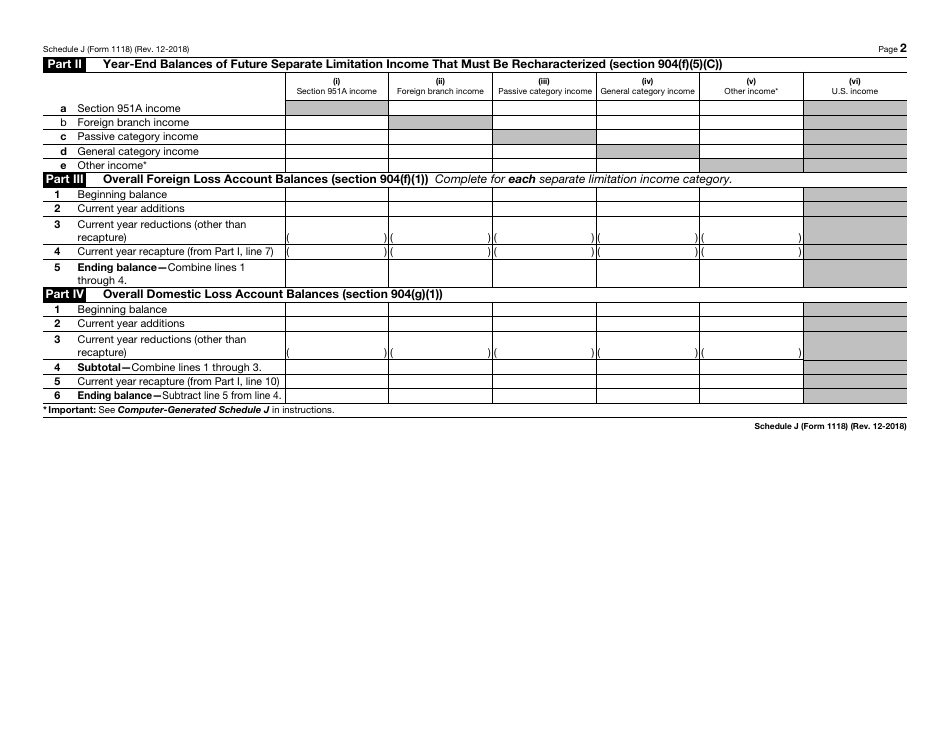

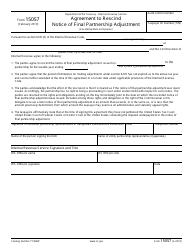

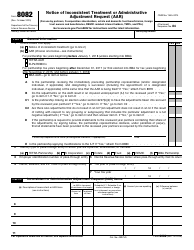

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1118 Schedule J

for the current year.

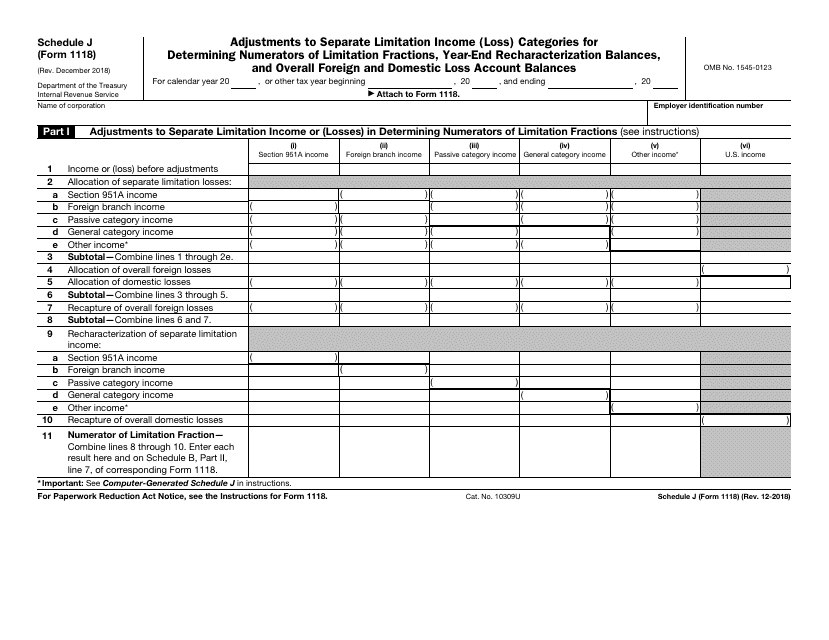

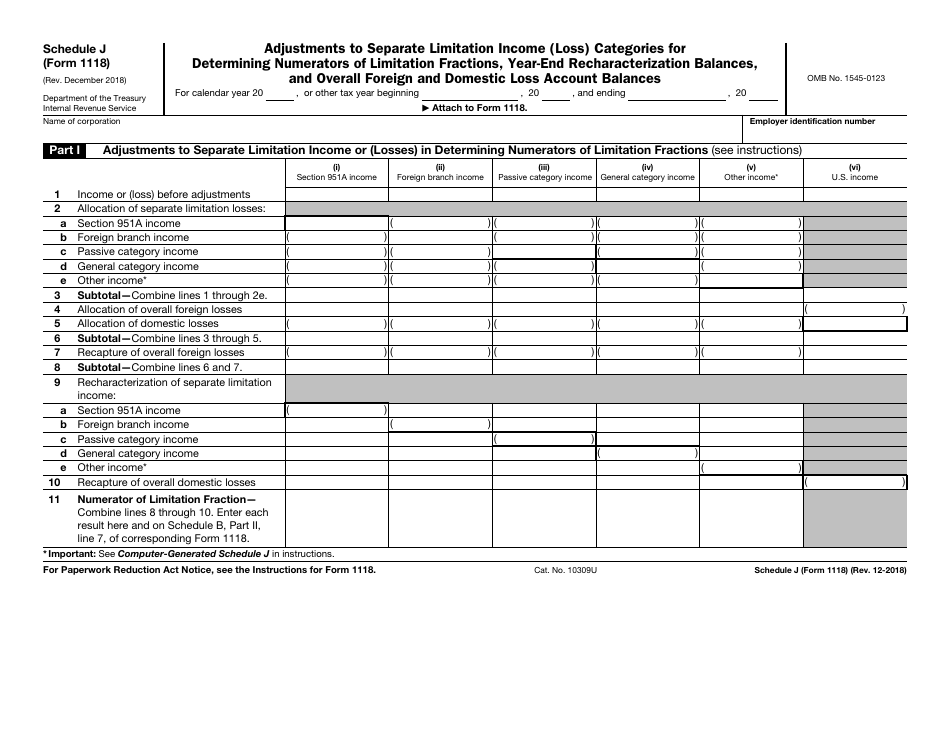

IRS Form 1118 Schedule J Adjustments to Separate Limitation Income (Loss) Categories for Determining Numerators of Limitation Fractions, Year-End Recharacterization Balances, and Overall Foreign and Domestic Loss Account Balances

What Is IRS Form 1118 Schedule J?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2018. The document is a supplement to IRS Form 1118, Foreign Tax Credit - Corporations. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1118 Schedule J?

A: IRS Form 1118 Schedule J is a form used to report adjustments to separate limitation income (loss) categories.

Q: What are the adjustments reported on IRS Form 1118 Schedule J?

A: IRS Form 1118 Schedule J is used to report adjustments to separate limitation income (loss) categories for determining numerators of limitation fractions.

Q: What is the purpose of reporting these adjustments?

A: The purpose of reporting these adjustments is to accurately calculate the limitation fractions for foreign and domestic income.

Q: What are Year-End Recharacterization Balances?

A: Year-End Recharacterization Balances refer to the balances of income or losses that are recharacterized at the end of the year for tax purposes.

Q: What are Overall Foreign and Domestic Loss Account Balances?

A: Overall Foreign and Domestic Loss Account Balances refer to the total balances of foreign and domestic loss accounts.

Q: Who needs to file IRS Form 1118 Schedule J?

A: Taxpayers who have separate limitation income (loss) categories and need to report adjustments for calculating limitation fractions should file IRS Form 1118 Schedule J.

Q: What is the deadline for filing IRS Form 1118 Schedule J?

A: The deadline for filing IRS Form 1118 Schedule J is typically the same as the deadline for filing the taxpayer's income tax return, usually April 15th.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1118 Schedule J through the link below or browse more documents in our library of IRS Forms.