This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1099-SB

for the current year.

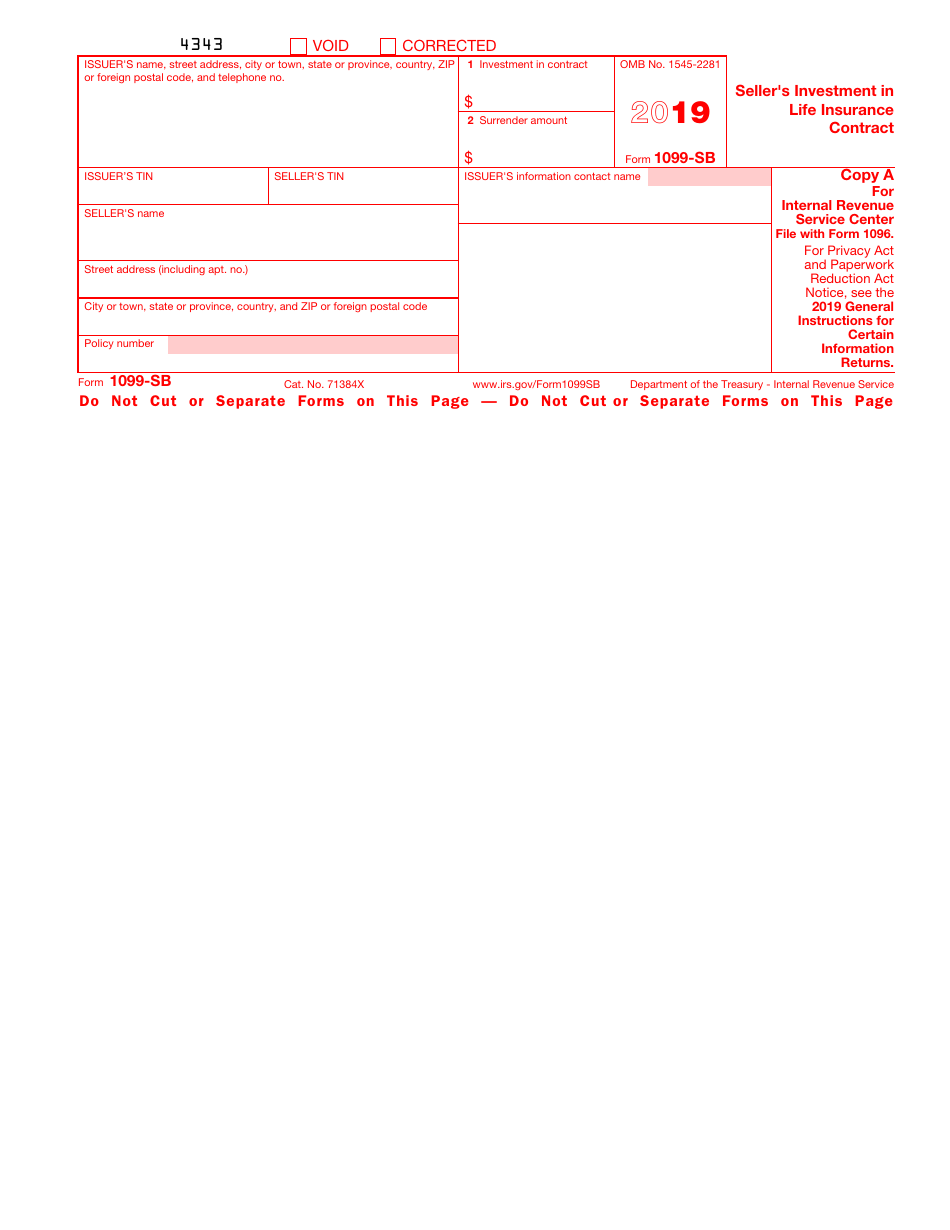

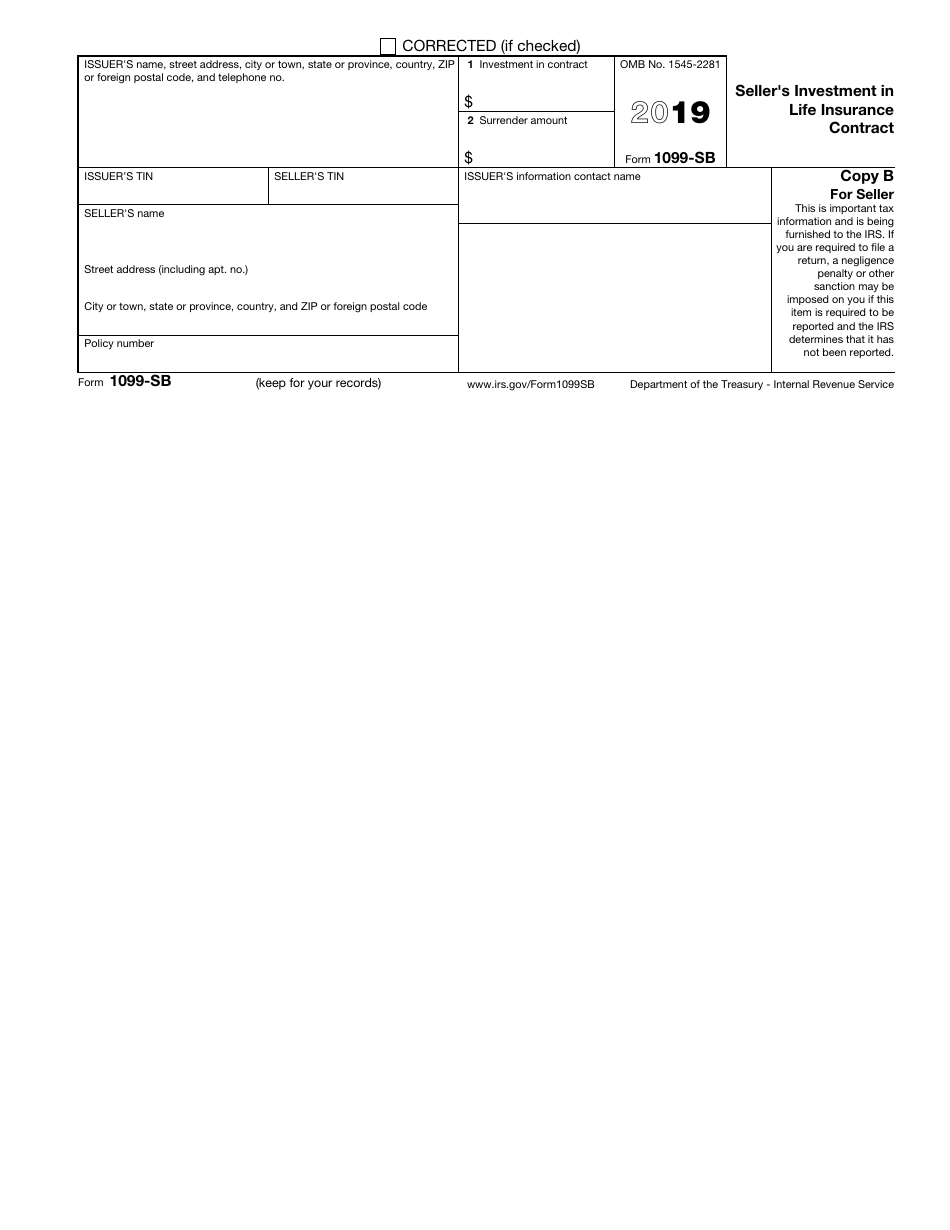

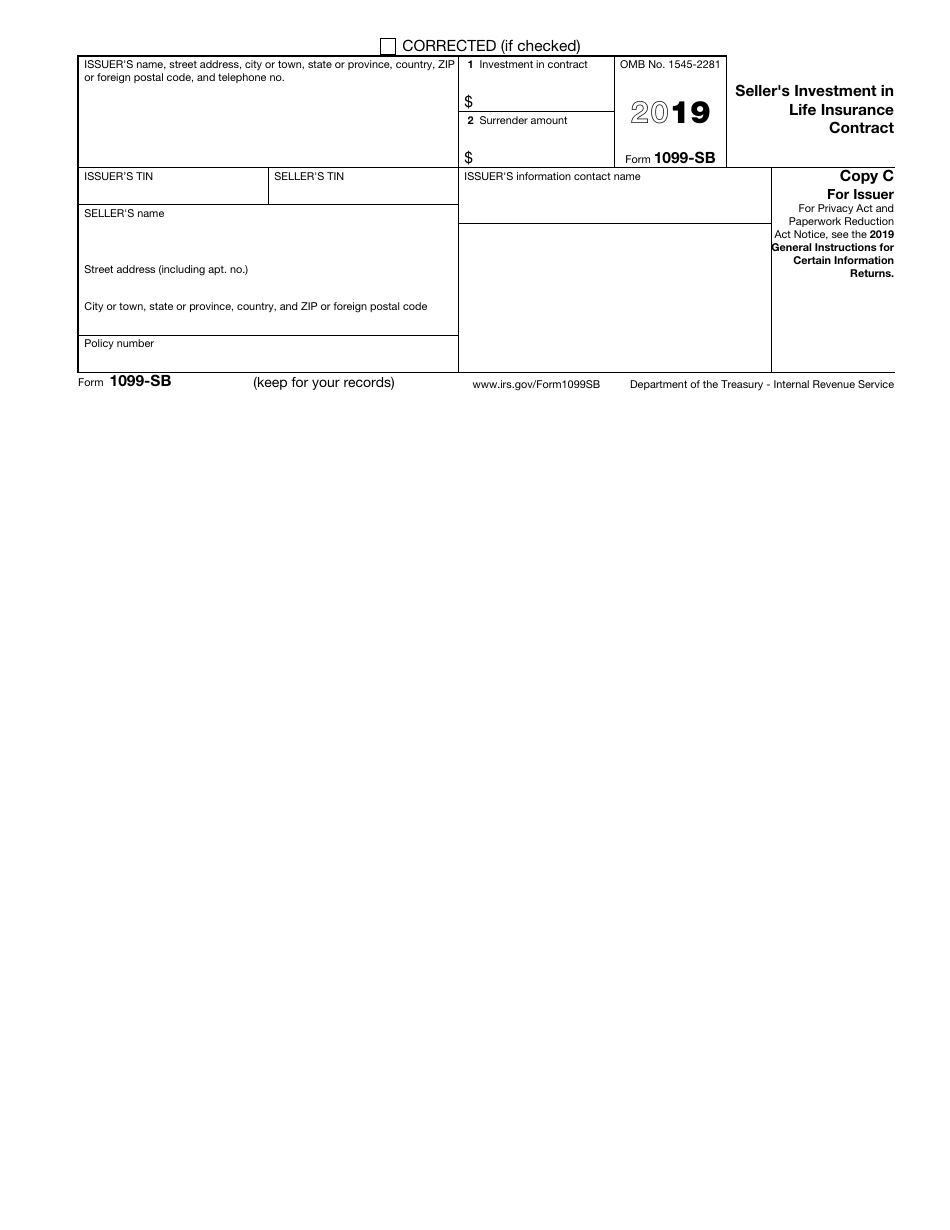

IRS Form 1099-SB Seller's Investment in Life Insurance Contract

What Is IRS Form 1099-SB?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1099-SB?

A: IRS Form 1099-SB is a tax form used to report the seller's investment in a life insurance contract.

Q: Who needs to file IRS Form 1099-SB?

A: The person or entity who sold a life insurance contract and received payment needs to file IRS Form 1099-SB.

Q: What information does IRS Form 1099-SB require?

A: IRS Form 1099-SB requires information about the seller, the buyer, and the sale of the life insurance contract.

Q: When is the deadline to file IRS Form 1099-SB?

A: The deadline to file IRS Form 1099-SB is usually January 31st of the year following the sale.

Q: What are the consequences of not filing IRS Form 1099-SB?

A: Failure to file IRS Form 1099-SB or filing it late can result in penalties imposed by the IRS.

Q: Can I e-file IRS Form 1099-SB?

A: Yes, you can e-file IRS Form 1099-SB using approved software or through an authorized e-file provider.

Form Details:

- A 6-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1099-SB through the link below or browse more documents in our library of IRS Forms.