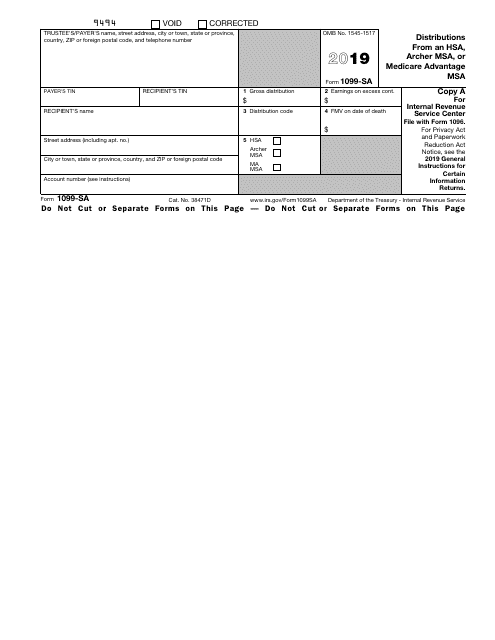

This version of the form is not currently in use and is provided for reference only. Download this version of

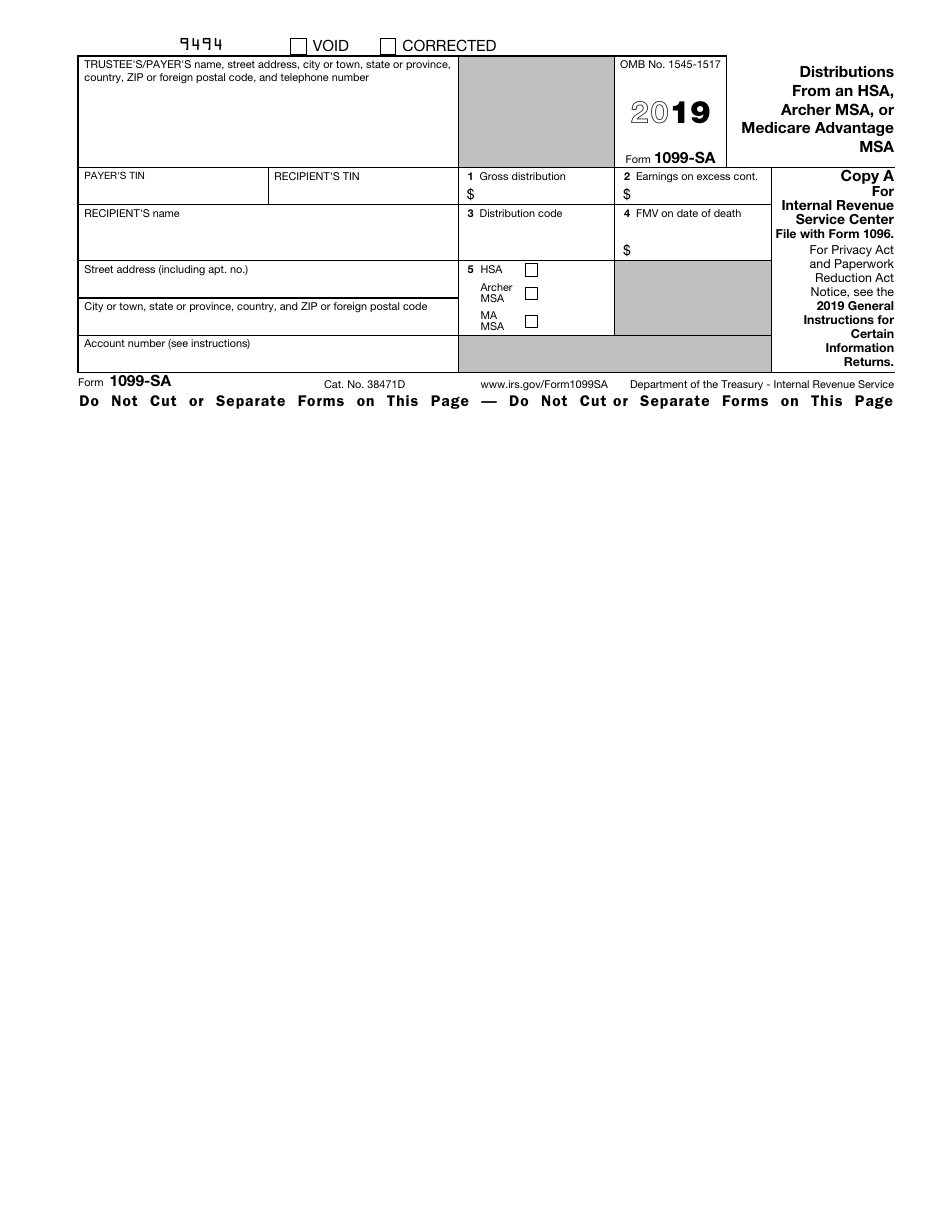

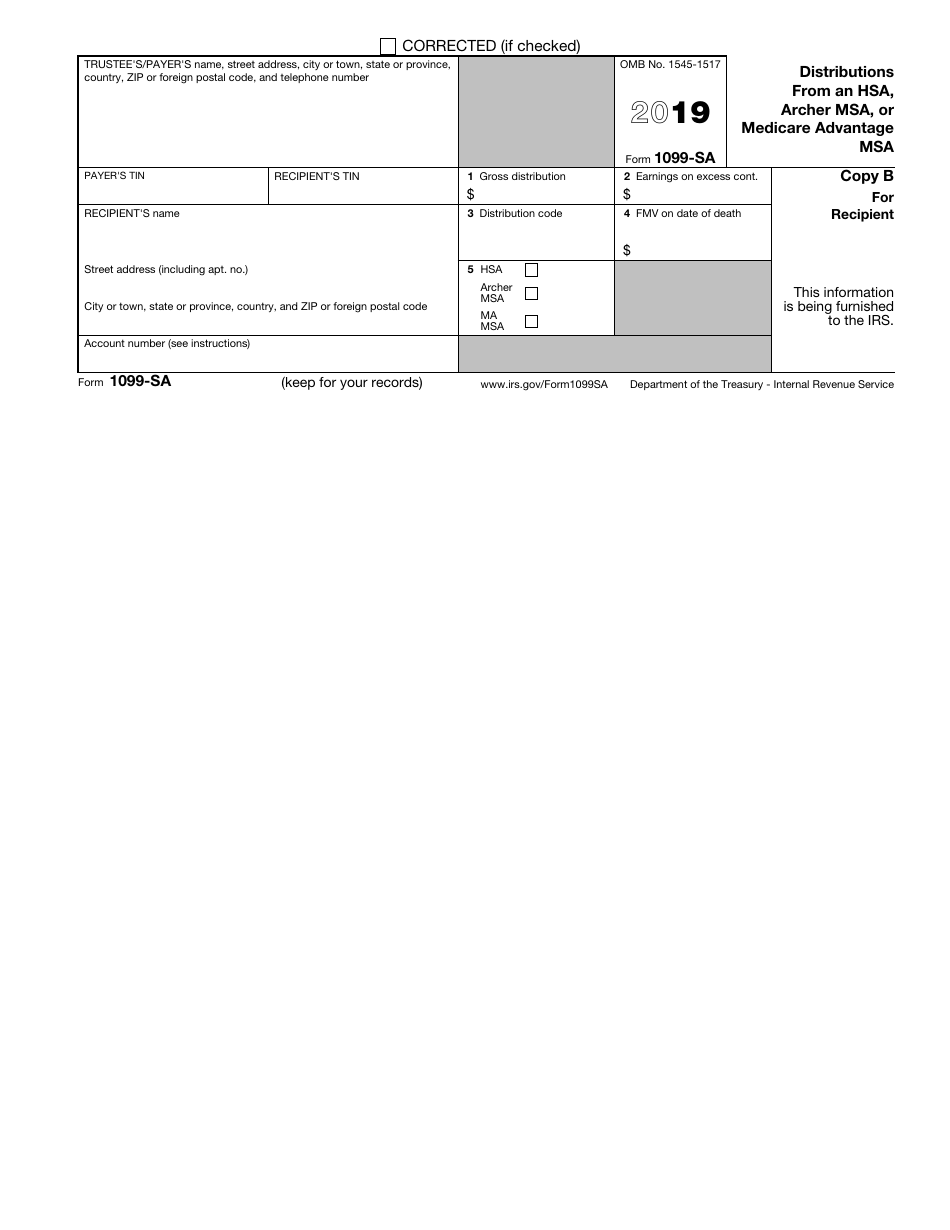

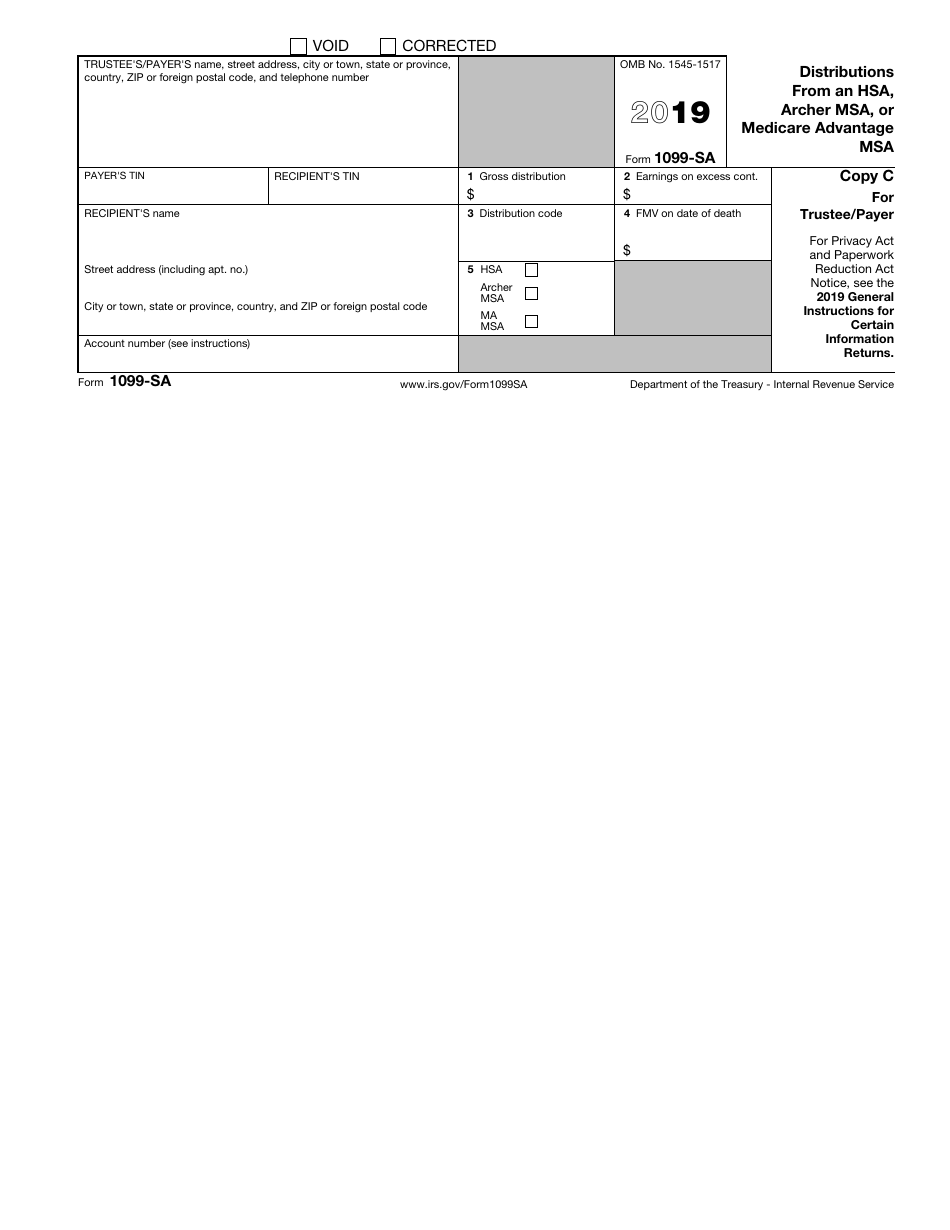

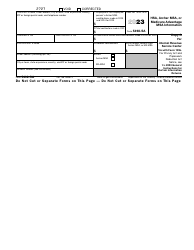

IRS Form 1099-SA

for the current year.

IRS Form 1099-SA Distributions From an Hsa, Archer Msa, or Medicare Advantage Msa

What Is IRS Form 1099-SA?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1099-SA?

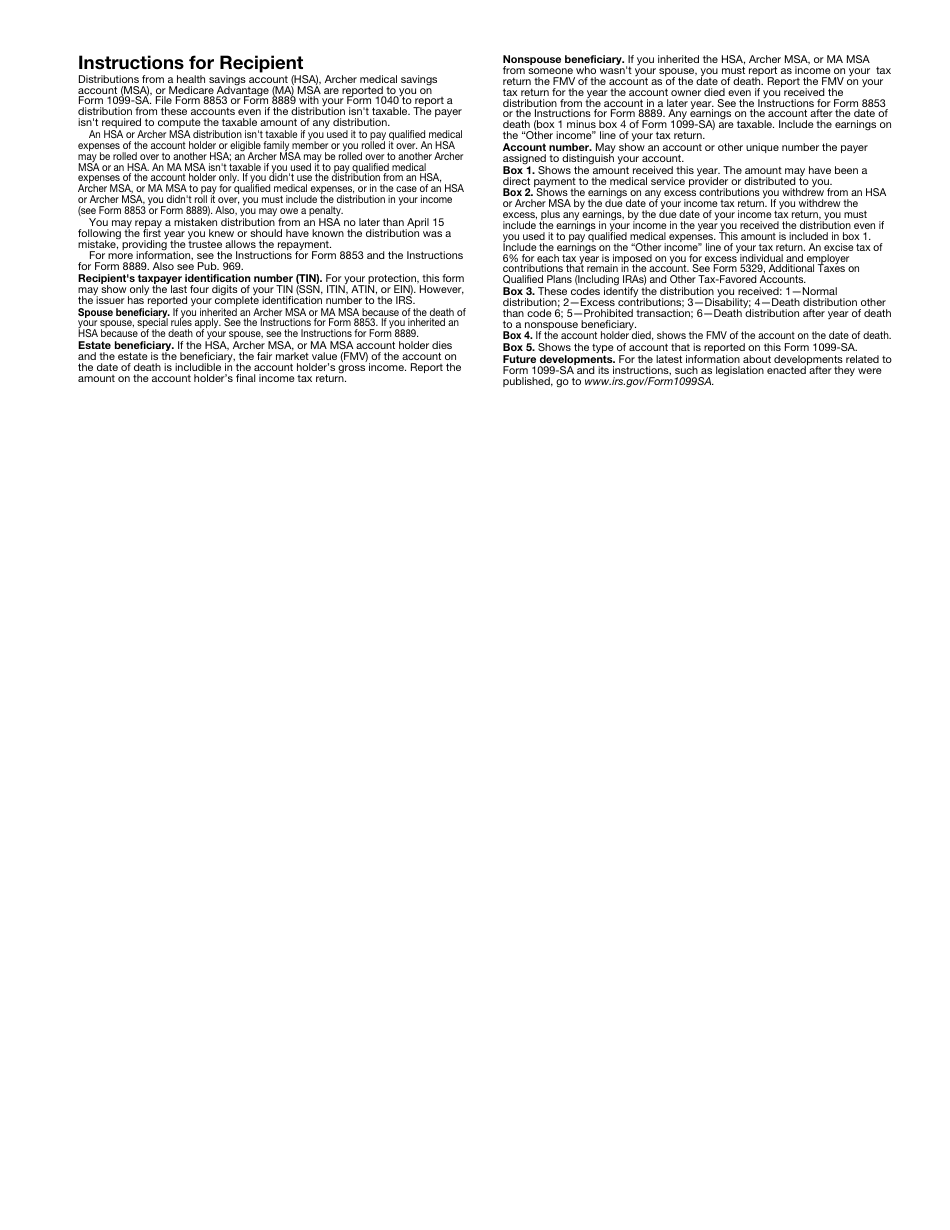

A: IRS Form 1099-SA is a tax form used to report distributions from Health Savings Accounts (HSA), Archer Medical Savings Accounts (MSA), and Medicare Advantage MSAs.

Q: What is the purpose of IRS Form 1099-SA?

A: The purpose of IRS Form 1099-SA is to report the amount of money distributed from an HSA, MSA, or Medicare Advantage MSA, which may be subject to tax and penalty.

Q: Who receives IRS Form 1099-SA?

A: Both the account holder and the IRS receive a copy of IRS Form 1099-SA. The account holder receives it as a record of their distributions, while the IRS uses it for tax enforcement and reporting purposes.

Q: When is IRS Form 1099-SA issued?

A: IRS Form 1099-SA is typically issued by the financial institution that administers the HSA, MSA, or Medicare Advantage MSA by January 31st of the year following the distribution.

Q: What information does IRS Form 1099-SA include?

A: IRS Form 1099-SA includes the account holder's name, address, and taxpayer identification number, as well as the amount of the distribution and any earnings or gains attributable to the distribution.

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1099-SA through the link below or browse more documents in our library of IRS Forms.