This version of the form is not currently in use and is provided for reference only. Download this version of

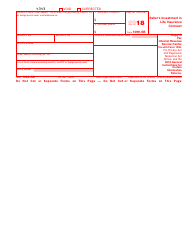

IRS Form 1099-SB

for the current year.

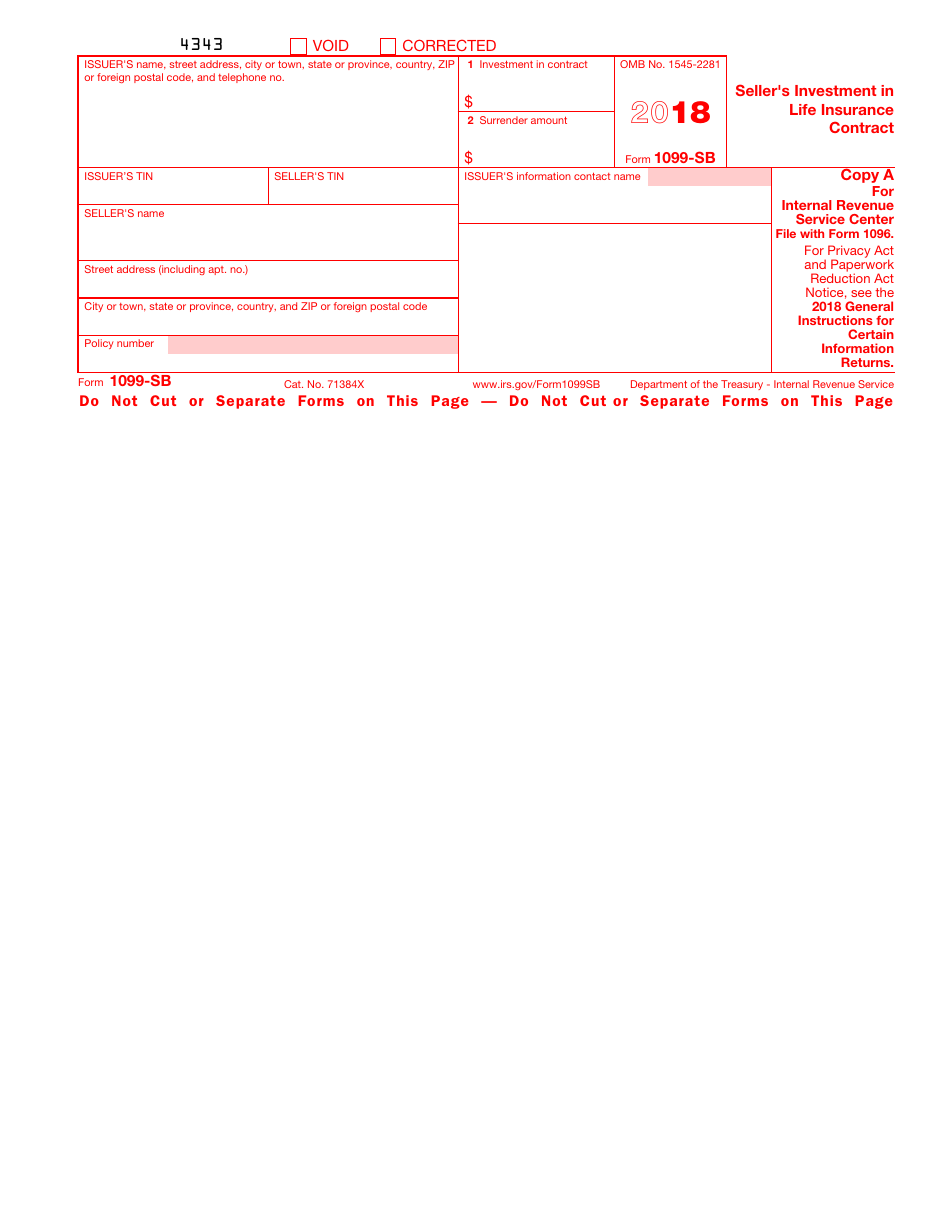

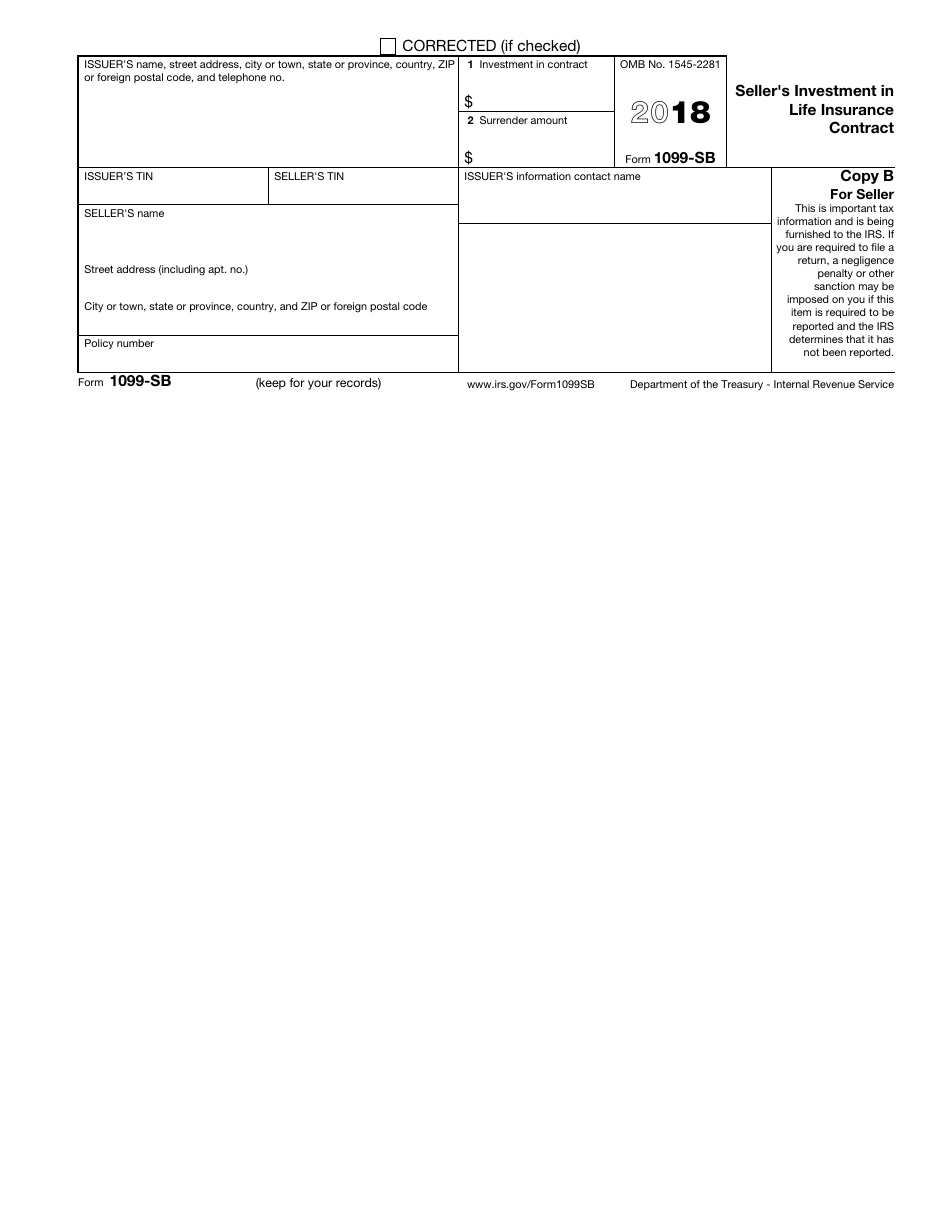

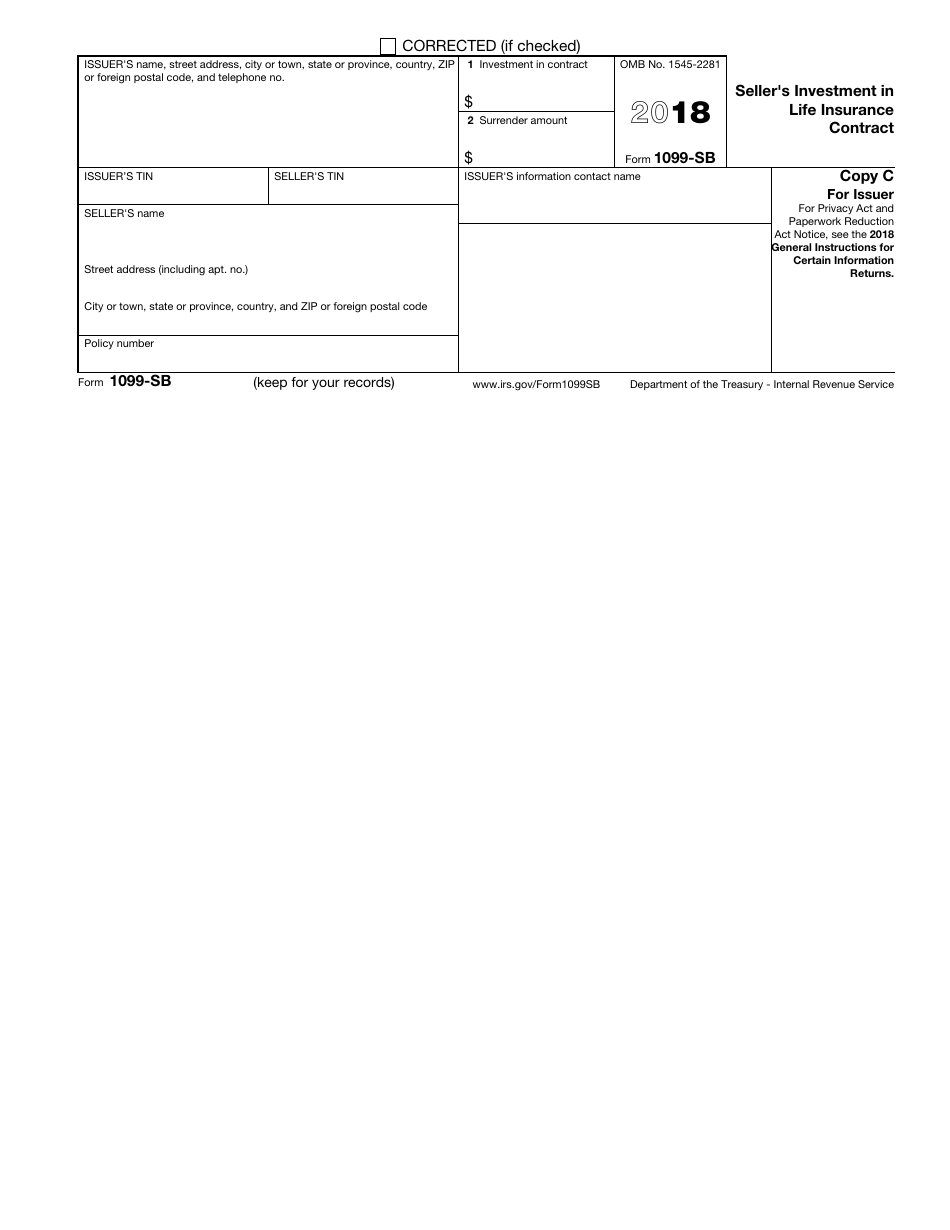

IRS Form 1099-SB Seller's Investment in Life Insurance Contract

What Is IRS Form 1099-SB?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1099-SB?

A: IRS Form 1099-SB is a tax form used to report the seller's investment in a life insurance contract.

Q: Who needs to file IRS Form 1099-SB?

A: The seller of a life insurance contract needs to file IRS Form 1099-SB.

Q: What information is reported on IRS Form 1099-SB?

A: IRS Form 1099-SB reports the seller's investment in a life insurance contract, including the gross proceeds and the seller's basis in the contract.

Q: When is IRS Form 1099-SB due?

A: IRS Form 1099-SB is due by January 31st of the year following the year of the sale.

Q: Are there any penalties for not filing IRS Form 1099-SB?

A: Yes, there are penalties for not filing IRS Form 1099-SB, including potential monetary fines.

Q: Can I file IRS Form 1099-SB electronically?

A: Yes, you can file IRS Form 1099-SB electronically using the IRS's Filing Information Returns Electronically (FIRE) system.

Q: What if I made a mistake on IRS Form 1099-SB?

A: If you made a mistake on IRS Form 1099-SB, you should file a corrected form as soon as possible.

Q: Do I need to send a copy of IRS Form 1099-SB to the recipient?

A: Yes, you need to send a copy of IRS Form 1099-SB to the recipient by January 31st of the year following the year of the sale.

Q: Can I get an extension to file IRS Form 1099-SB?

A: Yes, you can request an extension to file IRS Form 1099-SB by filing Form 8809 with the IRS.

Form Details:

- A 6-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1099-SB through the link below or browse more documents in our library of IRS Forms.