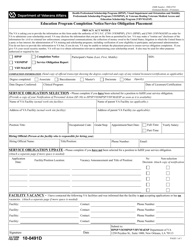

This version of the form is not currently in use and is provided for reference only. Download this version of

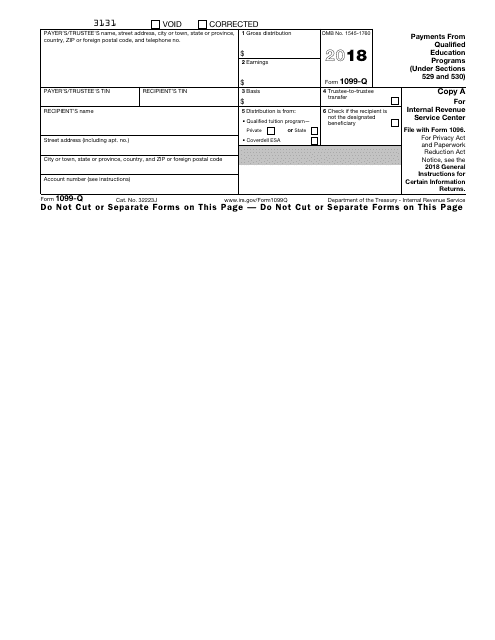

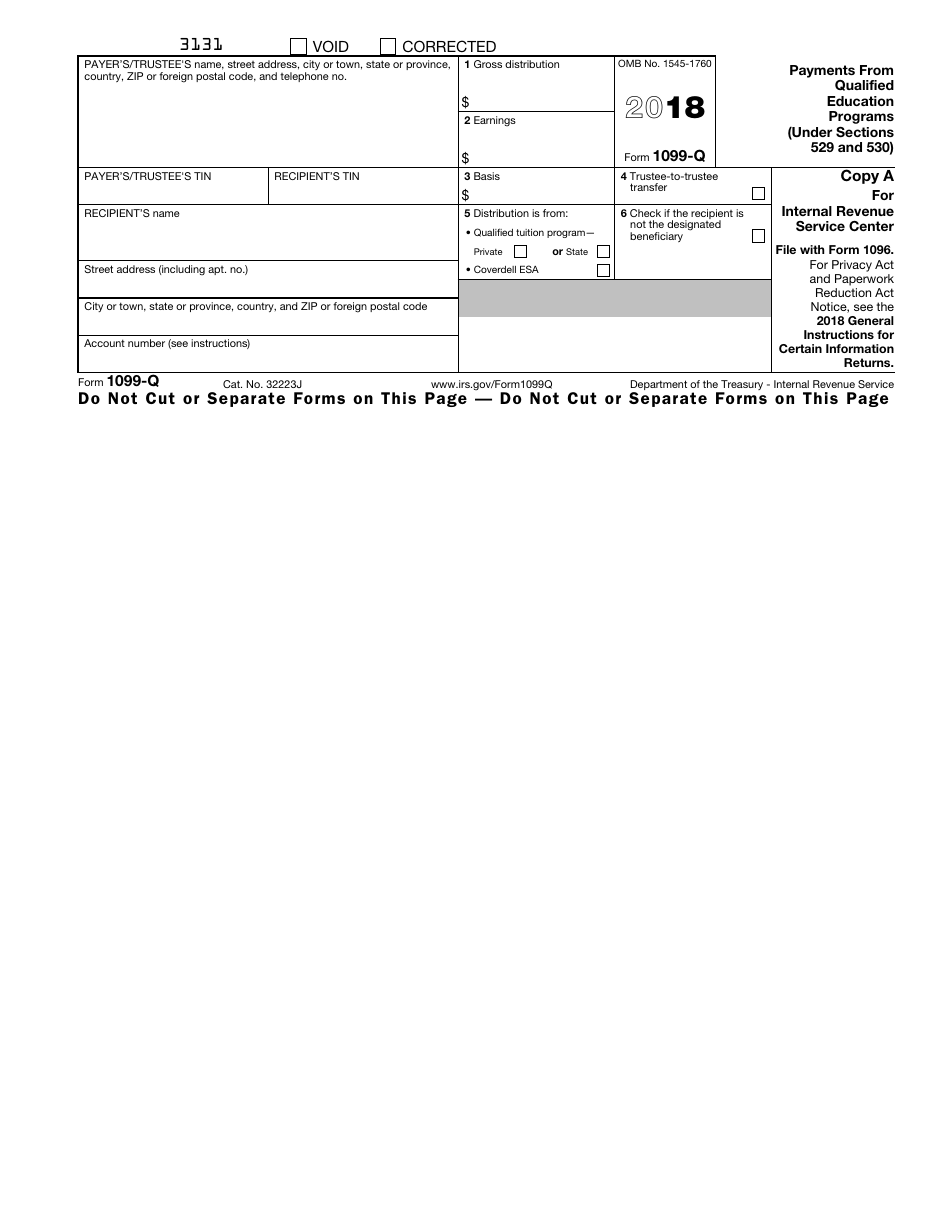

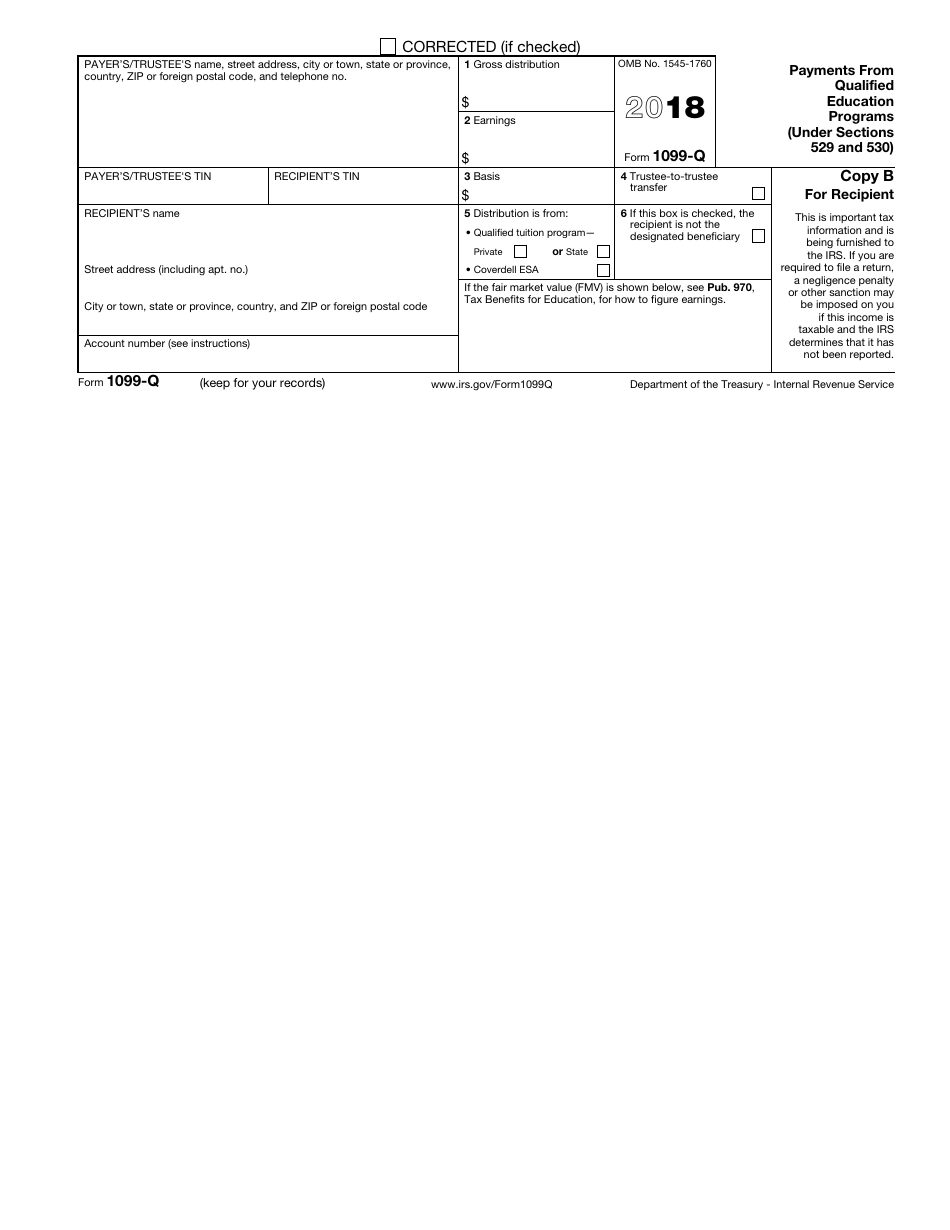

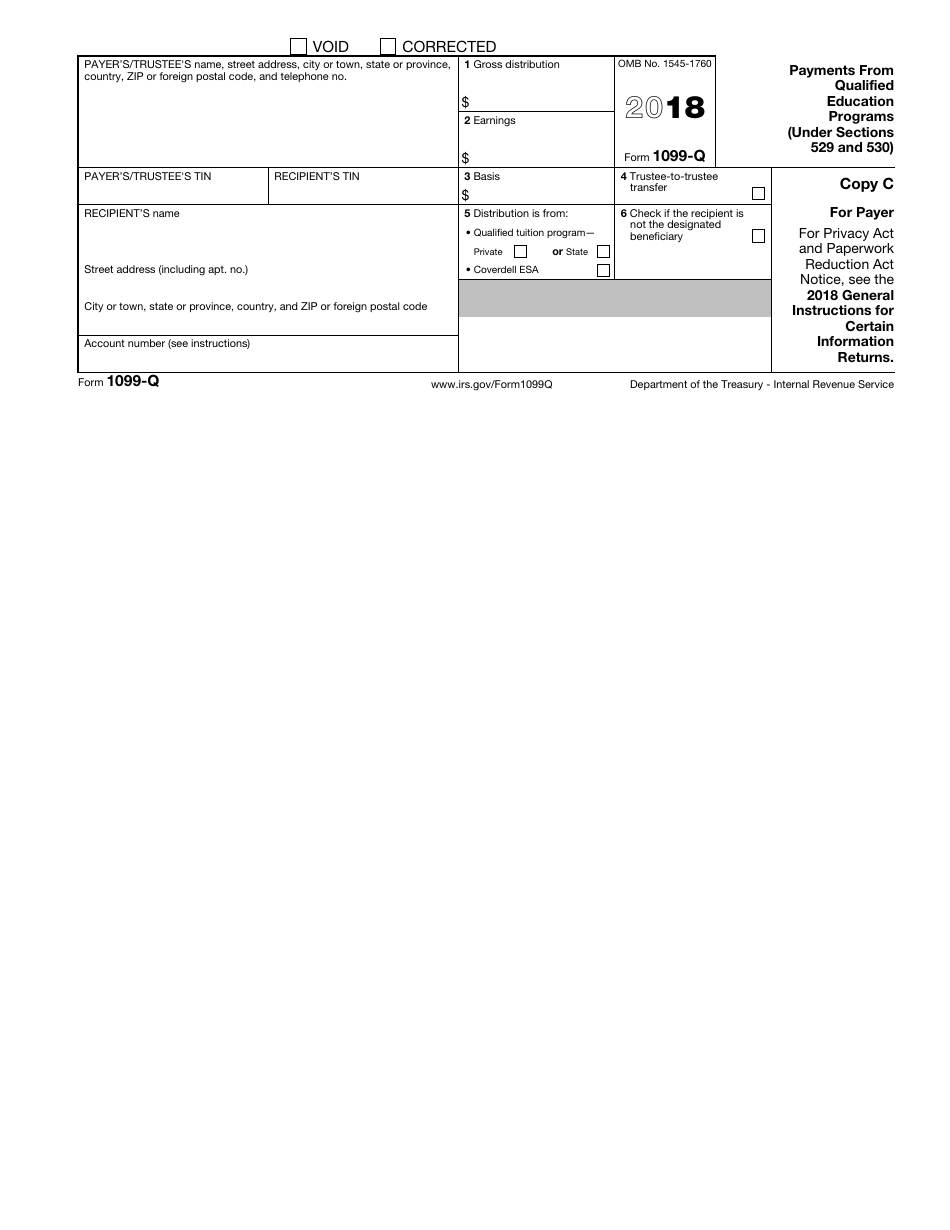

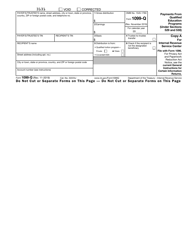

IRS Form 1099-Q

for the current year.

IRS Form 1099-Q Payments From Qualified Education Programs (Under Sections 529 and 530)

What Is IRS Form 1099-Q?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 1099-Q?

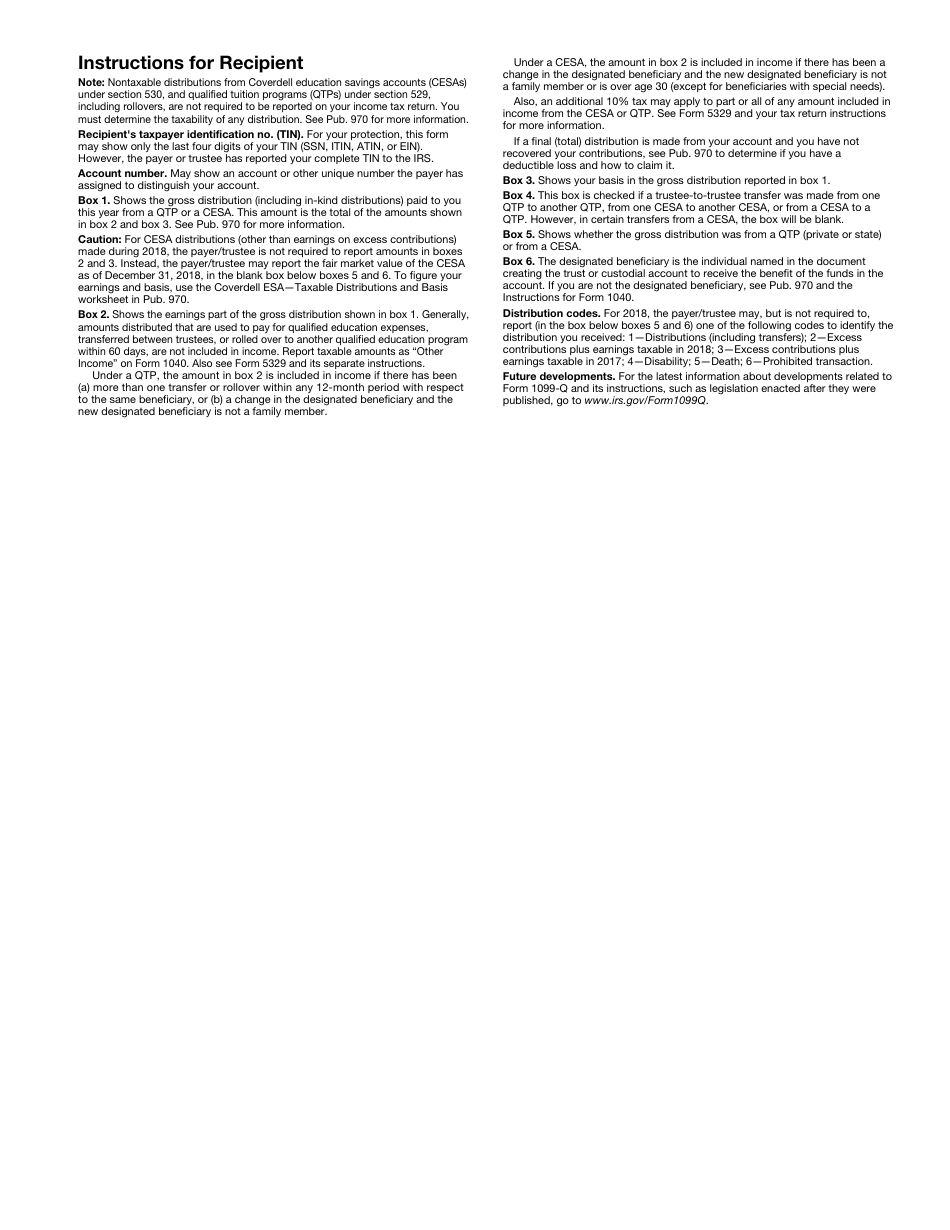

A: Form 1099-Q is a tax form used to report payments received from qualified education programs.

Q: What types of payments are reported on Form 1099-Q?

A: Form 1099-Q reports payments received from qualified education programs under Sections 529 and 530 of the tax code.

Q: What are qualified education programs?

A: Qualified education programs include 529 college savings plans and Coverdell Education Savings Accounts (ESAs).

Q: Why do I receive Form 1099-Q?

A: You receive Form 1099-Q if you received payments from a qualified education program during the tax year.

Q: Do I need to report the payments from Form 1099-Q on my tax return?

A: Yes, you generally need to include the payments reported on Form 1099-Q as income on your tax return.

Q: Are there any exceptions for including the payments as income?

A: There are certain exceptions and exclusions available for qualified education expenses. Consult the IRS guidelines or a tax professional for more information.

Q: What happens if I don't report the payments from Form 1099-Q?

A: Failure to report the payments from Form 1099-Q may result in penalties and additional taxes.

Q: Can I deduct qualified education expenses on my tax return?

A: There are certain education taxcredits and deductions available for qualified education expenses. Consult the IRS guidelines or a tax professional for more information.

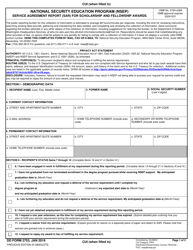

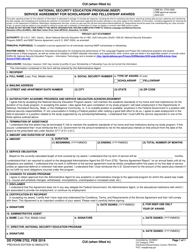

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1099-Q through the link below or browse more documents in our library of IRS Forms.