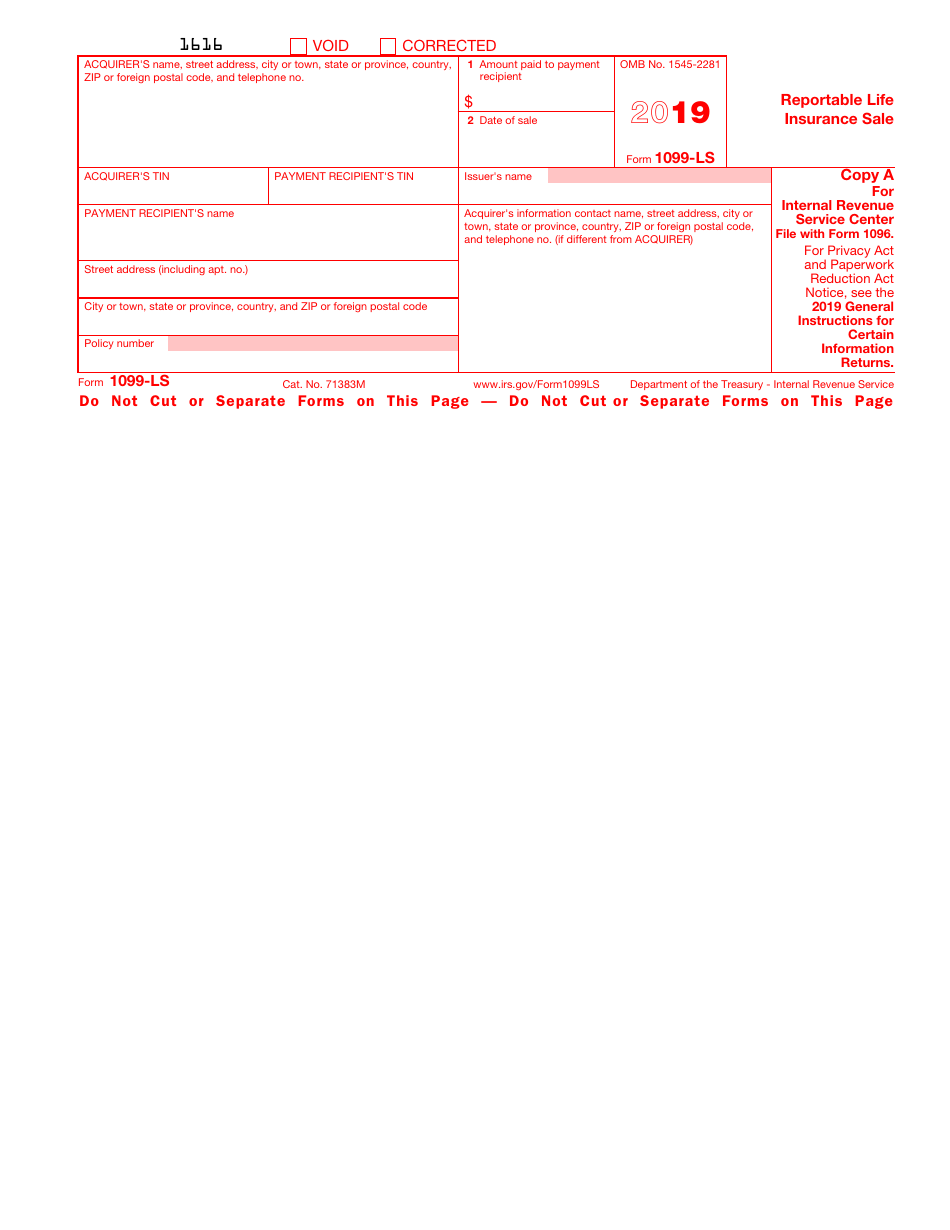

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1099-LS

for the current year.

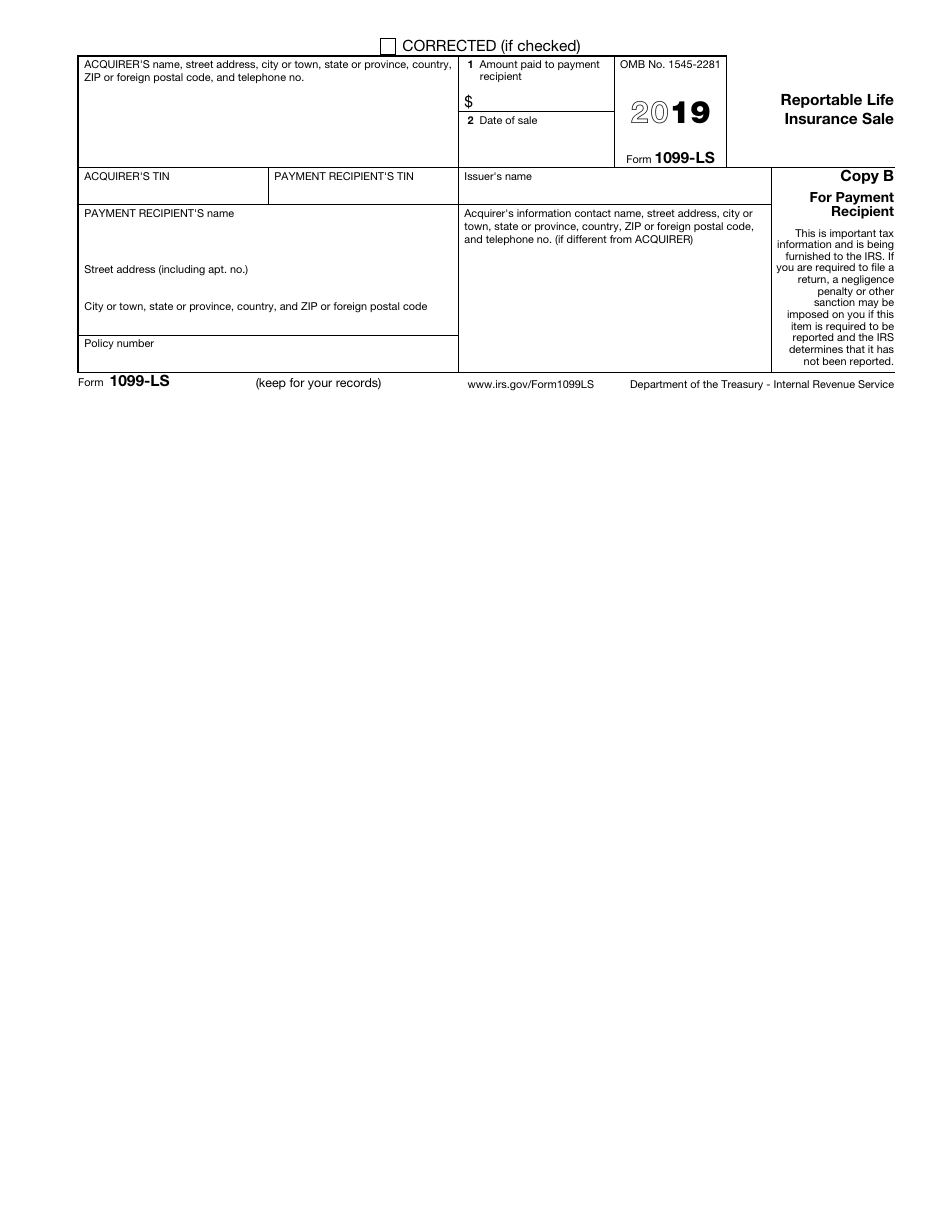

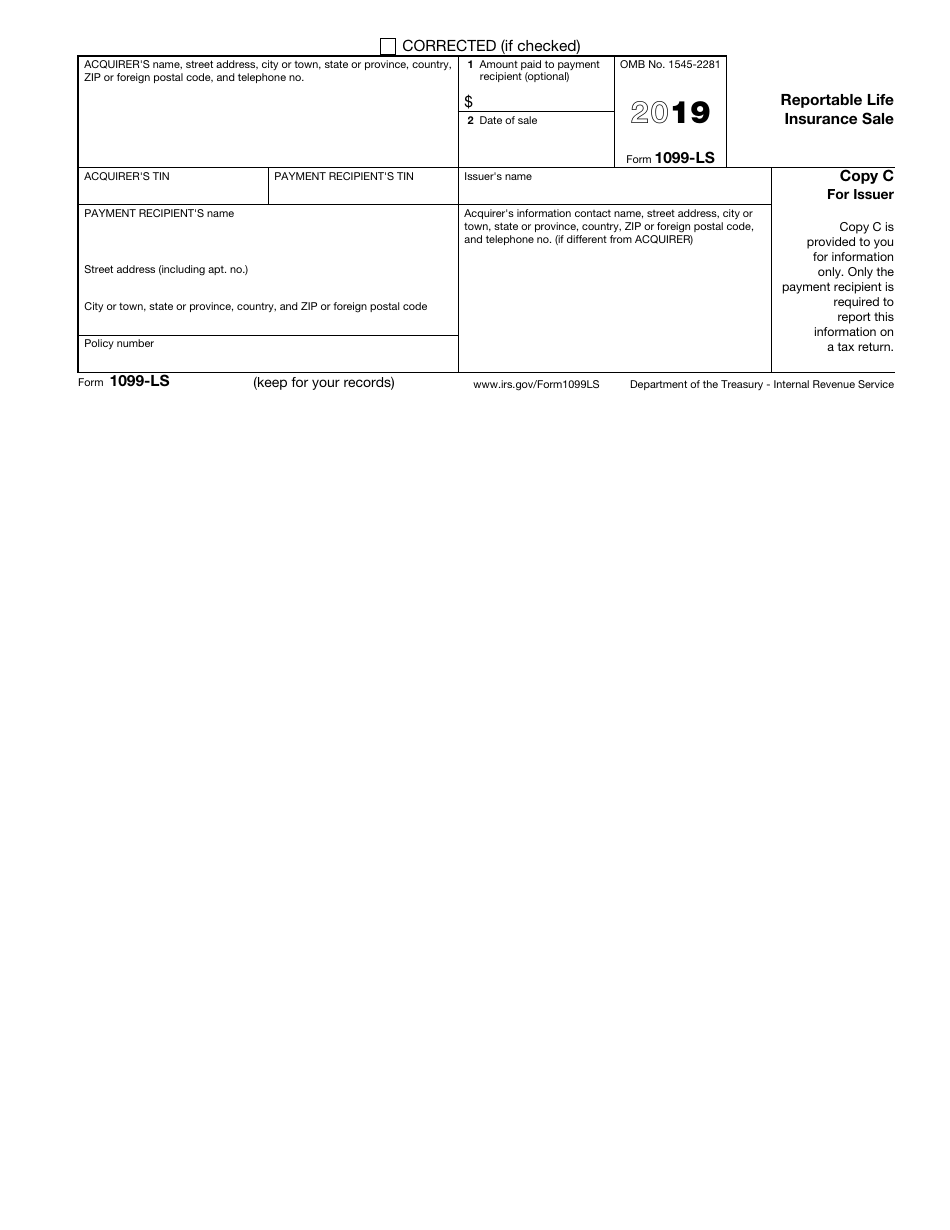

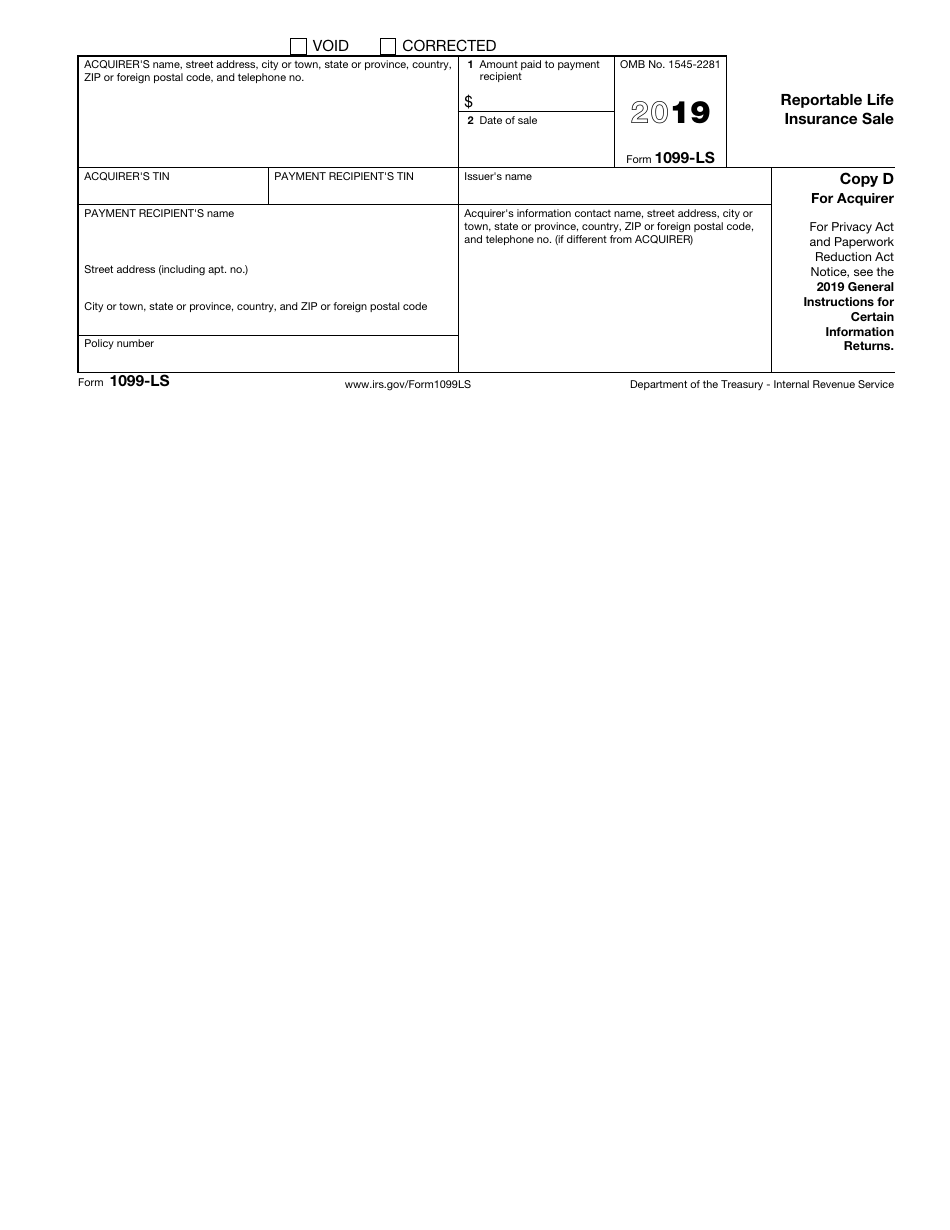

IRS Form 1099-LS Reportable Life Insurance Sale

What Is IRS Form 1099-LS?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1099-LS?

A: IRS Form 1099-LS is a tax form used to report a sale of a life insurance contract.

Q: What is a reportable life insurance sale?

A: A reportable life insurance sale is the sale or transfer of a life insurance contract where the seller receives money or other consideration.

Q: Who needs to file IRS Form 1099-LS?

A: The person or entity who acquires a life insurance contract in a reportable sale needs to file IRS Form 1099-LS.

Q: Is the sale of all life insurance contracts reportable?

A: No, only certain sales or transfers of life insurance contracts are reportable.

Q: What information is required to be reported on IRS Form 1099-LS?

A: IRS Form 1099-LS requires reporting of the seller's name, TIN/EIN, and the gross proceeds of the sale.

Q: When is the deadline to file IRS Form 1099-LS?

A: IRS Form 1099-LS must be filed with the IRS by January 31st of the year following the year of the reportable sale.

Form Details:

- A 8-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1099-LS through the link below or browse more documents in our library of IRS Forms.