This version of the form is not currently in use and is provided for reference only. Download this version of

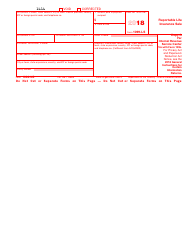

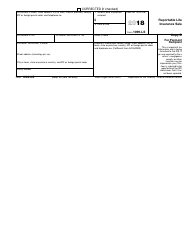

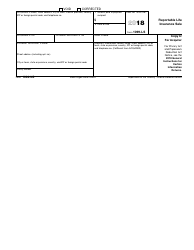

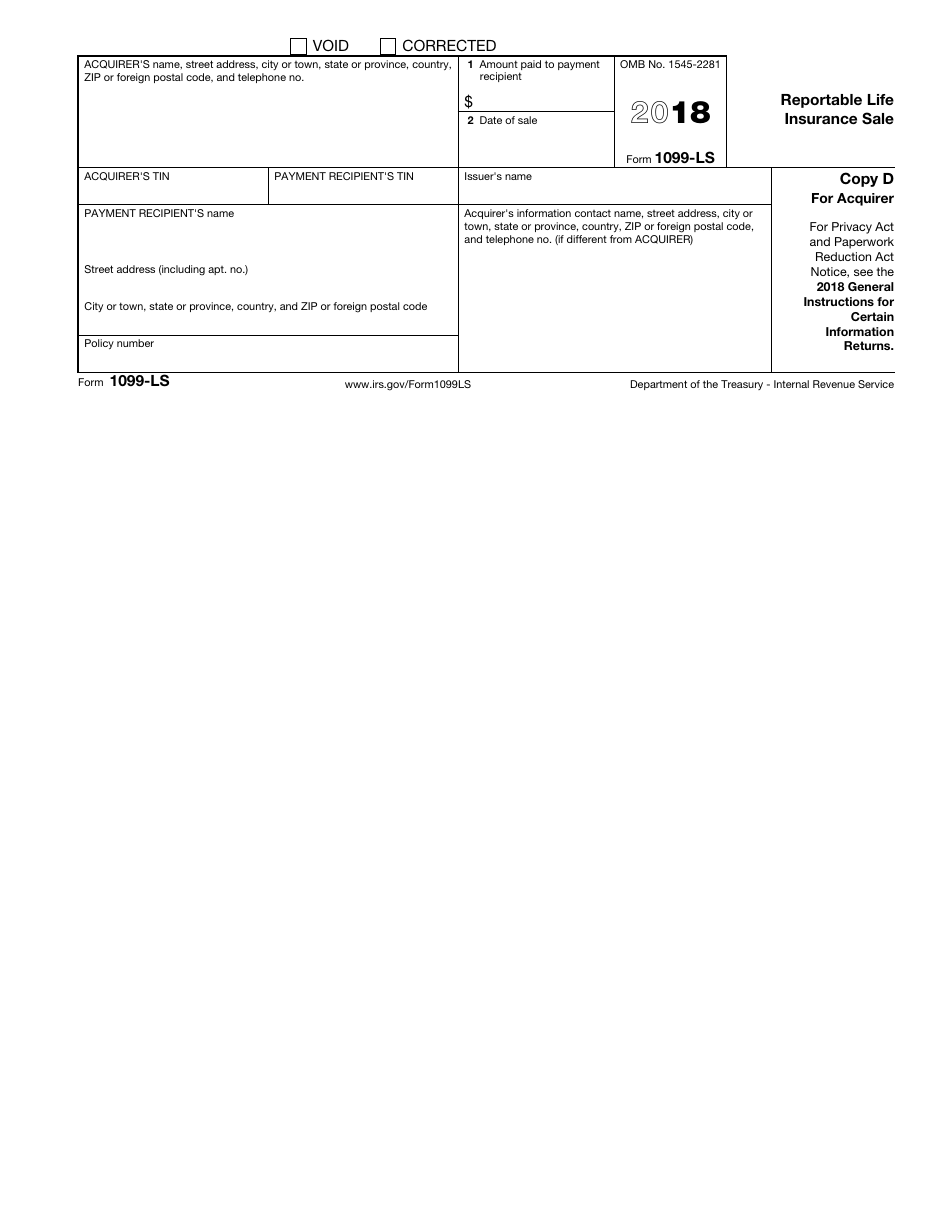

IRS Form 1099-LS

for the current year.

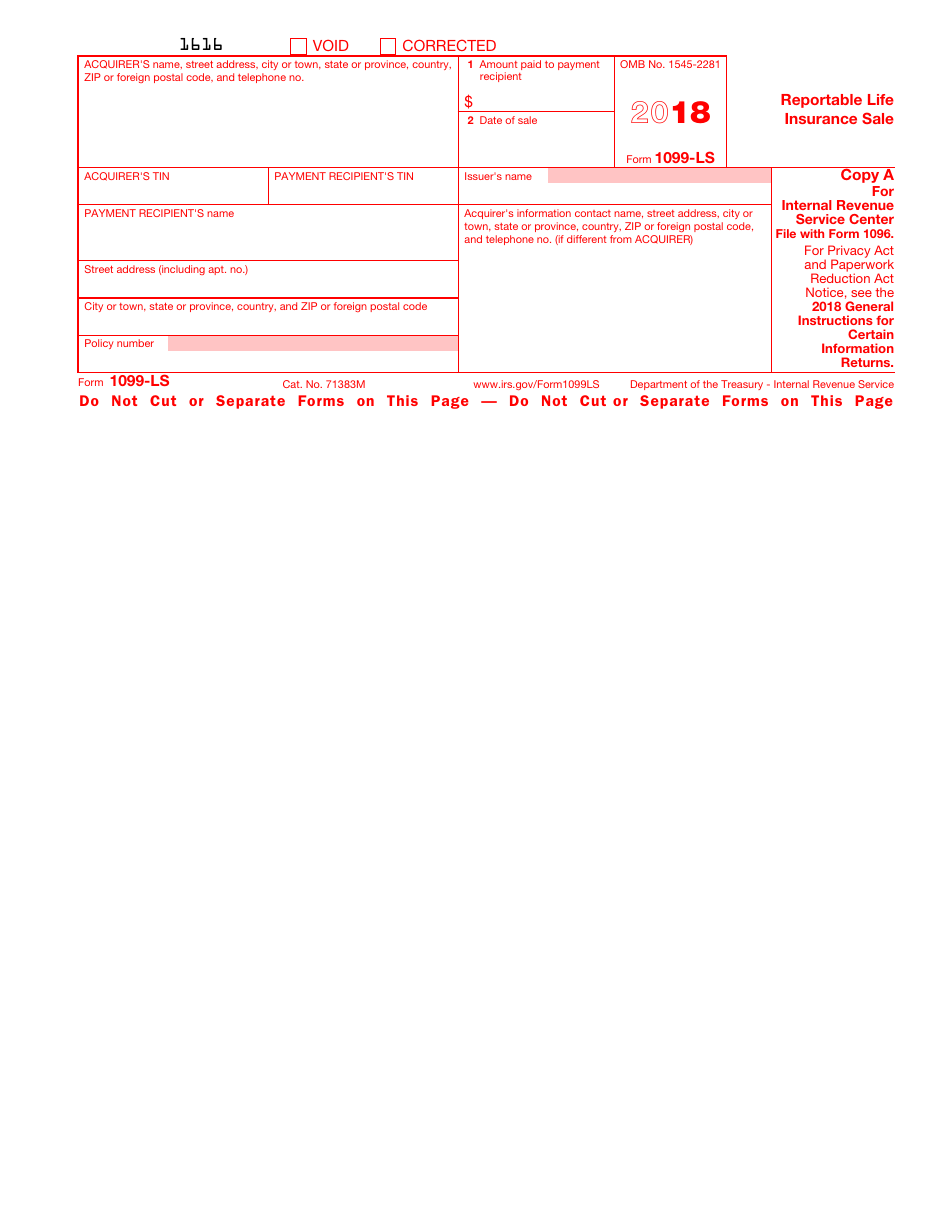

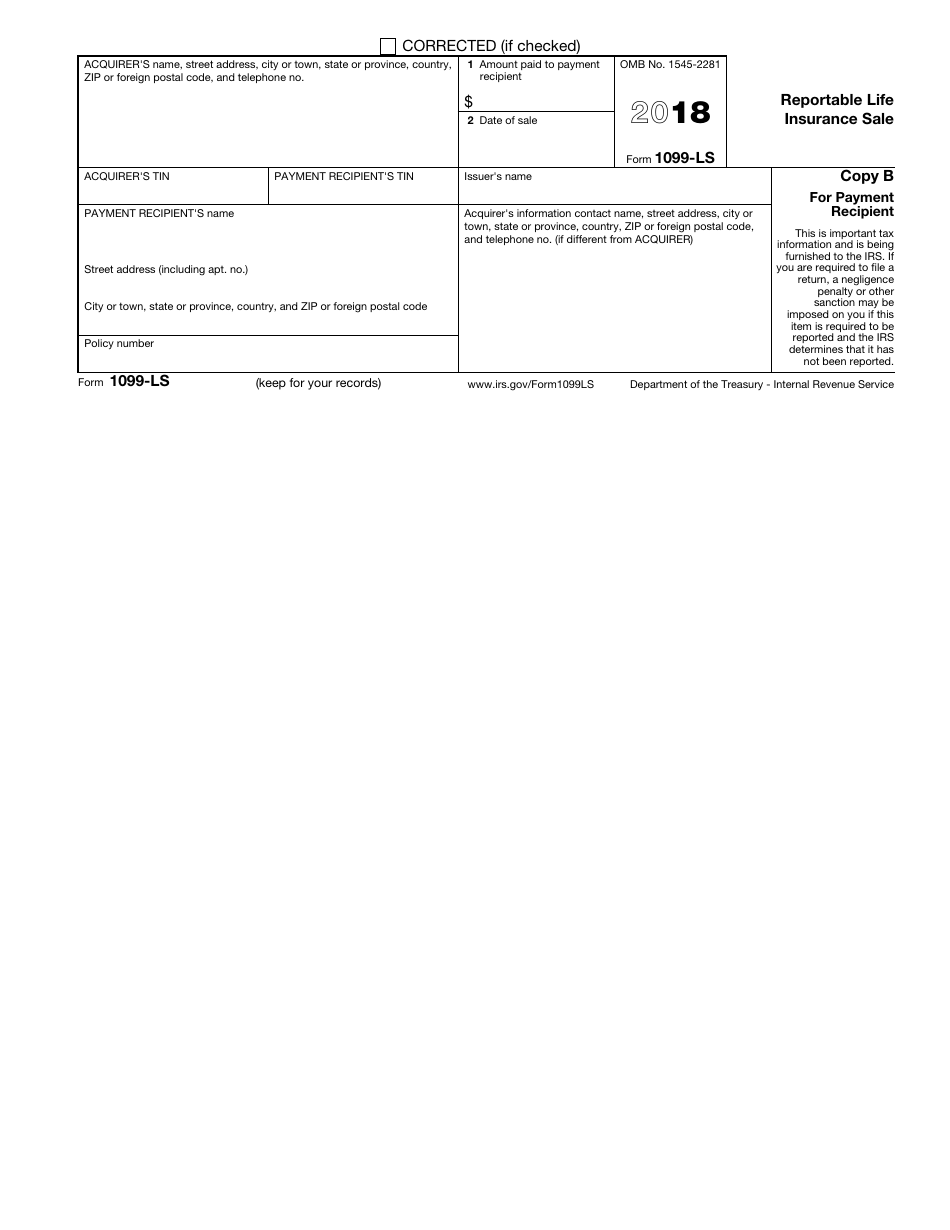

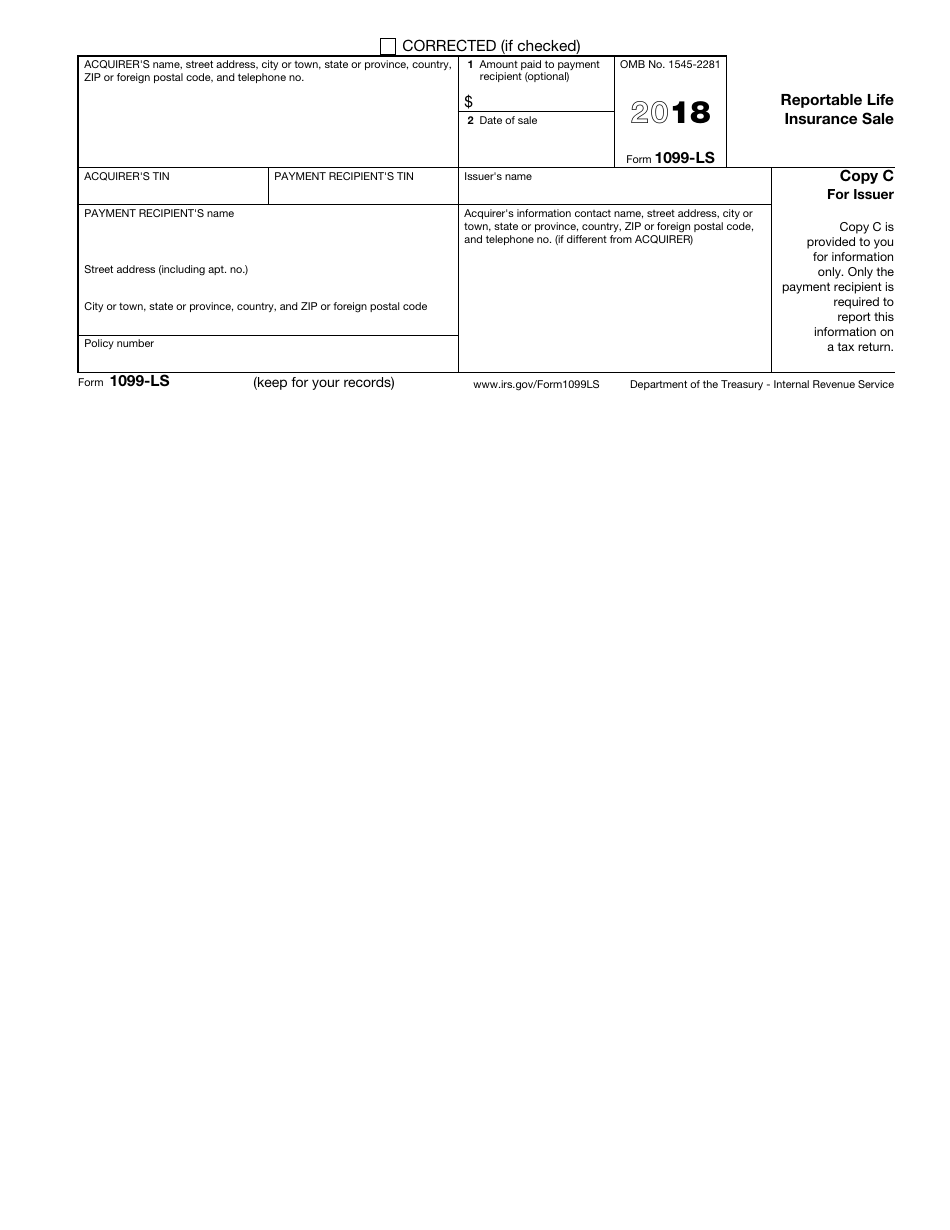

IRS Form 1099-LS Reportable Life Insurance Sale

What Is IRS Form 1099-LS?

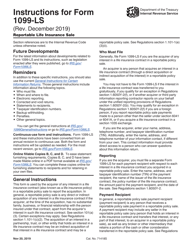

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1099-LS?

A: IRS Form 1099-LS is a tax form used to report the sale of a life insurance policy.

Q: Who needs to file IRS Form 1099-LS?

A: Any person or entity who purchases a life insurance policy is required to file IRS Form 1099-LS to report the sale.

Q: What information is required on IRS Form 1099-LS?

A: IRS Form 1099-LS requires the taxpayer's name, address, and taxpayer identification number, as well as the policy information and sale amount.

Q: When is IRS Form 1099-LS due?

A: IRS Form 1099-LS must be filed with the IRS by January 31st of the year following the sale.

Q: Do I need to provide a copy of IRS Form 1099-LS to the seller?

A: Yes, the person or entity who files IRS Form 1099-LS must furnish a copy to the seller by January 31st of the year following the sale.

Form Details:

- A 8-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1099-LS through the link below or browse more documents in our library of IRS Forms.