This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1099-H

for the current year.

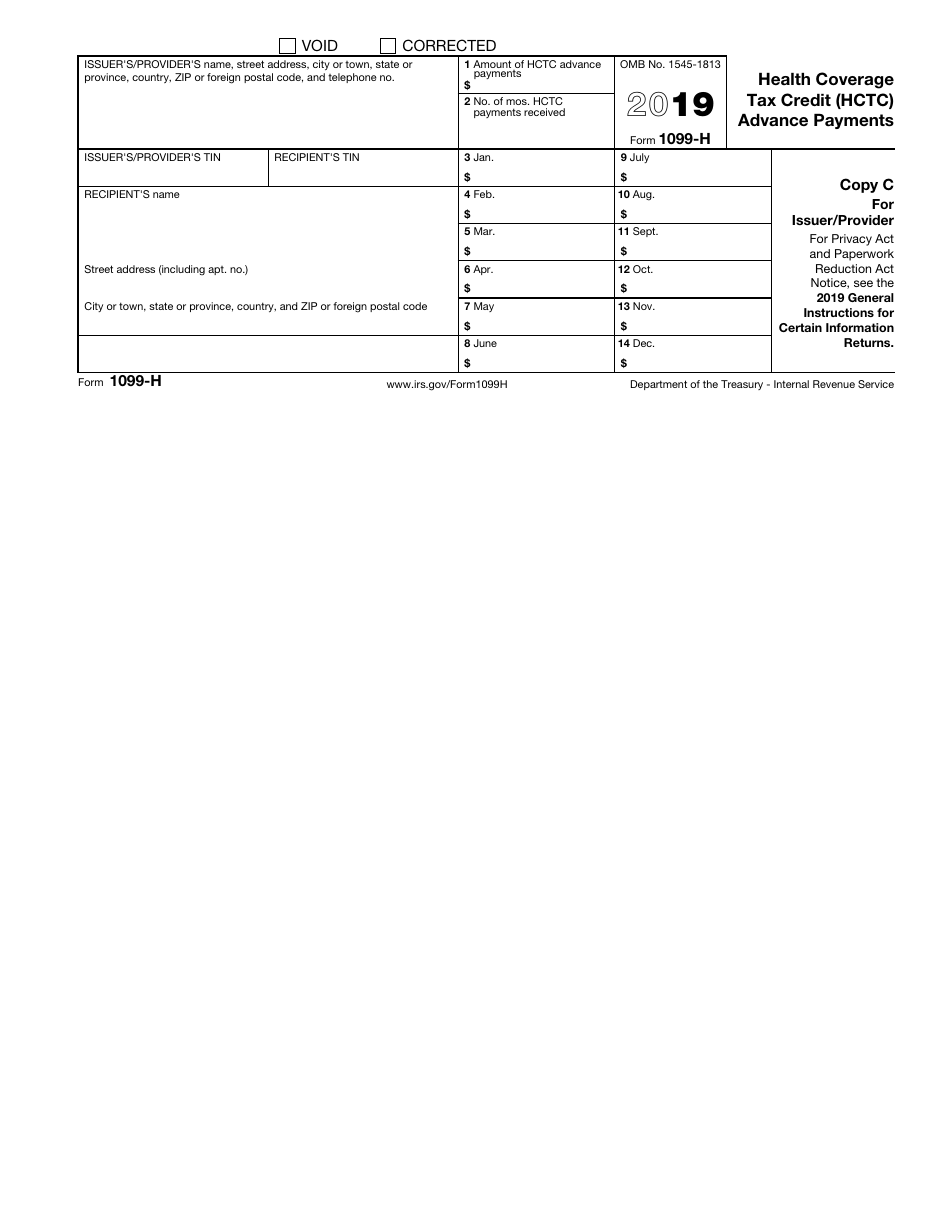

IRS Form 1099-H Health Coverage Tax Credit (Hctc) Advance Payments

What is Form 1099-H?

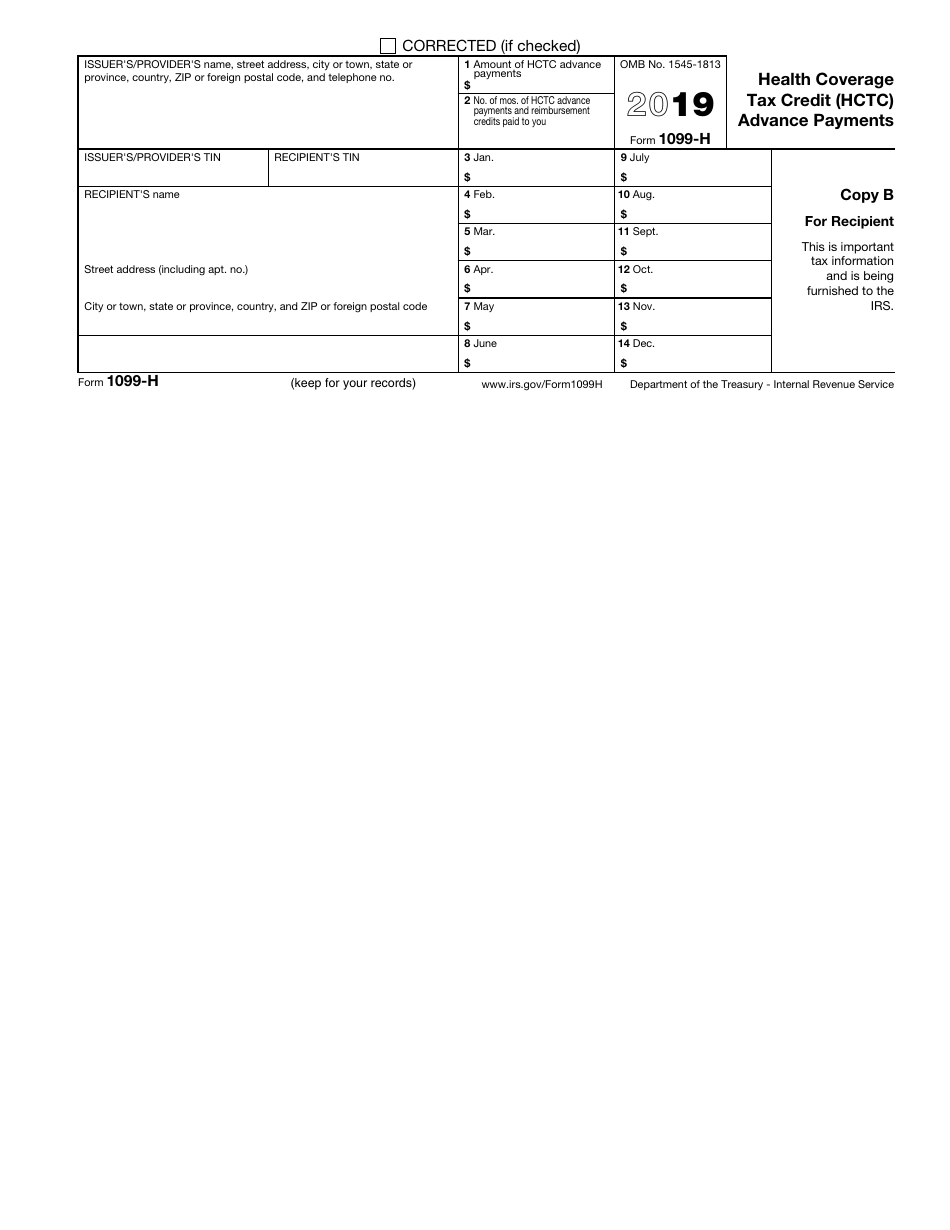

IRS Form 1099-H, Tax Credit (HCTC) Advance Payments , is a document released for those individuals who got payments during the calendar year of qualified health insurance payments for the benefit of eligible trade adjustment assistance. This form also covers alternative trade adjustment assistance , reemployment trade adjustment assistance, and Pension Benefit Guaranty Corporation payees.

The document is issued by the Internal Revenue Service (IRS) and was last revised in 2019 and is revised annually. A fillable 1099-H Form is available for download below. To see related 1099 forms follow the link here.

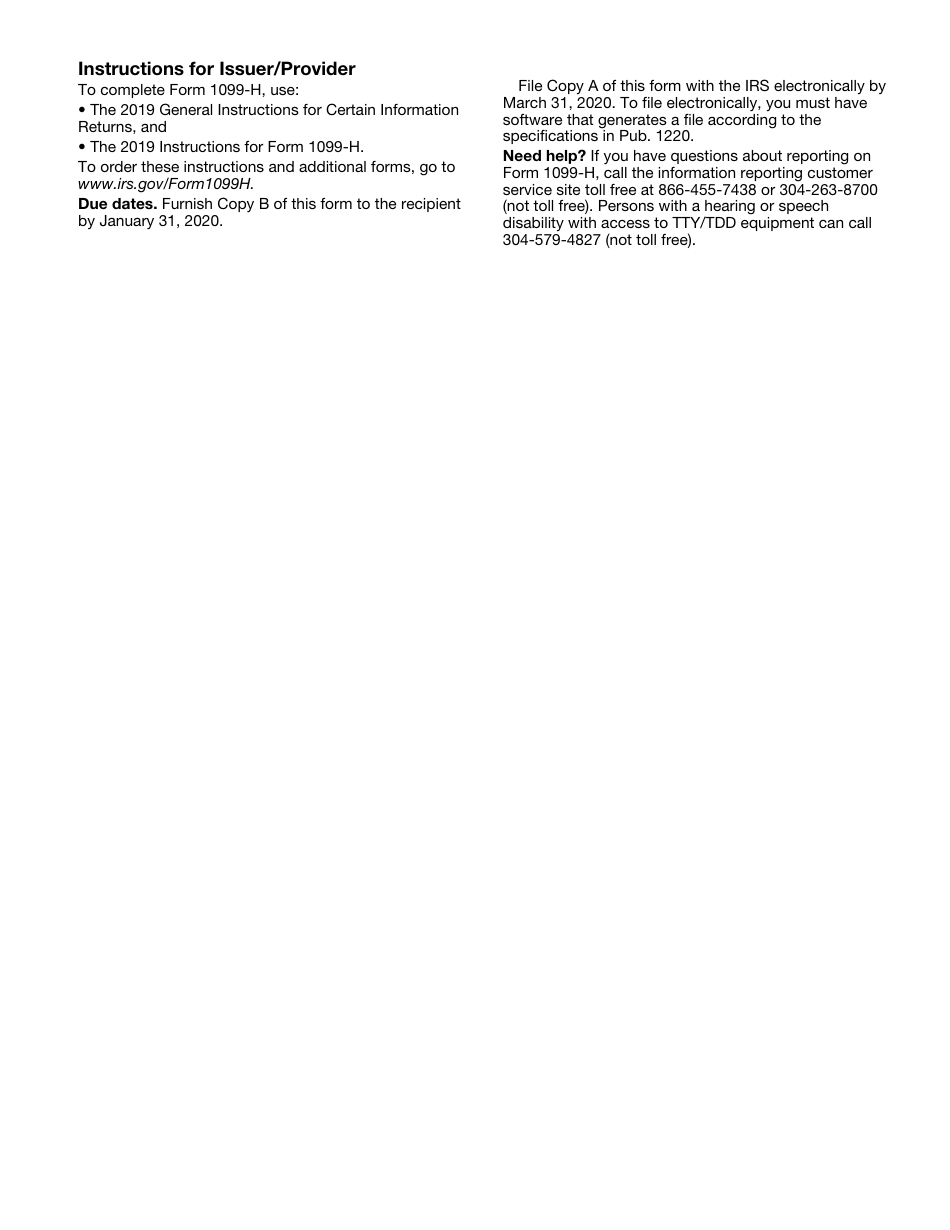

IRS Form 1099-H Instructions

If an applicant has any difficulties while filling in the form, they should use the Official instructions for the 1099-H form developed by the IRS. It contains necessary explanations and examples, as well as provide information on penalties, corrected or void returns, statements to the recipients, etc.

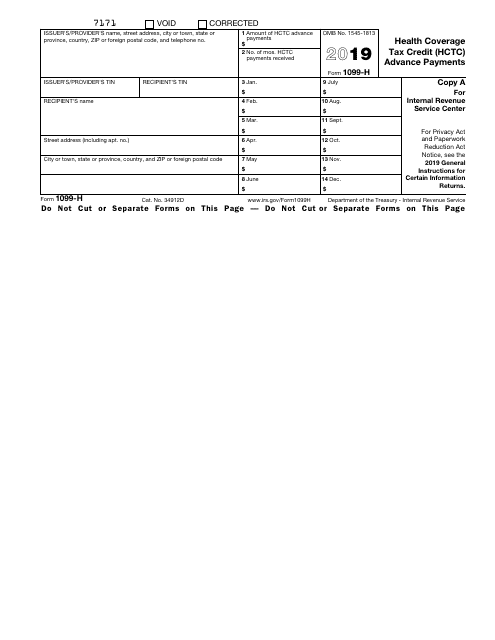

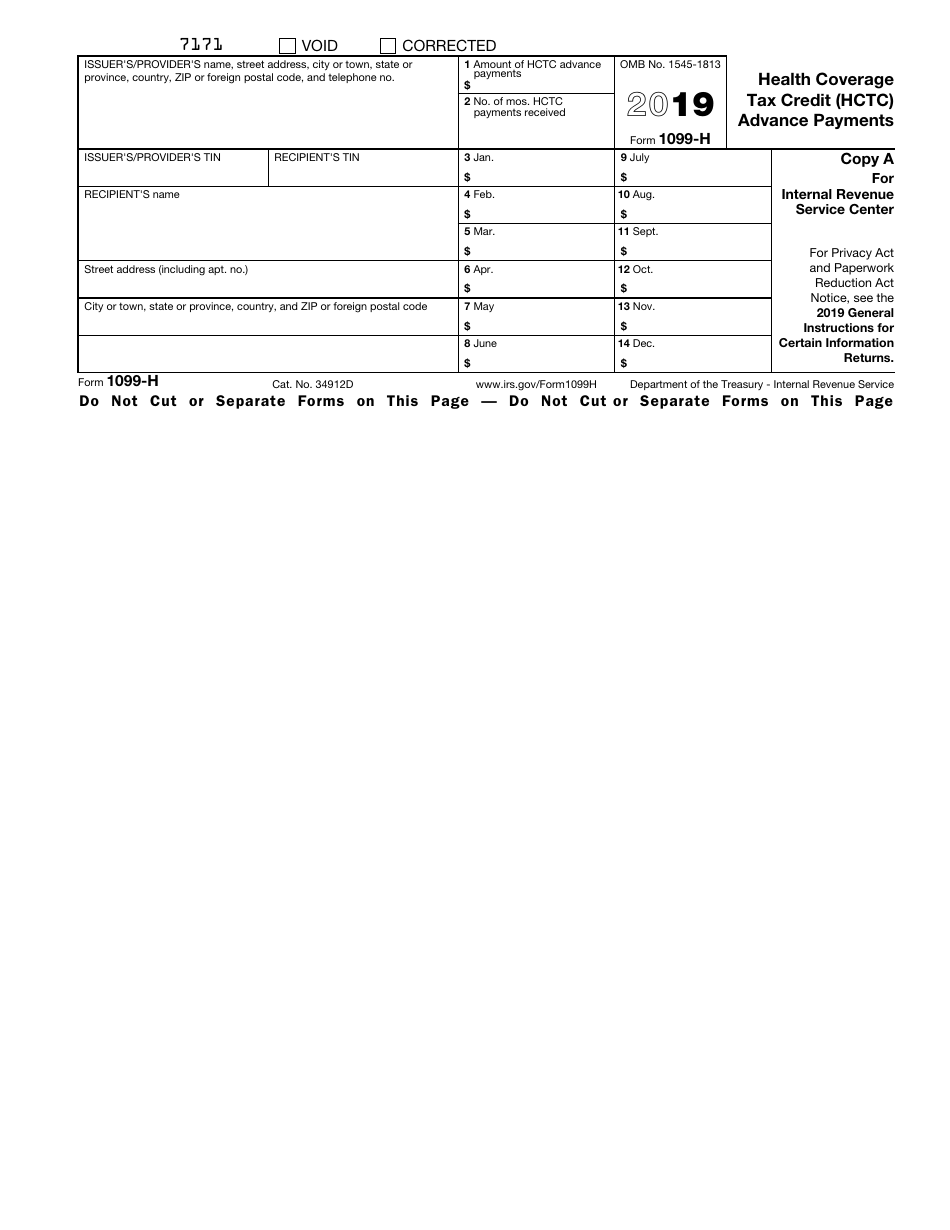

The application is supposed to be filled in by issuers/providers of qualified health insurance coverage that obtained advance payments from the Department of the Treasury on behalf of eligible recipients. They must report those payments and provide information about payments to the recipient. For that purpose the application was developed in three copies:

- Copy A - For the Internal Revenue Service Center ;

- Copy B - For the Recipient;

- Copy C - For the Provides (Issuer).

Copy A of the form is supposed to be filed by the provider with the IRS electronically Before March 31, 2020.

All copies contain the same amount of information and are presented on one page each. The document is divided into several sections, which include:

- Information about the issuer/provider. This section includes certain data, such as issuer's / provider's name, full address (street address, town or city, state or province, country, zip code , and telephone number), their taxpayer identification number (TIN), which can be presented by a social security number, adoption taxpayer identification number, or individual taxpayer identification number.

- Information about the recipient. Here an applicant must enter the recipient's name, their full address (which by the analogy with the previous section must include street address, city or town, state or province, country, zip code , and telephone number), and their TIN as well.

- Information about payments. In the last part of the application, a filer must state the amount of HCTC advance payments of qualified health insurance costs that were made and designate the payments per month.