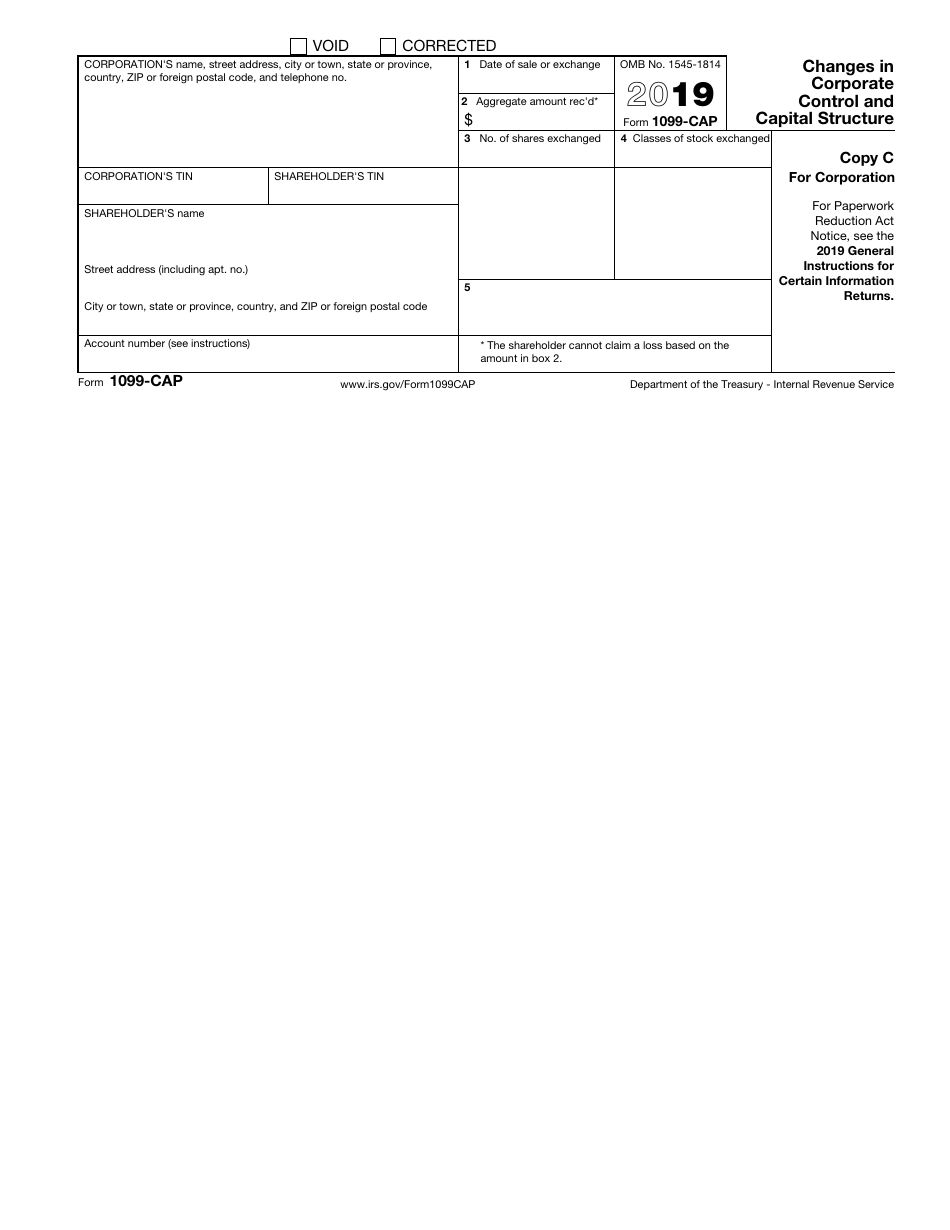

This version of the form is not currently in use and is provided for reference only. Download this version of

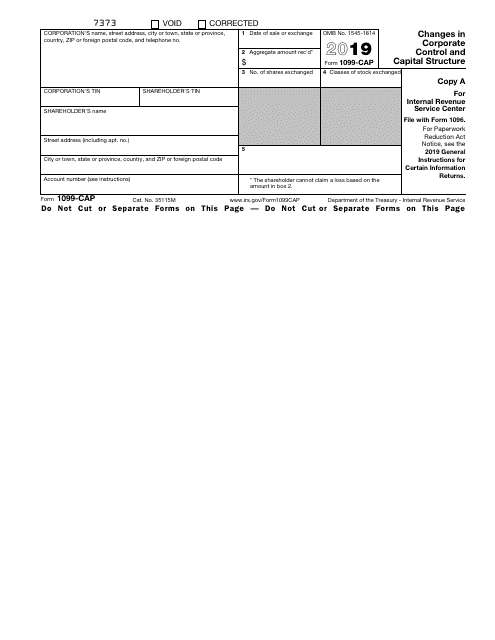

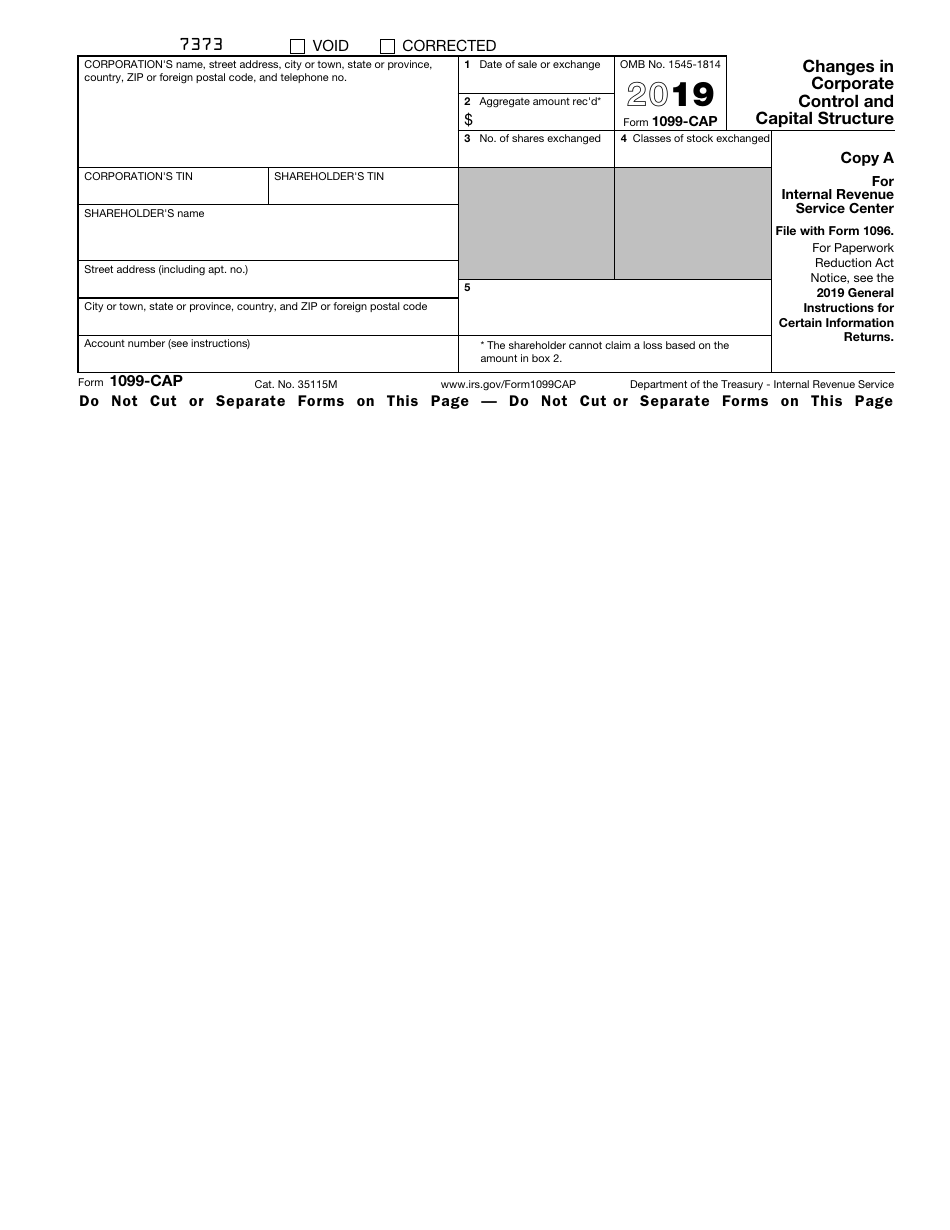

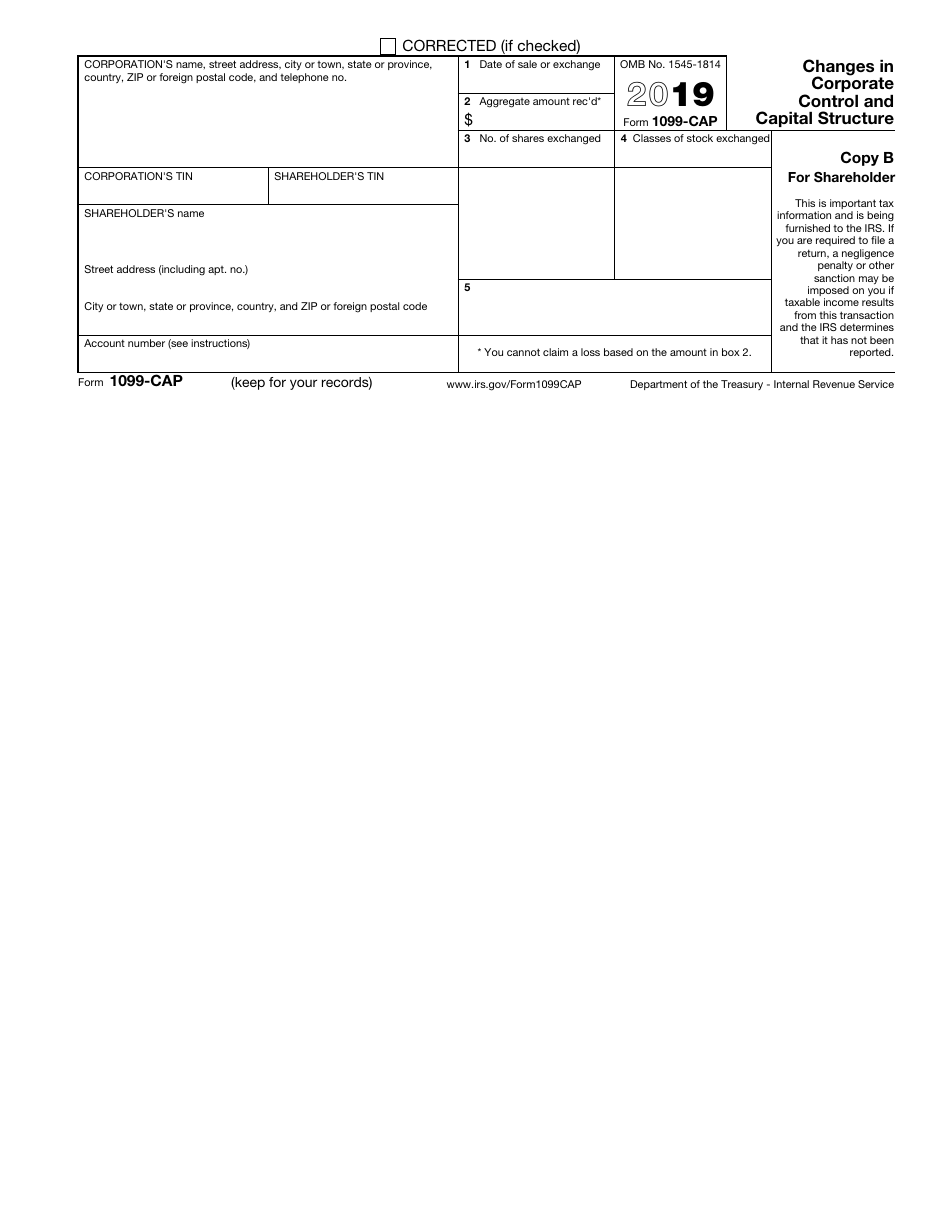

IRS Form 1099-CAP

for the current year.

IRS Form 1099-CAP Changes in Corporate Control and Capital Structure

What Is IRS Form 1099-CAP?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1099-CAP?

A: IRS Form 1099-CAP is used to report changes in corporate control and capital structure.

Q: Who needs to file IRS Form 1099-CAP?

A: Filing of Form 1099-CAP is required by corporations that have undergone significant changes in their ownership or capital structure.

Q: What information is reported on IRS Form 1099-CAP?

A: Form 1099-CAP reports information such as the name and address of the corporation, the date of the change, the type of transaction, and the amount of consideration received.

Q: When is IRS Form 1099-CAP due?

A: Form 1099-CAP must be filed with the IRS by January 31 of the year following the calendar year in which the change in control occurred.

Q: Are there any penalties for not filing IRS Form 1099-CAP?

A: Yes, there may be penalties for failure to timely file Form 1099-CAP or for filing incorrect or incomplete information.

Q: Can I e-file IRS Form 1099-CAP?

A: Yes, e-filing is an option for filing Form 1099-CAP. However, there may be specific requirements and procedures for electronic filing that need to be followed.

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1099-CAP through the link below or browse more documents in our library of IRS Forms.