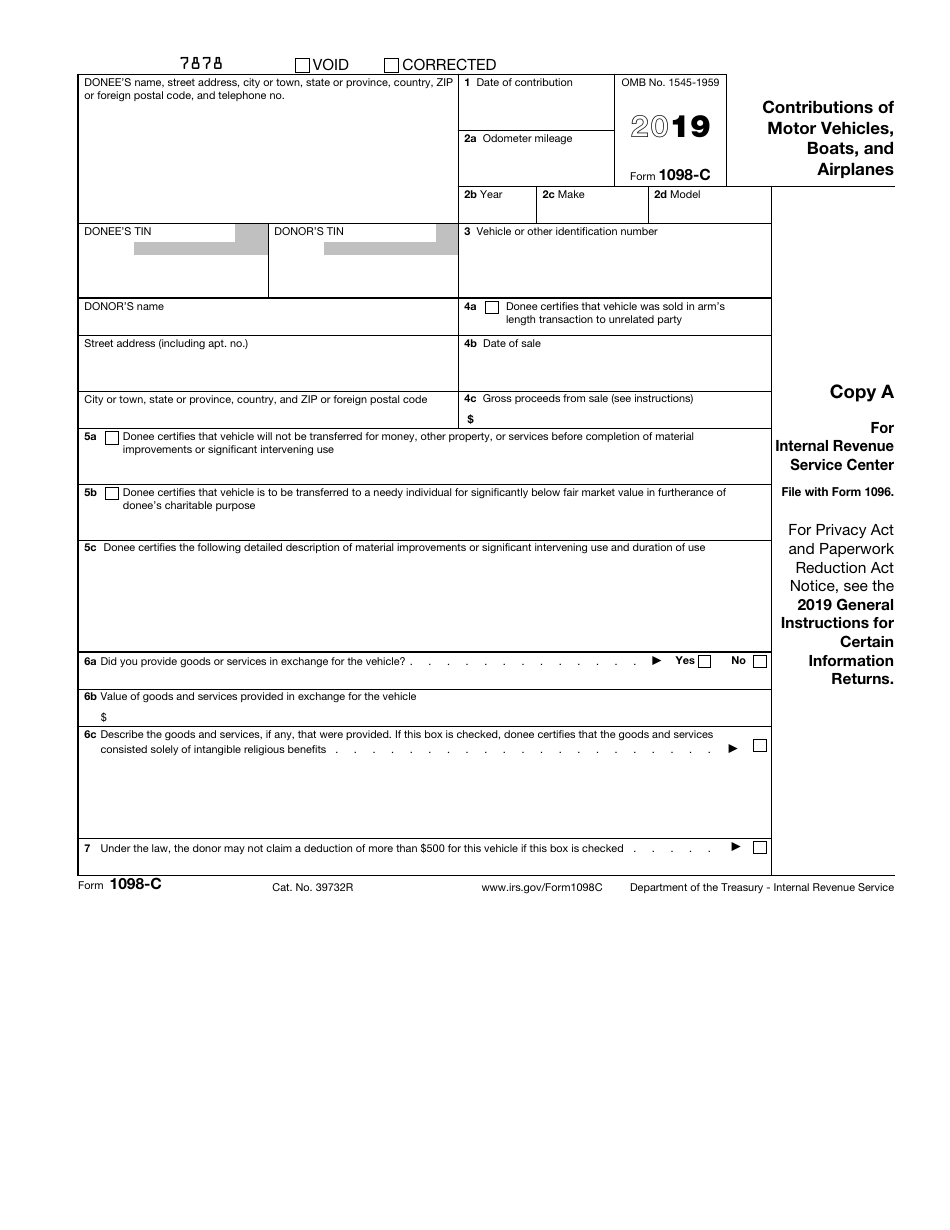

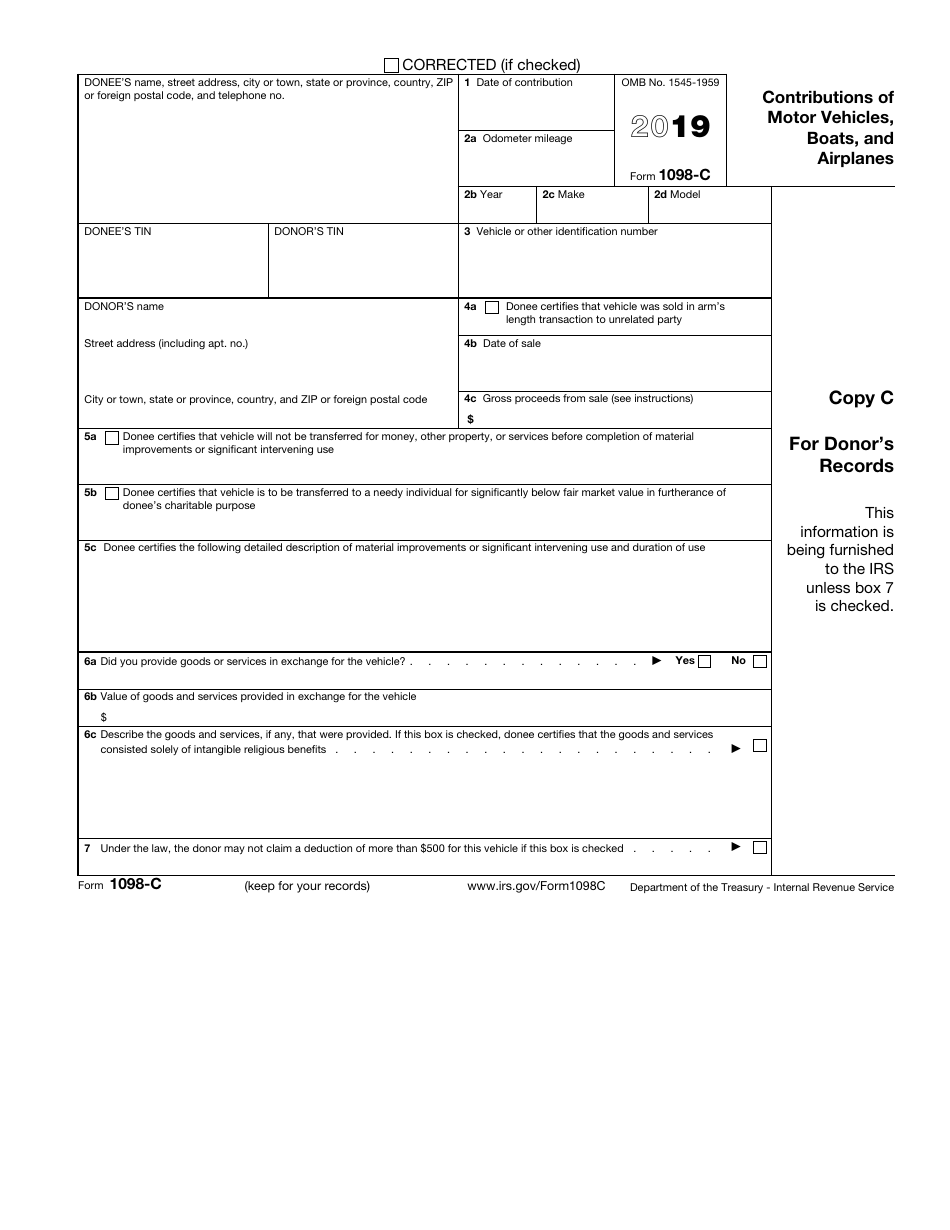

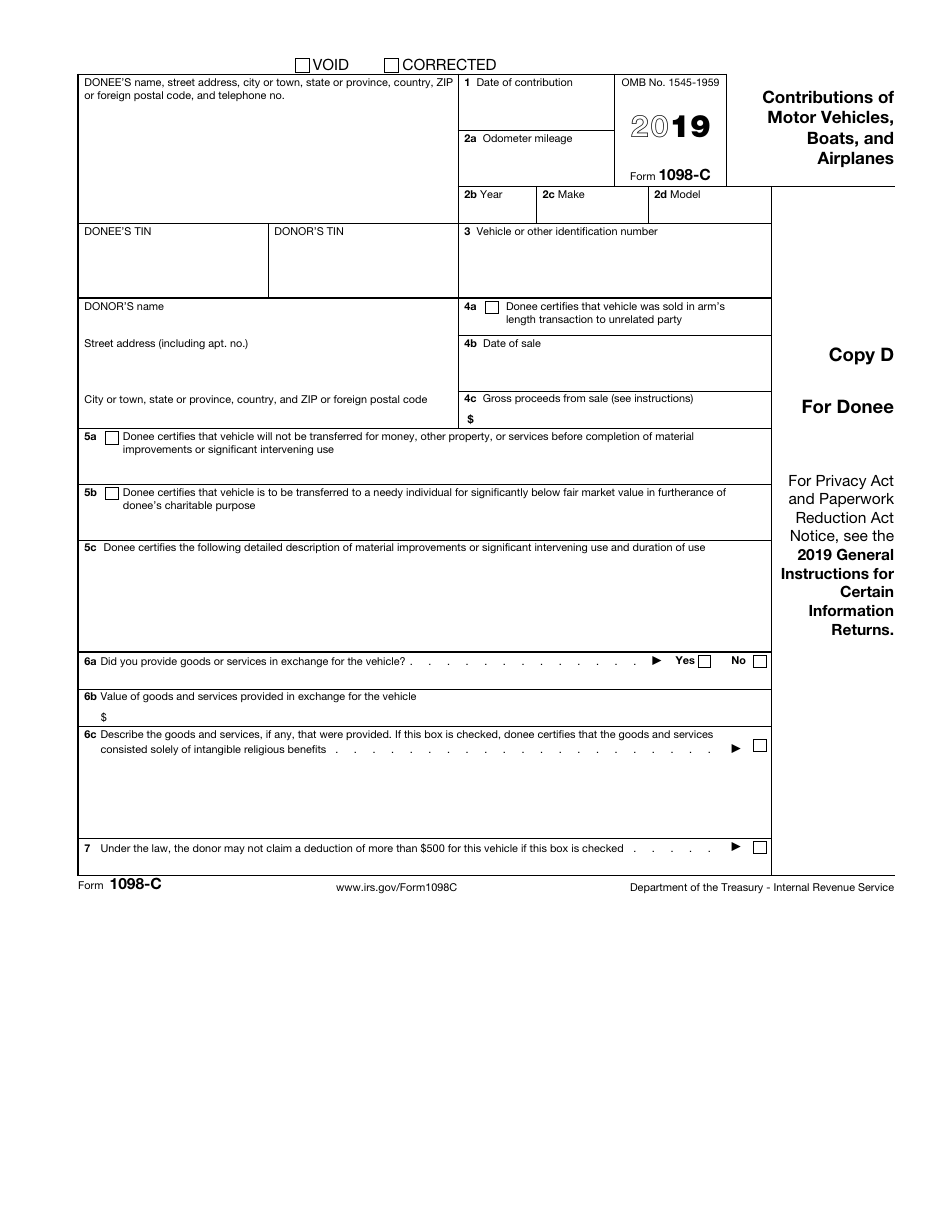

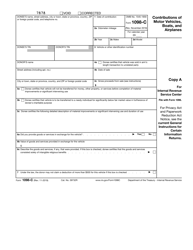

IRS Form 1098-C Contributions of Motor Vehicles, Boats, and Airplanes

What Is Form 1098-C?

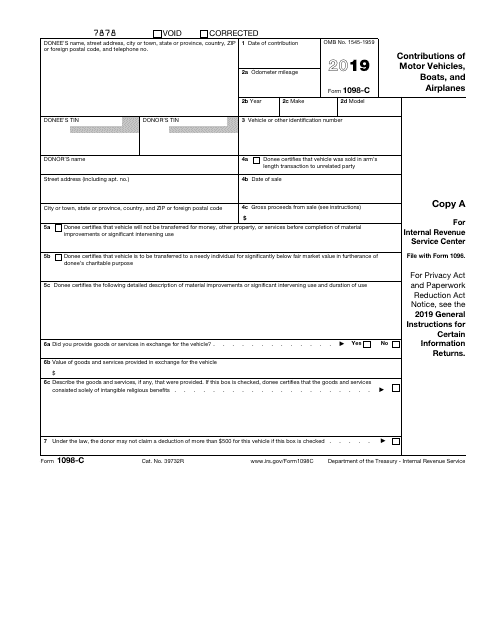

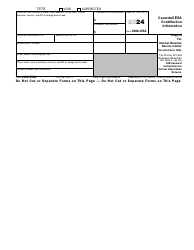

IRS Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes (also known as the IRS Vehicle Donation Form) is a form that details the donations of automobiles, boats, and airplanes made to charitable organizations. It is filed with the Internal Revenue Service (IRS) by the recipient organization. The form was issued by the IRS and is revised annually. Use the link below to download the latest fillable Form 1098-C.

What Is Form 1098-C Used For?

The form is used by the donor of an automobile, boat, or aircraft worth more than $500 for claiming a car donation tax deduction.

How to Fill Out Form 1098-C?

- Box 1. Date of Contribution. Enter the date you received the donation.

- Boxes 2a, 2b, 2c, and 2d. Odometer Mileage, Year, Make, and Model of Vehicle are self-explanatory.

- Box 3. Vehicle or Other Identification Number. This number is generally affixed to the vehicle.

- Box 4a. Vehicle Sold in Arm's Length Transaction to Unrelated Party. Check to certify this if the vehicle is sold to a buyer other than an individual without significant intervening use or material improvement on the vehicle. Skip if the vehicle's claimed value is $500 or less.

- Box 4b. Date of Sale and Box 4c. Gross Proceeds. Complete only if you checked box 4a.

- Box 5a. Vehicle Will Not Be Transferred Before Completion of Material Improvements or Significant Intervening Use. Skip it if the vehicle's claimed value is $500 or less.

- Box 5b. Vehicle To Be Transferred to a Needy Individual for Significantly Below FMV. FMV stands for Fair Market Value. Skip if the qualified vehicle has a claimed value of $500 or less.

- Box 5c. Description of Material Improvements or Significant Intervening Use and Duration of Use. Enter description only if the vehicle has a claimed value of $500 or more.

- Box 6a. Checkbox for Whether Donee Provided Goods and Services in Exchange for the Vehicle Described. Check if the answer is Yes.

- Box 6b. Value of Goods and Services Provided in Exchange for the Vehicle Described. Refer to IRS Publication 561 for an estimated value of goods and services.

- Box 6c (Description of the Goods and Services) and Box 7 (Checkbox for a Vehicle With a Claimed Value of $500 or Less) are self-explanatory.

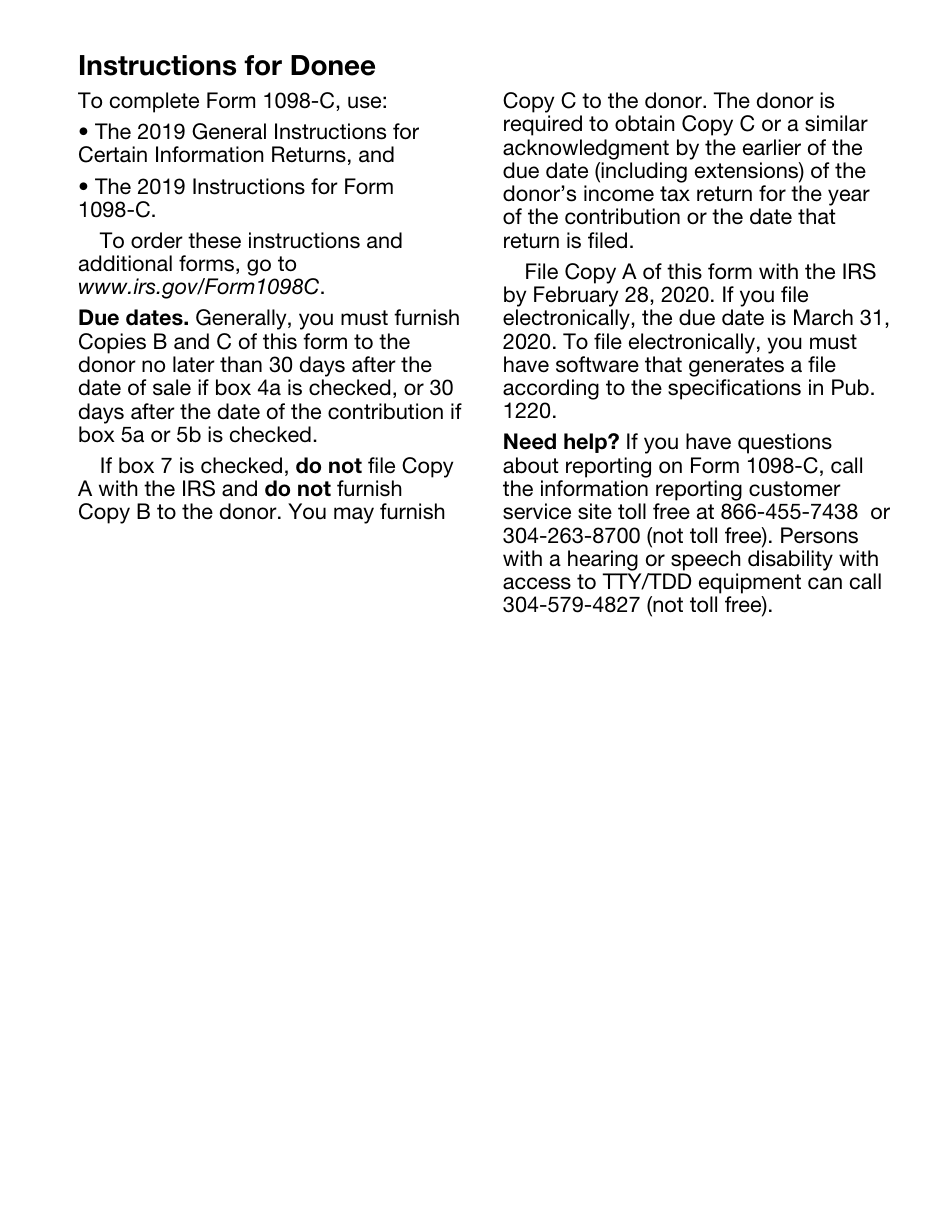

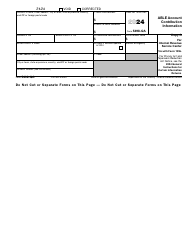

IRS Form 1098-C Instructions

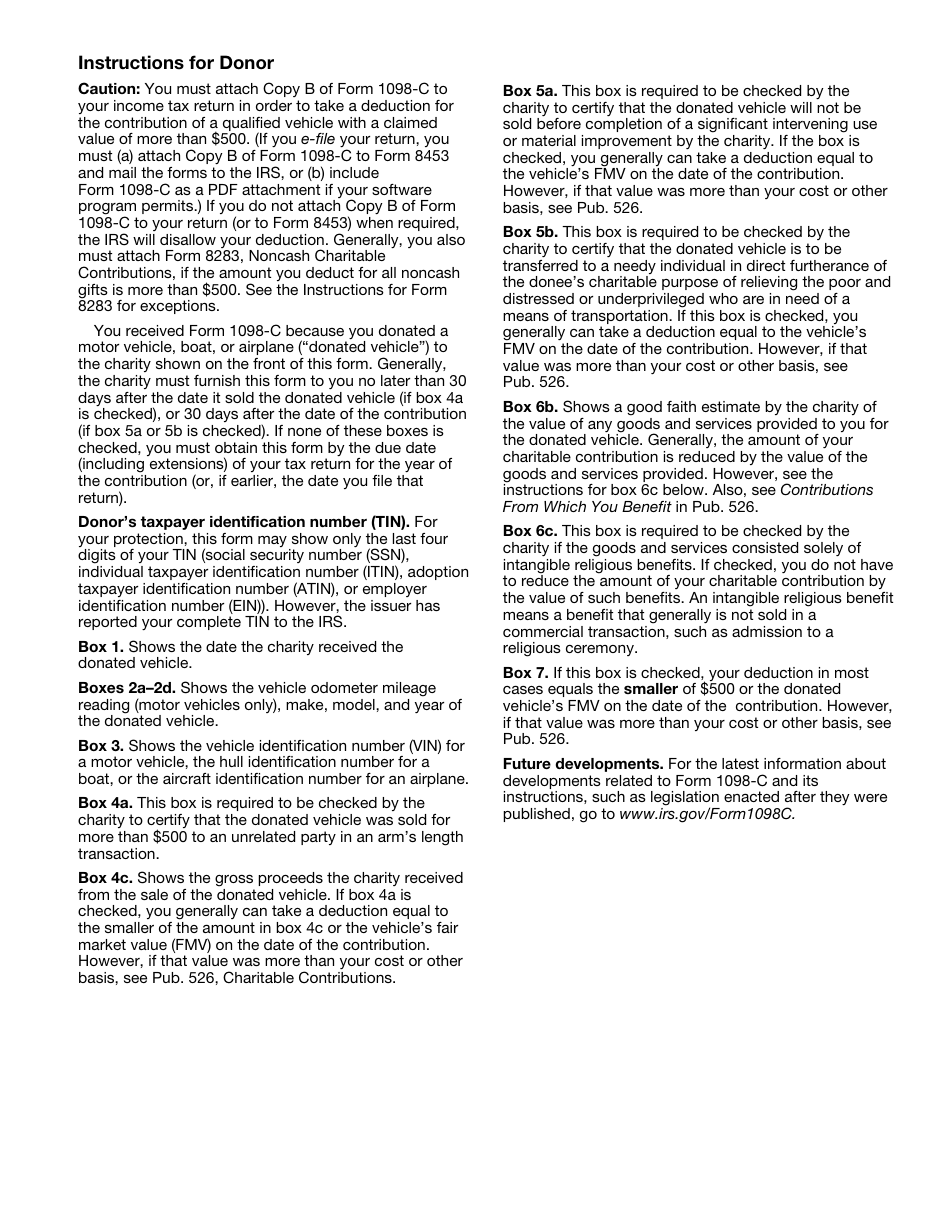

The IRS provides official instructions for filing the form. A separate Form 1098-C must be filed with the IRS by the recipient organization for each received contribution of a qualified vehicle that has a claimed value of more than $500. The said organization is also required to provide the donor with copy B and C of the form. The recipient organization must furnish these copies to the donor no later than 30 days after the date of the sale (if box 4a was checked) or the date of the contribution (if box 5a or 5b was checked).

If the organization files the form on paper, they are required to send the black-and-white Copy A together with Form 1096.

The due date for Form 1098-C on paper is February 28, 2020, or March 31, 2020, if filed electronically. Late filing penalties shall apply if the lender fails to file a correct information return by the due date without reasonable cause. The penalty is the following:

- $50 per information return if you file with no errors within 30 days;

- $110 per information return if you file with no errors more than 30 days after the due date but by August 1;

- $270 per information return if you file correctly after August 1 or you do not file required information returns.

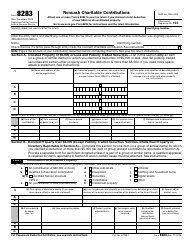

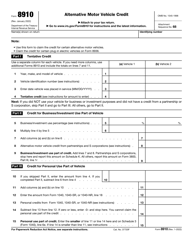

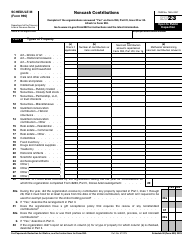

Donors must attach Copy B of Form 1098-C to their federal tax return for claiming a deduction of more than $500 for the donated vehicle. In general, the donor also must attach Form 8283, Noncash Charitable Contributions to their tax return if the amount to be deducted for all noncash gifts is more than $500.

IRS 1098-C Related Forms

- IRS Form 1098, Mortgage Interest Statement. This is a form that reports the amount of interest and related expenses that an individual or sole proprietor paid on their mortgage during the tax year to estimate tax deductions.

- IRS Form 1098-E, Student Loan Interest Statement. This form reports an interest amount paid on qualified student loans during the tax year, to have it deducted on the taxpayer's income tax return.

- IRS Form 1098-T, Tuition Statement. This statement provides information about qualified tuition and related fees during the tax year and can be used to calculate education-related tax deductions and credits.

- IRS Form 1098-Q, Qualifying Longevity Annuity Contract. This form is filed by the person who issues a contract intended to be a Qualifying Longevity Annuity Contract (QLAC) so that the annuity holder can claim distribution taxes deductions.