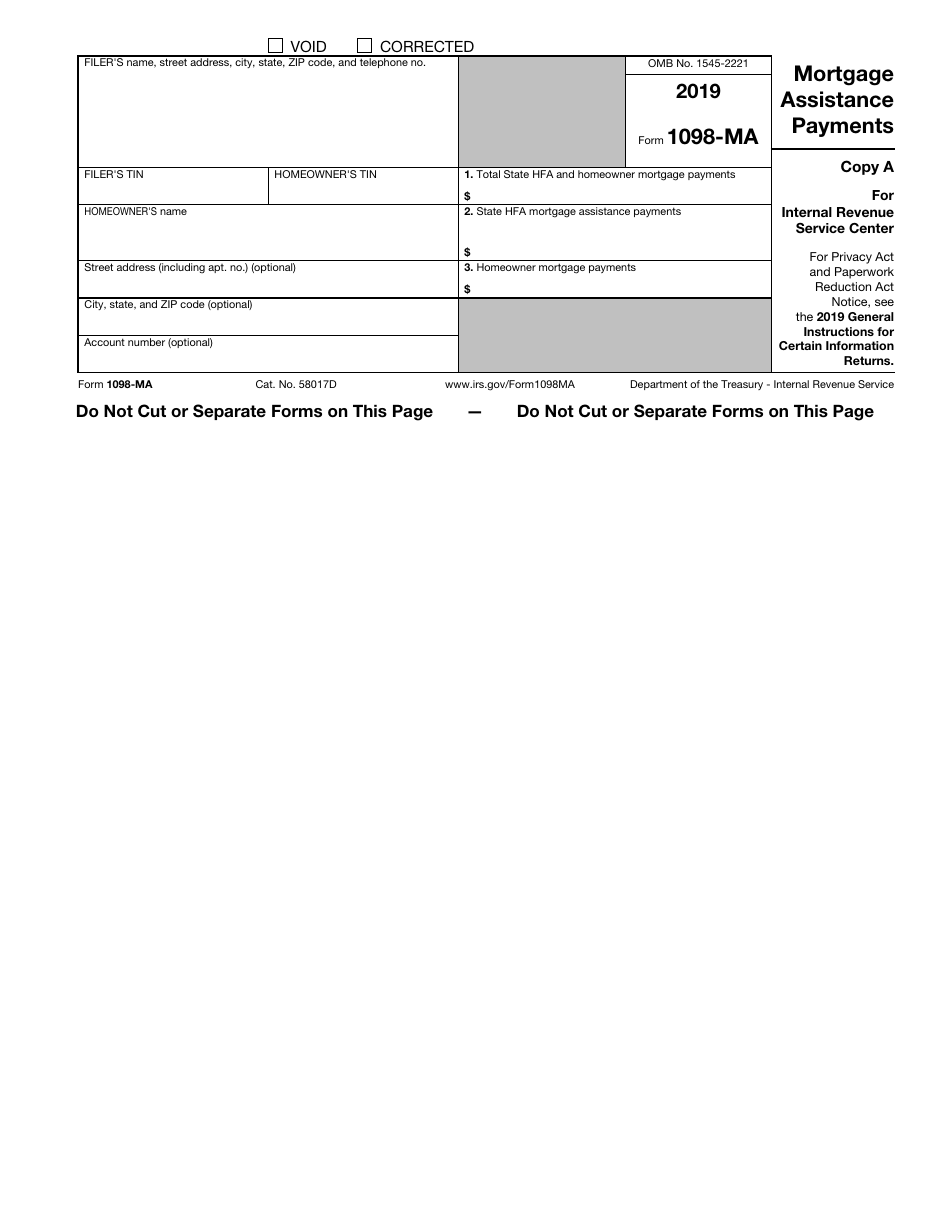

This version of the form is not currently in use and is provided for reference only. Download this version of

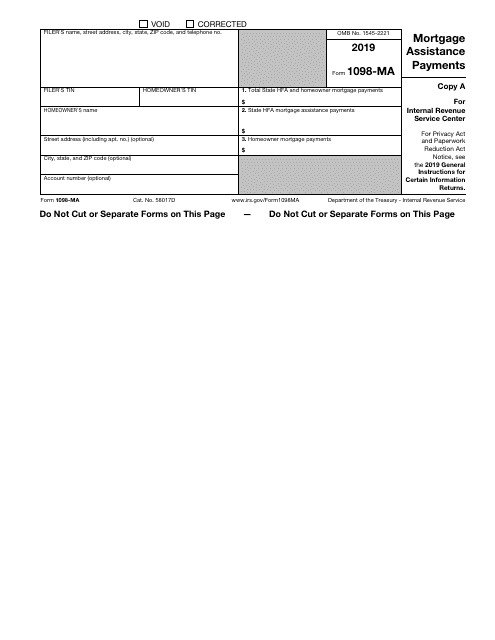

IRS Form 1098-MA

for the current year.

IRS Form 1098-MA Mortgage Assistance Payments

What Is IRS Form 1098-MA?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1098-MA?

A: IRS Form 1098-MA is a tax form used to report mortgage assistance payments made under a qualified government program.

Q: Who needs to file IRS Form 1098-MA?

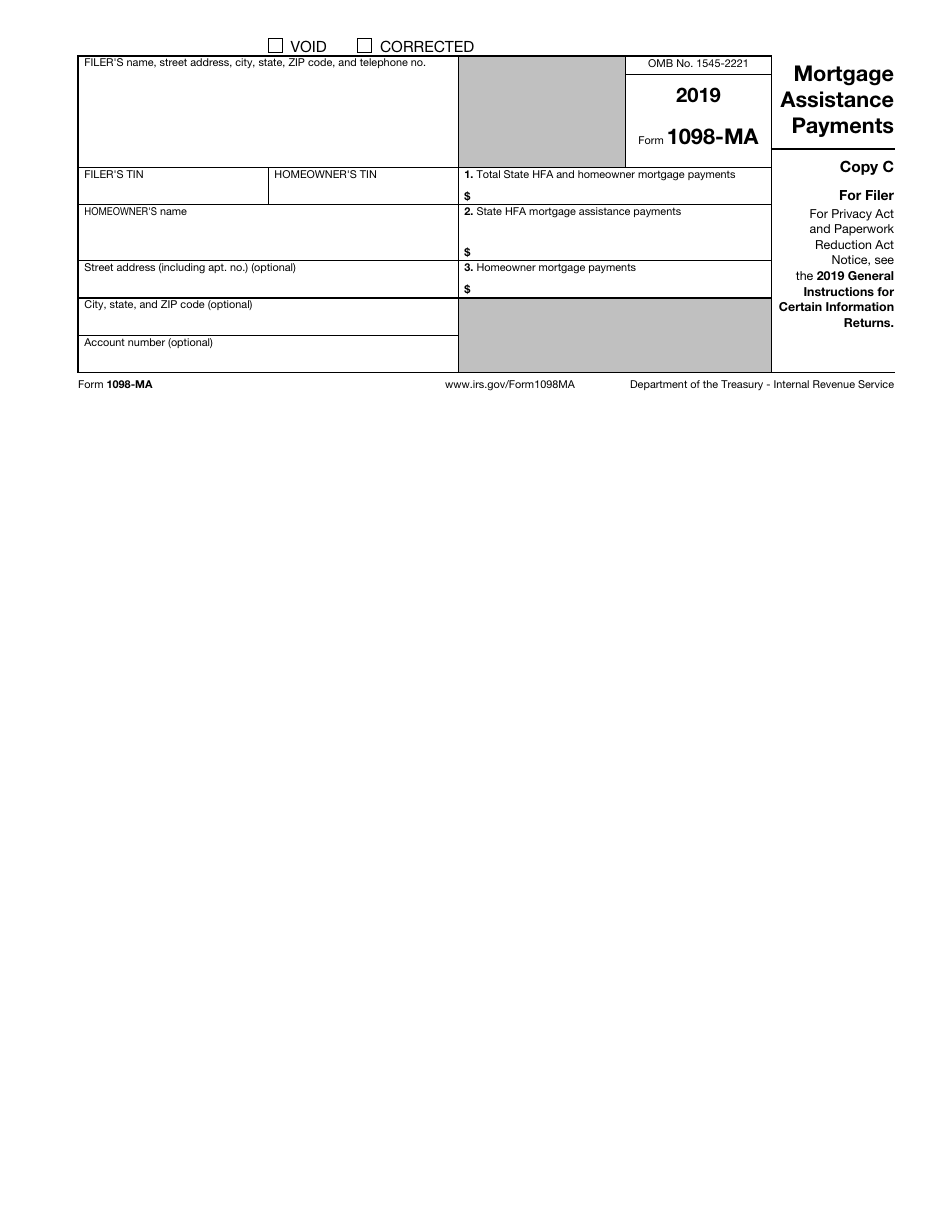

A: Lenders or government agencies that make qualifying mortgage assistance payments need to file IRS Form 1098-MA.

Q: What are mortgage assistance payments?

A: Mortgage assistance payments are payments made by a government agency or lender to assist homeowners with mortgage expenses.

Q: What qualifies as a government program for IRS Form 1098-MA?

A: A government program that provides mortgage assistance to homeowners who have experienced a significant reduction in income or an increase in living expenses qualifies for IRS Form 1098-MA.

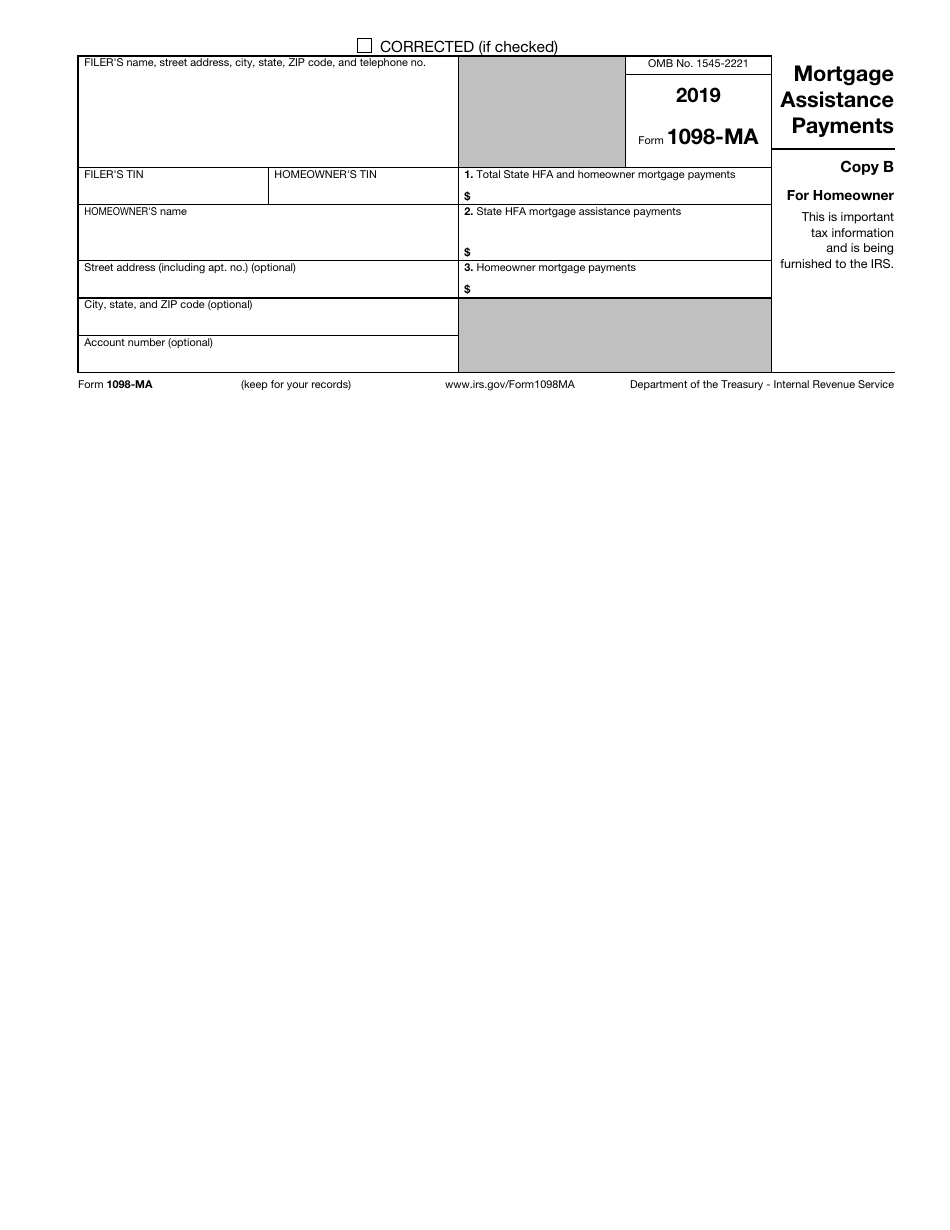

Q: What information is included in IRS Form 1098-MA?

A: IRS Form 1098-MA includes information about the homeowner, the lender or government agency making the payments, and the amount of mortgage assistance received.

Q: When is IRS Form 1098-MA due?

A: IRS Form 1098-MA is due to be filed with the IRS by February 28th of each year, or by March 31st if filing electronically.

Q: What are the consequences of not filing IRS Form 1098-MA?

A: Failure to file IRS Form 1098-MA or filing incorrect information may result in penalties or fines for the lender or government agency making the payments.

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1098-MA through the link below or browse more documents in our library of IRS Forms.