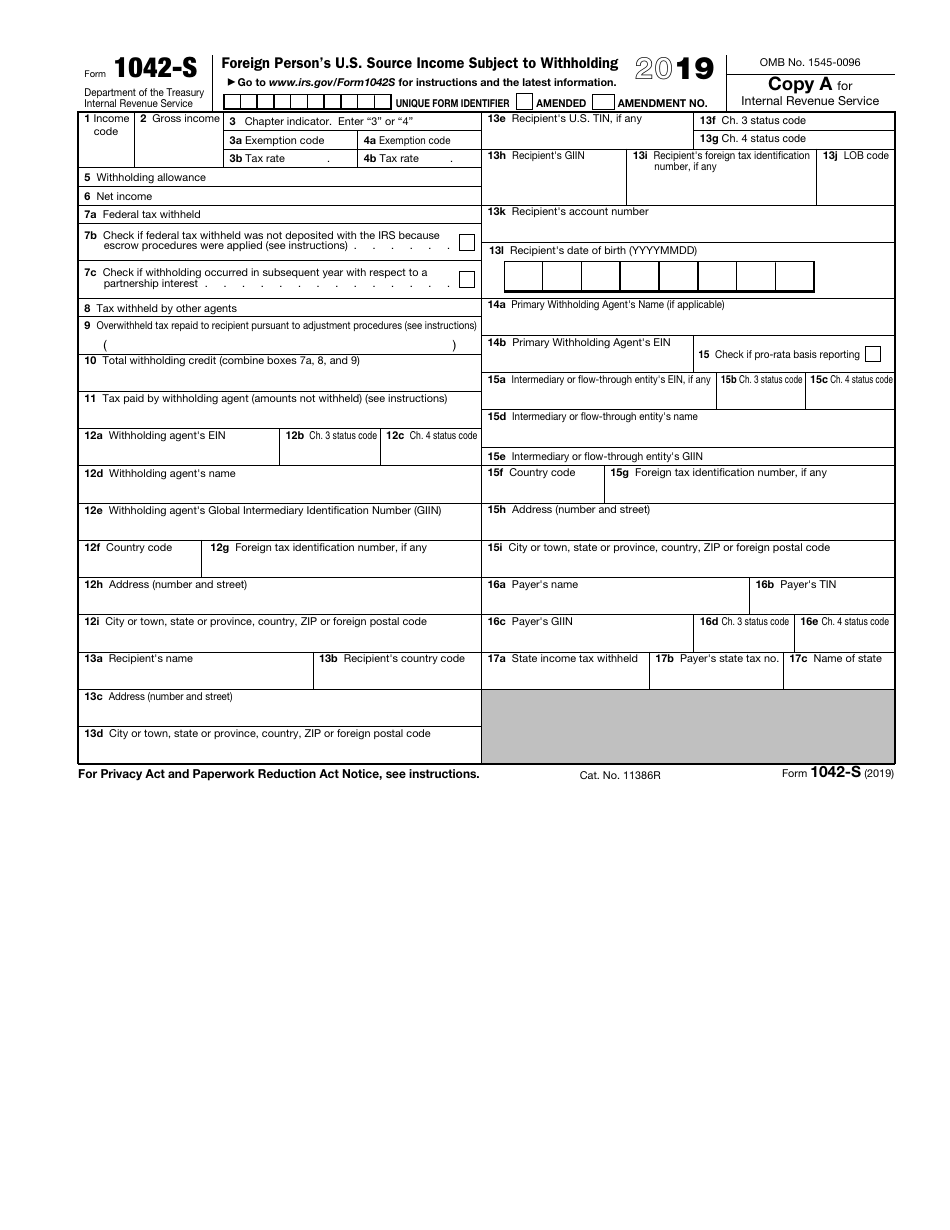

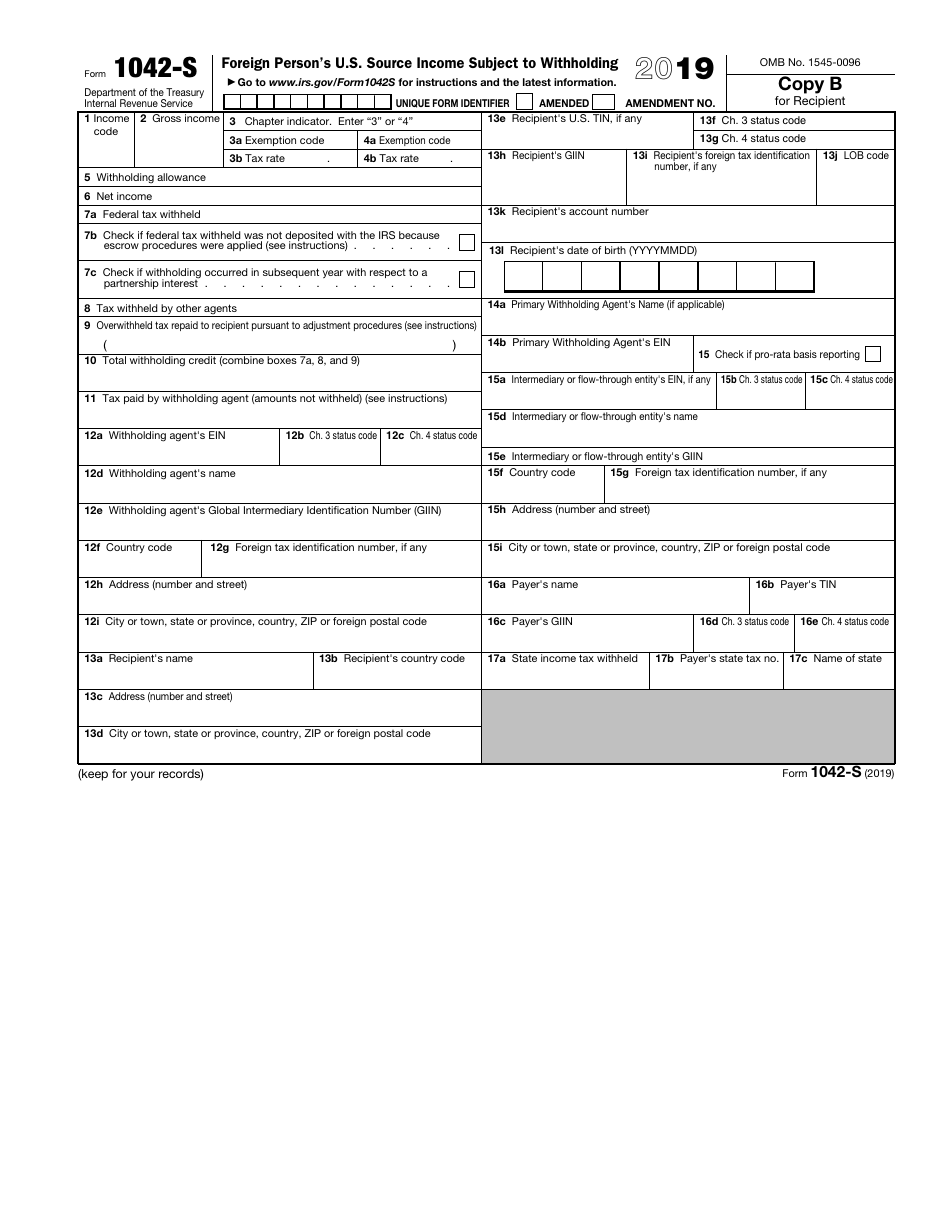

This version of the form is not currently in use and is provided for reference only. Download this version of

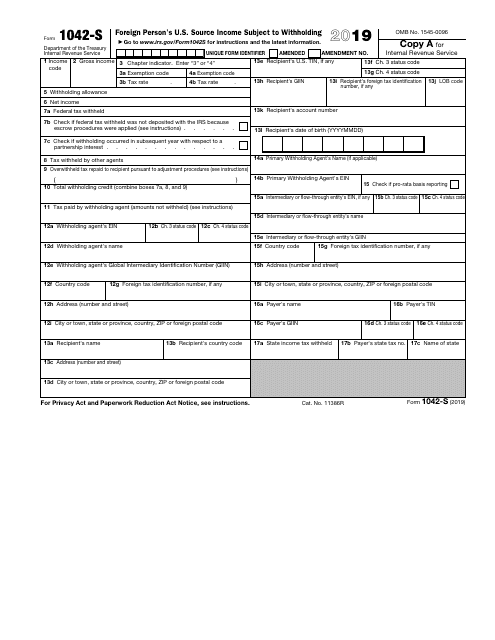

IRS Form 1042-S

for the current year.

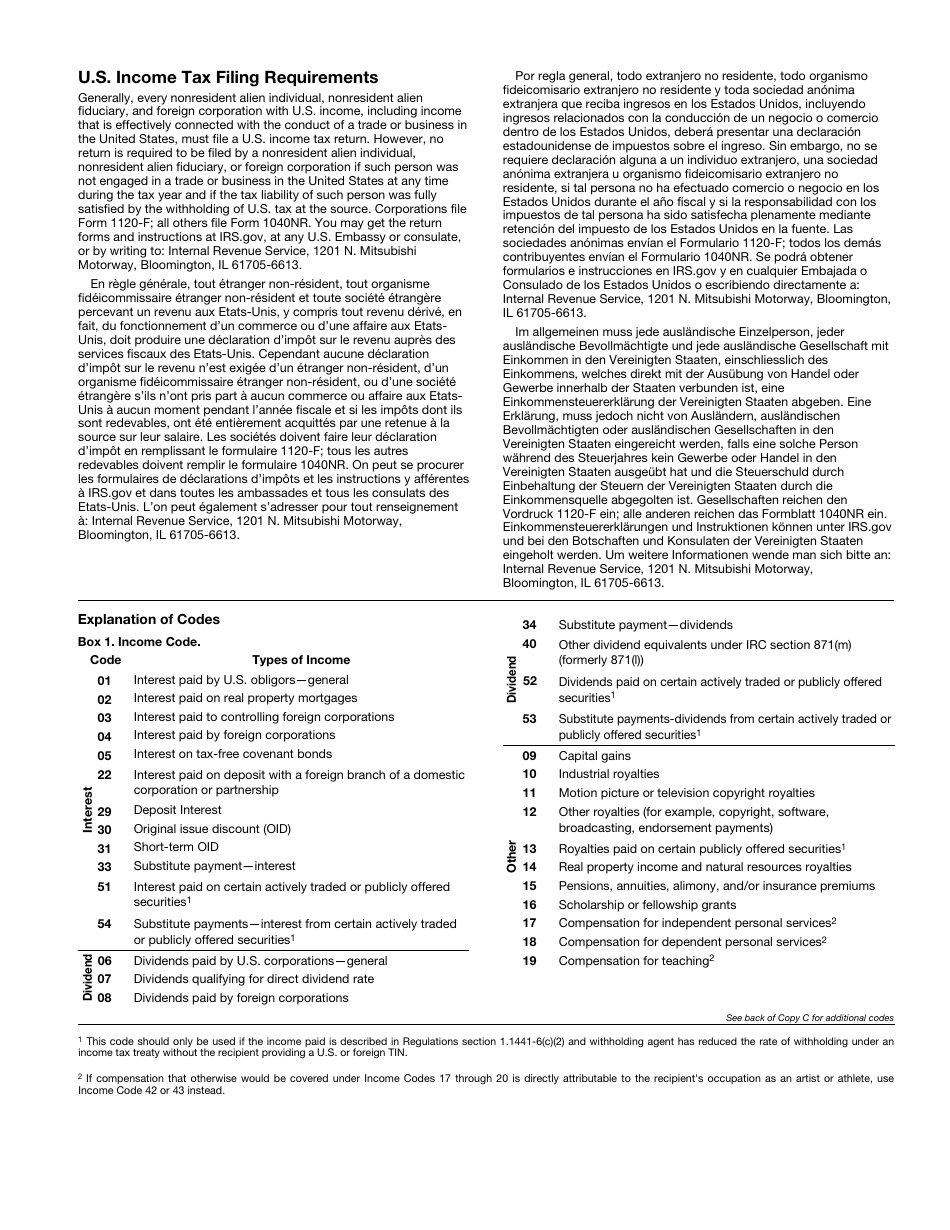

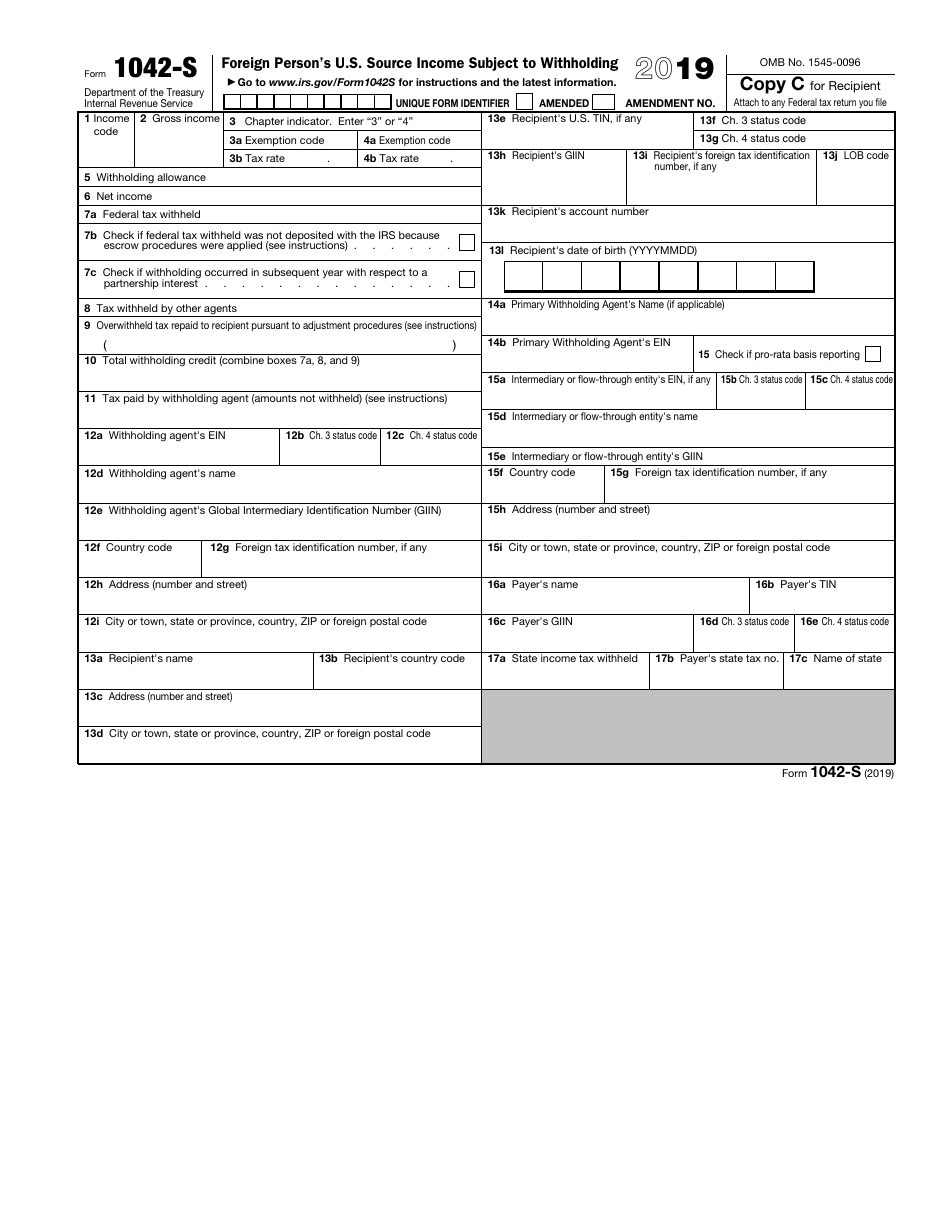

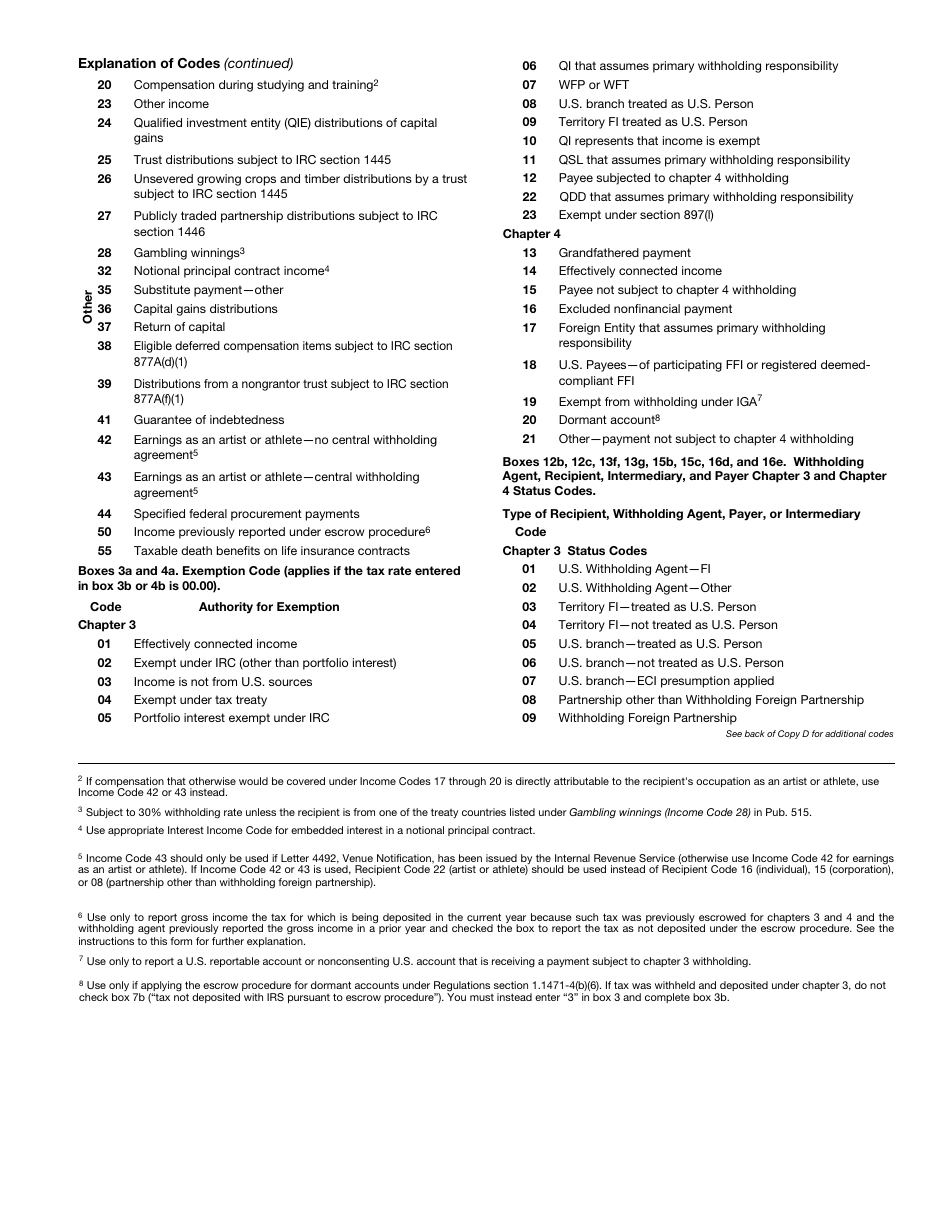

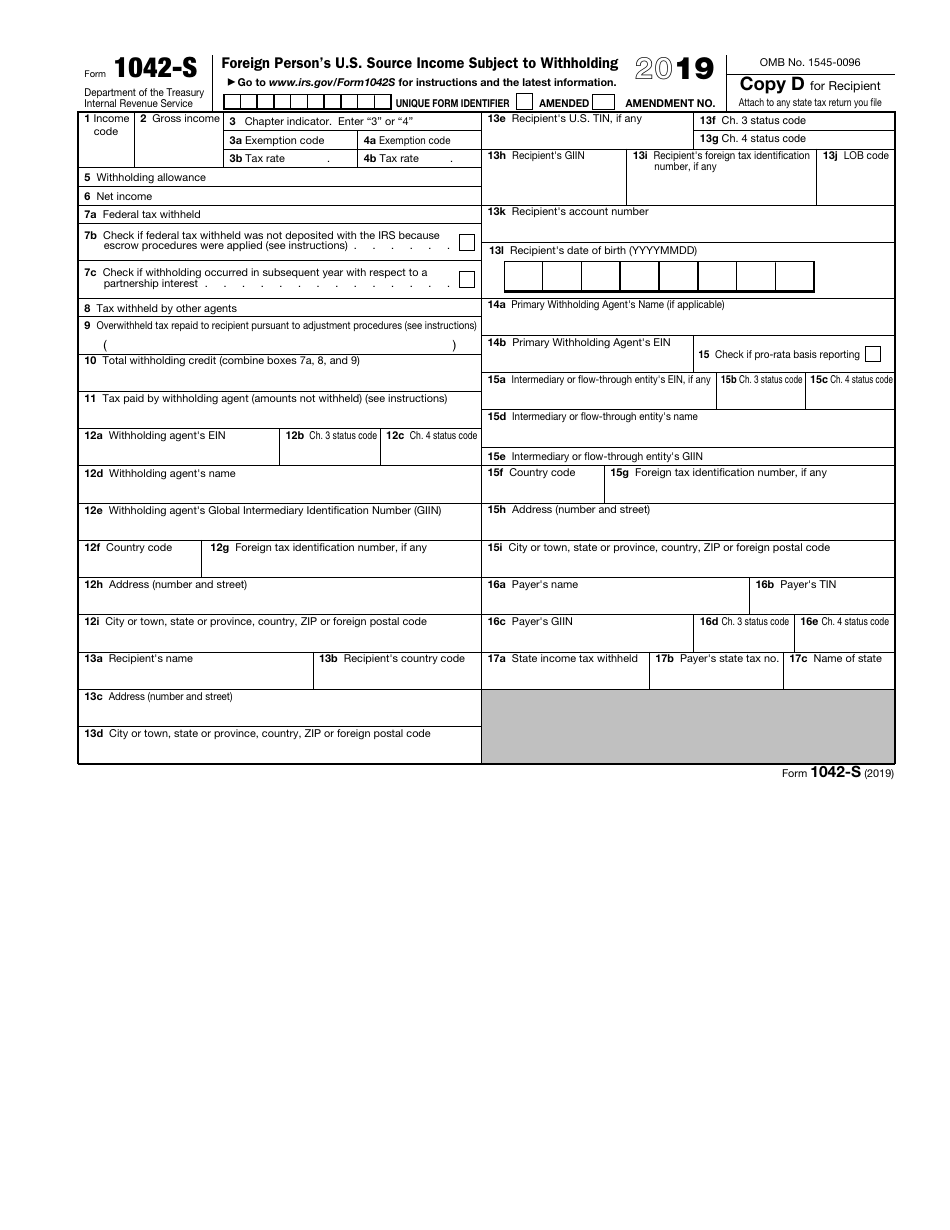

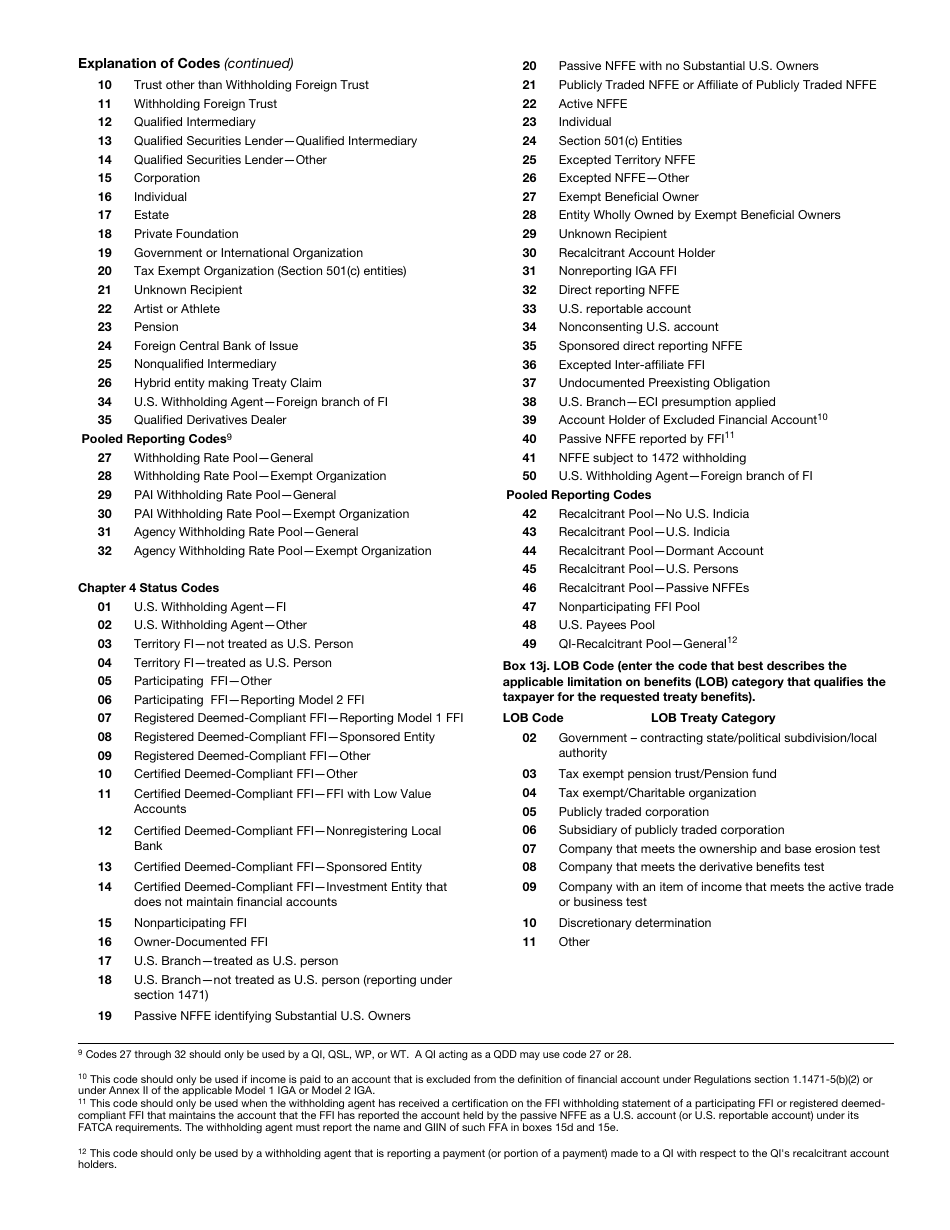

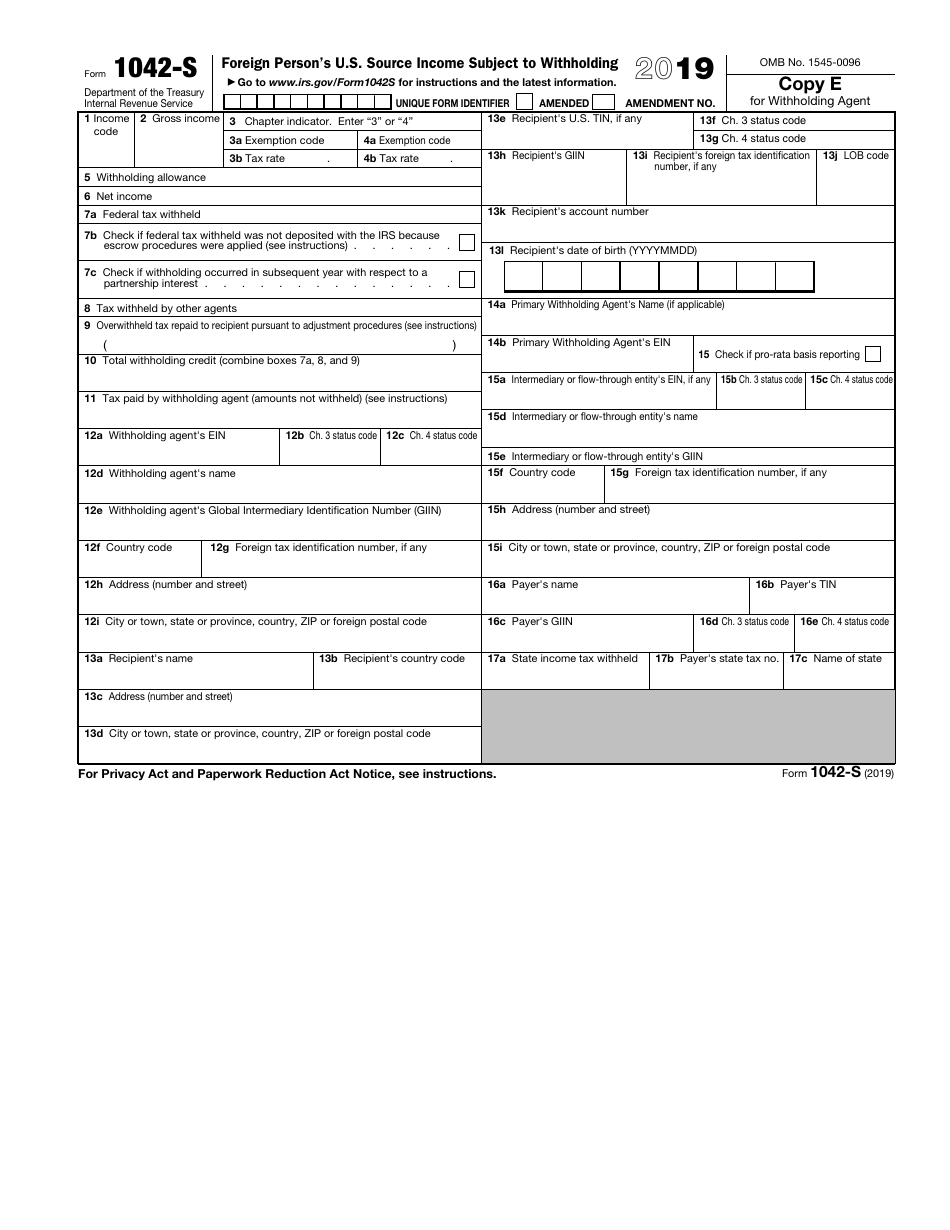

IRS Form 1042-S Foreign Person's U.S. Source Income Subject to Withholding

What Is IRS Form 1042-S?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1042-S?

A: IRS Form 1042-S is used to report foreign person's U.S. source income subject to withholding.

Q: Who needs to file IRS Form 1042-S?

A: Foreign persons who received U.S. source income that is subject to withholding need to file IRS Form 1042-S.

Q: What is U.S. source income?

A: U.S. source income refers to income derived from U.S. sources, such as wages, salaries, scholarships, and royalties.

Q: What is withholding?

A: Withholding is the process of deducting taxes from income at the time it is earned.

Q: How is IRS Form 1042-S different from Form 1040?

A: IRS Form 1042-S is specifically for reporting income of foreign persons subject to withholding, while Form 1040 is used by U.S. residents to report their income and claim deductions.

Q: When is the deadline to file IRS Form 1042-S?

A: The deadline to file IRS Form 1042-S is usually March 15th of the following year.

Q: Do I need to attach Form 1042-S to my tax return?

A: No, Form 1042-S is not attached to your individual tax return (Form 1040), but it serves as documentation for the income you received and the tax withheld.

Q: What if I make a mistake on IRS Form 1042-S?

A: If you make a mistake on Form 1042-S, you can file a corrected form (1042-S) to rectify the error.

Q: Can I e-file IRS Form 1042-S?

A: Yes, you can e-file IRS Form 1042-S if you are required to file 250 or more forms. Otherwise, you must file a paper copy by mail.

Form Details:

- A 8-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1042-S through the link below or browse more documents in our library of IRS Forms.