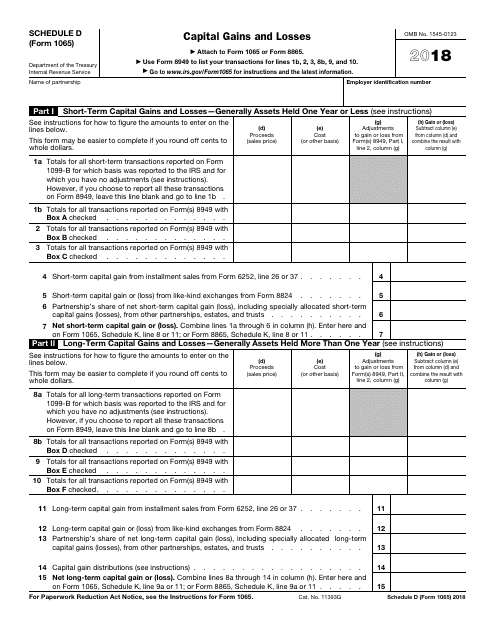

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1065 Schedule D

for the current year.

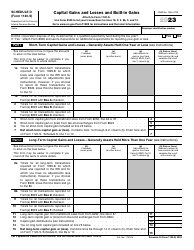

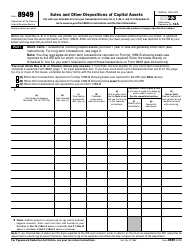

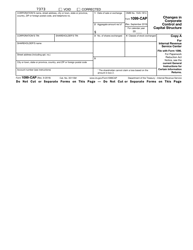

IRS Form 1065 Schedule D Capital Gains and Losses

What Is IRS Form 1065 Schedule D?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1065, U.S. Return of Partnership Income. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

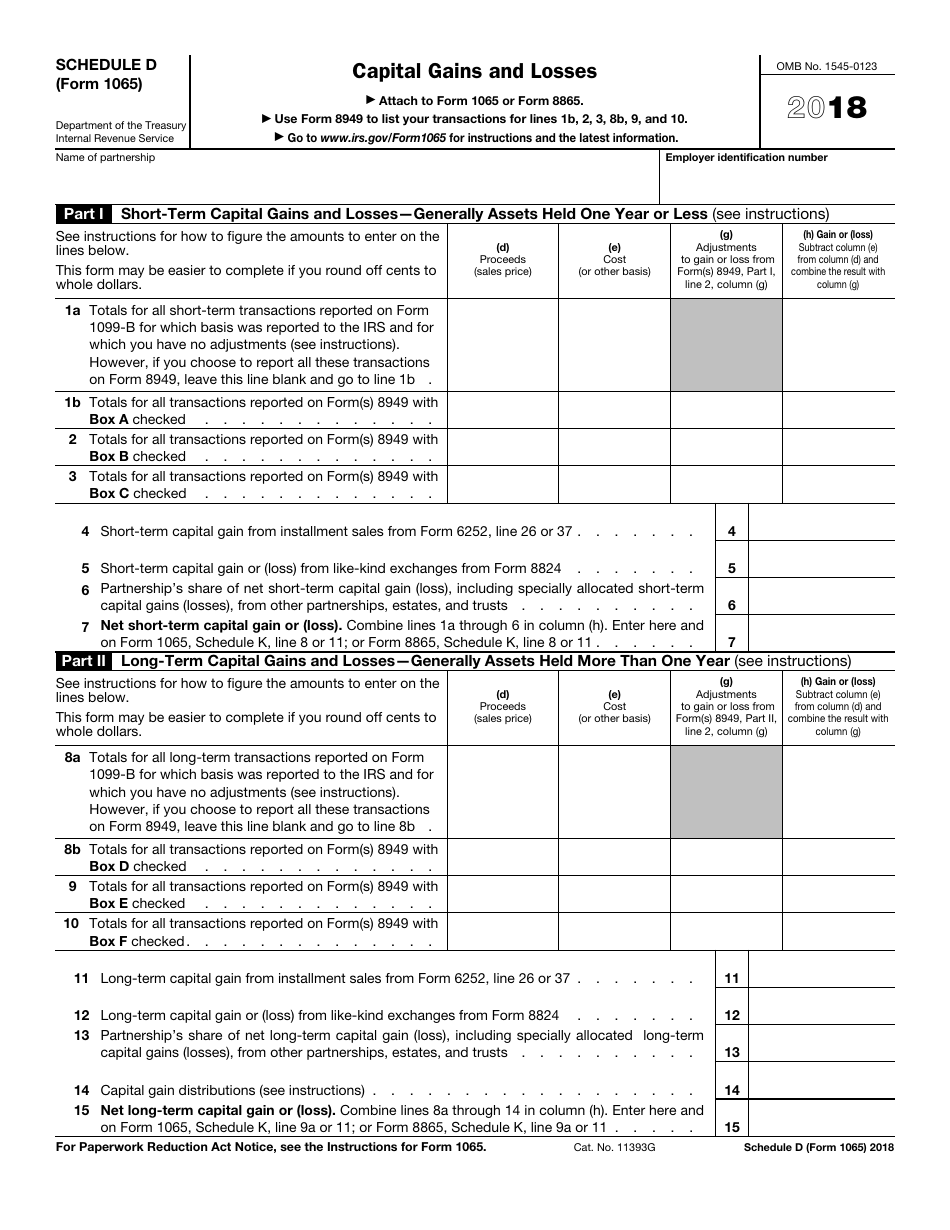

Q: What is IRS Form 1065 Schedule D?

A: IRS Form 1065 Schedule D is a form used by partnerships to report capital gains and losses.

Q: Who needs to file IRS Form 1065 Schedule D?

A: Partnerships that have capital gains or losses during the year need to file IRS Form 1065 Schedule D.

Q: What information is required on IRS Form 1065 Schedule D?

A: IRS Form 1065 Schedule D requires information about the partnership's capital gains and losses, including the type of asset, the date acquired, the date sold, the sale price, and the cost or basis of the asset.

Q: When is the deadline to file IRS Form 1065 Schedule D?

A: IRS Form 1065 Schedule D is generally due on the same date as the partnership's tax return, which is usually March 15th.

Q: What happens if I don't file IRS Form 1065 Schedule D?

A: Failure to file IRS Form 1065 Schedule D can result in penalties or the disallowance of capital losses.

Q: Can I e-file IRS Form 1065 Schedule D?

A: As of 2021, partnerships cannot e-file IRS Form 1065 Schedule D. The form must be filed by mail.

Q: How do I calculate my capital gains or losses for IRS Form 1065 Schedule D?

A: To calculate capital gains or losses for IRS Form 1065 Schedule D, you subtract the basis (or cost) of the asset from the sale price. If the result is positive, it's a capital gain; if it's negative, it's a capital loss.

Q: Are there any special rules or considerations for reporting capital gains or losses on IRS Form 1065 Schedule D?

A: Yes, there are special rules and considerations for reporting capital gains or losses on IRS Form 1065 Schedule D. It's recommended to consult a tax professional for guidance.

Q: Can I amend IRS Form 1065 Schedule D if I made a mistake?

A: Yes, if you made a mistake on IRS Form 1065 Schedule D, you can file an amended form using IRS Form 1065X.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1065 Schedule D through the link below or browse more documents in our library of IRS Forms.