This version of the form is not currently in use and is provided for reference only. Download this version of

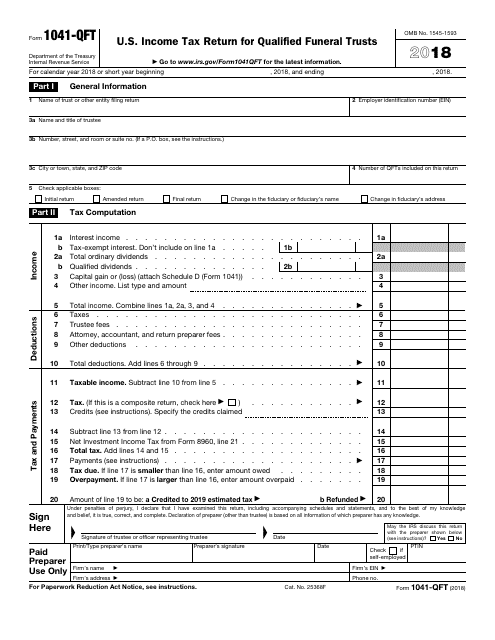

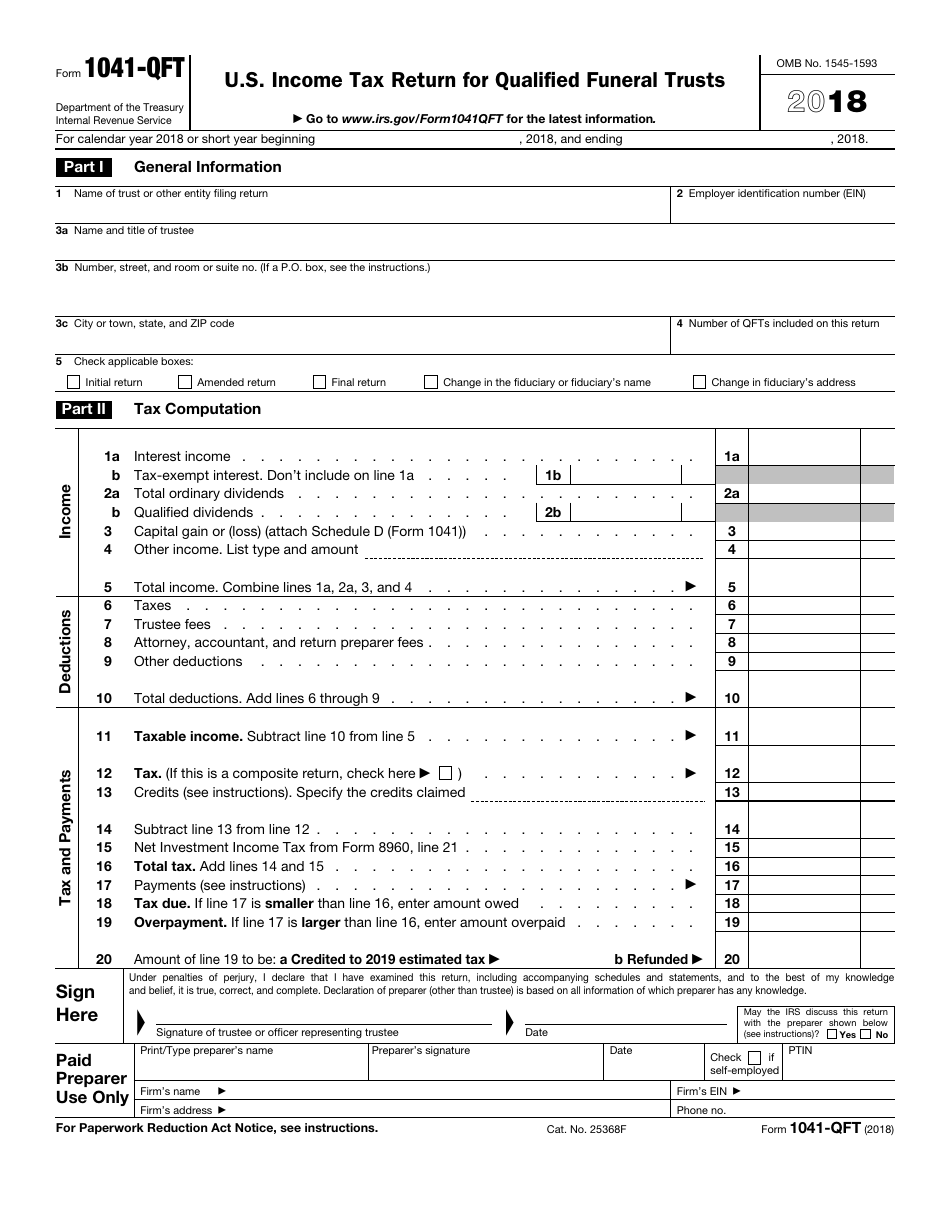

IRS Form 1041-QFT

for the current year.

IRS Form 1041-QFT U.S. Income Tax Return for Qualified Funeral Trusts

What Is IRS Form 1041-QFT?

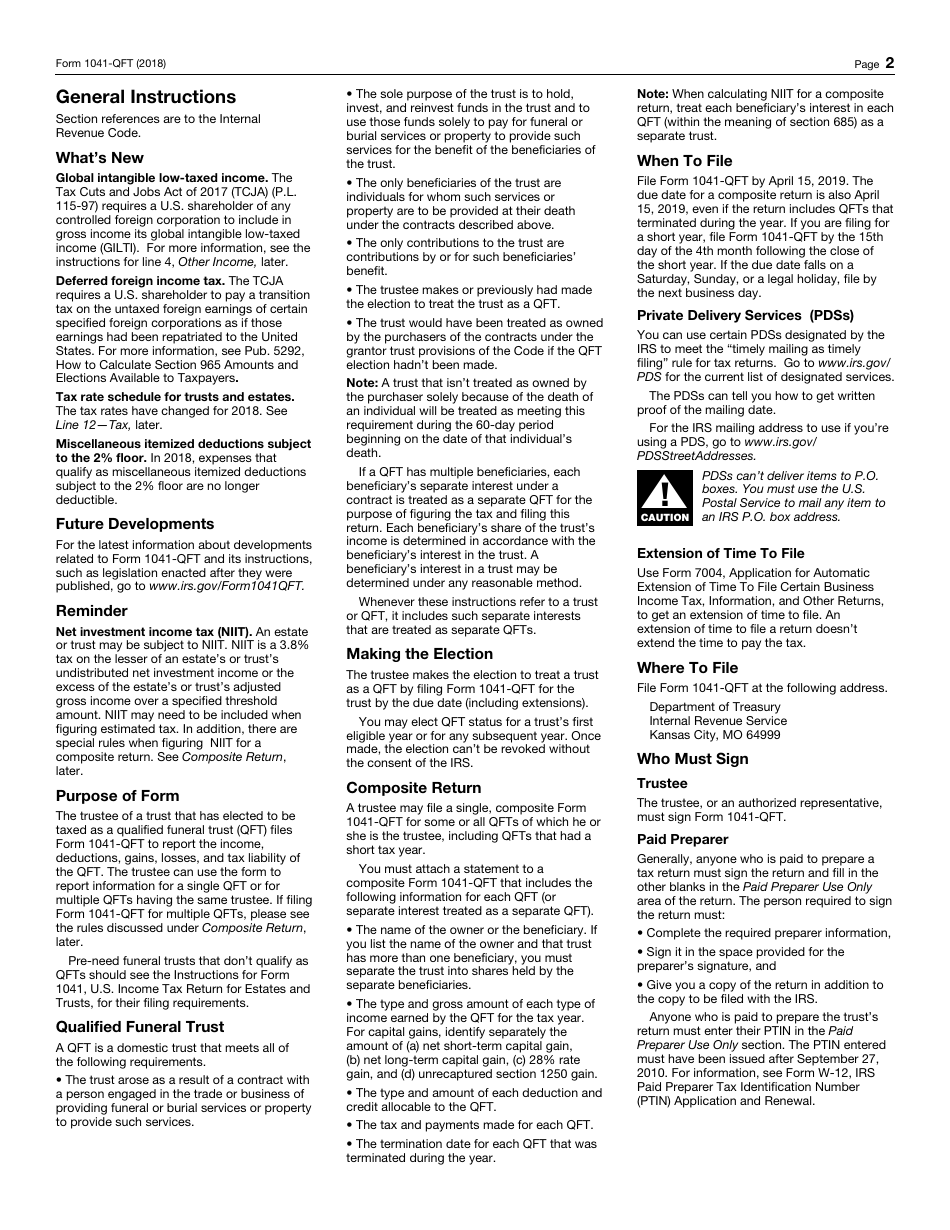

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1041-QFT?

A: IRS Form 1041-QFT is the U.S. Income Tax Return specifically designed for Qualified Funeral Trusts.

Q: Who needs to file IRS Form 1041-QFT?

A: Any Qualified Funeral Trust is required to file IRS Form 1041-QFT.

Q: What is a Qualified Funeral Trust?

A: A Qualified Funeral Trust is a trust established to hold funds intended for funeral expenses.

Q: When is IRS Form 1041-QFT due?

A: IRS Form 1041-QFT is due on April 15th of the following year.

Q: Can I file IRS Form 1041-QFT electronically?

A: No, currently IRS Form 1041-QFT cannot be filed electronically. It must be filed by mail.

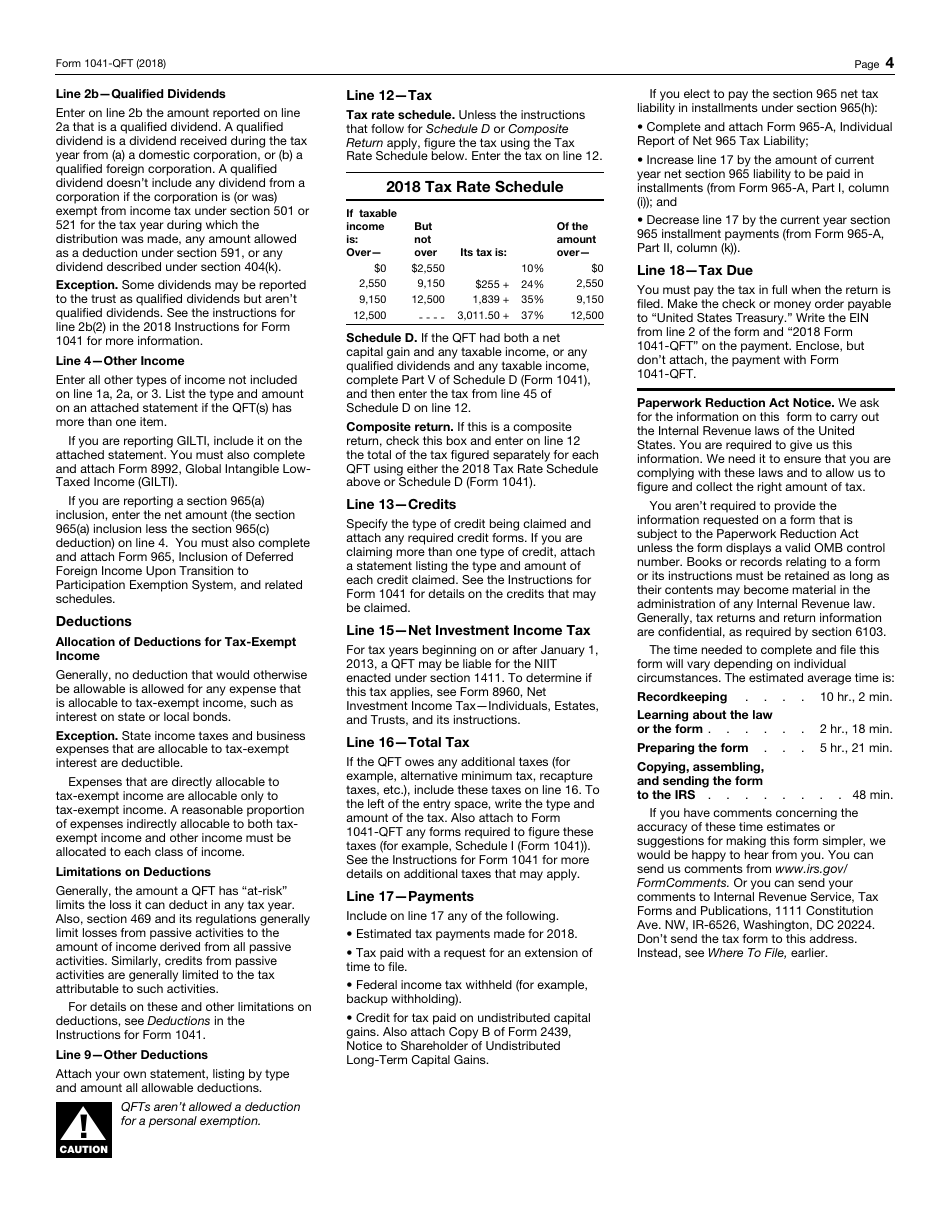

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1041-QFT through the link below or browse more documents in our library of IRS Forms.