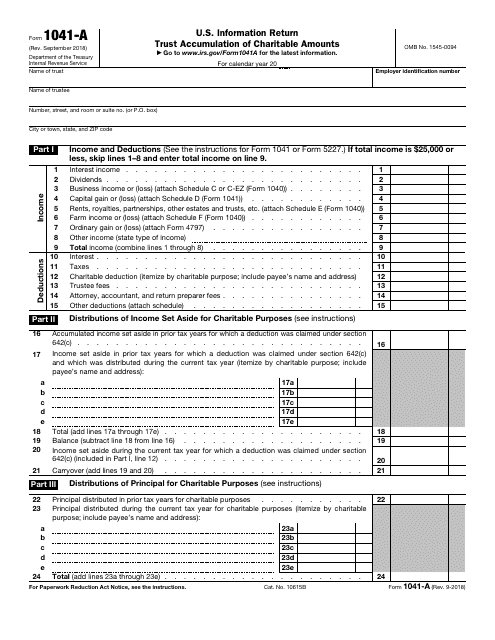

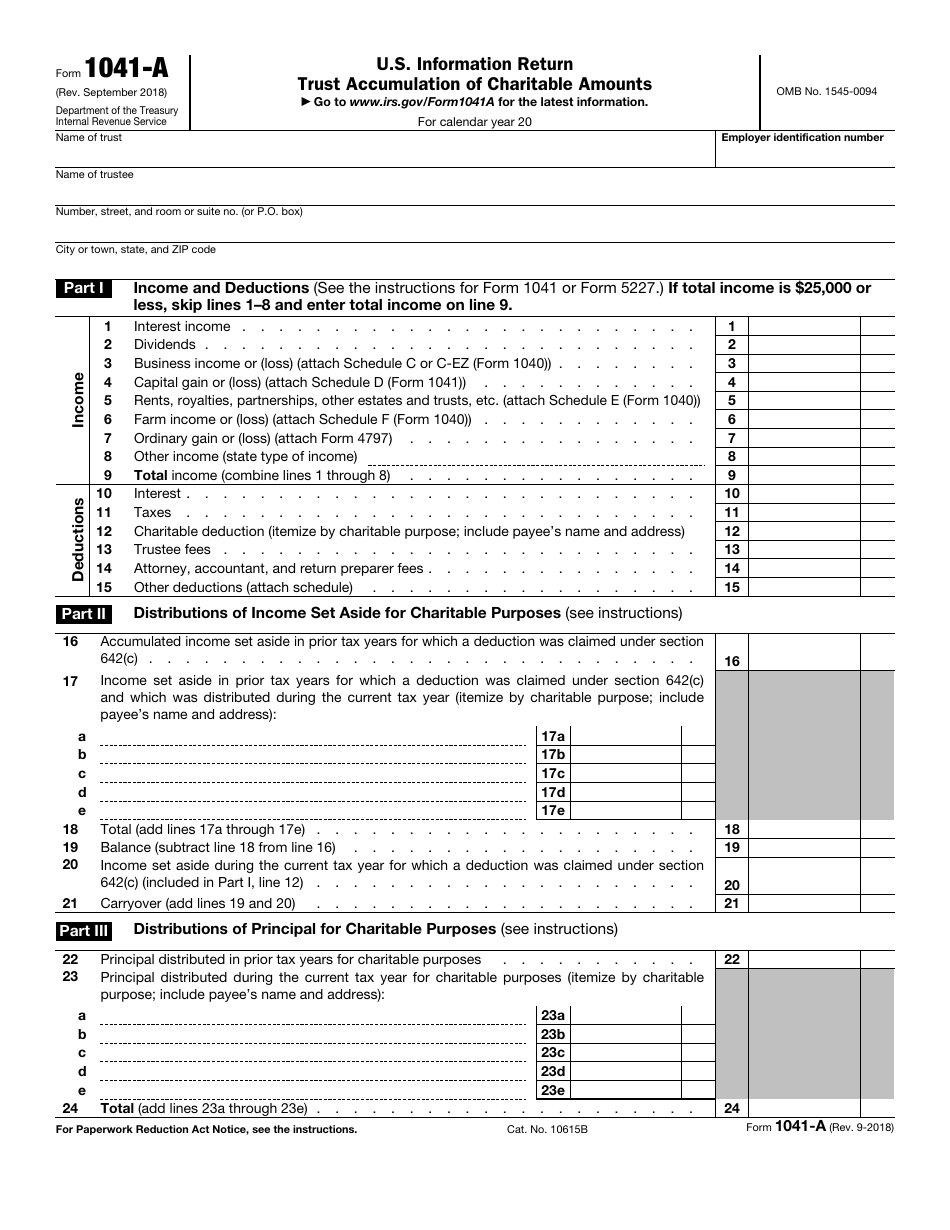

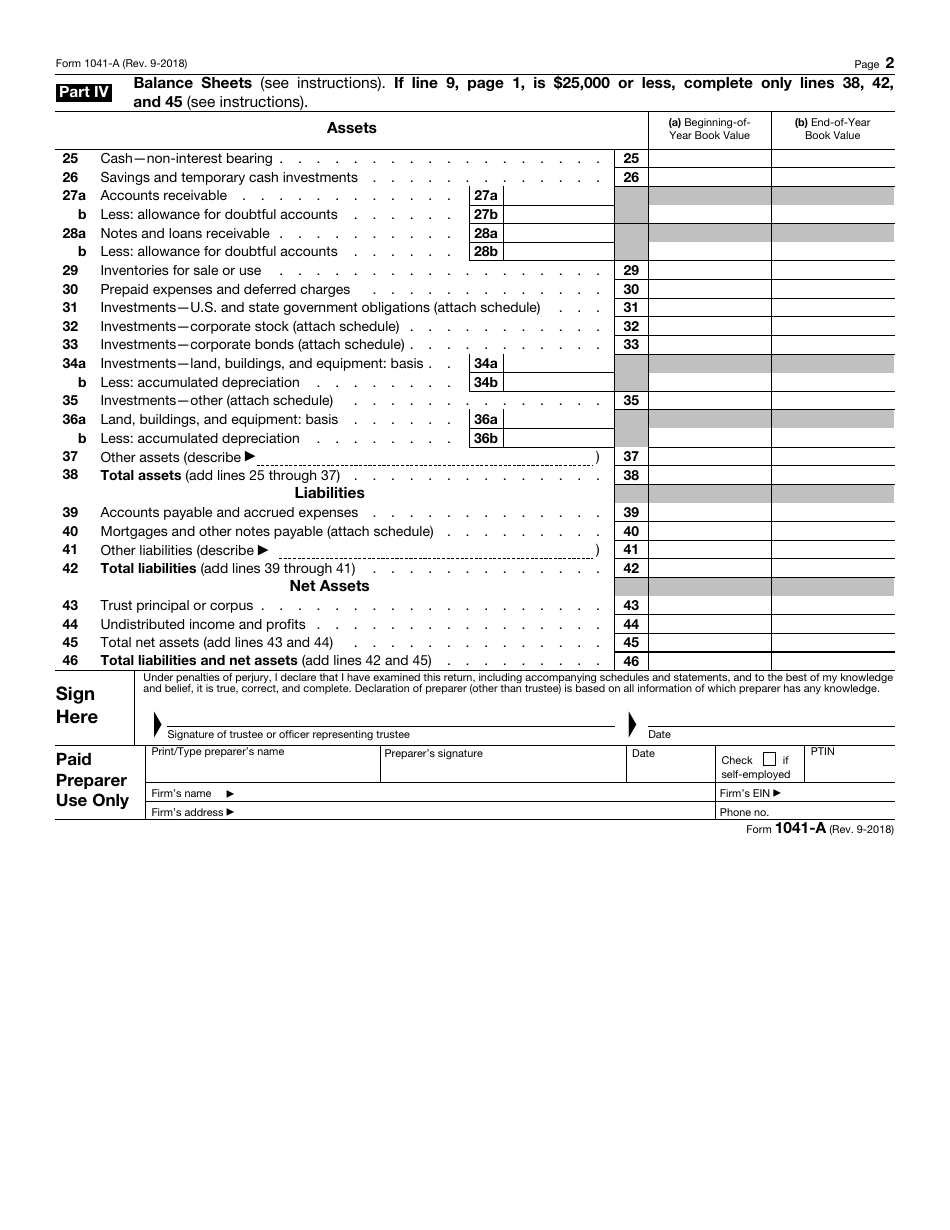

IRS Form 1041-A U.S. Information Return Trust Accumulation of Charitable Amounts

What Is IRS Form 1041-A?

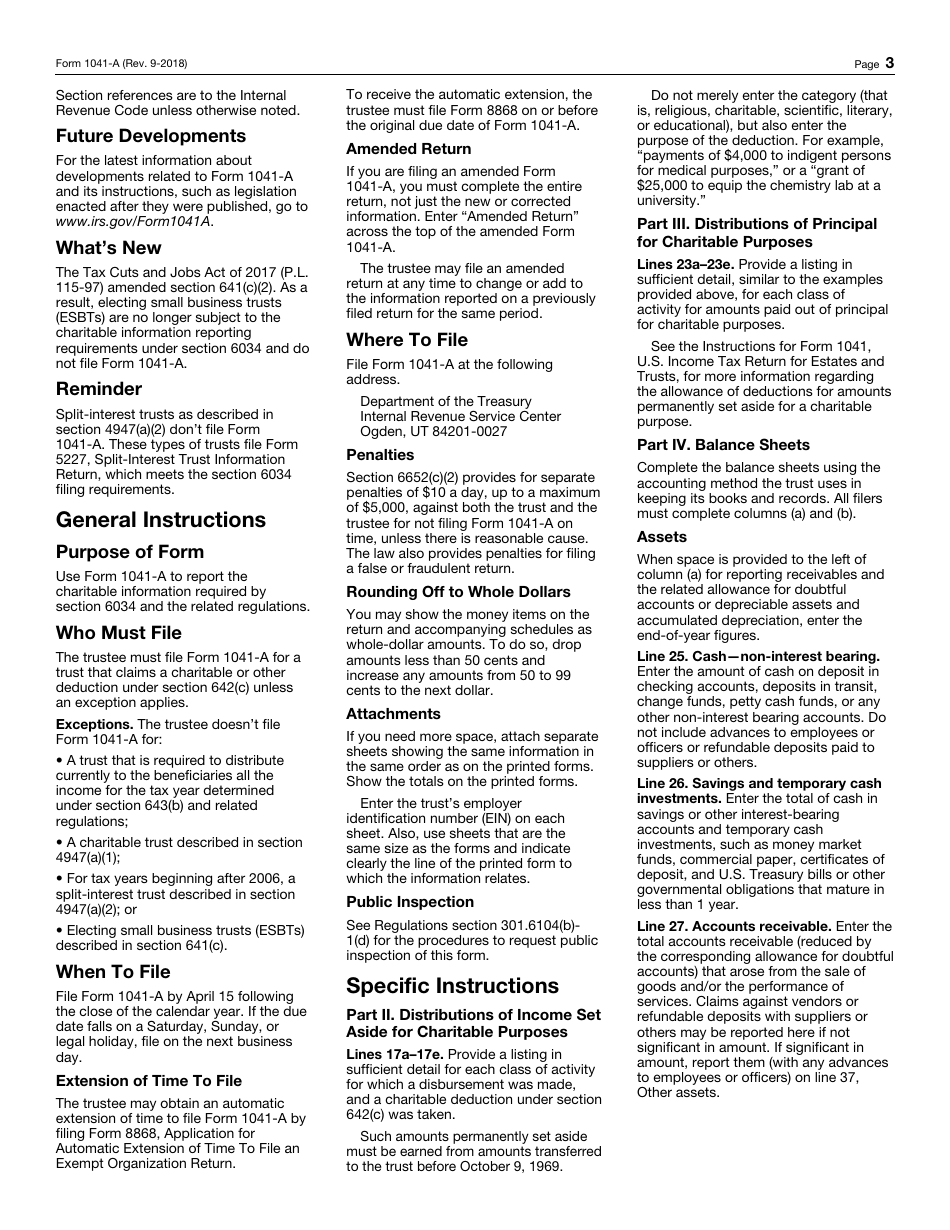

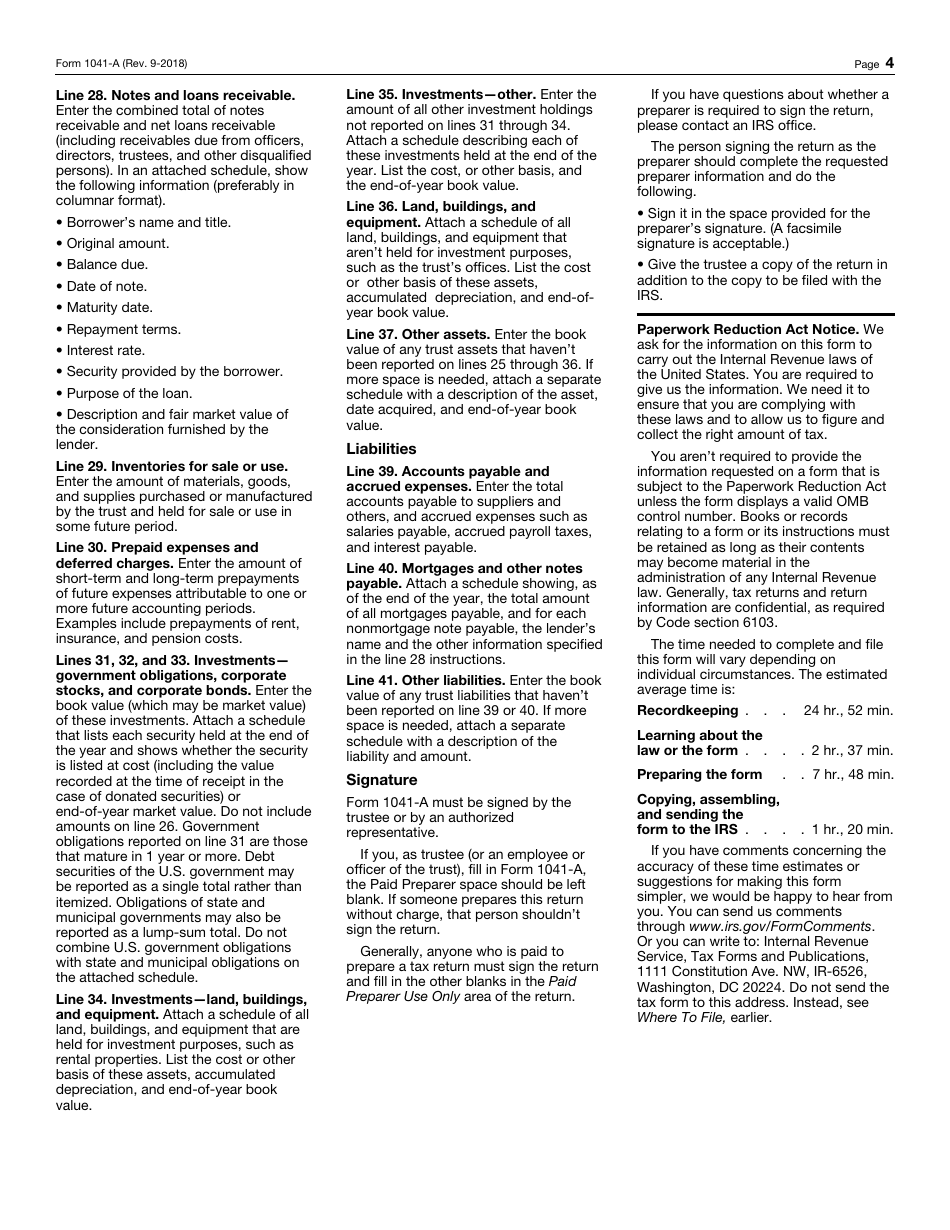

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1041-A?

A: IRS Form 1041-A is the U.S. Information Return for Trust Accumulation of Charitable Amounts.

Q: Who needs to file IRS Form 1041-A?

A: Trusts that have accumulated charitable amounts need to file IRS Form 1041-A.

Q: What is the purpose of IRS Form 1041-A?

A: The purpose of IRS Form 1041-A is to report the accumulation of charitable amounts by a trust.

Q: When is IRS Form 1041-A due?

A: IRS Form 1041-A is generally due by the 15th day of the 4th month after the end of the trust's tax year.

Form Details:

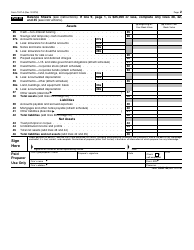

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1041-A through the link below or browse more documents in our library of IRS Forms.