This version of the form is not currently in use and is provided for reference only. Download this version of

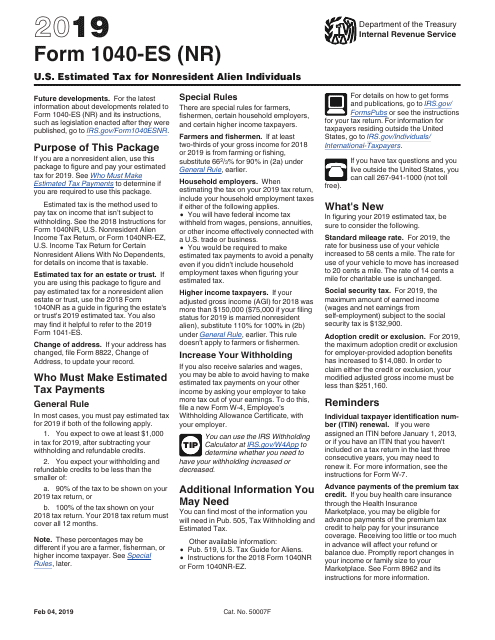

IRS Form 1040-ES (NR)

for the current year.

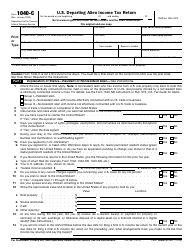

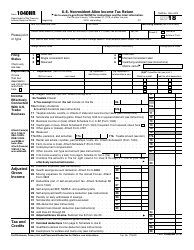

IRS Form 1040-ES (NR) U.S. Estimated Tax for Nonresident Alien Individuals

What Is Form 1040-ES (NR)?

IRS Form 1040-ES (NR), U.S. Estimated Tax for Nonresident Alien Individuals is a form used by nonresident aliens to calculate and pay estimated tax on income that isn't subject to withholding to the Internal Revenue Service (IRS) and to inform the IRS about financial activity on U.S. territory.

The income subject to reporting includes but is not limited to:

- Income derived from self-employment.

- Pension or annuity income.

- Prize winnings, lottery, and horse racing proceeds.

- Capital gains.

- Interest income, dividend income, and rental income.

Form 1040-ES (NR) was re-released for the current year on February 4, 2019. A fillable version of the form can be downloaded through the link below.

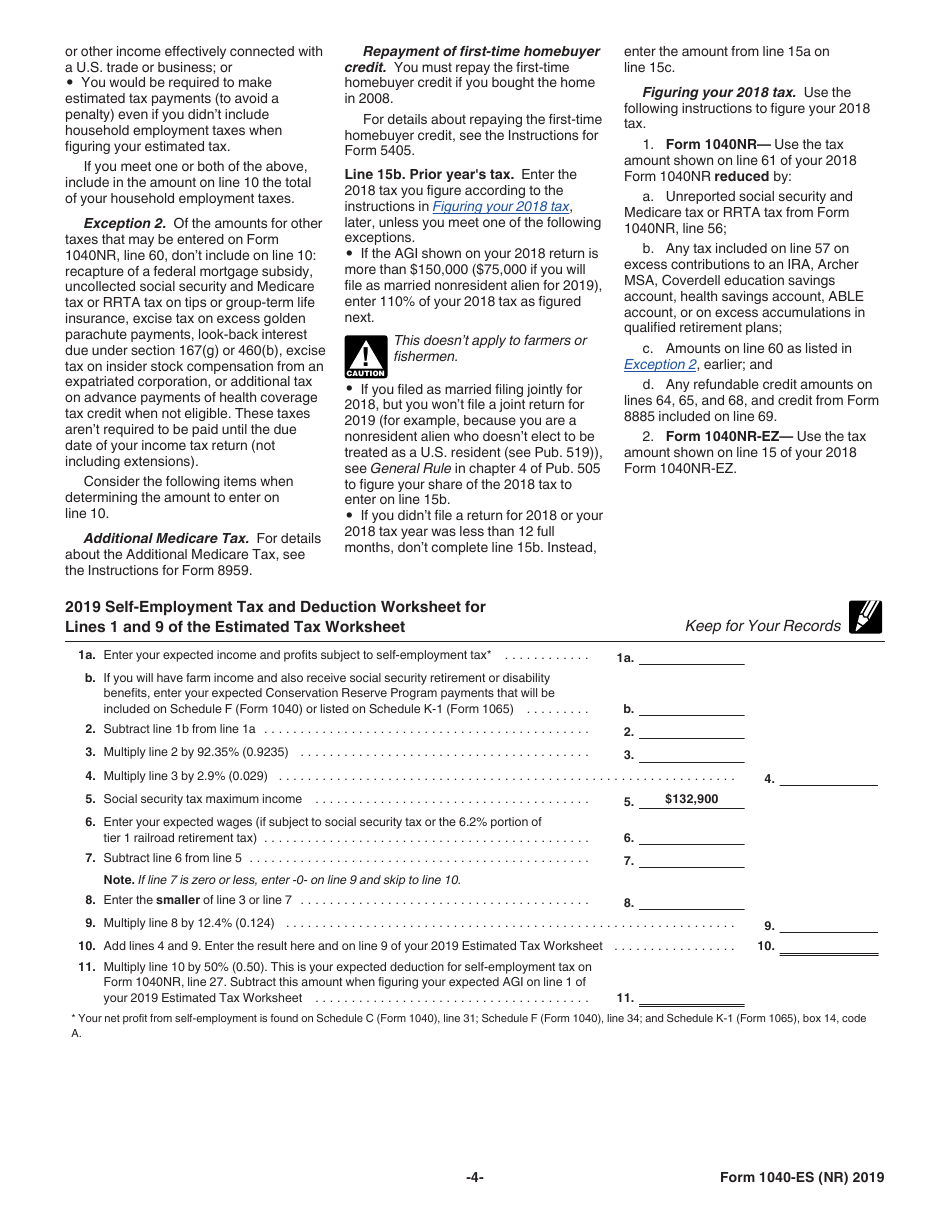

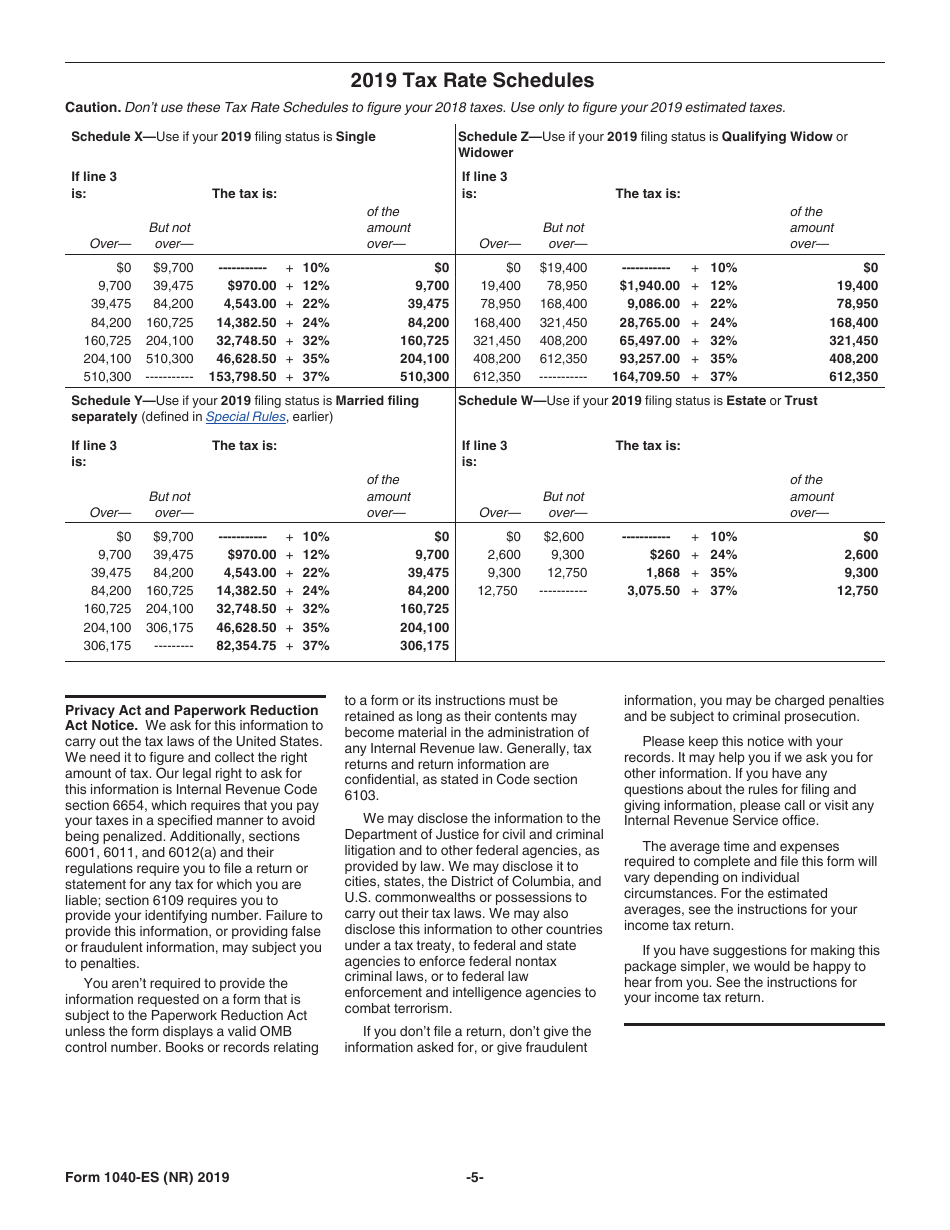

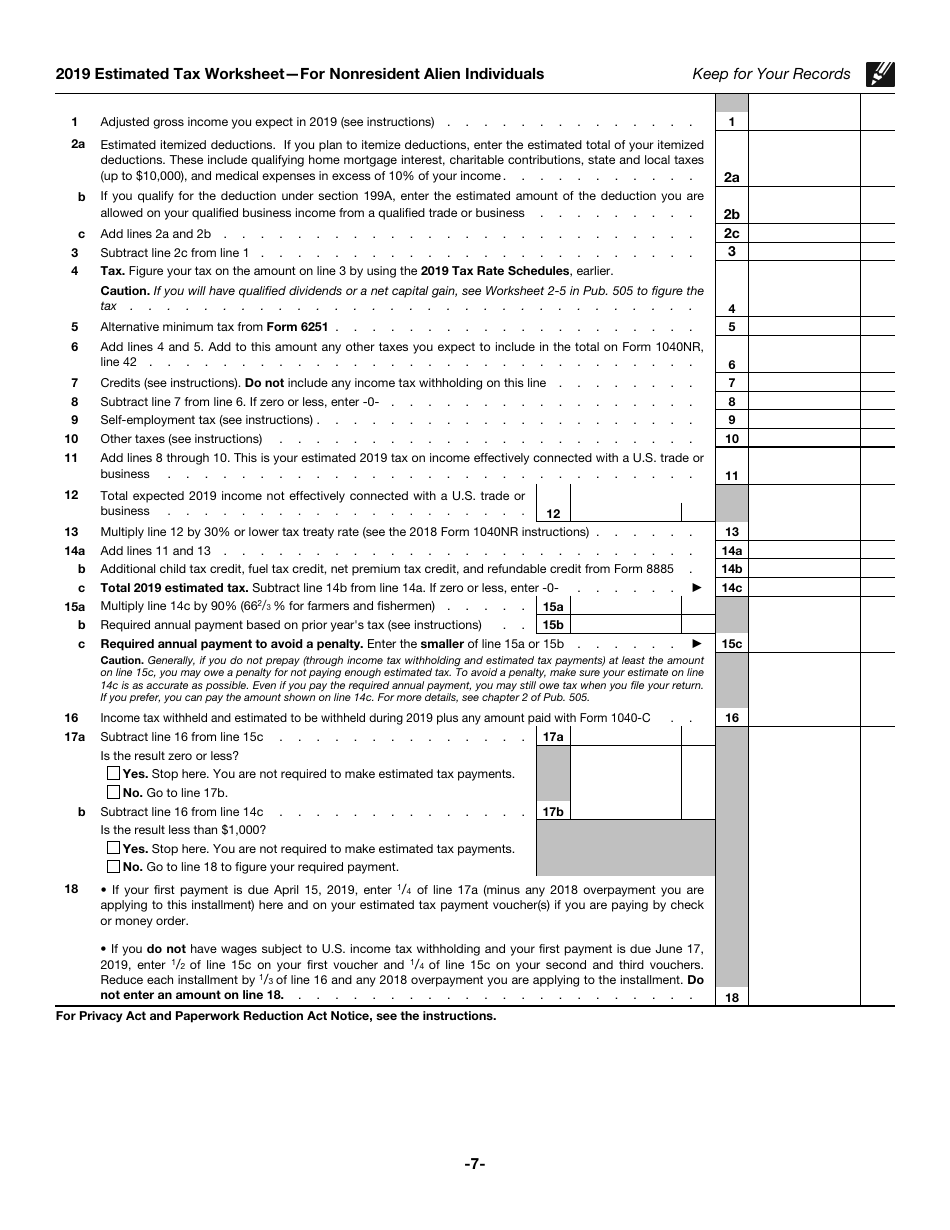

How to Complete a 1040-ES (NR) Form?

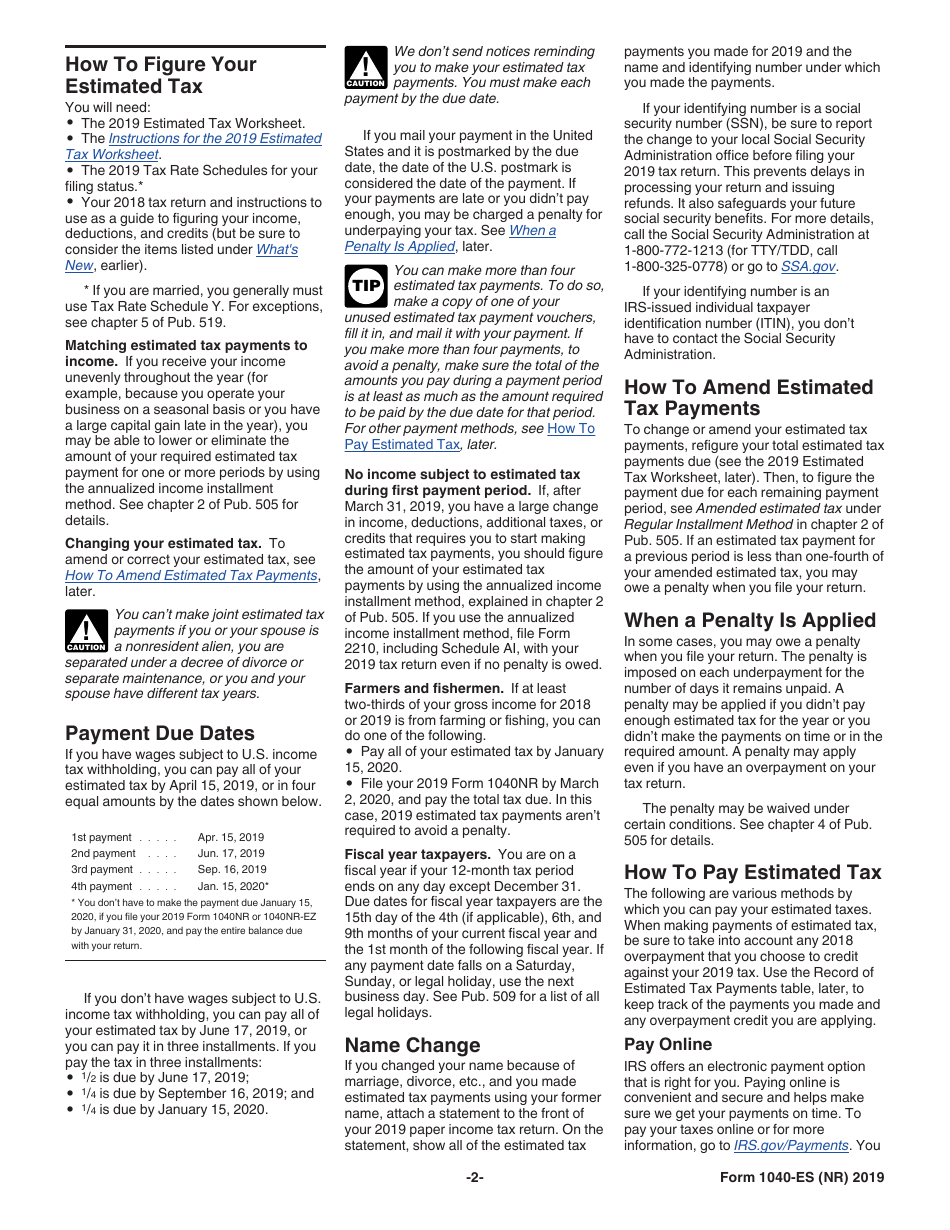

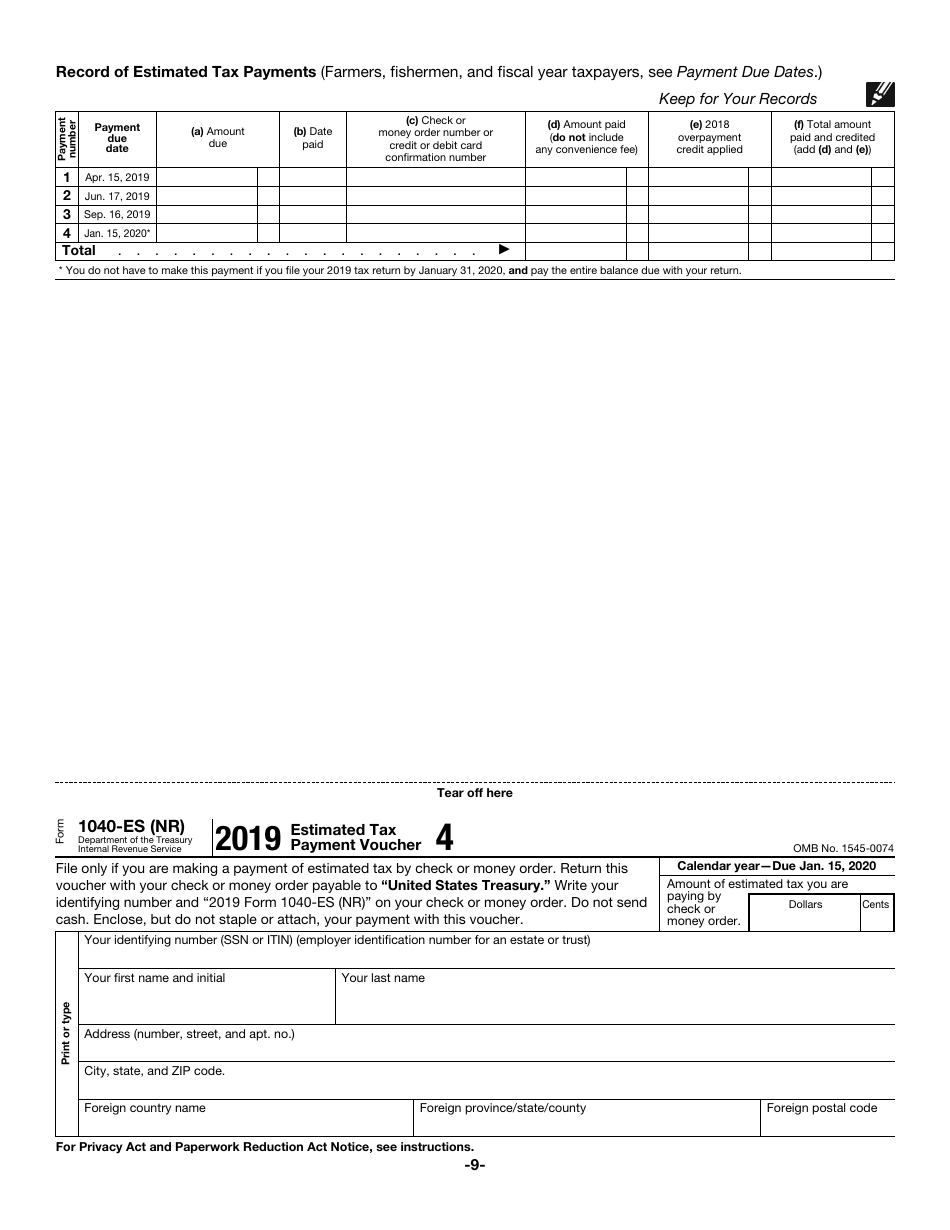

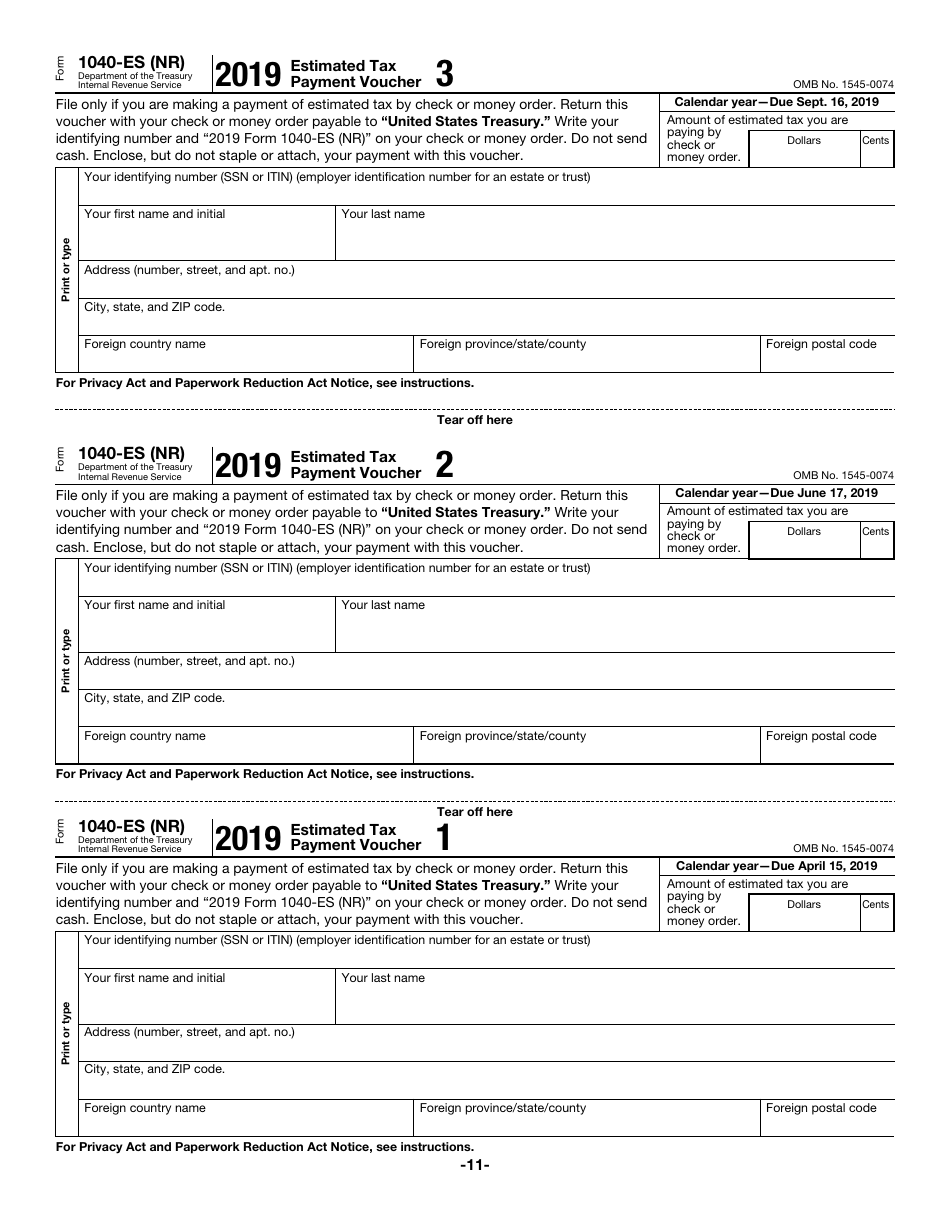

Complete Form 1040-ES (NR) instructions can be found on pages 1 through 5 of the form. Estimated tax for nonresident aliens must generally be paid in full by April 15, 2019, or in four equal amounts by the following dates:

- April 15, 2019;

- June 17, 2019;

- September 16, 2019;

- January 15, 2020.

The estimated tax can be paid via several different methods:

- Online with IRS Direct Pay or Electronic Fund Withdrawal through IRS.gov/Payments.

- By phone through the IRS2Go mobile application.

- With debit cards or credit cards.

- With cash. To pay with cash, individuals must first register at www.officialpayments.com.

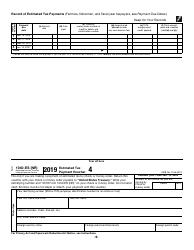

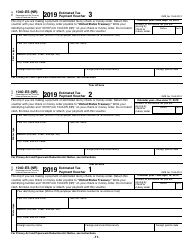

- Via check or money order with an estimated tax payment voucher provided within Form 1040-ES (NR).

Instructions for the estimated tax payment voucher are as follows:

- Print or type your name, address, and social security number (SSN) in the field provided on the estimated tax payment voucher. If you don't have or aren't eligible to get an SSN, enter your individual taxpayer identification number (ITIN) whenever SSN is requested.

- The completed form is due on Jan. 15, 2020 along with the check or money order. The check or money order must be marked with "2019 Form 1040-ES (NR)" and should feature your ITIN or SSN.

- After filling in the estimated tax payment voucher, you must send it to this billing address: Internal Revenue Service P.O. Box 1300 Charlotte, NC 28201-1300 U.S.A.

You cannot pay tax exceeding $100 million on nonresident alien individuals with a single check. In order, to pay taxes of $100 million or more with a check or money order, you need to spread the payment over two or more checks with each check carrying less than $100 million. Other taxpaying methods do not stipulate any payment amount limit and may be more suitable for paying amounts of $100 million or more.