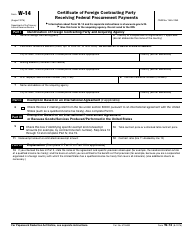

This version of the form is not currently in use and is provided for reference only. Download this version of

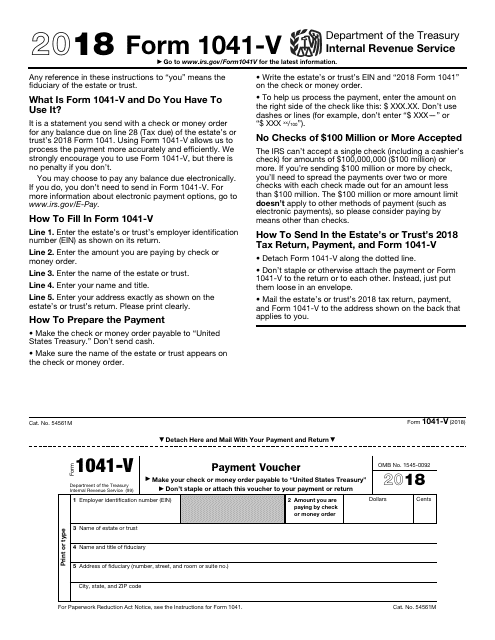

IRS Form 1041-V

for the current year.

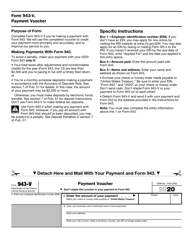

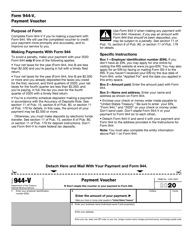

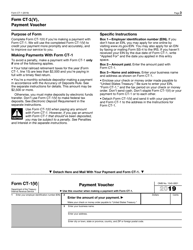

IRS Form 1041-V Payment Voucher

What Is IRS Form 1041-V?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1041-V?

A: IRS Form 1041-V is a payment voucher for estate or trust income tax returns.

Q: When is IRS Form 1041-V used?

A: IRS Form 1041-V is used when making a payment for an estate or trust income tax return.

Q: Do I need to file IRS Form 1041-V?

A: You only need to file IRS Form 1041-V if you are making a payment for an estate or trust income tax return.

Q: Is there a due date for IRS Form 1041-V?

A: The due date for IRS Form 1041-V varies depending on the tax year and filing deadline. It is usually included in the instructions for the estate or trust income tax return.

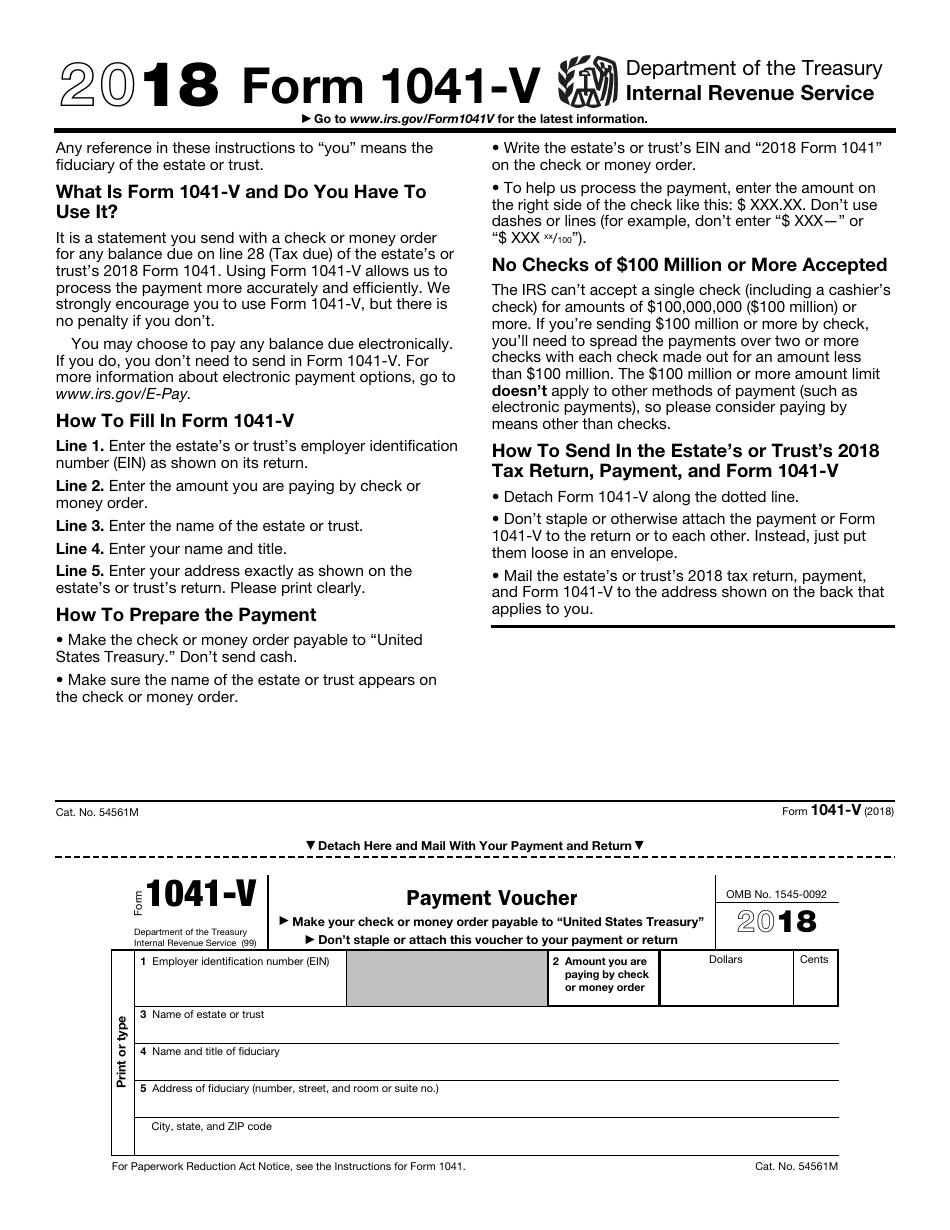

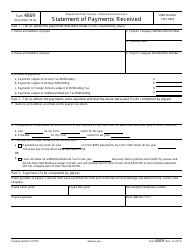

Q: What information is required on IRS Form 1041-V?

A: IRS Form 1041-V requires information such as the taxpayer's identification number, name, address, payment amount, and tax period.

Q: Can I use IRS Form 1041-V for other types of tax payments?

A: No, IRS Form 1041-V is specifically for estate or trust income tax payments. Other types of tax payments may require different forms.

Q: What should I do after submitting IRS Form 1041-V?

A: After submitting IRS Form 1041-V, make sure to keep a copy for your records and monitor the payment to ensure it is processed by the IRS.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1041-V through the link below or browse more documents in our library of IRS Forms.