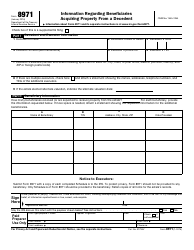

This version of the form is not currently in use and is provided for reference only. Download this version of

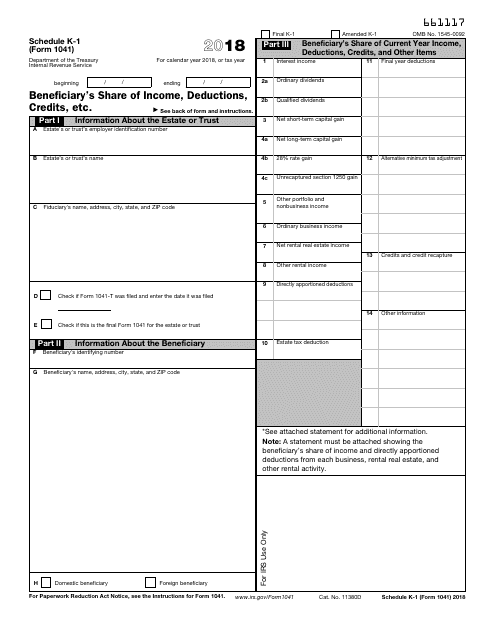

IRS Form 1041 Schedule K-1

for the current year.

IRS Form 1041 Schedule K-1 Beneficiary's Share of Income, Deductions, Credits, Etc.

What Is IRS Form 1041 Schedule K-1?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1041, U.S. Income Tax Return for Estates and Trusts. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1041 Schedule K-1?

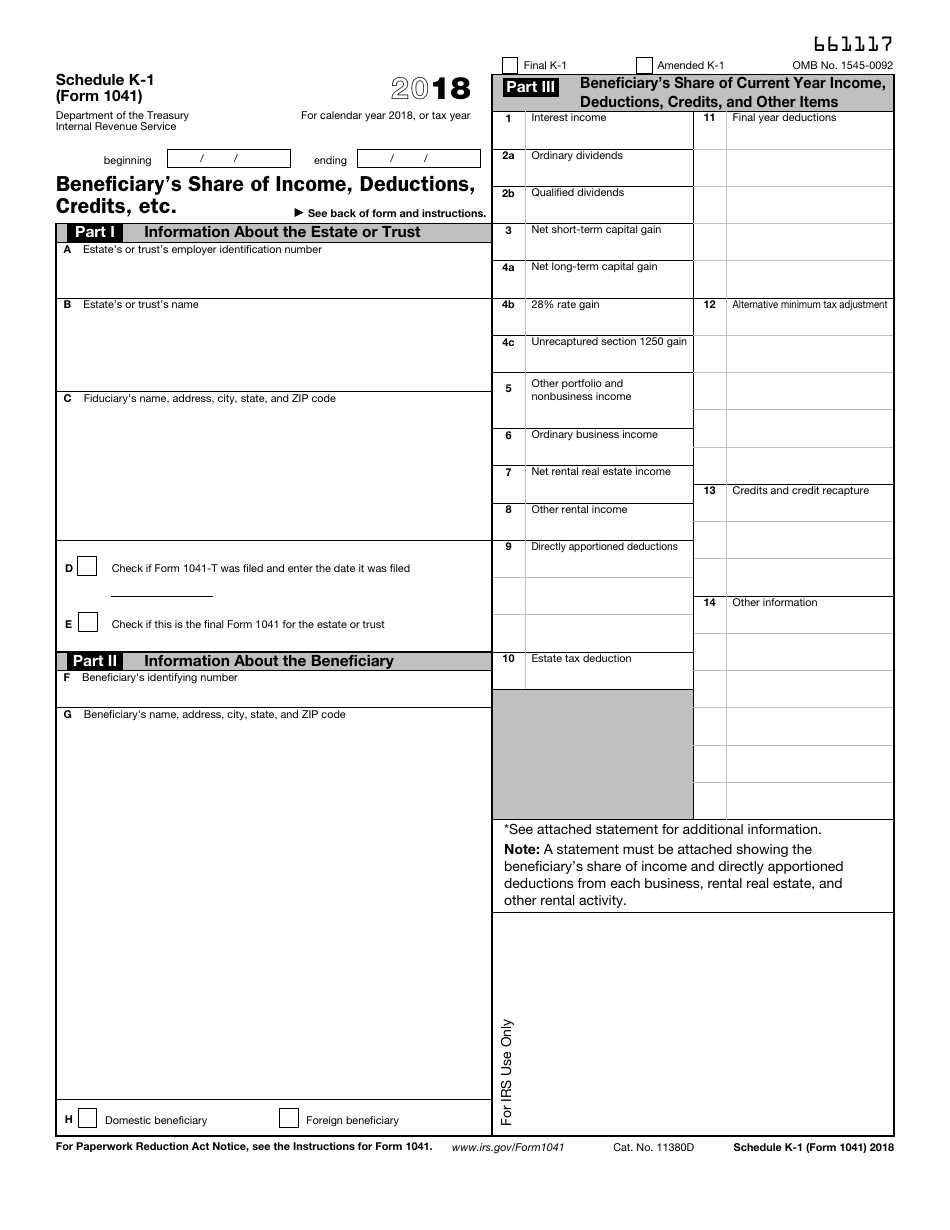

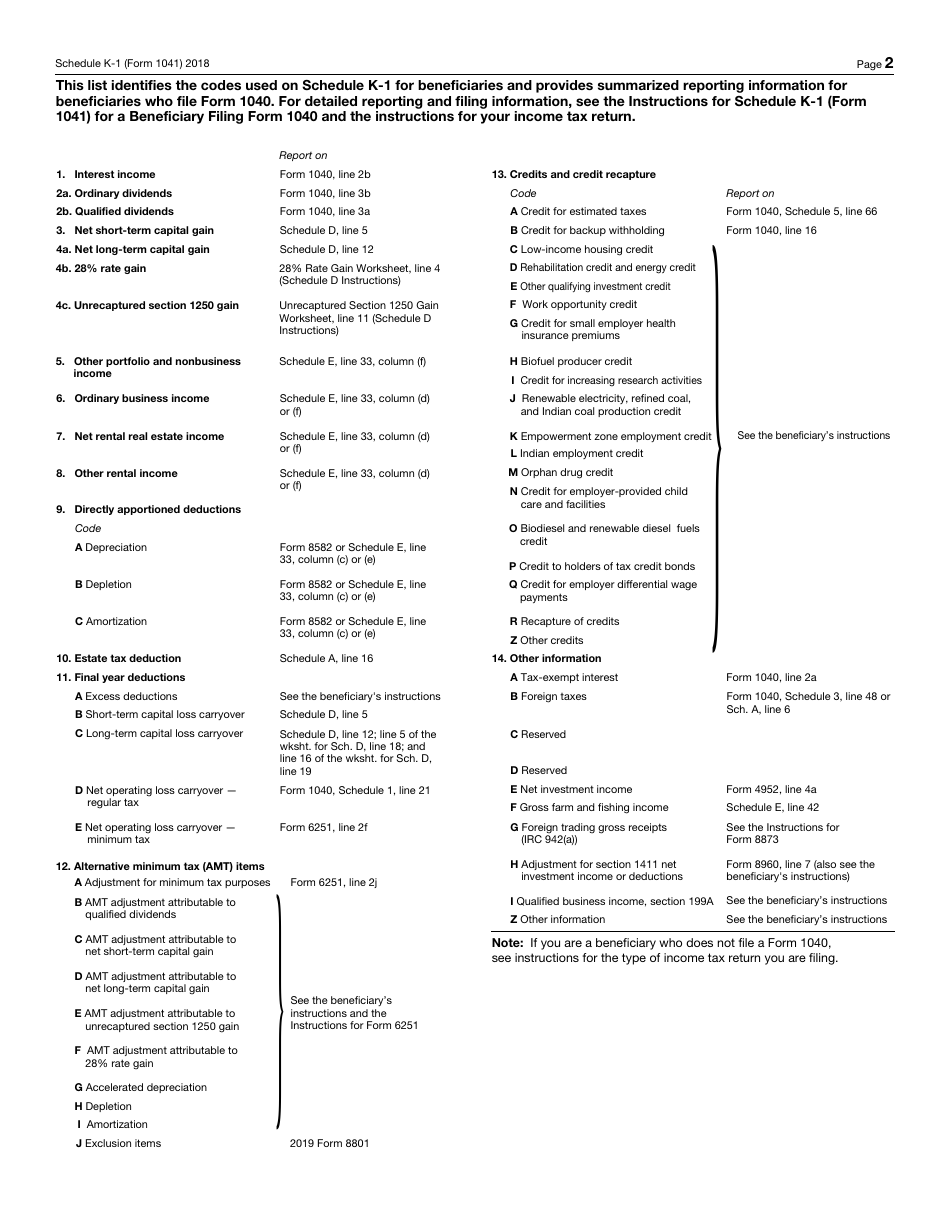

A: IRS Form 1041 Schedule K-1 is a tax form that reports a beneficiary's share of income, deductions, credits, etc. from a trust or estate.

Q: Who needs to file IRS Form 1041 Schedule K-1?

A: Beneficiaries of trusts or estates need to file IRS Form 1041 Schedule K-1 to report their share of income, deductions, credits, etc.

Q: What information is reported on IRS Form 1041 Schedule K-1?

A: IRS Form 1041 Schedule K-1 reports a beneficiary's share of income, deductions, credits, etc. It includes information such as interest, dividends, capital gains, and deductions.

Q: When is the deadline to file IRS Form 1041 Schedule K-1?

A: The deadline to file IRS Form 1041 Schedule K-1 is typically April 15th, or the 15th day of the 4th month following the end of the trust or estate's tax year.

Q: What happens if I don't file IRS Form 1041 Schedule K-1?

A: If you don't file IRS Form 1041 Schedule K-1, you may face penalties and interest charges from the IRS.

Q: Do I need to attach IRS Form 1041 Schedule K-1 to my tax return?

A: No, you do not need to attach IRS Form 1041 Schedule K-1 to your personal tax return. However, you should keep a copy for your records.

Q: Can I e-file IRS Form 1041 Schedule K-1?

A: No, IRS Form 1041 Schedule K-1 cannot be e-filed. It must be filed by mail or hand-delivered to the IRS.

Q: Do I need to pay taxes on income reported on IRS Form 1041 Schedule K-1?

A: In general, you may need to pay taxes on the income reported on IRS Form 1041 Schedule K-1. Consult a tax professional for guidance based on your specific situation.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1041 Schedule K-1 through the link below or browse more documents in our library of IRS Forms.