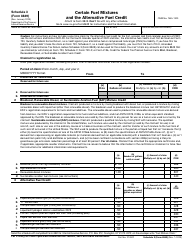

This version of the form is not currently in use and is provided for reference only. Download this version of

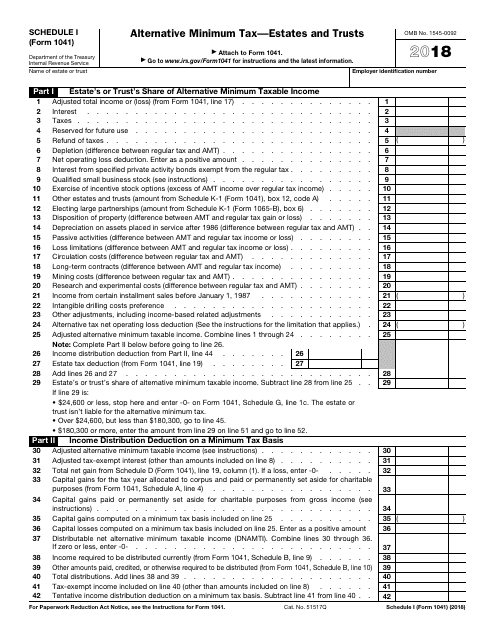

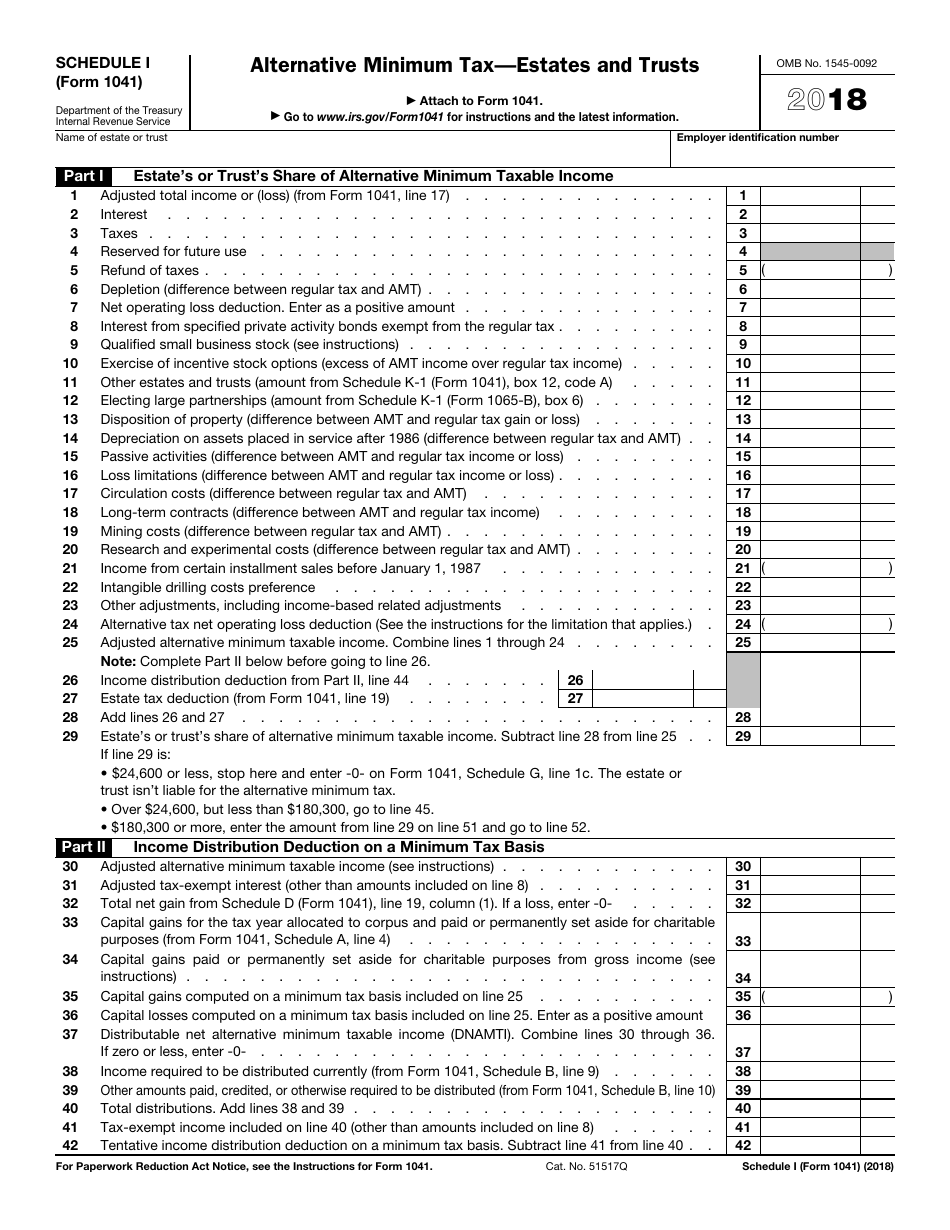

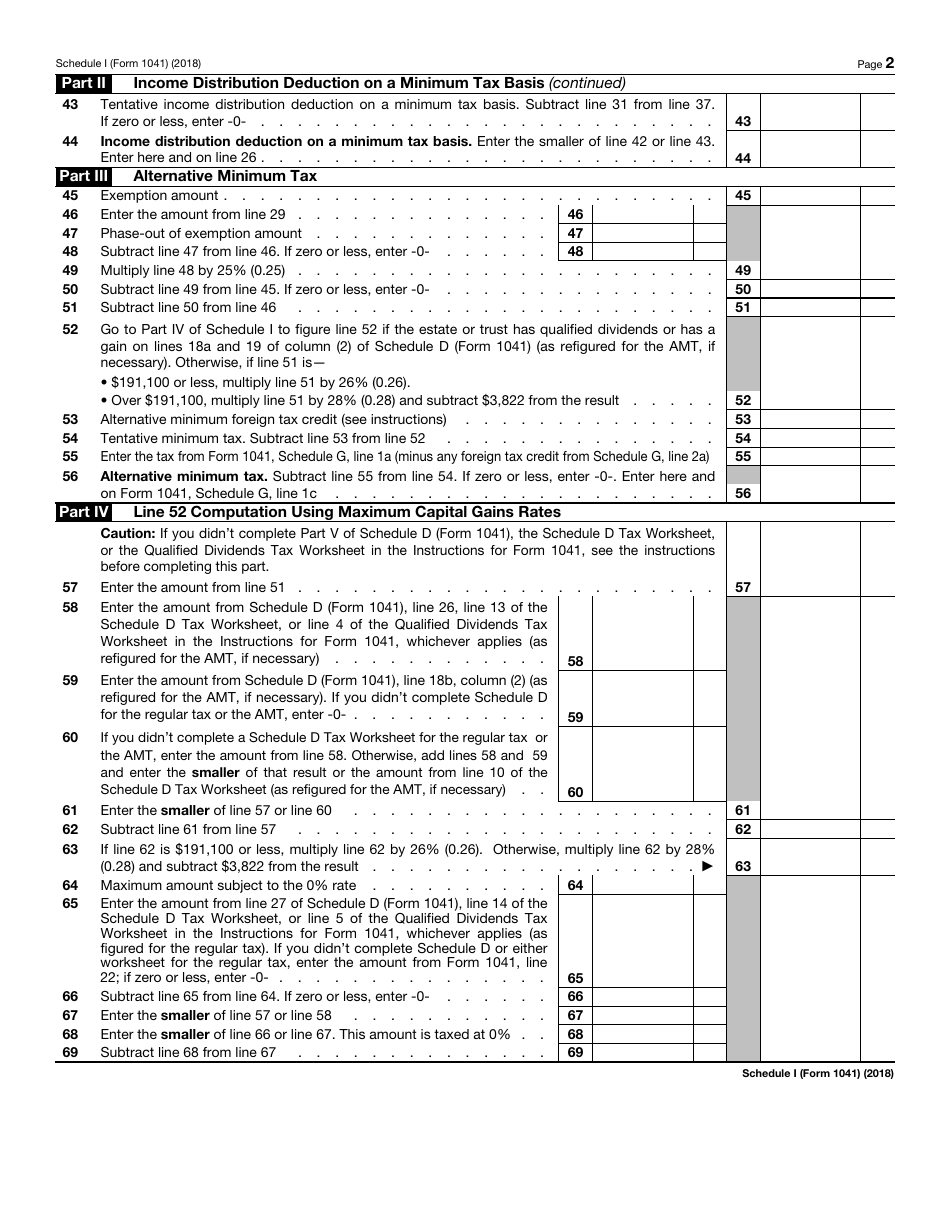

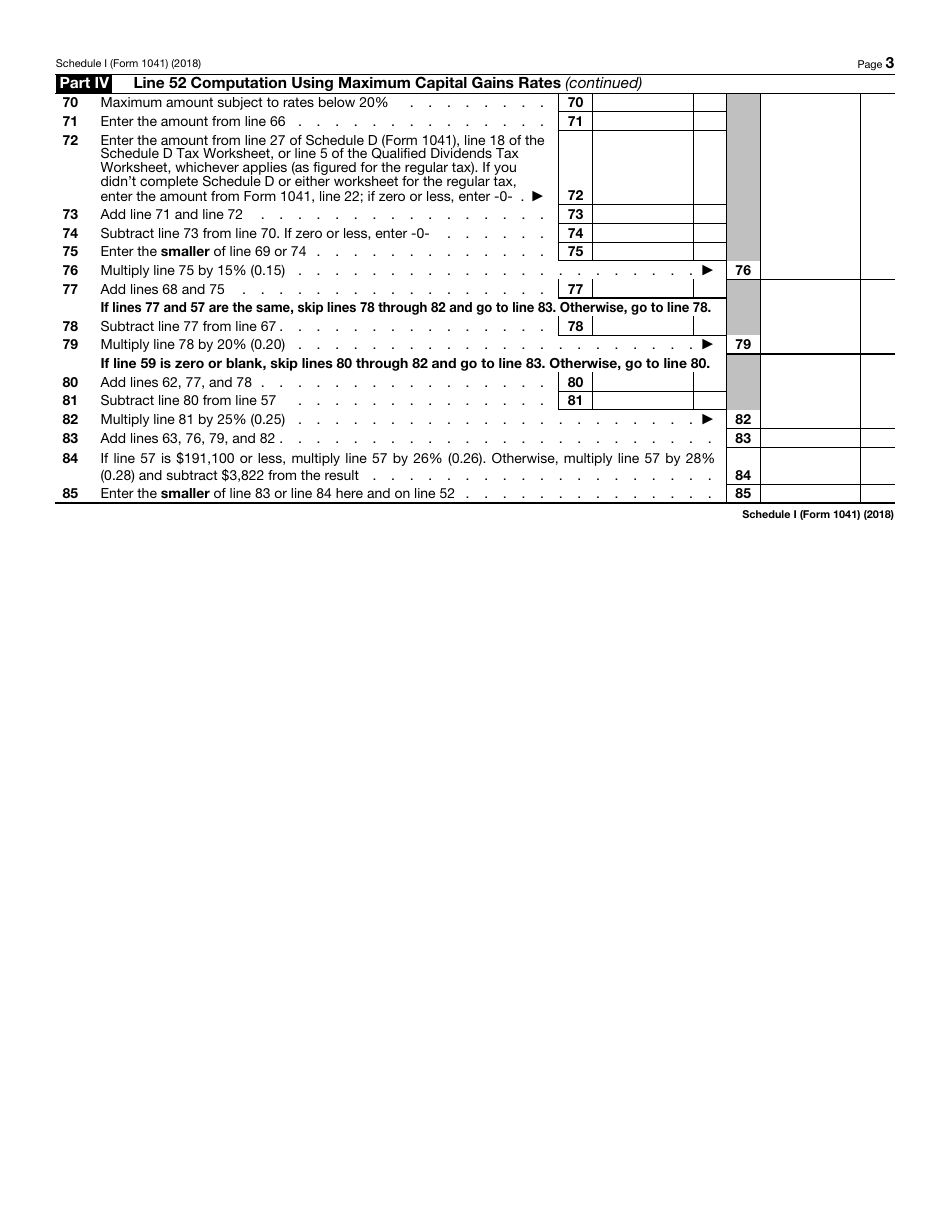

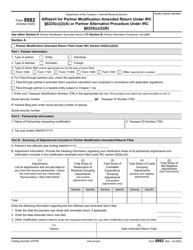

IRS Form 1041 Schedule I

for the current year.

IRS Form 1041 Schedule I Alternative Minimum Tax - Estates and Trusts

What Is IRS Form 1041 Schedule I?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1041, U.S. Income Tax Return for Estates and Trusts. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1041 Schedule I?

A: IRS Form 1041 Schedule I is a form used for calculating the Alternative Minimum Tax (AMT) for estates and trusts.

Q: What is the Alternative Minimum Tax (AMT)?

A: The Alternative Minimum Tax (AMT) is an additional tax calculation designed to ensure that high-income taxpayers pay a minimum amount of tax.

Q: Who needs to file IRS Form 1041 Schedule I?

A: Estates and trusts that meet specific criteria need to file IRS Form 1041 Schedule I to determine if they owe any Alternative Minimum Tax (AMT).

Q: What information does IRS Form 1041 Schedule I require?

A: IRS Form 1041 Schedule I requires information about the estate or trust's income, deductions, credits, and adjustments to calculate the Alternative Minimum Tax (AMT).

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1041 Schedule I through the link below or browse more documents in our library of IRS Forms.