This version of the form is not currently in use and is provided for reference only. Download this version of

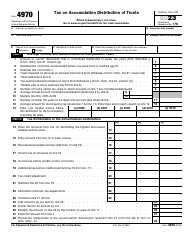

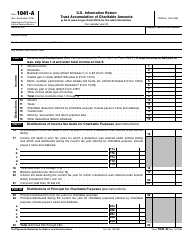

IRS Form 1041 Schedule J

for the current year.

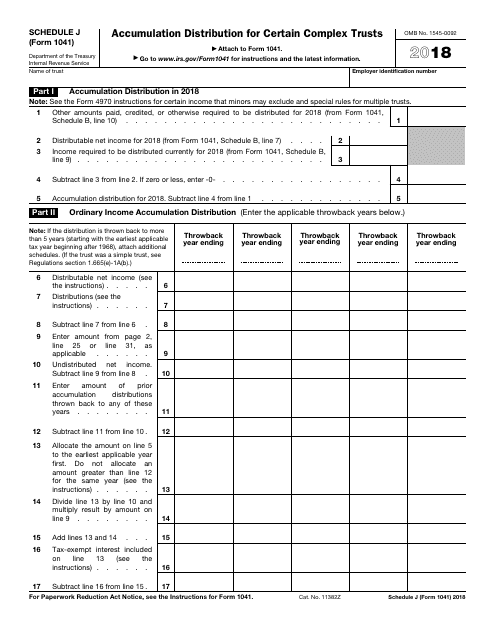

IRS Form 1041 Schedule J Accumulation Distribution for Certain Complex Trusts

What Is IRS Form 1041 Schedule J?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1041, U.S. Income Tax Return for Estates and Trusts. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1041 Schedule J?

A: IRS Form 1041 Schedule J is a form used to report the accumulation distribution for certain complex trusts.

Q: Who needs to file IRS Form 1041 Schedule J?

A: Complex trusts that have accumulated income and distributed it to beneficiaries need to file IRS Form 1041 Schedule J.

Q: What is an accumulation distribution?

A: An accumulation distribution refers to the income that a complex trust has accumulated over the years and distributed to its beneficiaries.

Q: What information is required on IRS Form 1041 Schedule J?

A: IRS Form 1041 Schedule J requires information about the trust, the beneficiaries, and the amounts distributed.

Q: When is the deadline to file IRS Form 1041 Schedule J?

A: The deadline to file IRS Form 1041 Schedule J is the same as the deadline for filing the trust's annual income tax return, which is normally April 15th.

Q: Are there any penalties for failing to file IRS Form 1041 Schedule J?

A: Yes, there may be penalties for failing to file IRS Form 1041 Schedule J, so it is important to ensure timely and accurate filing.

Q: Can I e-file IRS Form 1041 Schedule J?

A: Yes, e-filing IRS Form 1041 Schedule J is an option, but it is important to check with the IRS for specific instructions and requirements on e-filing.

Q: Can I file IRS Form 1041 Schedule J separately from Form 1041?

A: No, IRS Form 1041 Schedule J is a schedule that must be filed as part of IRS Form 1041, which is the annual income tax return for trusts and estates.

Q: Are there any income thresholds for filing IRS Form 1041 Schedule J?

A: There are no specific income thresholds for filing IRS Form 1041 Schedule J, but it is required for complex trusts with accumulated income distributed to beneficiaries.

Form Details:

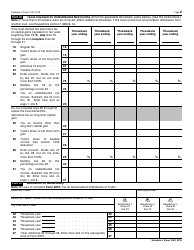

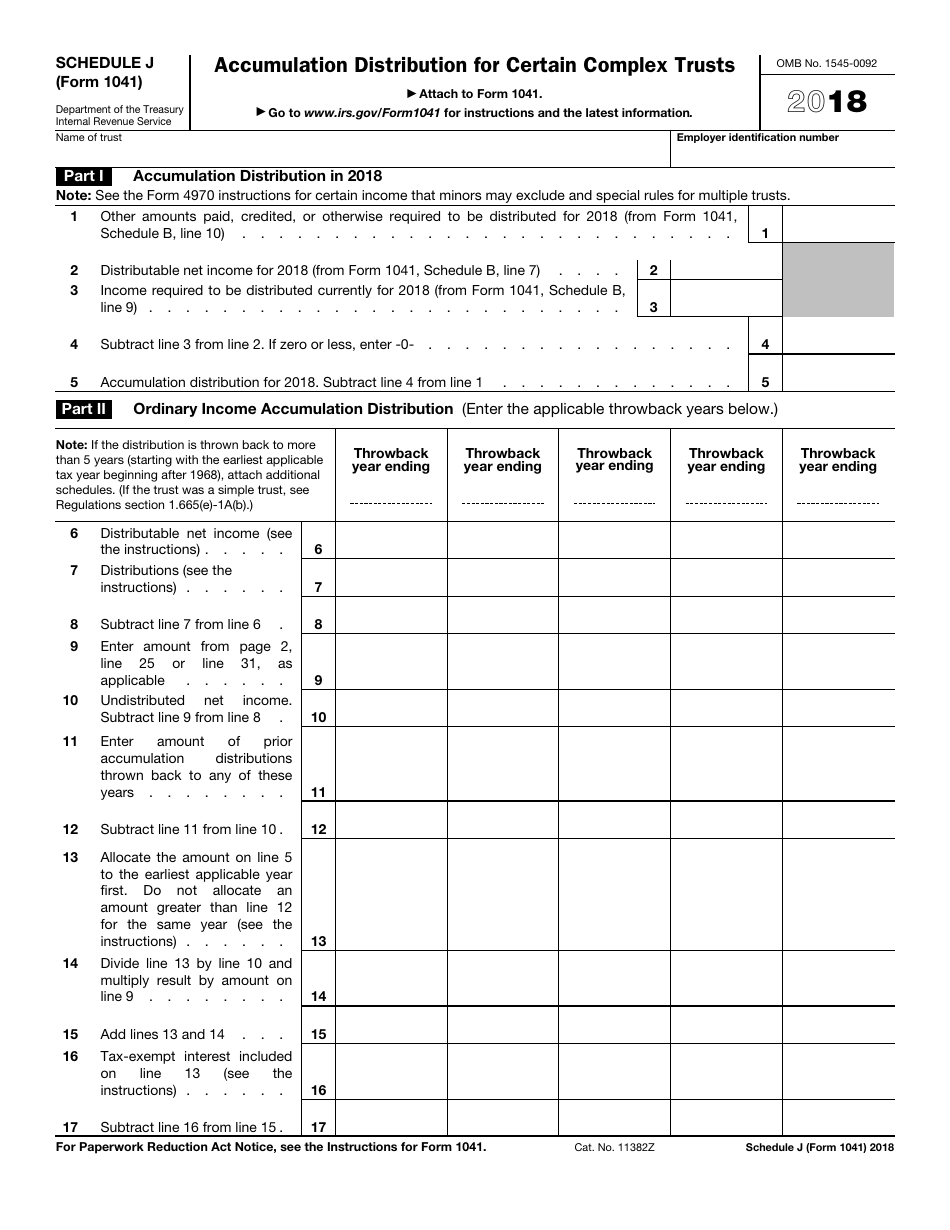

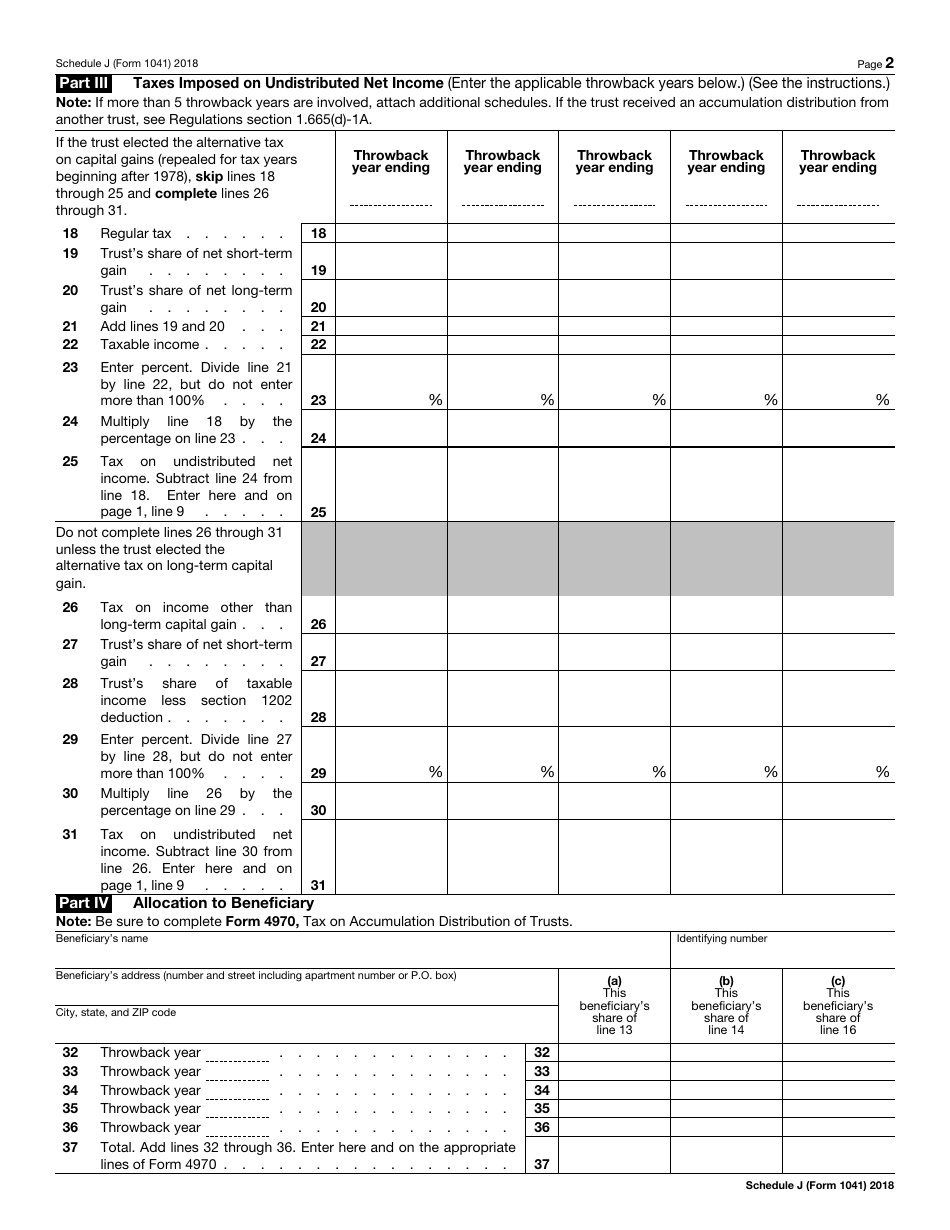

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1041 Schedule J through the link below or browse more documents in our library of IRS Forms.