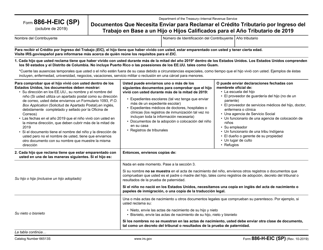

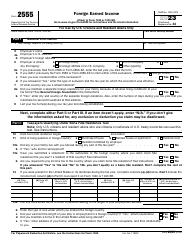

This version of the form is not currently in use and is provided for reference only. Download this version of

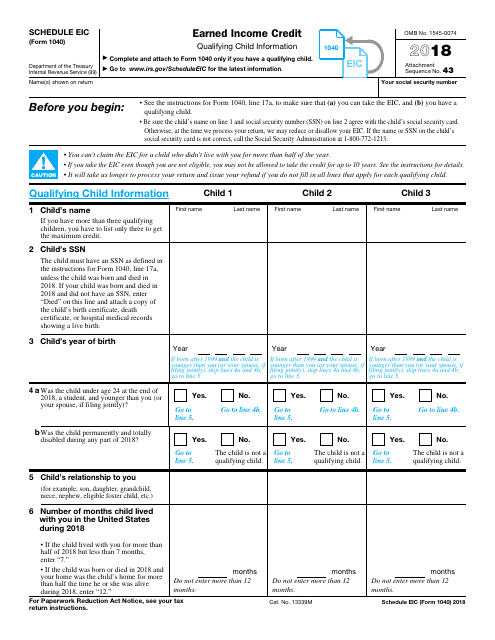

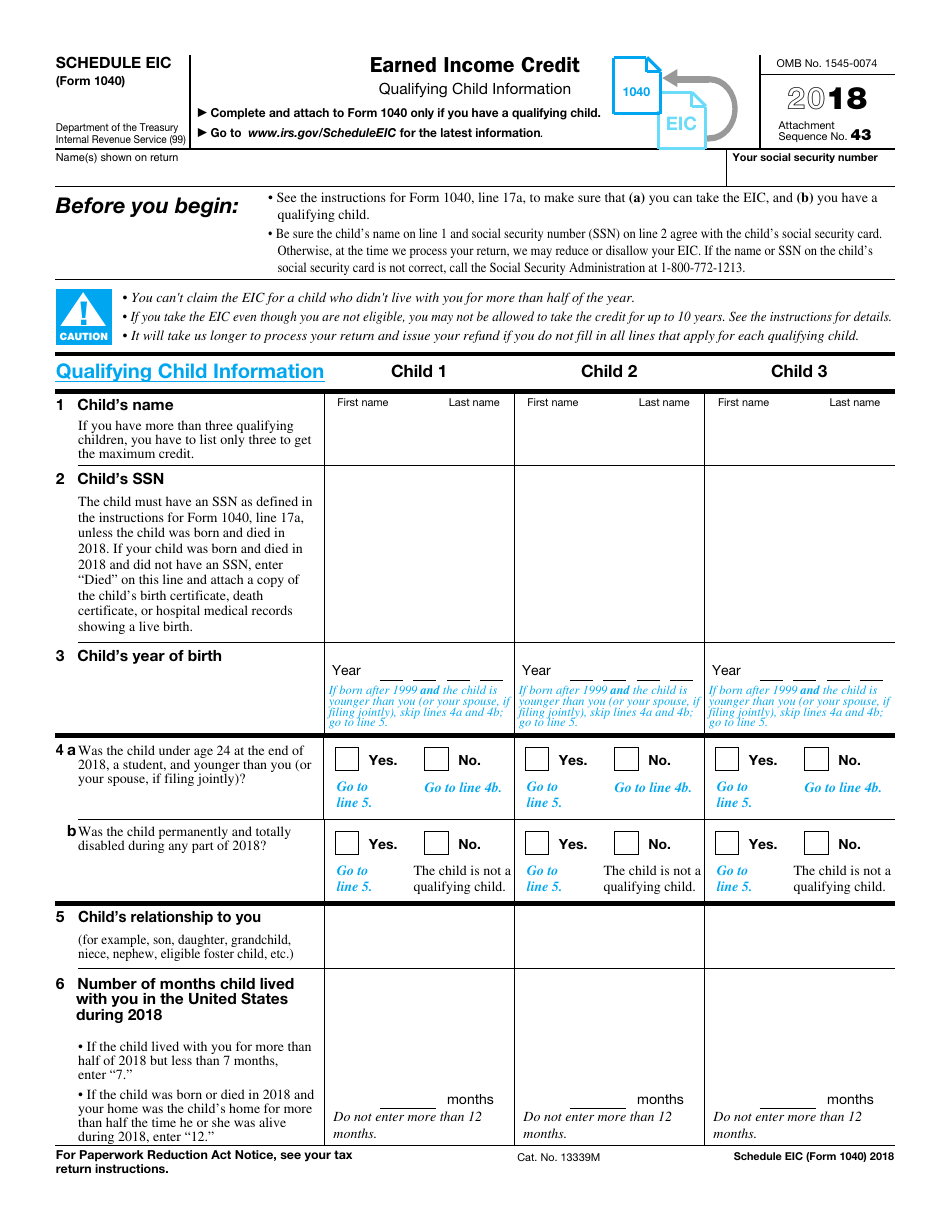

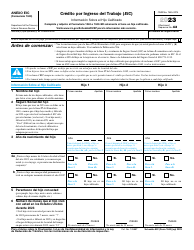

IRS Form 1040 Schedule EIC

for the current year.

IRS Form 1040 Schedule EIC Earned Income Credit

What Is IRS Form 1040 Schedule EIC?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040 Schedule EIC?

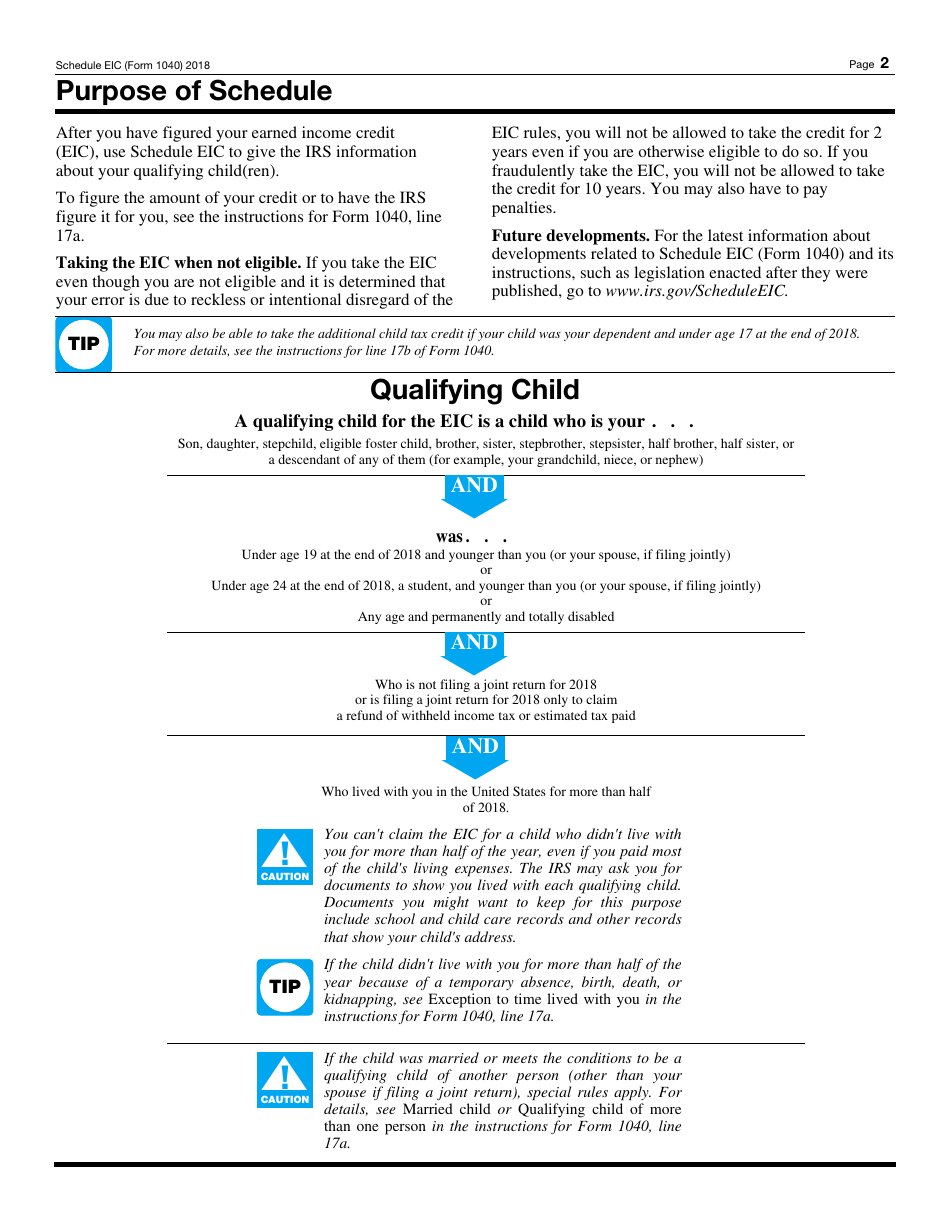

A: IRS Form 1040 Schedule EIC is a form used to claim the Earned Income Credit (EIC).

Q: What is the Earned Income Credit?

A: The Earned Income Credit is a tax credit available to low-income individuals and families. It can help reduce the amount of tax they owe and may result in a refund.

Q: Who is eligible for the Earned Income Credit?

A: Eligibility for the Earned Income Credit is based on income and family size. Generally, individuals or families with low to moderate income may qualify.

Q: How do I claim the Earned Income Credit?

A: To claim the Earned Income Credit, you need to file IRS Form 1040 Schedule EIC and meet the eligibility requirements. The credit is then applied to your tax liability.

Q: Can I e-file IRS Form 1040 Schedule EIC?

A: Yes, you can e-file IRS Form 1040 Schedule EIC along with your tax return. Many tax preparation software also supports e-filing this form.

Q: What documents do I need to claim the Earned Income Credit?

A: You may need documents such as W-2 forms, 1099 forms, and records of self-employment income to claim the Earned Income Credit. It is important to keep accurate records.

Q: How much is the Earned Income Credit?

A: The amount of the Earned Income Credit varies depending on income, family size, and filing status. It can range from a few hundred dollars to several thousand dollars.

Q: Is the Earned Income Credit refundable?

A: Yes, the Earned Income Credit is a refundable tax credit. This means that if the credit exceeds your tax liability, you may receive the excess amount as a refund.

Q: Are there any other tax credits I can claim in addition to the Earned Income Credit?

A: Yes, there are several other tax credits you may be eligible for, such as the Child Tax Credit, the Child and Dependent Care Credit, and the American Opportunity Credit.

Q: Can I get help with filing my taxes and claiming the Earned Income Credit?

A: Yes, there are free tax preparation programs and resources available to help individuals and families with low to moderate income.

Q: Is the Earned Income Credit only available to US citizens?

A: No, the Earned Income Credit is also available to certain resident aliens. However, there are specific eligibility requirements for non-citizens.

Q: Can I claim the Earned Income Credit if I am self-employed?

A: Yes, self-employed individuals may be eligible for the Earned Income Credit. However, they need to meet the income and other requirements.

Q: What happens if I make a mistake on IRS Form 1040 Schedule EIC?

A: If you make a mistake on IRS Form 1040 Schedule EIC, you may need to file an amended tax return using Form 1040X to correct the error.

Q: When is the deadline for filing IRS Form 1040 Schedule EIC?

A: The deadline for filing IRS Form 1040 Schedule EIC is generally the same as the deadline for filing your federal income tax return, which is usually April 15th.

Q: Can I still claim the Earned Income Credit if I didn't work for the entire year?

A: Yes, you may still be eligible for the Earned Income Credit if you meet the income and other requirements, even if you didn't work for the entire year.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule EIC through the link below or browse more documents in our library of IRS Forms.