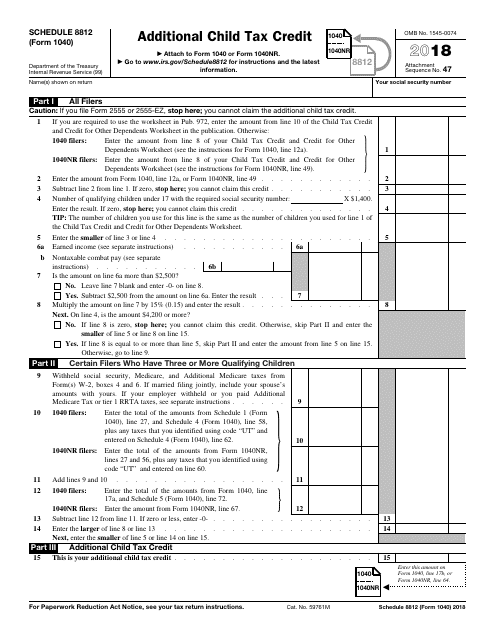

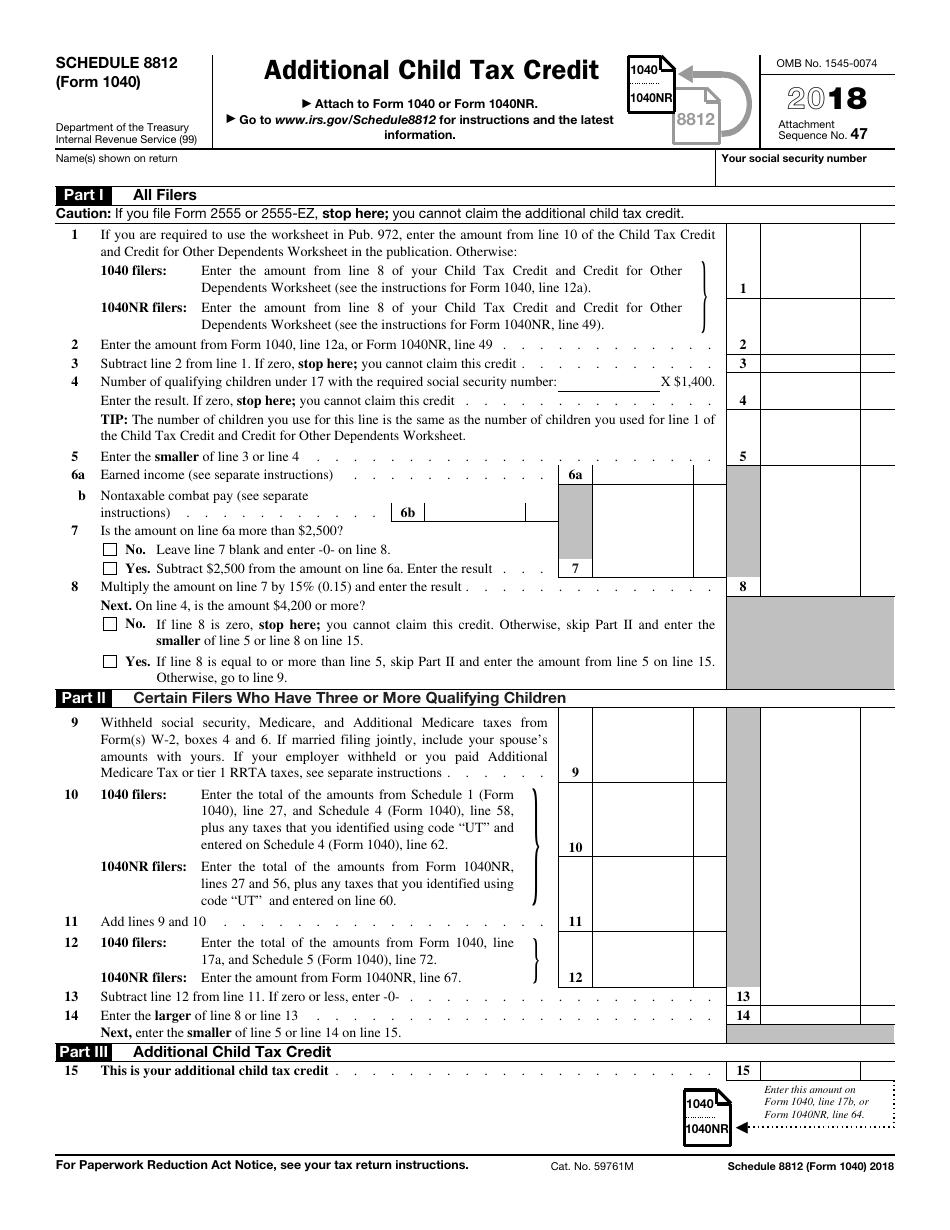

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040 Schedule 8812

for the current year.

IRS Form 1040 Schedule 8812 Additional Child Tax Credit

What Is IRS Form 1040 Schedule 8812?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040 Schedule 8812?

A: IRS Form 1040 Schedule 8812 is a form used to calculate and claim the Additional Child Tax Credit.

Q: Who is eligible for the Additional Child Tax Credit?

A: Families with qualifying children may be eligible for the Additional Child Tax Credit.

Q: What is the purpose of the Additional Child Tax Credit?

A: The Additional Child Tax Credit provides additional tax relief for families with qualifying children.

Q: How do I calculate the Additional Child Tax Credit?

A: You can calculate the Additional Child Tax Credit by completing IRS Form 1040 Schedule 8812.

Q: How do I claim the Additional Child Tax Credit?

A: To claim the Additional Child Tax Credit, you must file IRS Form 1040 Schedule 8812 along with your annual tax return.

Q: What documents do I need to claim the Additional Child Tax Credit?

A: You will need to provide basic information about your qualifying children, such as their names, Social Security numbers, and relationship to you.

Q: Is the Additional Child Tax Credit refundable?

A: Yes, the Additional Child Tax Credit is refundable, meaning that even if you don't owe any taxes, you may still receive a refund.

Q: Are there any income limits to qualify for the Additional Child Tax Credit?

A: Yes, there are income limits to qualify for the Additional Child Tax Credit. The credit begins to phase out for taxpayers with incomes above certain thresholds.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule 8812 through the link below or browse more documents in our library of IRS Forms.