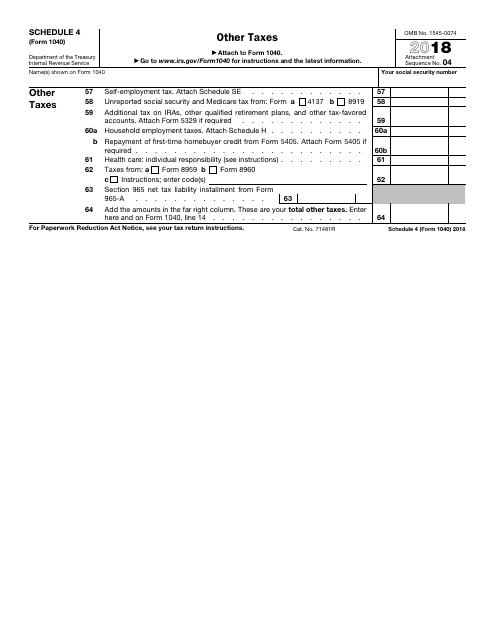

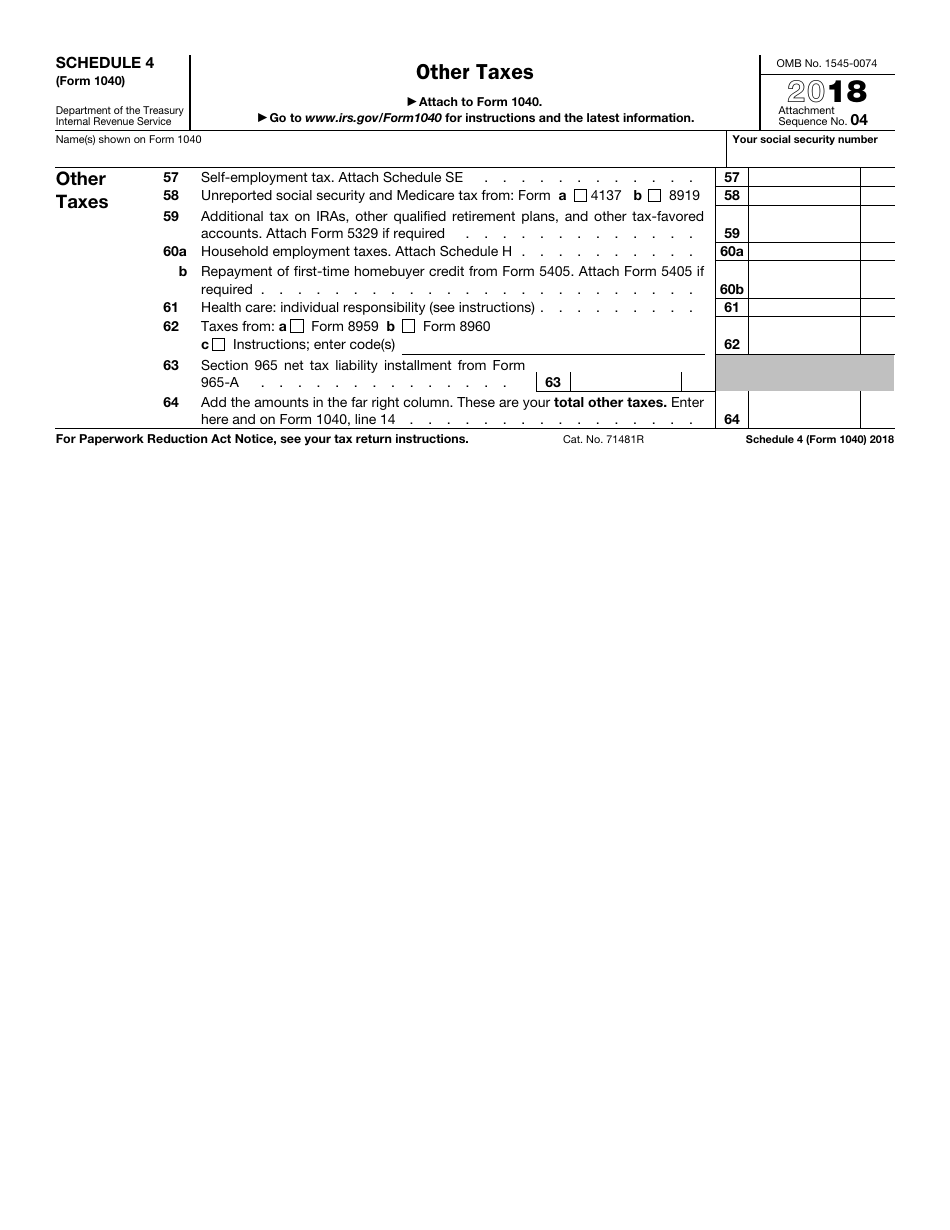

IRS Form 1040 Schedule 4 Other Taxes

What Is IRS Form 1040 Schedule 4?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040 Schedule 4?

A: IRS Form 1040 Schedule 4 is a supplementary form used to report other taxes that may not be included on the main 1040 form.

Q: What types of taxes can be reported on Schedule 4?

A: Schedule 4 allows you to report taxes such as self-employment tax, additional taxes on IRAs or other retirement accounts, household employment taxes, and certain fuel taxes.

Q: When do I need to use Schedule 4?

A: You need to use Schedule 4 if you have any taxes that are not reported on the main 1040 form.

Q: Do I need to include Schedule 4 with my tax return?

A: You only need to include Schedule 4 with your tax return if you have other taxes to report that are not included on the main 1040 form.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule 4 through the link below or browse more documents in our library of IRS Forms.