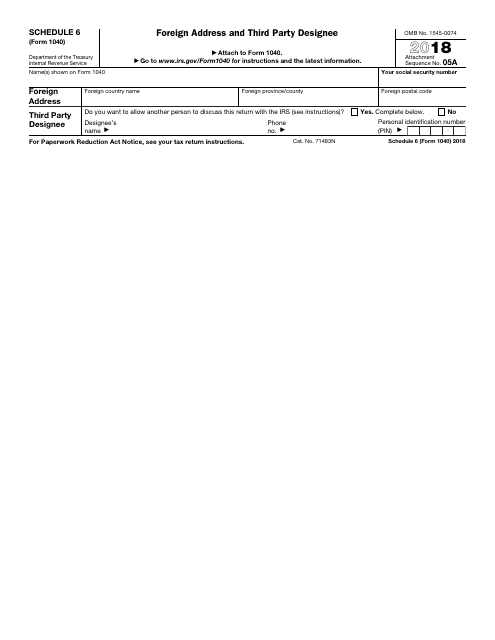

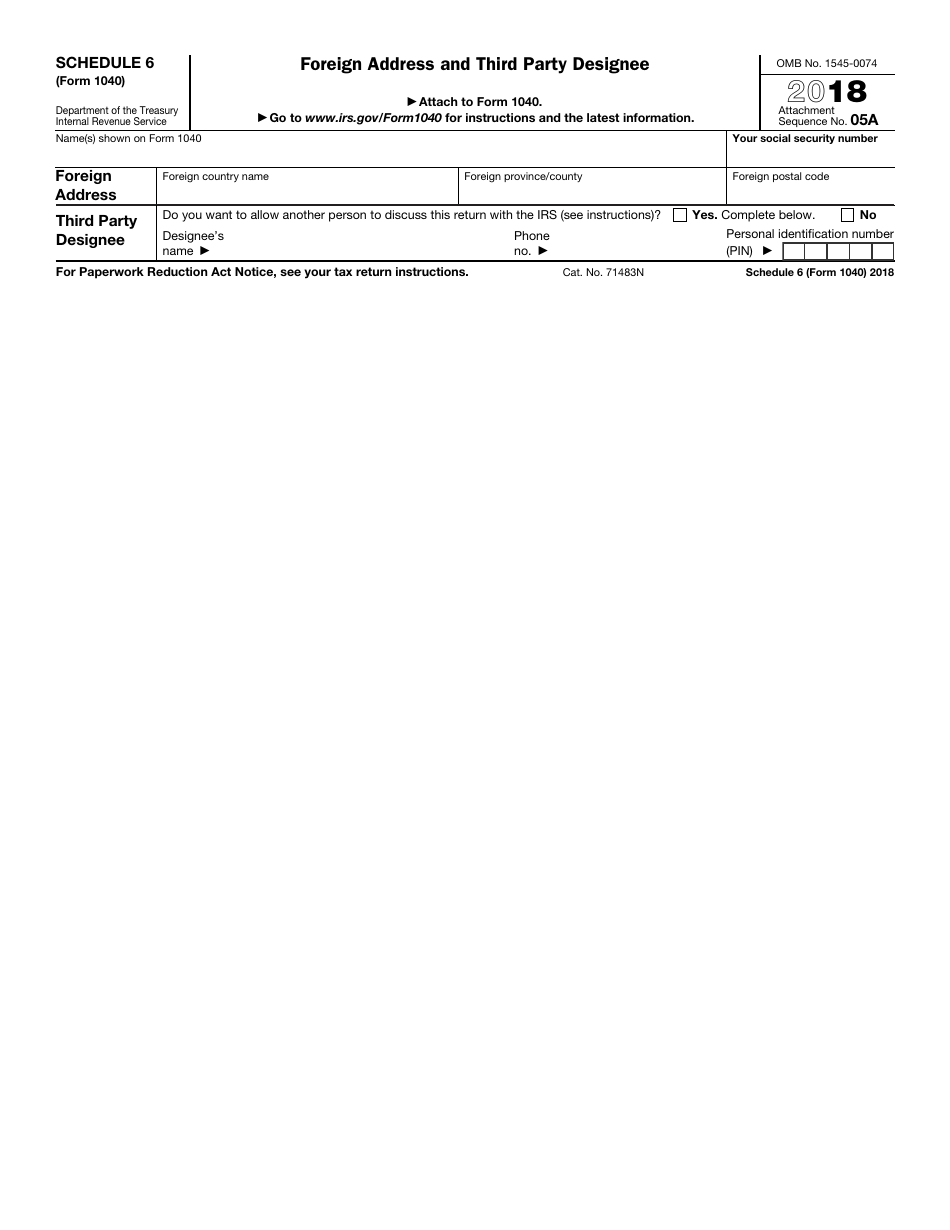

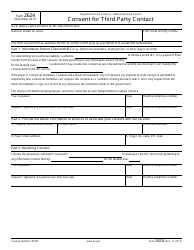

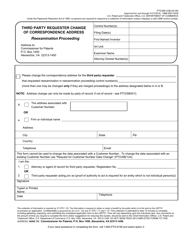

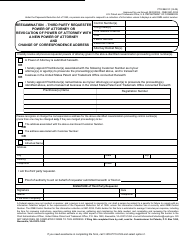

IRS Form 1040 Schedule 6 Foreign Address and Third Party Designee

What Is IRS Form 1040 Schedule 6?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040 Schedule 6?

A: IRS Form 1040 Schedule 6 is a supplemental form that is used to report a foreign address and designate a third party to discuss your tax return with the IRS.

Q: When do I need to use IRS Form 1040 Schedule 6?

A: You need to use IRS Form 1040 Schedule 6 if you have a foreign address and want to designate a third party to discuss your tax return with the IRS.

Q: What information do I need to provide on IRS Form 1040 Schedule 6?

A: You need to provide your foreign address information and the information of the third party you wish to designate on IRS Form 1040 Schedule 6.

Q: Do I need to file IRS Form 1040 Schedule 6 if I don't have a foreign address?

A: No, you only need to file IRS Form 1040 Schedule 6 if you have a foreign address and want to designate a third party to discuss your tax return with the IRS.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule 6 through the link below or browse more documents in our library of IRS Forms.