This version of the form is not currently in use and is provided for reference only. Download this version of

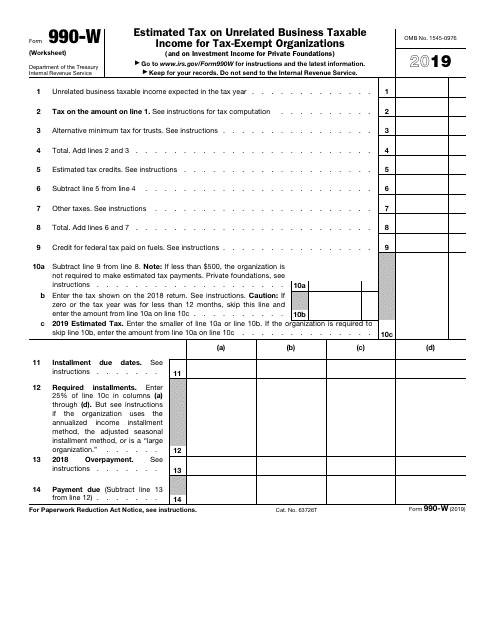

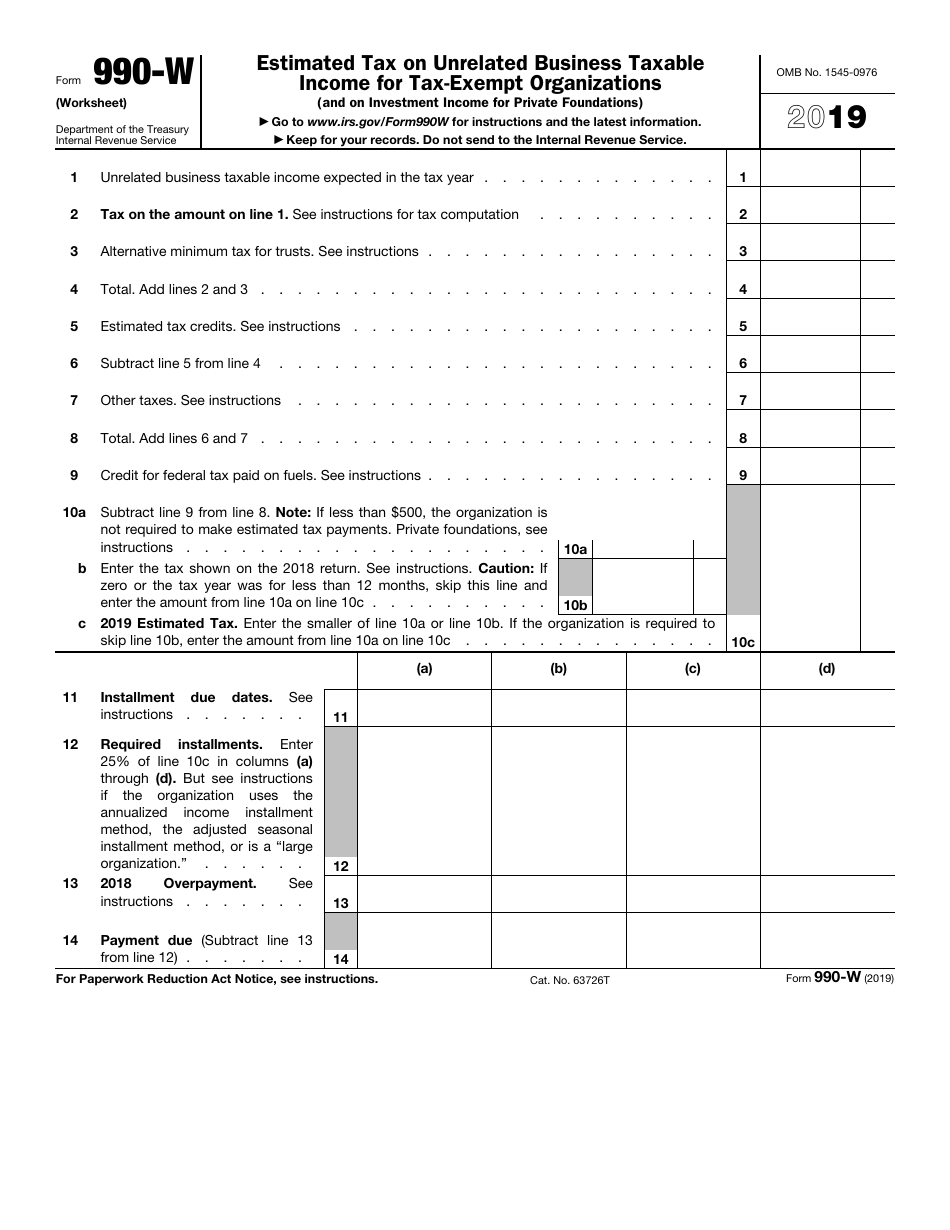

IRS Form 990-W

for the current year.

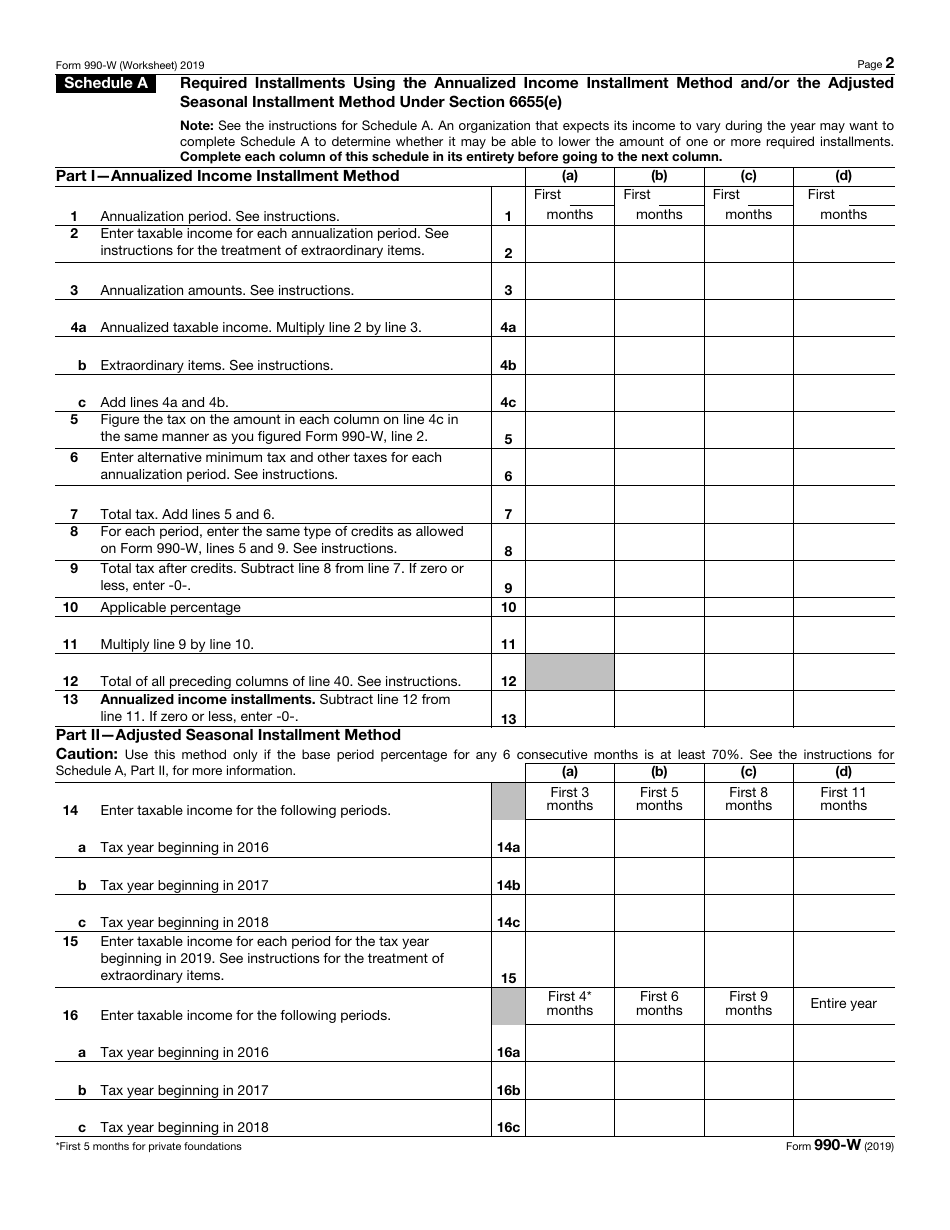

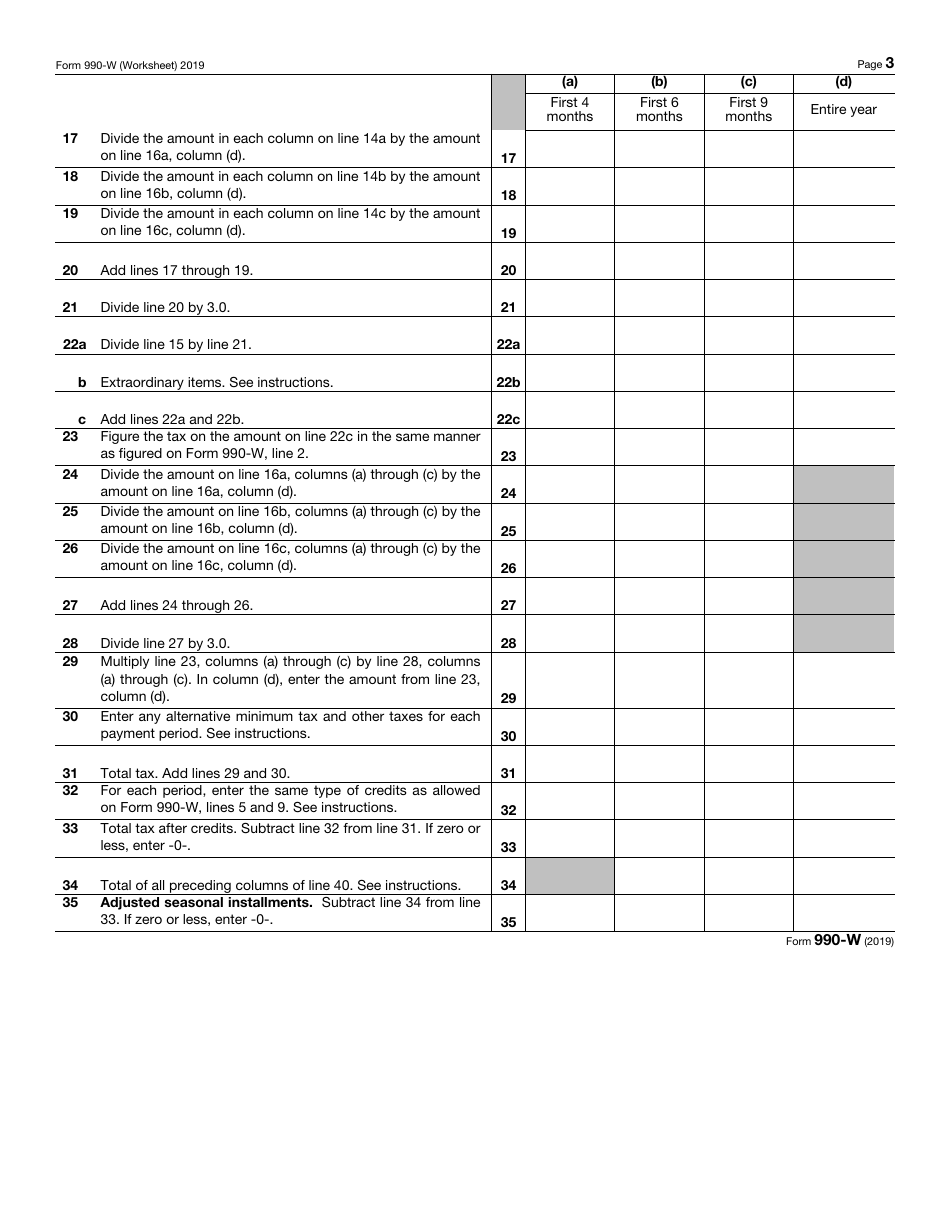

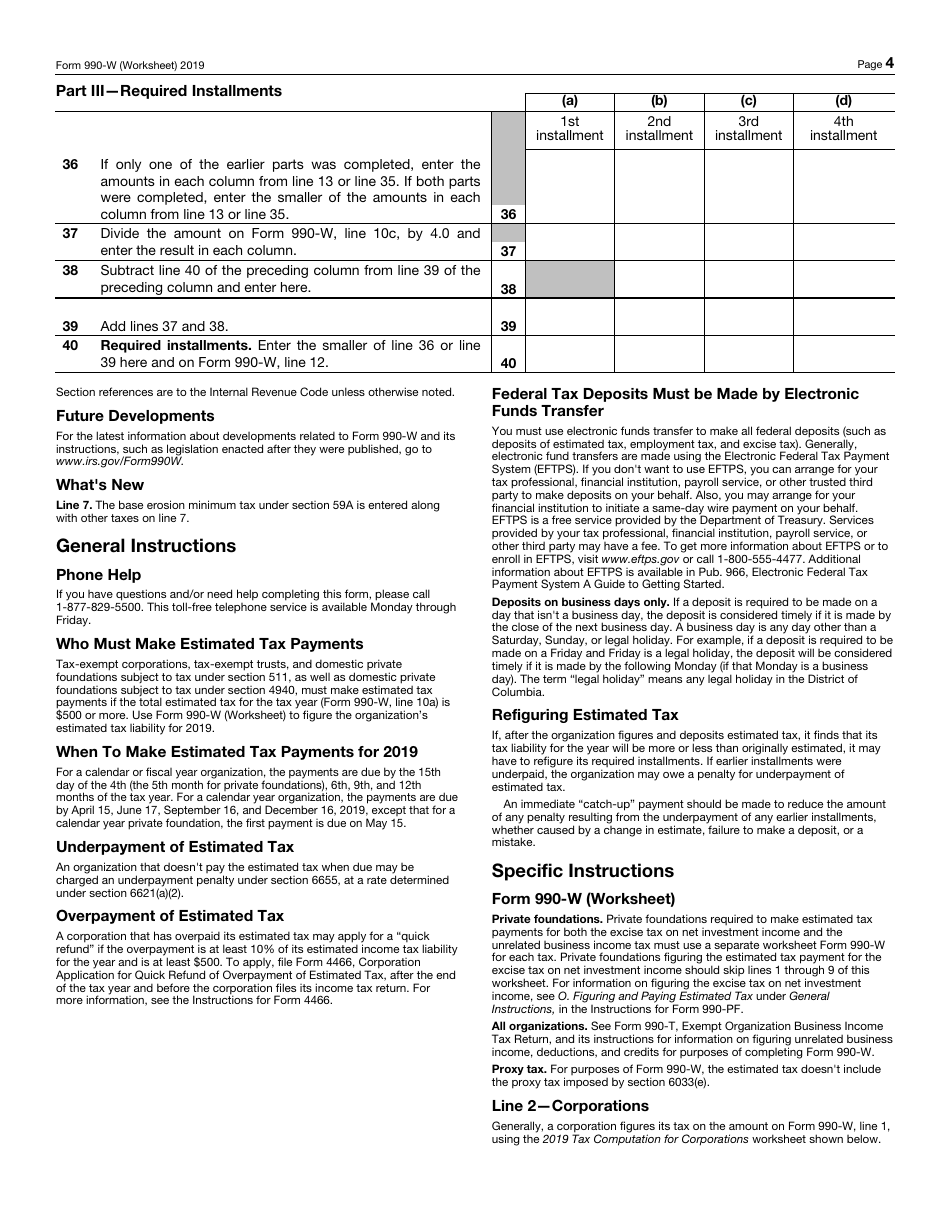

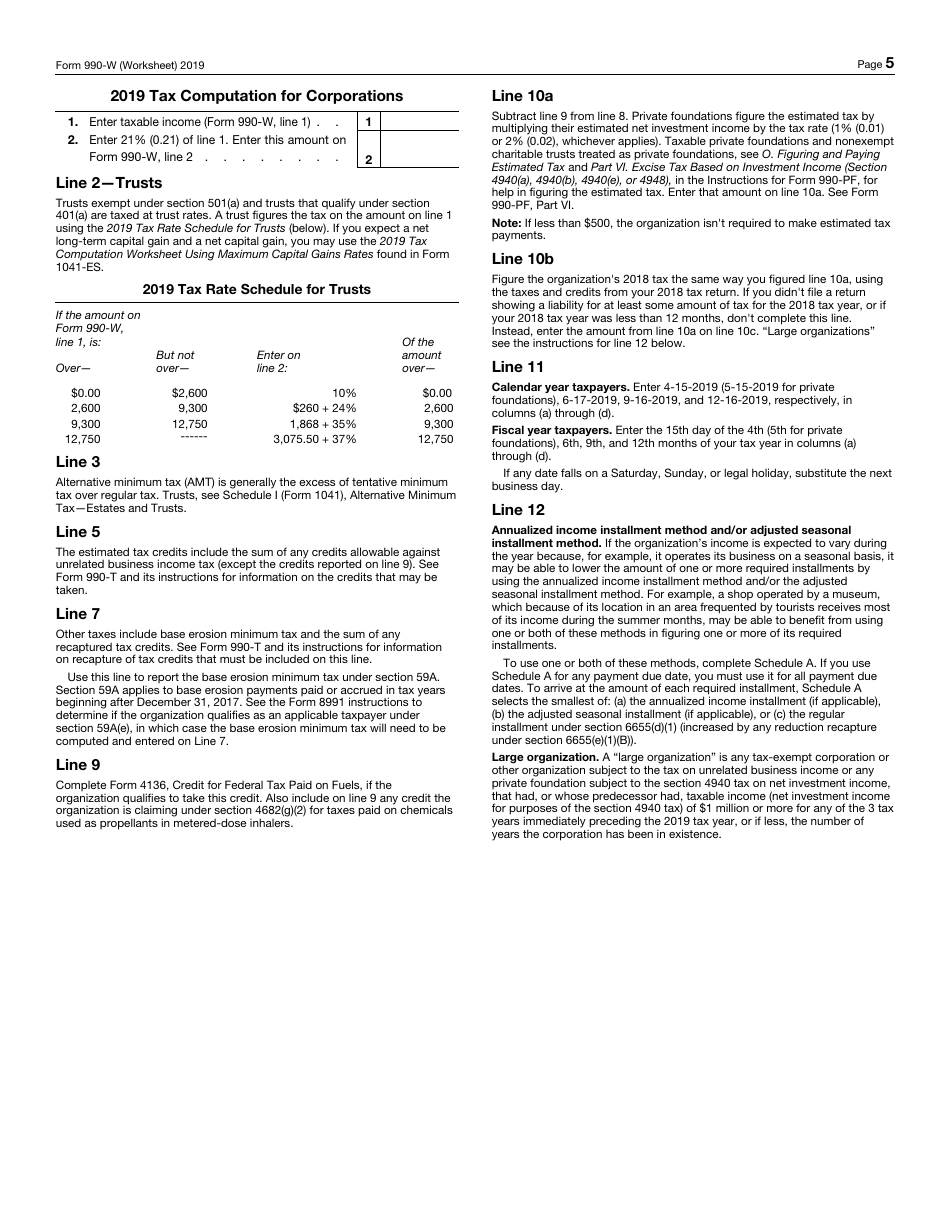

IRS Form 990-W Estimated Tax on Unrelated Business Taxable Income for Tax-Exempt Organizations (And on Investment Income for Private Foundations)

What Is IRS Form 990-W?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 990-W?

A: Form 990-W is a tax form used by tax-exempt organizations and private foundations to calculate their estimated tax on unrelated business taxable income.

Q: Who should use Form 990-W?

A: Tax-exempt organizations and private foundations should use Form 990-W to calculate their estimated tax.

Q: What is unrelated business taxable income?

A: Unrelated business taxable income refers to income generated by a tax-exempt organization from activities that are not related to its tax-exempt purpose.

Q: What is investment income for private foundations?

A: Investment income for private foundations refers to the income earned from investments made by private foundations.

Q: Why do tax-exempt organizations and private foundations need to calculate estimated tax?

A: Tax-exempt organizations and private foundations are generally required to pay estimated tax on their unrelated business taxable income and investment income to fulfill their tax obligations.

Form Details:

- A 7-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990-W through the link below or browse more documents in our library of IRS Forms.