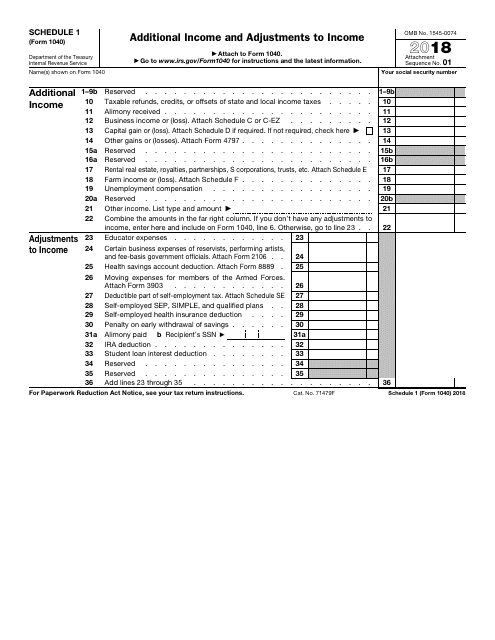

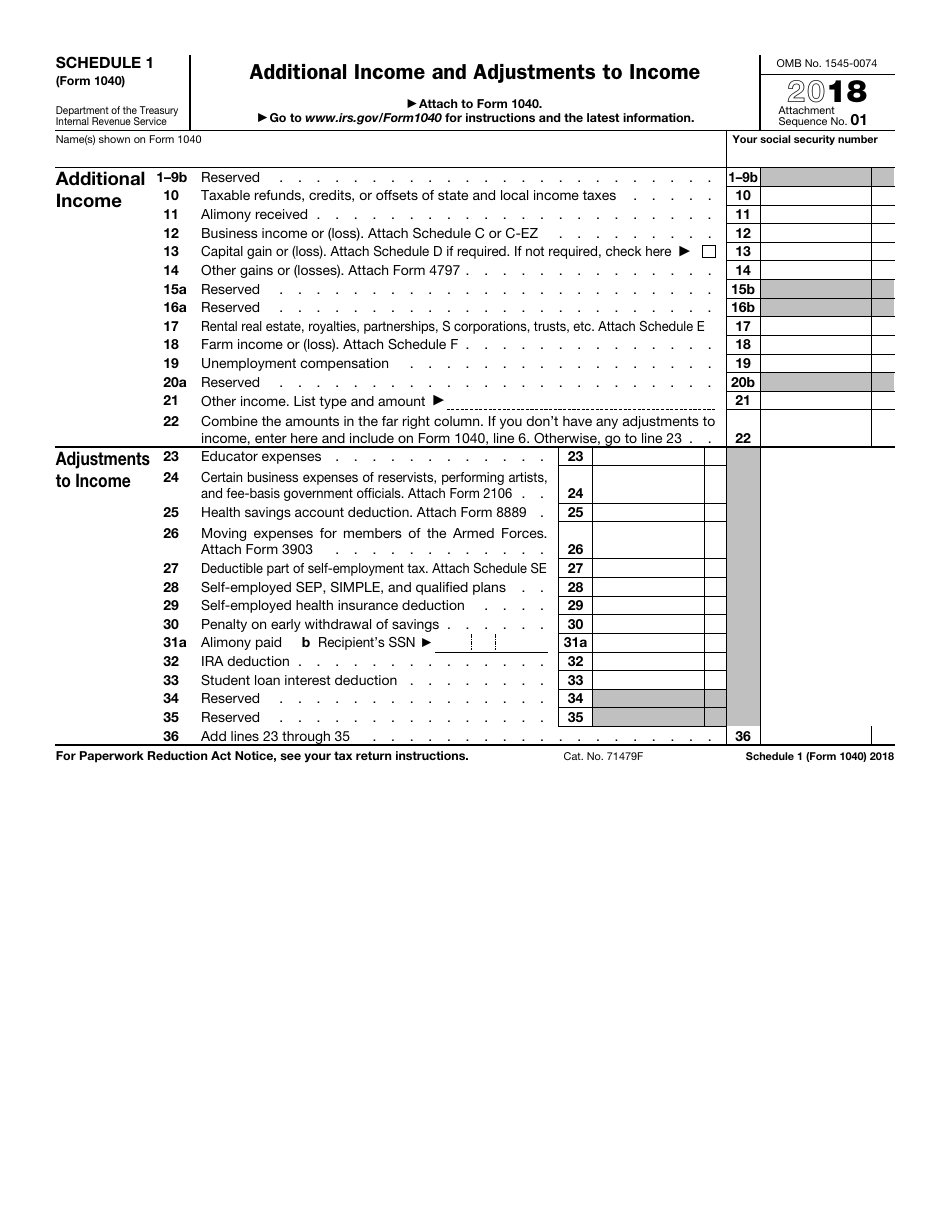

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040 Schedule 1

for the current year.

IRS Form 1040 Schedule 1 Additional Income and Adjustments to Income

What Is IRS Form 1040 Schedule 1?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040 Schedule 1?

A: IRS Form 1040 Schedule 1 is a supplemental form to the main Form 1040 that is used to report additional income and adjustments to income.

Q: What is the purpose of IRS Form 1040 Schedule 1?

A: The purpose of IRS Form 1040 Schedule 1 is to report any additional income that you may have received during the tax year, as well as any adjustments to your income that may affect your tax liability.

Q: What types of income should I report on IRS Form 1040 Schedule 1?

A: You should report any additional income that is not already reported on your main Form 1040, such as business income, rental income, or any other types of income that you may have received.

Q: What are some examples of adjustments to income?

A: Examples of adjustments to income include student loan interest deductions, contributions to a traditional IRA or Health Savings Account, and self-employment tax deductions.

Q: Do I need to file IRS Form 1040 Schedule 1?

A: You will need to file IRS Form 1040 Schedule 1 if you have any additional income to report or if you have any adjustments to income that may affect your tax liability.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule 1 through the link below or browse more documents in our library of IRS Forms.