This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 990-T

for the current year.

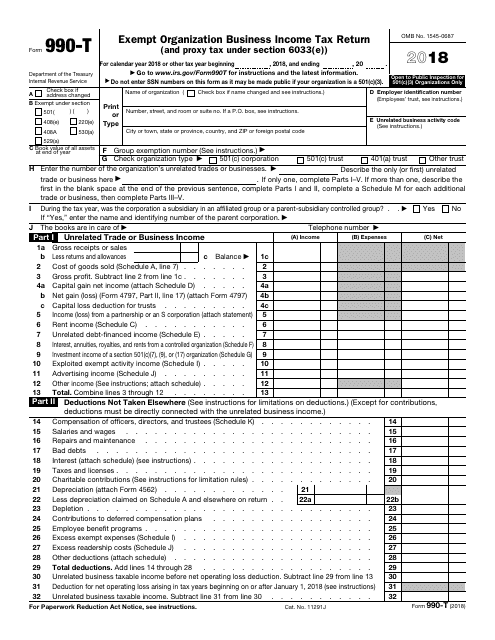

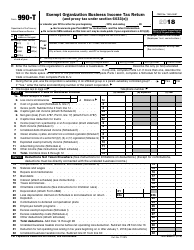

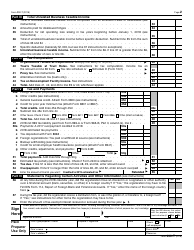

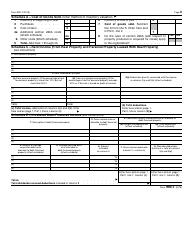

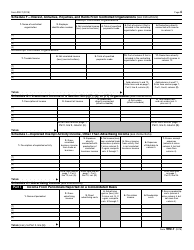

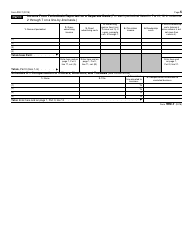

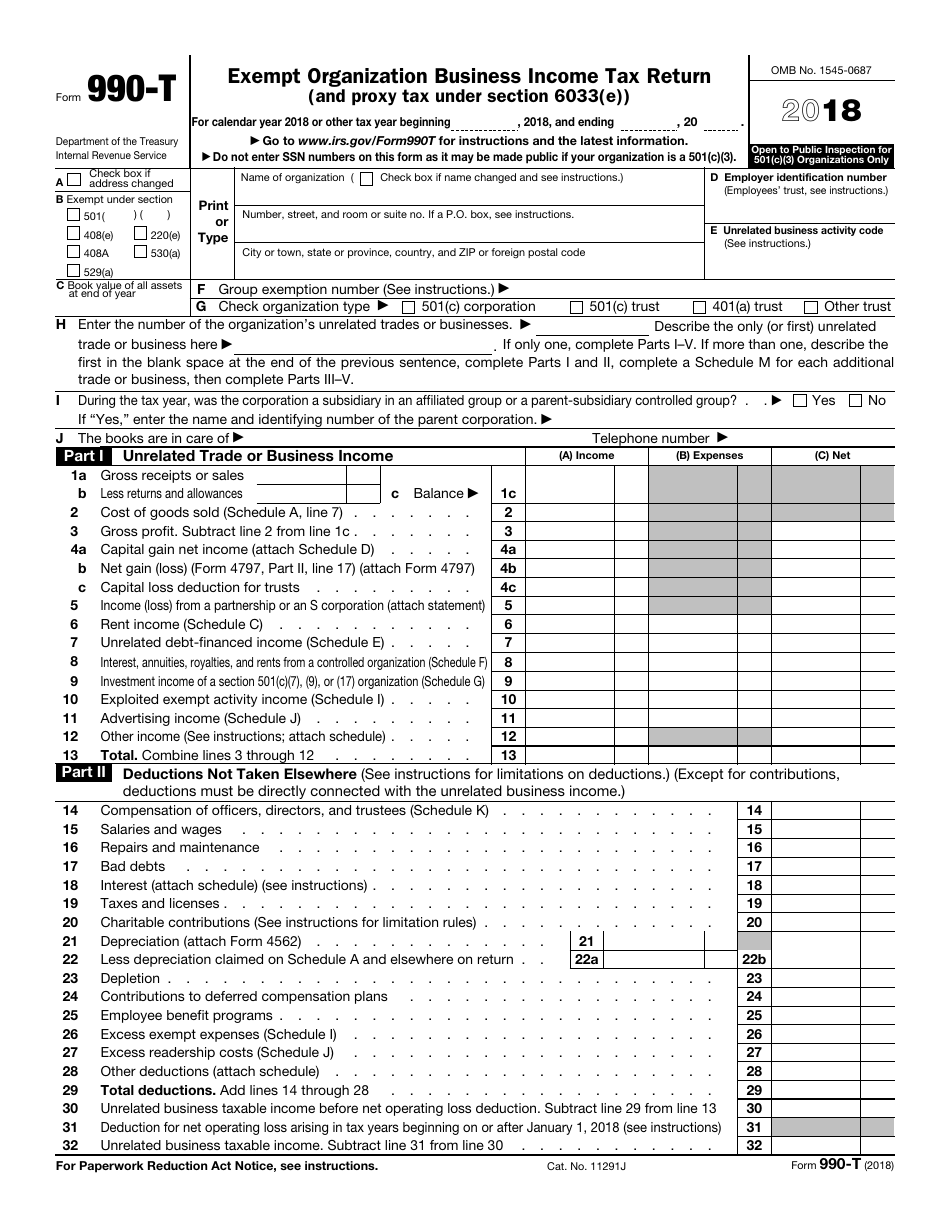

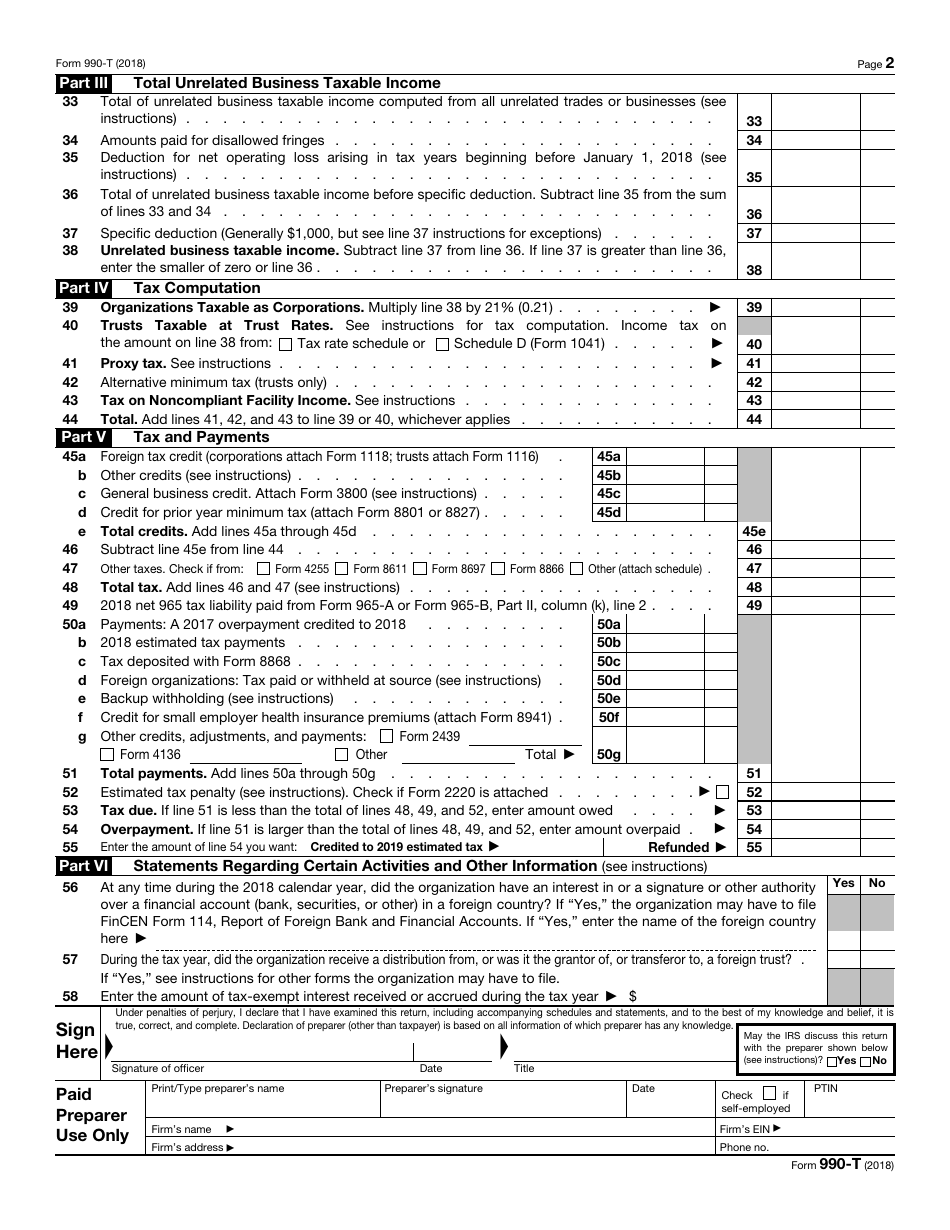

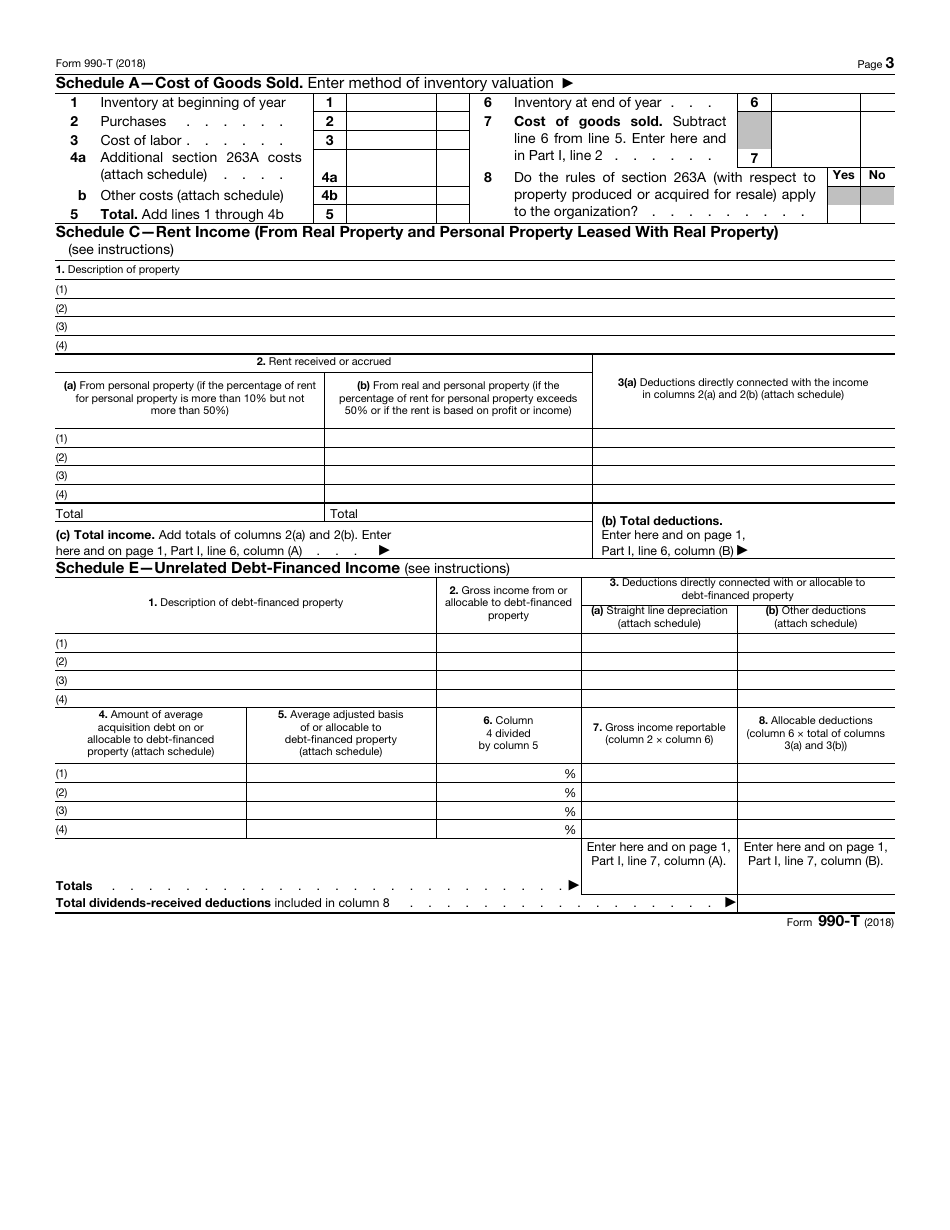

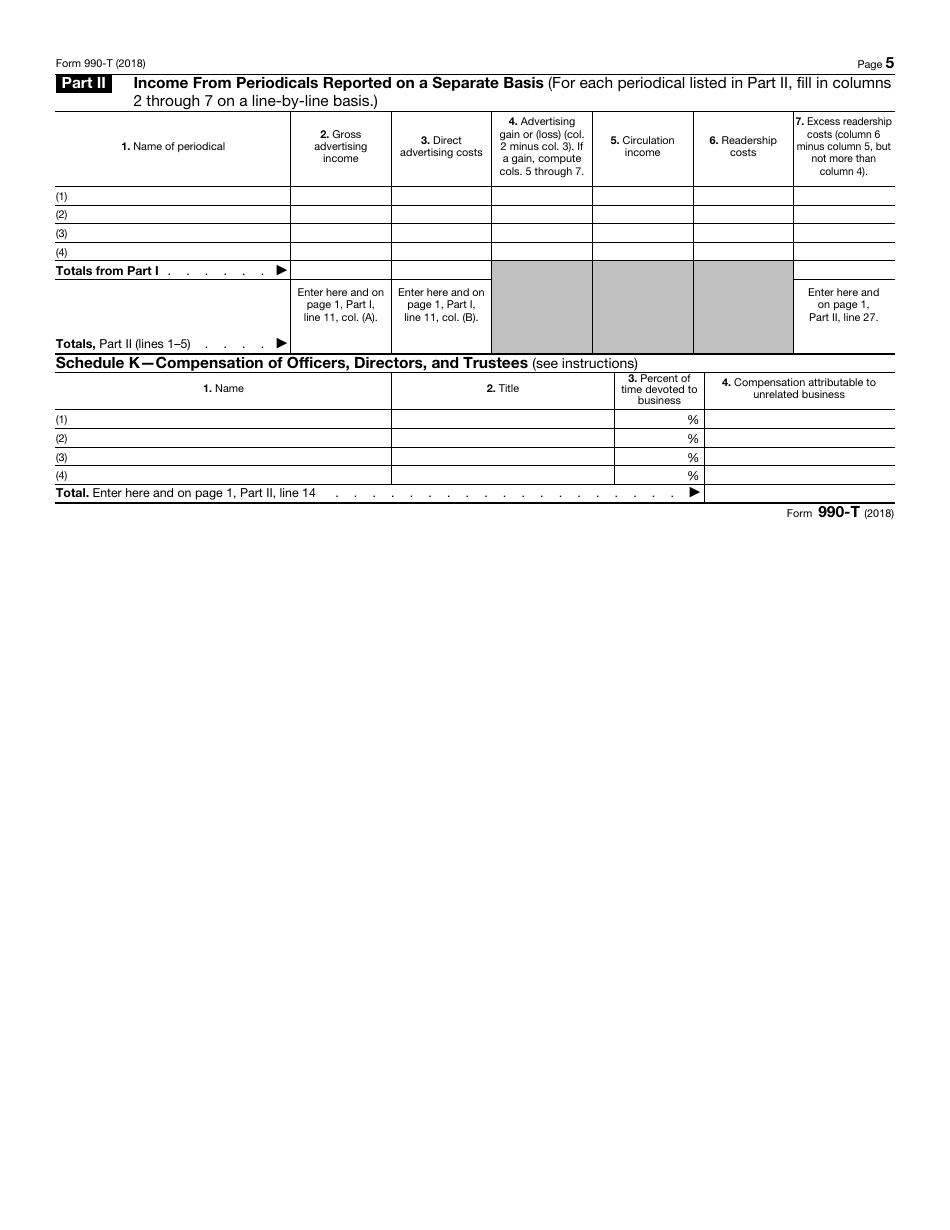

IRS Form 990-T Exempt Organization Business Income Tax Return (And Proxy Tax Under Section 6033(E))

What Is IRS Form 990-T?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 990-T?

A: IRS Form 990-T is the Exempt OrganizationBusiness Income Tax Return.

Q: Who must file IRS Form 990-T?

A: Certain tax-exempt organizations, such as charities and religious organizations, must file Form 990-T if they have unrelated business income.

Q: What is unrelated business income?

A: Unrelated business income is income generated by a tax-exempt organization from a trade or business that is not substantially related to its exempt purpose.

Q: What is the purpose of filing IRS Form 990-T?

A: The purpose of filing IRS Form 990-T is to report and pay taxes on any unrelated business income.

Q: What is proxy tax under Section 6033(e)?

A: Proxy tax under Section 6033(e) is a tax imposed on certain lobbying and political expenditures by tax-exempt organizations.

Q: Do all tax-exempt organizations have to pay taxes?

A: No, only tax-exempt organizations that have unrelated business income or certain lobbying and political expenditures may be required to pay taxes.

Q: Is there a deadline for filing IRS Form 990-T?

A: Yes, the deadline for filing IRS Form 990-T is generally the 15th day of the 5th month after the end of the organization's fiscal year.

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990-T through the link below or browse more documents in our library of IRS Forms.