This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 990-EZ

for the current year.

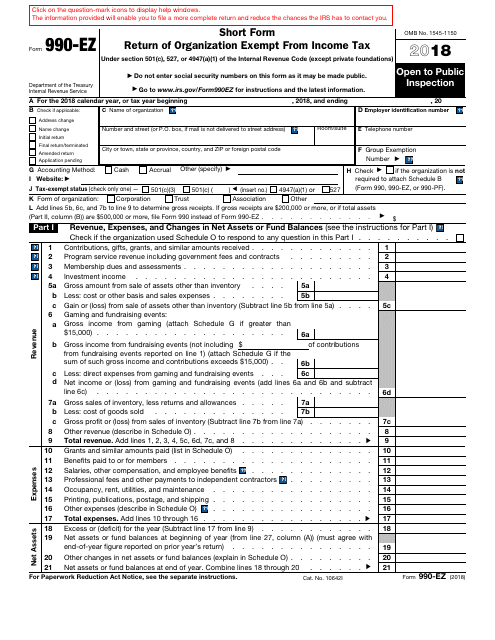

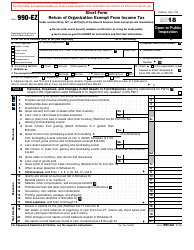

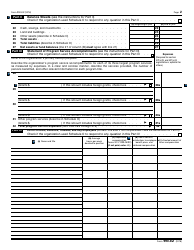

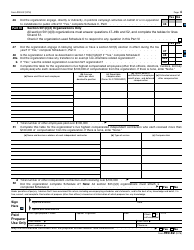

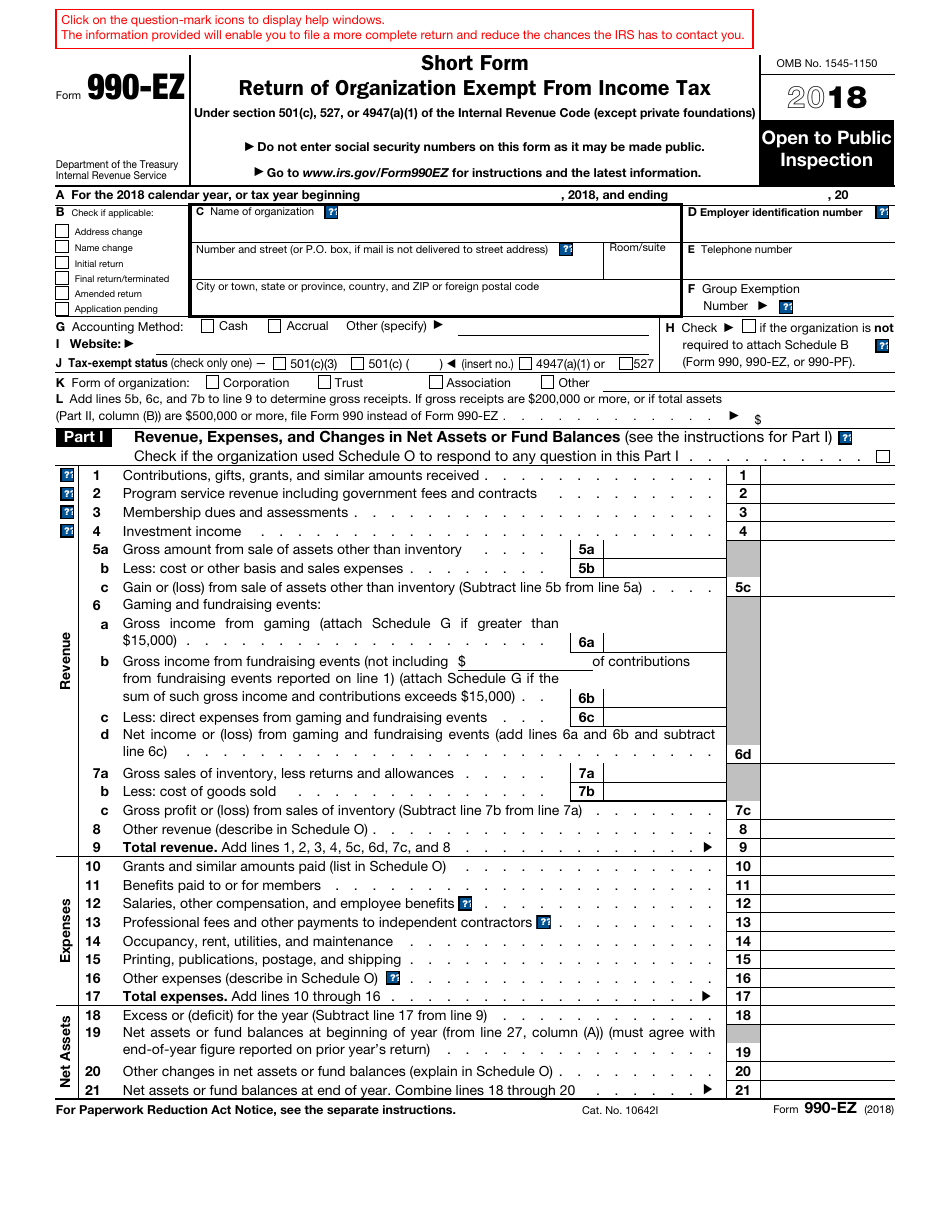

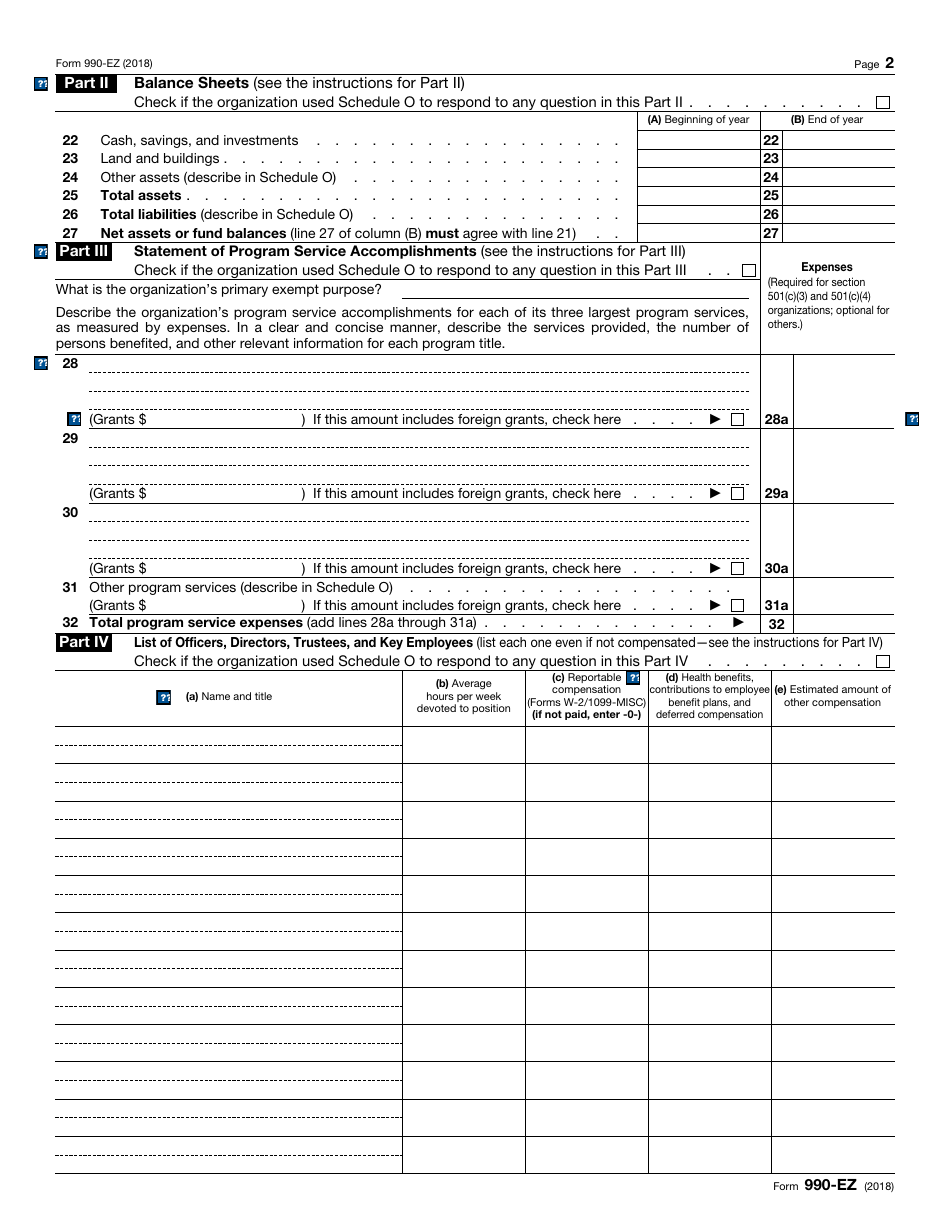

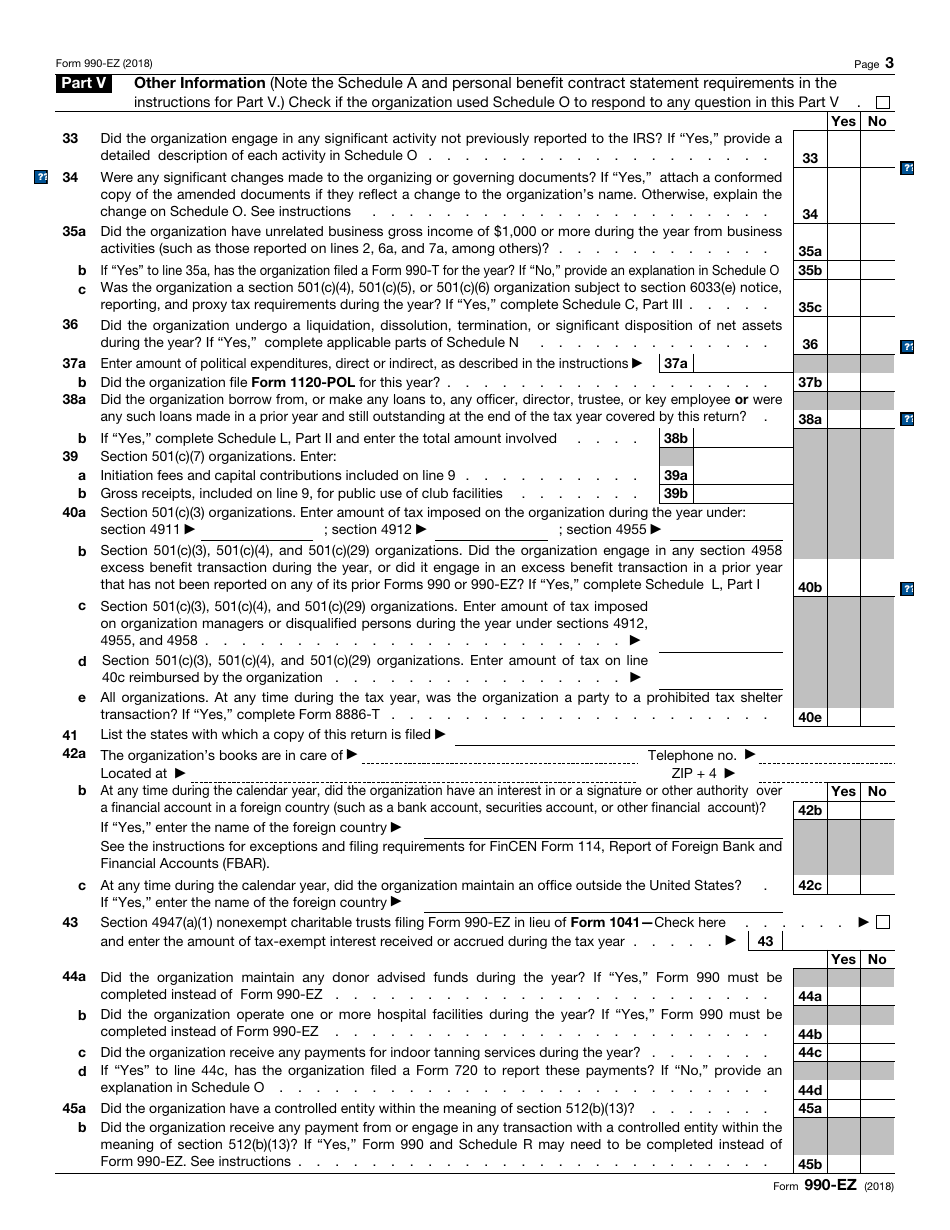

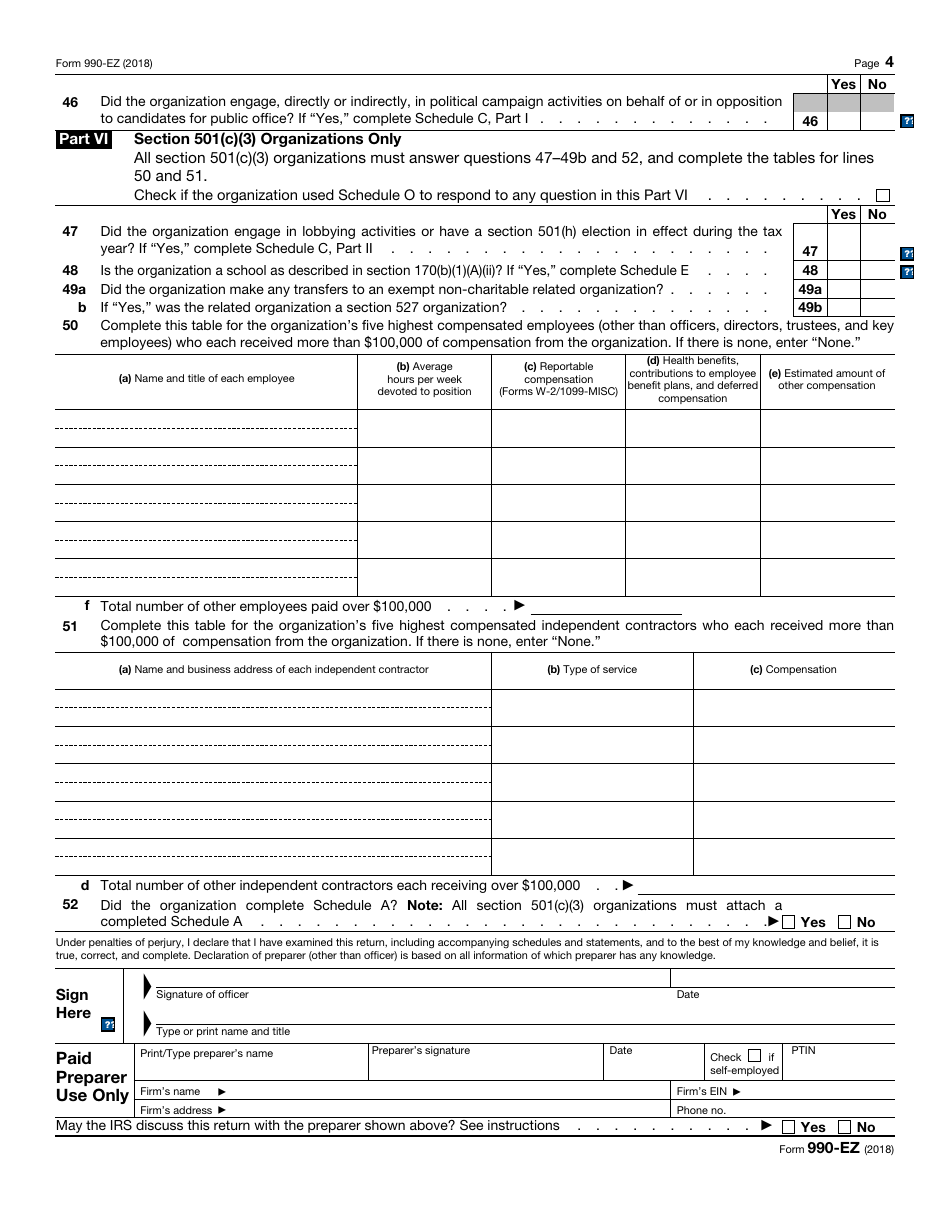

IRS Form 990-EZ Short Form Return of Organization Exempt From Income Tax

What Is IRS Form 990-EZ?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990-EZ?

A: IRS Form 990-EZ is a short form return that certain tax-exempt organizations must file to report their financial information.

Q: Who needs to file IRS Form 990-EZ?

A: Certain tax-exempt organizations, such as non-profit organizations, must file IRS Form 990-EZ.

Q: What information is reported on IRS Form 990-EZ?

A: IRS Form 990-EZ requires organizations to report their financial information, including revenue, expenses, and assets.

Q: How is IRS Form 990-EZ different from IRS Form 990?

A: IRS Form 990-EZ is a shorter version of IRS Form 990 and is meant for smaller tax-exempt organizations.

Q: Is there a fee to file IRS Form 990-EZ?

A: Yes, there is a fee to file IRS Form 990-EZ. The fee amount depends on the organization's annual gross receipts.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990-EZ through the link below or browse more documents in our library of IRS Forms.