This version of the form is not currently in use and is provided for reference only. Download this version of

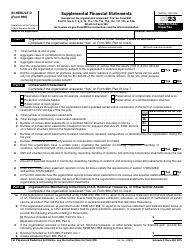

IRS Form 990 (990-EZ) Schedule G

for the current year.

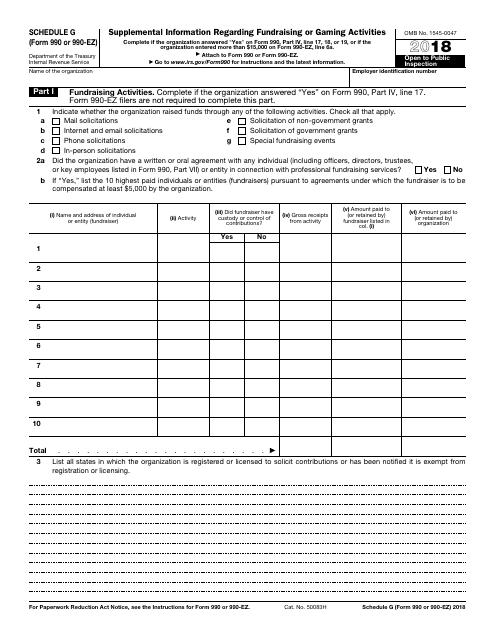

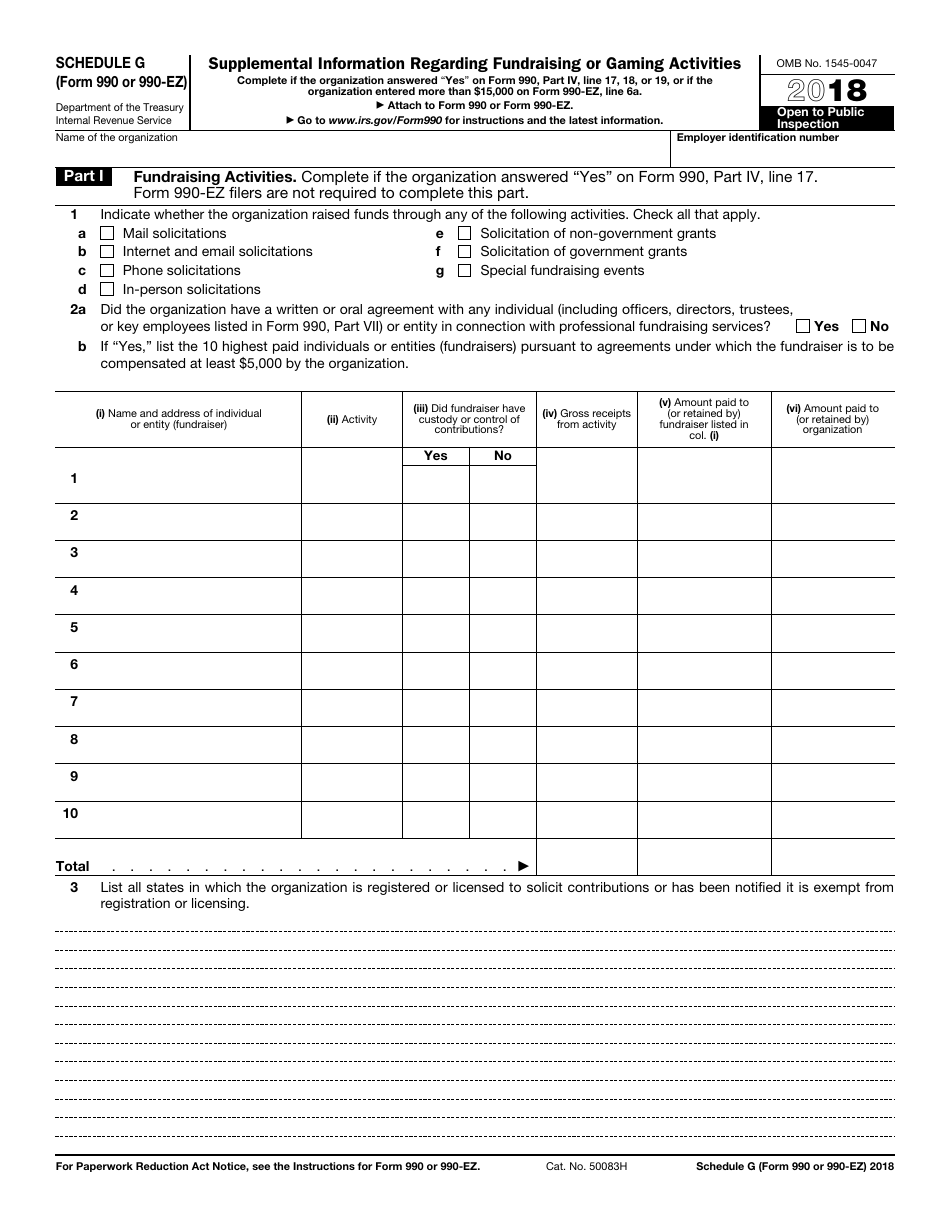

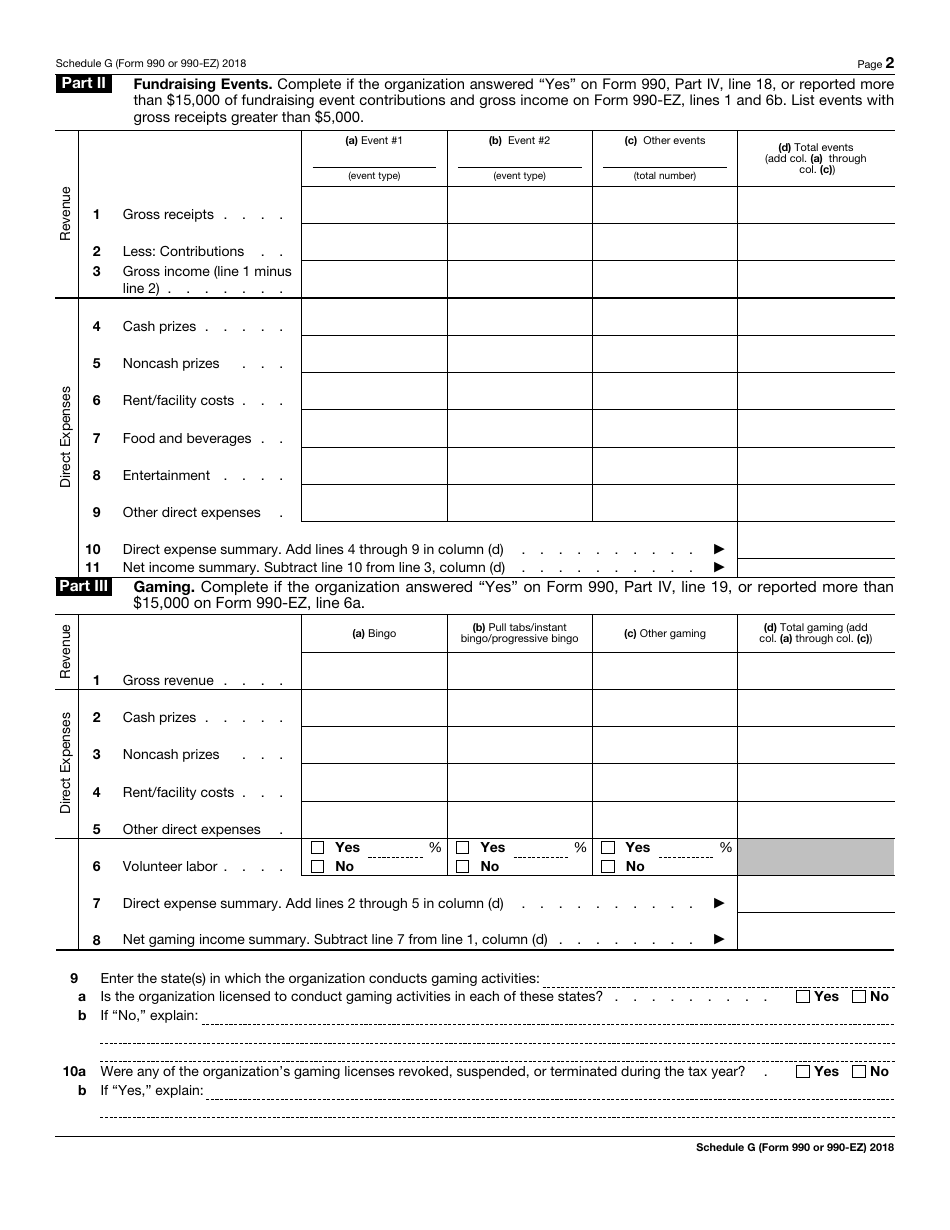

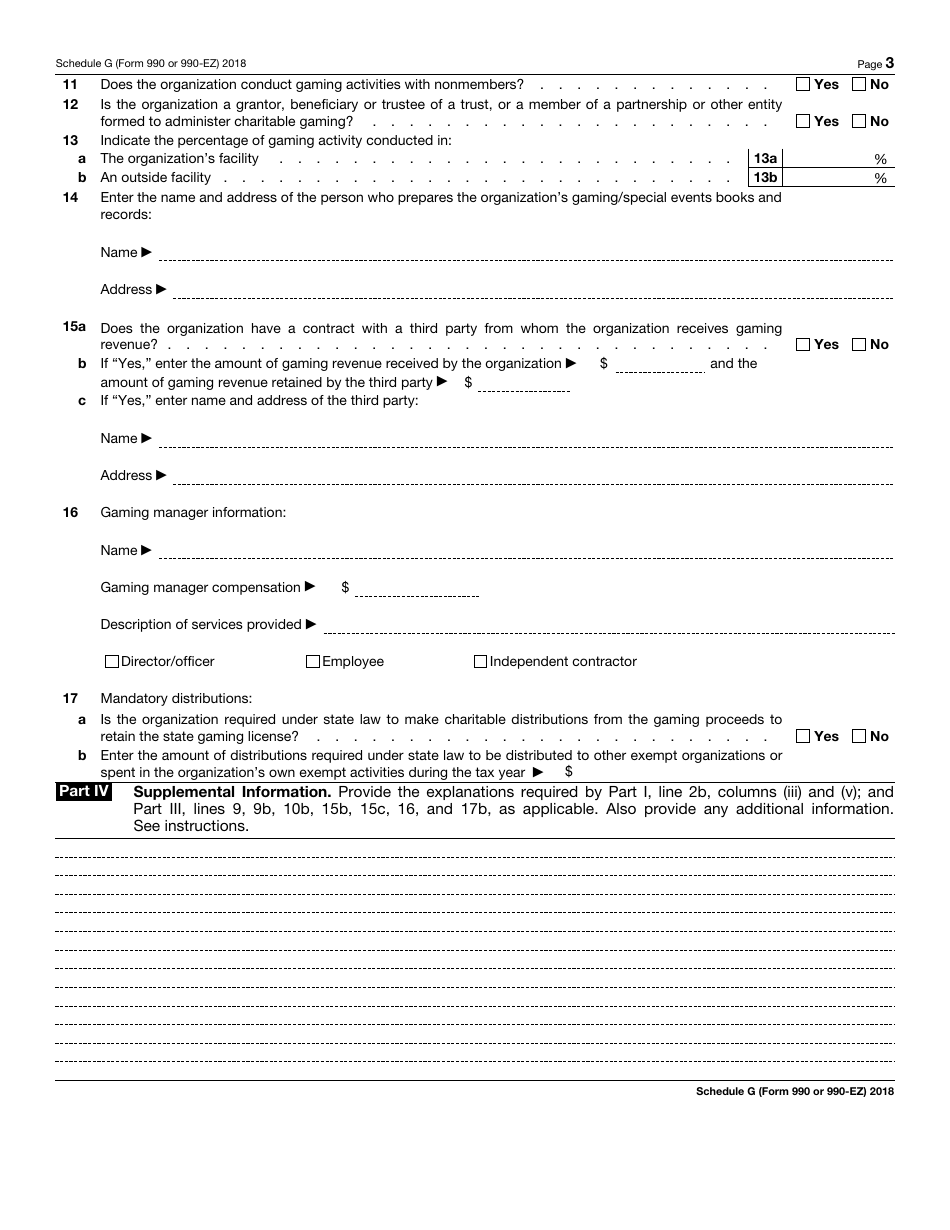

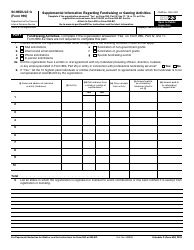

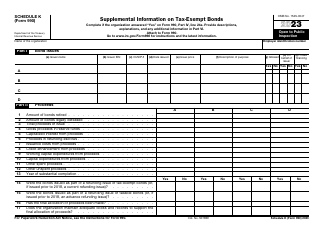

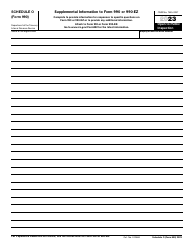

IRS Form 990 (990-EZ) Schedule G Supplemental Information Regarding Fundraising or Gaming Activities

What Is IRS Form 990 (990-EZ) Schedule G?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, and IRS Form 990-EZ. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990 (990-EZ) Schedule G?

A: IRS Form 990 (990-EZ) Schedule G is a supplemental form that provides information regarding fundraising or gaming activities of an organization.

Q: Who needs to file IRS Form 990 (990-EZ) Schedule G?

A: Nonprofit organizations that engaged in fundraising or gaming activities during the tax year are required to file IRS Form 990 (990-EZ) Schedule G.

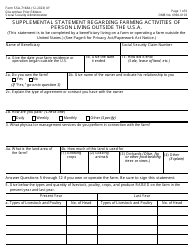

Q: What information does IRS Form 990 (990-EZ) Schedule G require?

A: IRS Form 990 (990-EZ) Schedule G requires information about the organization's fundraising and gaming activities, including the type of activity, gross revenue, expenses, and any professional fundraising services used.

Q: When is the deadline to file IRS Form 990 (990-EZ) Schedule G?

A: The deadline to file IRS Form 990 (990-EZ) Schedule G is the same as the deadline for the organization's annual tax return, typically on the 15th day of the fifth month after the end of the organization's fiscal year.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 (990-EZ) Schedule G through the link below or browse more documents in our library of IRS Forms.