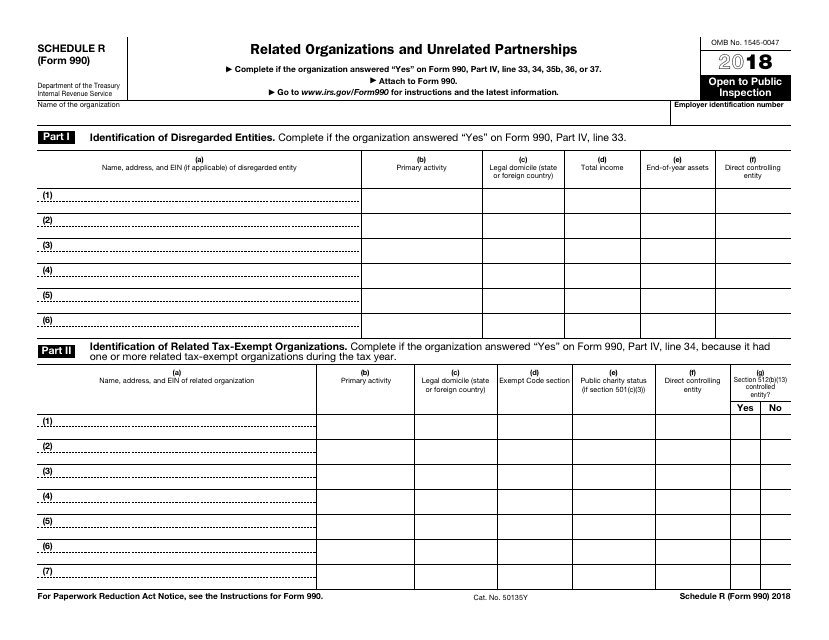

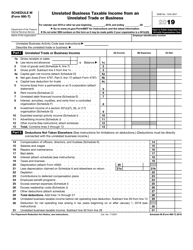

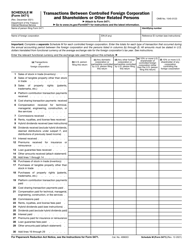

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 990 Schedule R

for the current year.

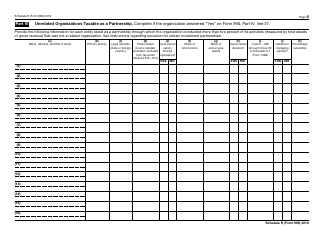

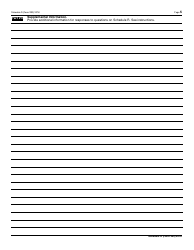

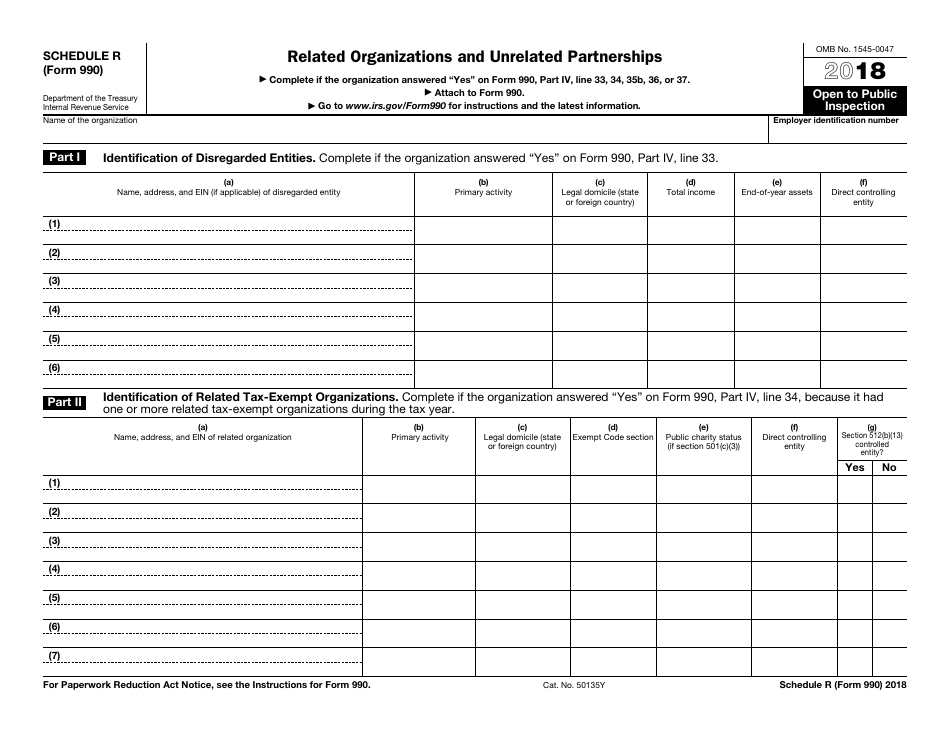

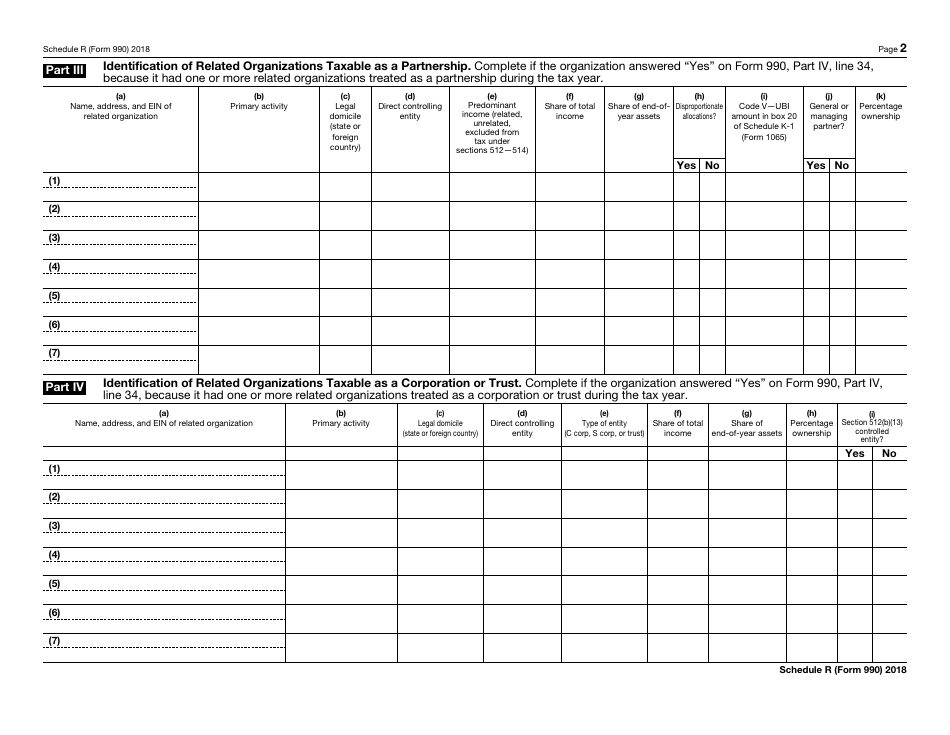

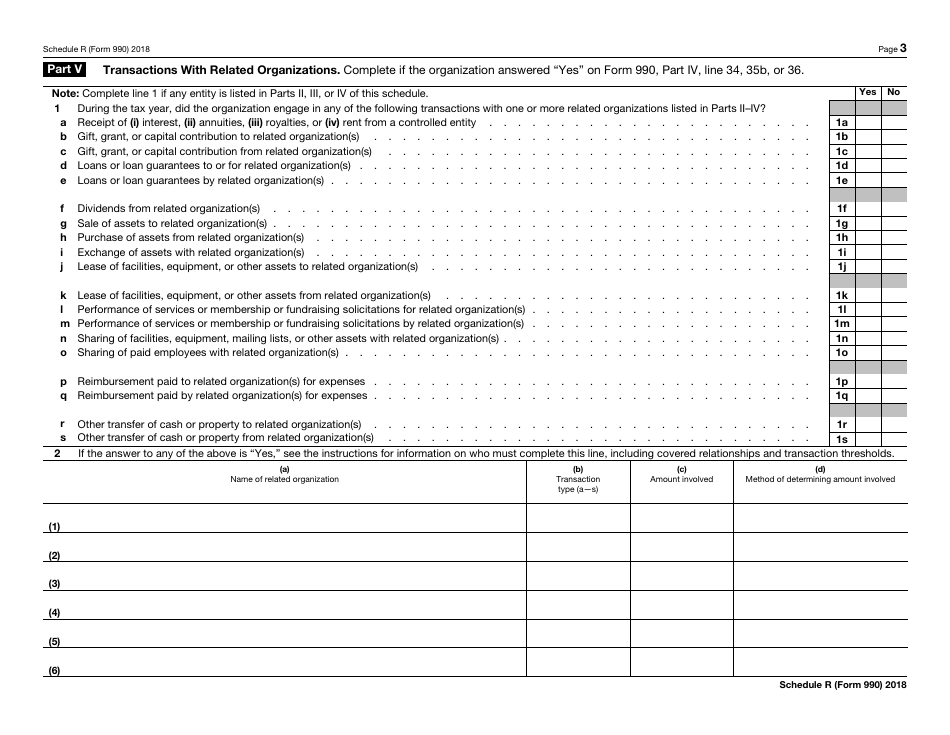

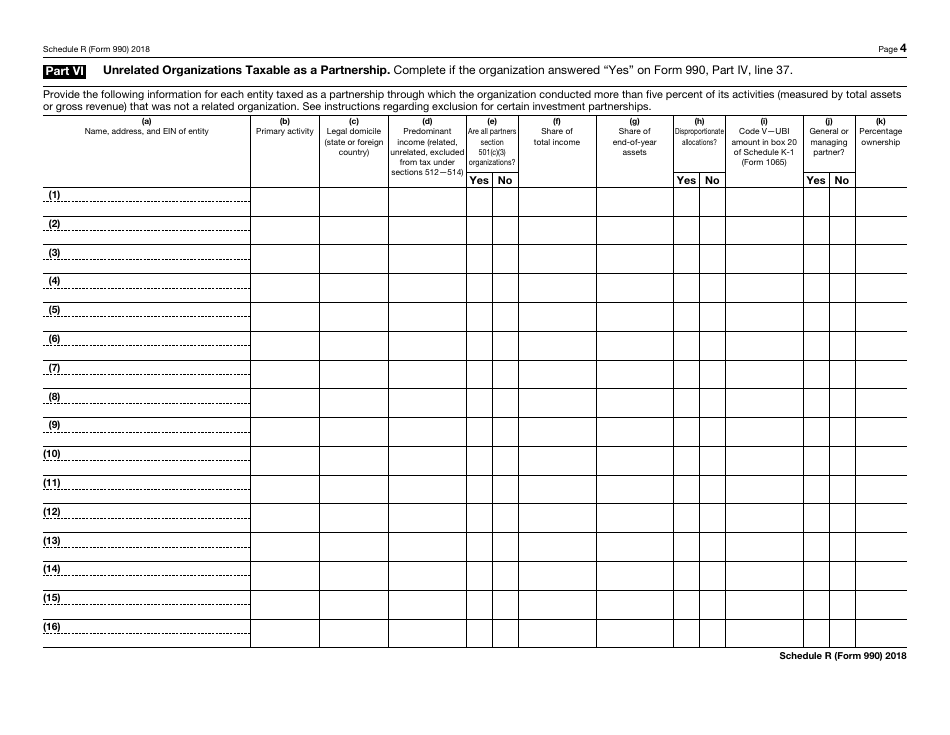

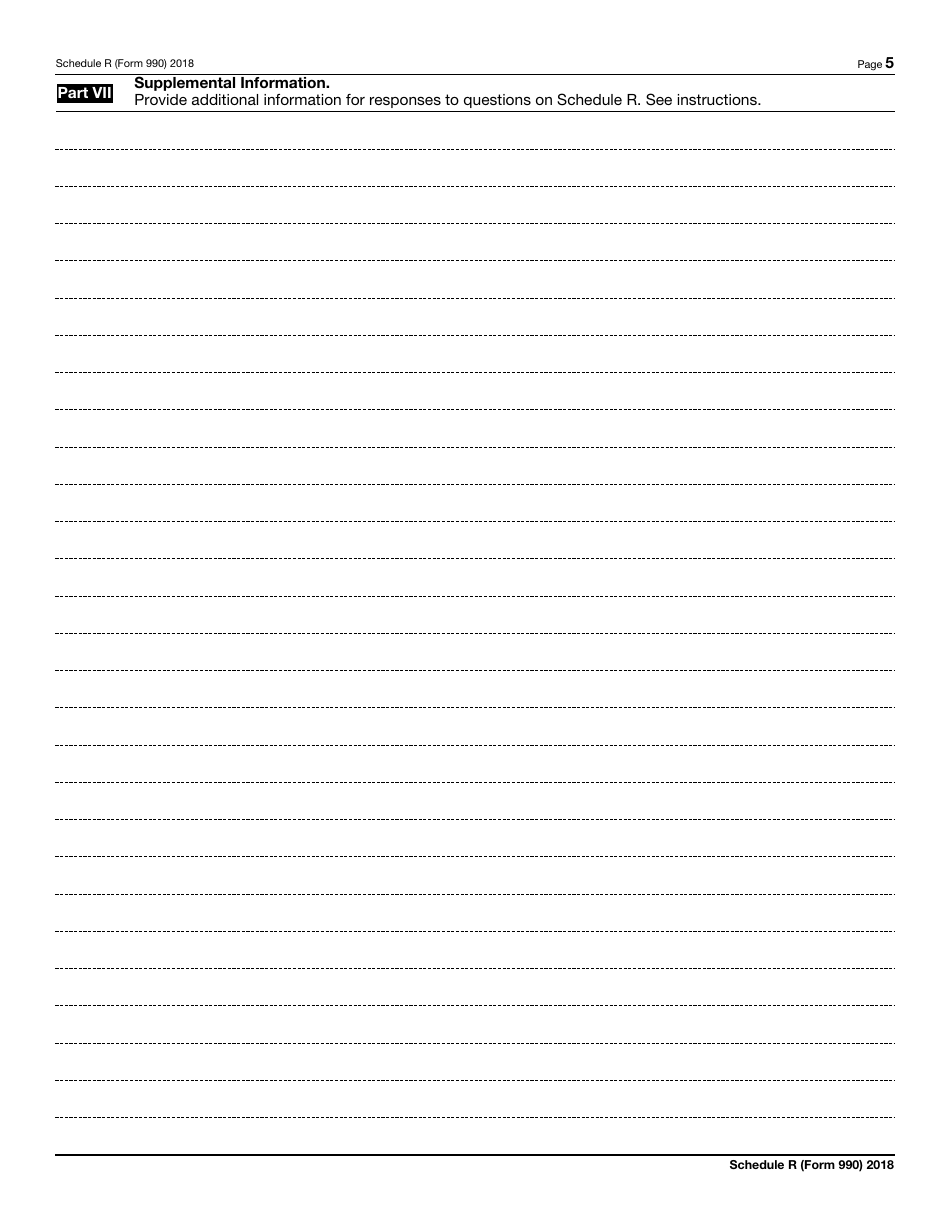

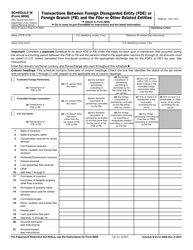

IRS Form 990 Schedule R Related Organizations and Unrelated Partnerships

What Is IRS Form 990 Schedule R?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, Return of Organization Exempt From Income Tax. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990 Schedule R?

A: IRS Form 990 Schedule R is a form used by tax-exempt organizations to report their relationships with other organizations and partnerships.

Q: What does Schedule R report?

A: Schedule R reports the tax-exempt organization's relationships with related organizations and partnerships.

Q: What are related organizations?

A: Related organizations are entities that have a close relationship with the tax-exempt organization, such as subsidiaries, parent organizations, or sister organizations.

Q: What are unrelated partnerships?

A: Unrelated partnerships are business partnerships that the tax-exempt organization has entered into that do not have a close relationship with the organization.

Q: Why is it important to file Schedule R?

A: Filing Schedule R is important because it provides the IRS with information about the tax-exempt organization's relationships and partnerships, helping to ensure compliance with tax laws.

Q: Do all tax-exempt organizations need to file Schedule R?

A: No, not all tax-exempt organizations need to file Schedule R. It is only required for organizations that have relationships with other entities or have entered into partnerships.

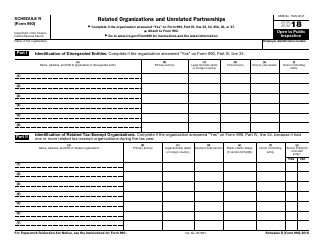

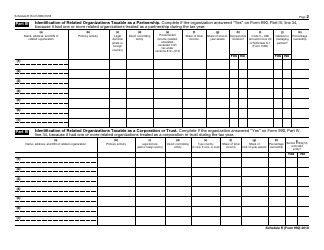

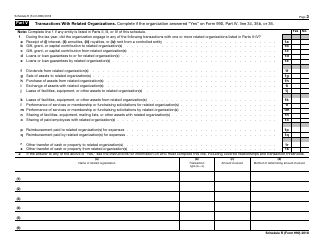

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule R through the link below or browse more documents in our library of IRS Forms.