This version of the form is not currently in use and is provided for reference only. Download this version of

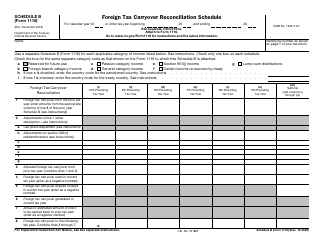

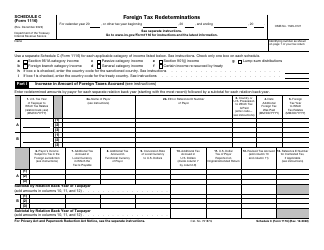

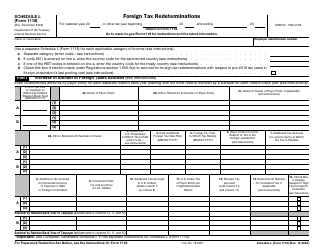

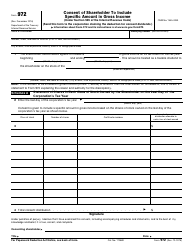

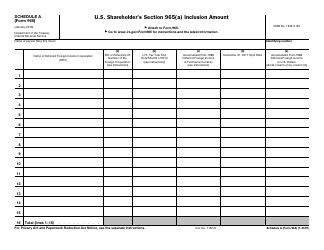

IRS Form 965 Schedule H

for the current year.

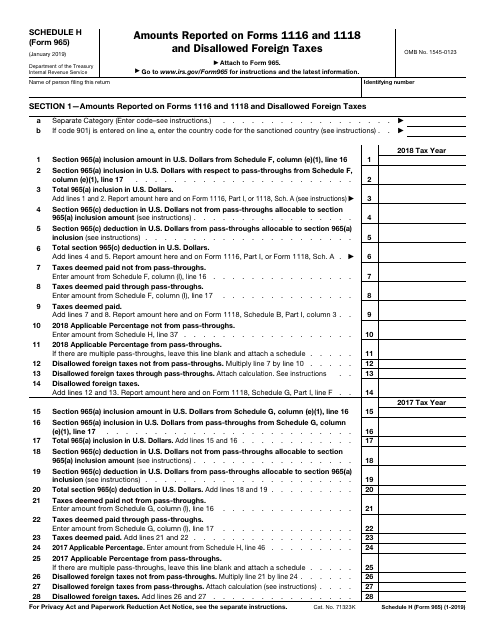

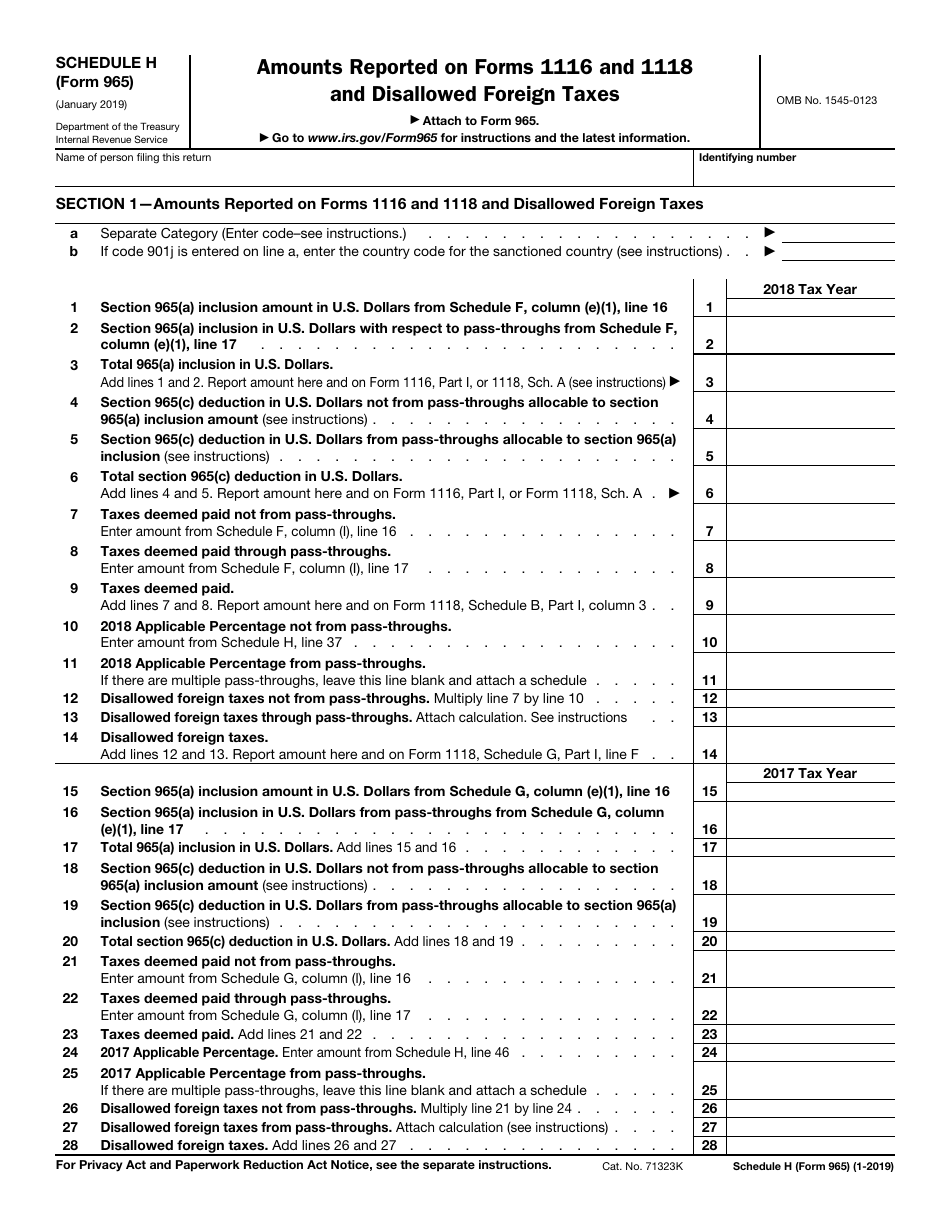

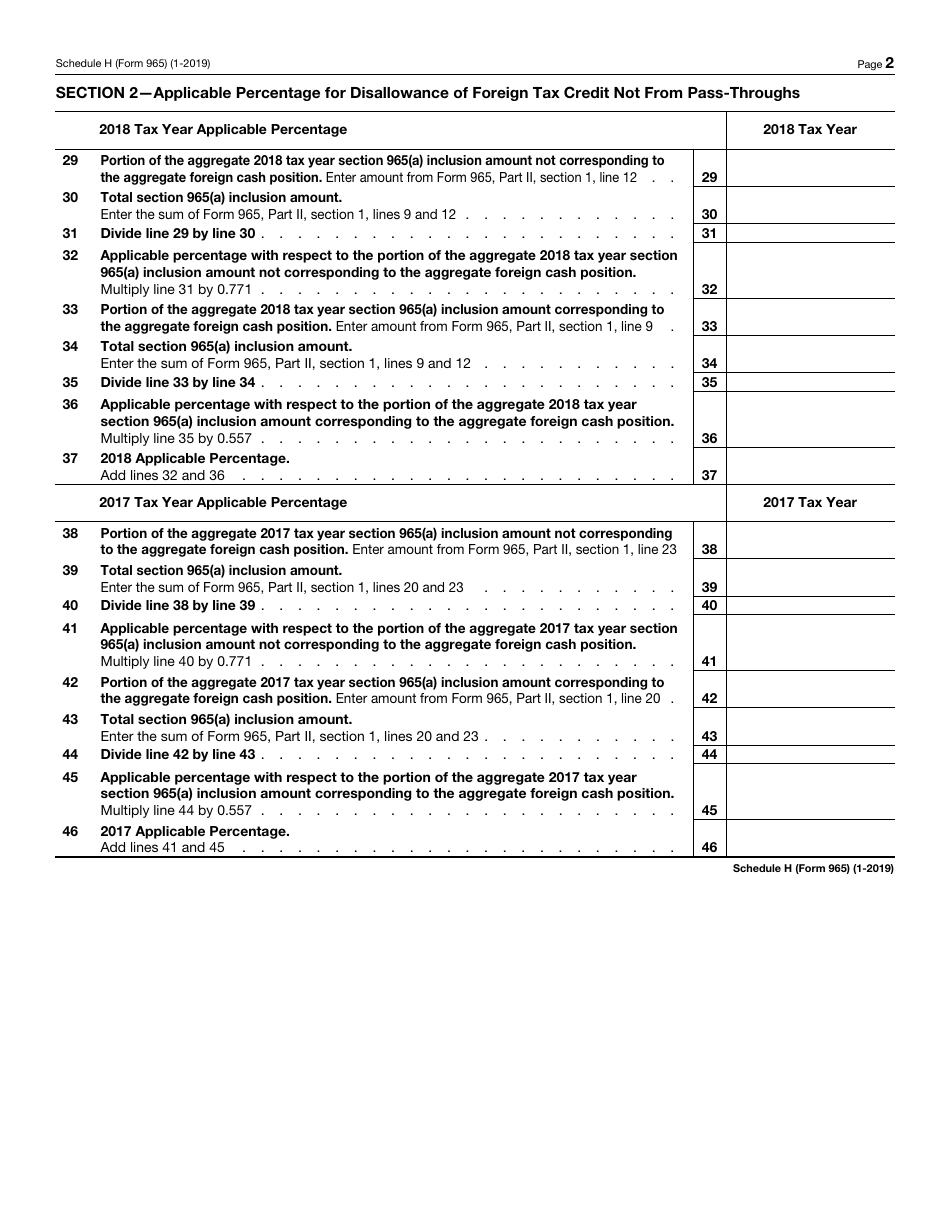

IRS Form 965 Schedule H Amounts Reported on Forms 1116 and 1118 and Disallowed Foreign Taxes

What Is IRS Form 965 Schedule H?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2019. The document is a supplement to IRS Form 965, Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 965 Schedule H?

A: IRS Form 965 Schedule H is a tax form used to report amounts reported on Forms 1116 and 1118 and disallowed foreign taxes.

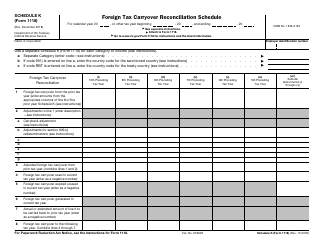

Q: What are Forms 1116 and 1118?

A: Forms 1116 and 1118 are tax forms used to report foreign tax credits and disallowed foreign taxes.

Q: What are foreign tax credits?

A: Foreign tax credits are credits that can be claimed to reduce your U.S. income tax liability on income that is subject to foreign taxes.

Q: What are disallowed foreign taxes?

A: Disallowed foreign taxes are foreign taxes that cannot be claimed as a credit on your U.S. income tax return.

Q: Why would foreign taxes be disallowed?

A: Foreign taxes may be disallowed if they were not actually paid or accrued, or if they do not meet certain requirements for the foreign tax credit.

Q: How do I report disallowed foreign taxes?

A: You can report disallowed foreign taxes on IRS Form 965 Schedule H.

Q: Is filing IRS Form 965 Schedule H mandatory?

A: Filing IRS Form 965 Schedule H is only required if you have amounts reported on Forms 1116 and 1118 and disallowed foreign taxes.

Form Details:

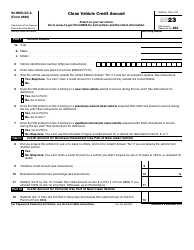

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 965 Schedule H through the link below or browse more documents in our library of IRS Forms.