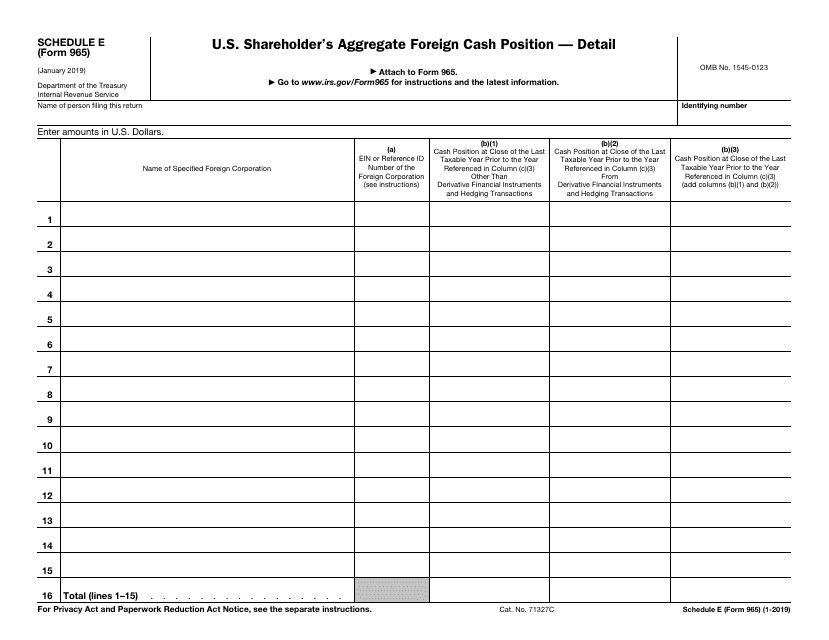

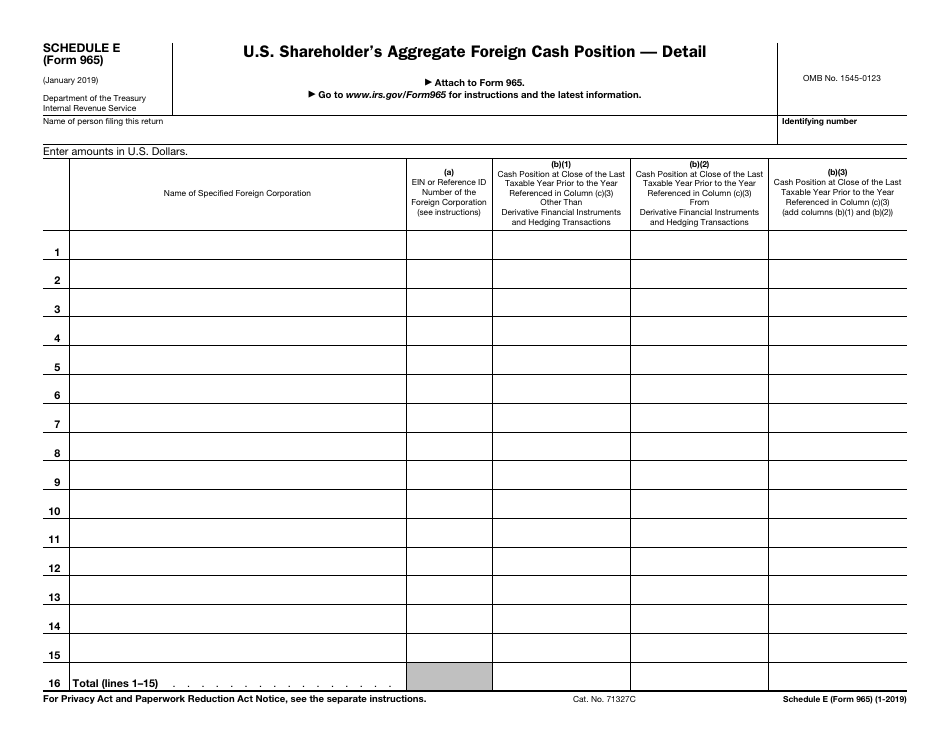

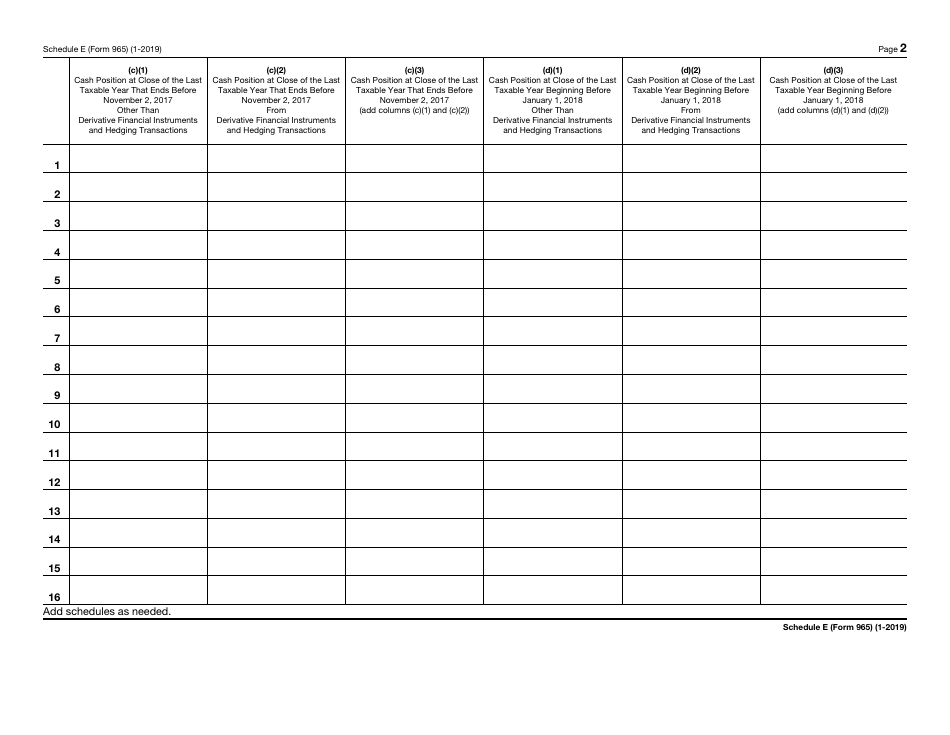

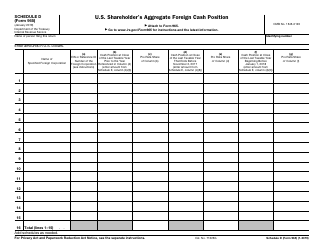

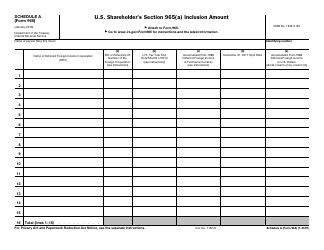

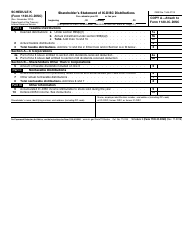

IRS Form 965 Schedule E U.S. Shareholder's Aggregate Foreign Cash Position - Detail

What Is IRS Form 965 Schedule E?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2019. The document is a supplement to IRS Form 965, Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 965 Schedule E?

A: IRS Form 965 Schedule E is a form used by U.S. shareholders to report their aggregate foreign cash position.

Q: Who needs to file IRS Form 965 Schedule E?

A: U.S. shareholders need to file IRS Form 965 Schedule E if they have an aggregate foreign cash position.

Q: What is an aggregate foreign cash position?

A: An aggregate foreign cash position refers to the total amount of cash held outside the United States by a U.S. shareholder.

Q: Why is IRS Form 965 Schedule E important?

A: IRS Form 965 Schedule E is important because it helps the IRS track and tax the foreign cash holdings of U.S. shareholders.

Form Details:

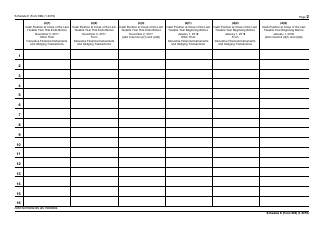

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 965 Schedule E through the link below or browse more documents in our library of IRS Forms.