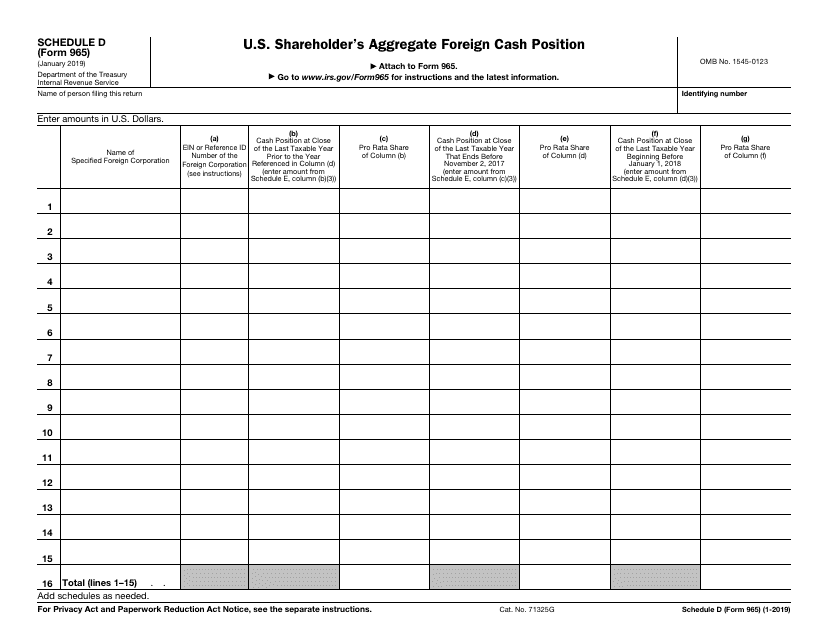

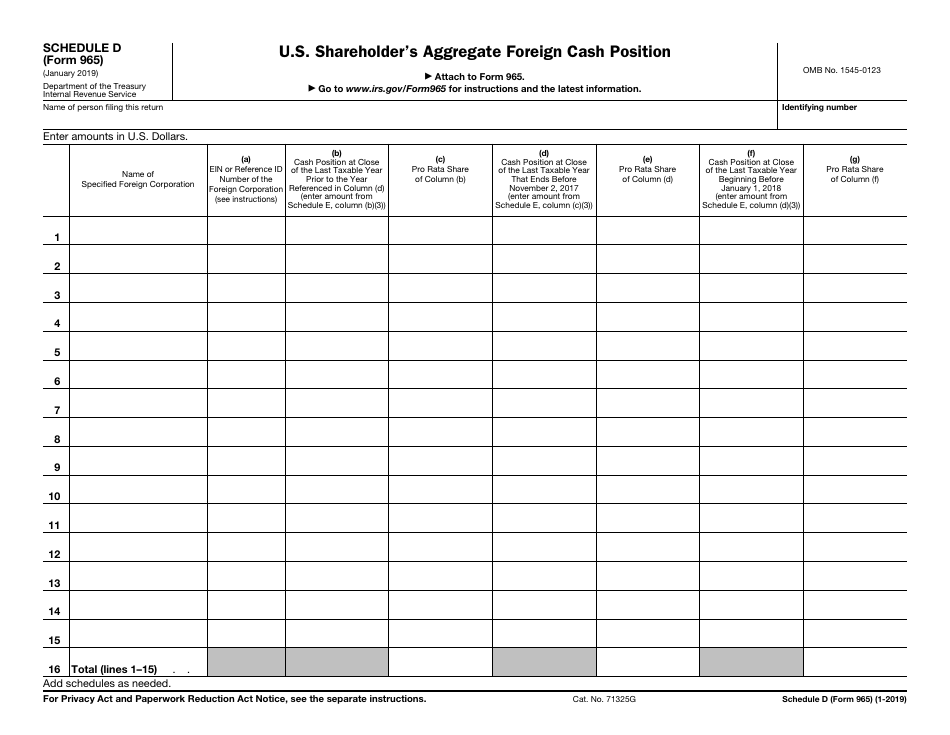

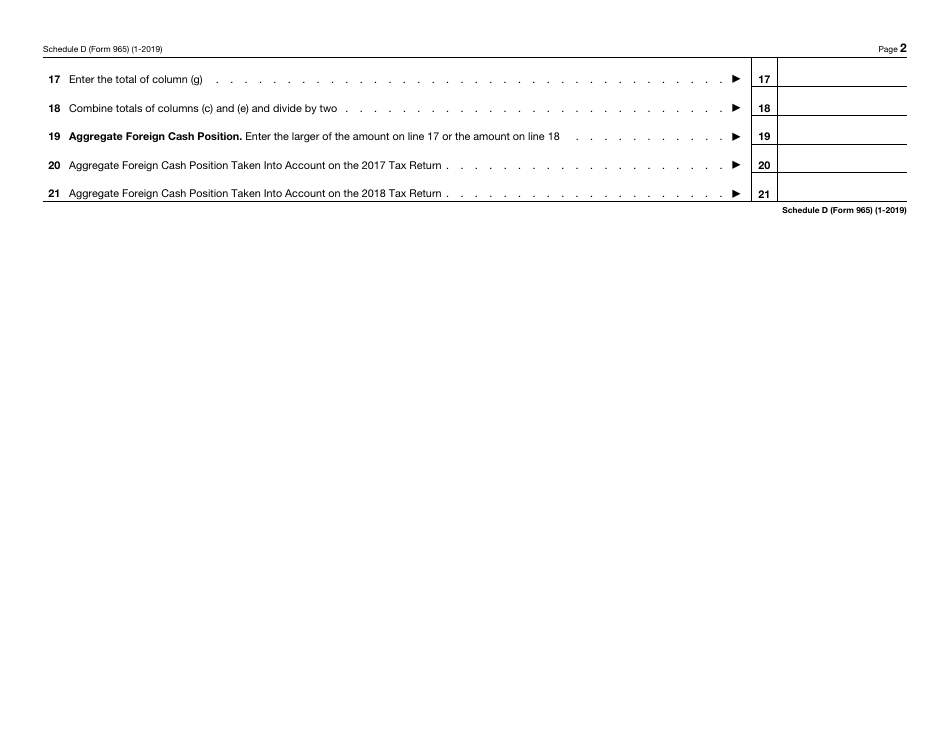

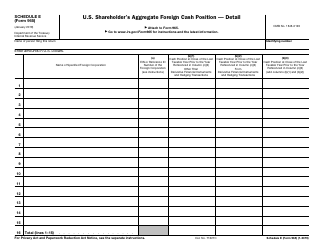

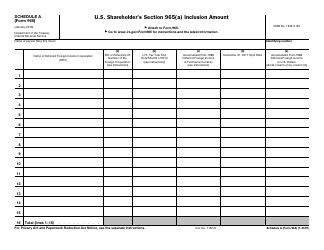

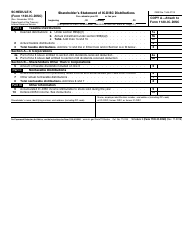

IRS Form 965 Schedule D U.S. Shareholder's Aggregate Foreign Cash Position

What Is IRS Form 965 Schedule D?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2019. The document is a supplement to IRS Form 965, Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 965 Schedule D?

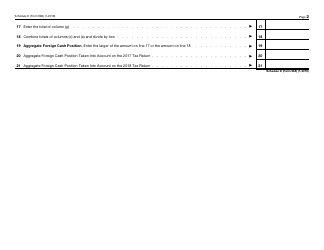

A: IRS Form 965 Schedule D is a tax form used by U.S. shareholders to report their aggregate foreign cash position.

Q: Who needs to file IRS Form 965 Schedule D?

A: U.S. shareholders who have an aggregate foreign cash position are required to file IRS Form 965 Schedule D.

Q: What is an aggregate foreign cash position?

A: An aggregate foreign cash position refers to the total amount of cash held by a U.S. shareholder in foreign corporations.

Q: Why do U.S. shareholders need to report their aggregate foreign cash position?

A: Reporting the aggregate foreign cash position allows the IRS to track and tax any potentially undisclosed foreign income.

Q: When is the deadline to file IRS Form 965 Schedule D?

A: The deadline to file IRS Form 965 Schedule D is typically April 15th, unless an extension has been granted.

Q: Are there any penalties for not filing IRS Form 965 Schedule D?

A: Yes, there can be penalties for failing to file IRS Form 965 Schedule D, including potential fines and interest charges.

Q: Can I file IRS Form 965 Schedule D electronically?

A: Yes, IRS Form 965 Schedule D can be filed electronically using the appropriate tax software or through a qualified tax professional.

Q: Is IRS Form 965 Schedule D applicable to Canadian residents?

A: No, IRS Form 965 Schedule D is specific to U.S. shareholders and does not apply to Canadian residents.

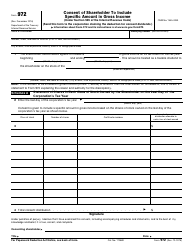

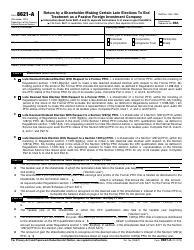

Q: What other forms may be required in addition to IRS Form 965 Schedule D?

A: Depending on the individual's circumstances, other forms such as Form 5471 or Form 8938 may be required to report foreign financial assets or investments.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 965 Schedule D through the link below or browse more documents in our library of IRS Forms.