This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 941-SS

for the current year.

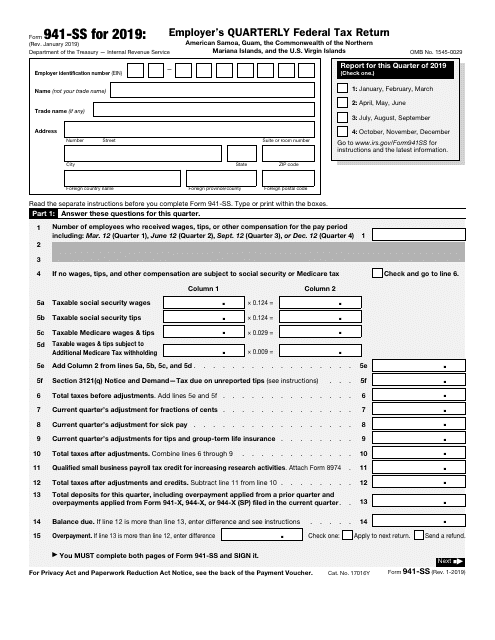

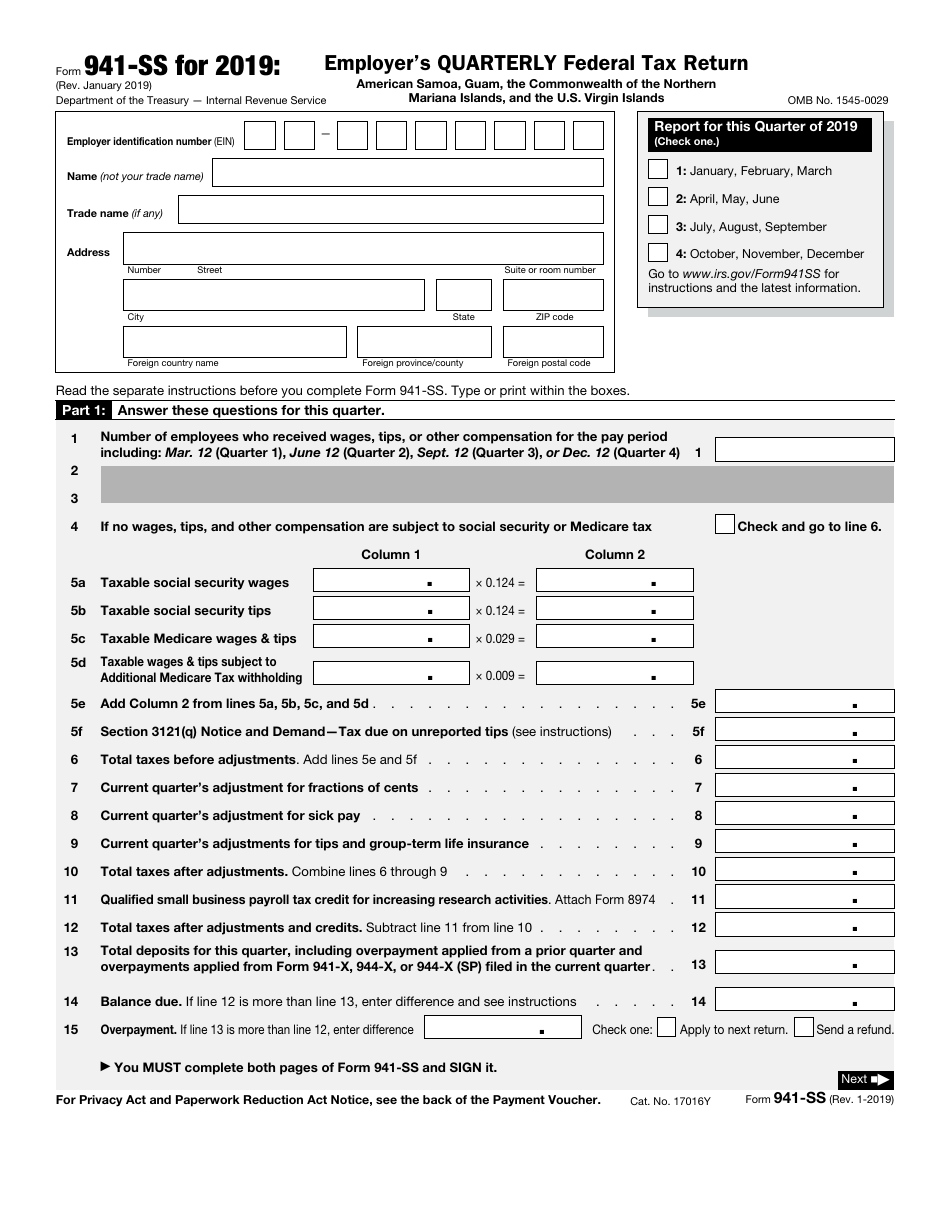

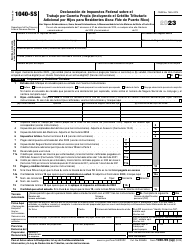

IRS Form 941-SS Employer's Quarterly Federal Tax Return

What Is Form 941-SS?

IRS Form 941-SS, Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands - also known as the Employer's Quarterly Federal Tax Return - is a form used to report the amount of social security and Medicare taxes withheld from employees' paychecks and to pay the employer's share of the Medicare or social security taxes. This form is used only if the principal place of business is located within the above-mentioned territories.

The form is issued by the Internal Revenue Service (IRS) every year and the most recent version of the form was released on January 1, 2019 . A fillable IRS Form 941-SS is available for download below.

The form is filed at the end of each quarter. The due dates for each quarter are the last day of the month following the last month of the quarter. If the due date falls on a legal holiday, Sunday or Saturday, the deadline is the next business day. If the form is filed late, the employer will be subject to a penalty for 5% from the unpaid tax for each month the form is late. The maximum amount of the penalty is 25%. However, if the form is filed with a reasonable explanation, the penalty may be avoided.

Instructions for Form 941-SS

-

Part 1. Questions for the quarter.

- Boxes 1 to 4 are self-explanatory;

- Line 4. Check the box, if no wages, tips or other compensation are subject to social security or Medicare tax and skip Lines 5a-d;

- Lines 5a-d. Enter the number of wages or tips in Column 1, multiply it by the number given on the form and enter the result in Column 2;

- Line 5e. Add numbers from Column 2 from Lines 5a-d and enter the result;

- Line 5f, Section 3121(q) Notice and Demand-Tax due on unreported tips. Enter the tax due on tips your employers failed to report to you;

- Line 6, Total taxes before adjustments. Add numbers entered in lines 5e and 5f and enter the result;

- Lines 7-9. Enter the negative amount of tax adjustments;

- Line 10, Total taxes after adjustments. Combine numbers from lines 6-9 and enter the result;

- Line 11, Qualified small businesspayroll tax credit for increasing research activities. Enter the amount of credit shown on your IRS Form 8974, Qualified Small BusinessPayroll Tax Credit for Increasing Research Activities;

- Line 12, Total taxes after adjustments and credits. Subtract the number entered in Line 11 from the one entered in Line 10;

- Line 13, Total deposits for this quarter, including overpayment applied from a prior quarter and overpayments applied from Form 941-X, 944-X, or 944-X (SP) filed in the current quarter. Self-explanatory;

- Lines 14 and 15. If the amount in Line 12 is bigger than the one entered in Line 13, fill line 14. Otherwise, fill line 15. Fill only one line.

-

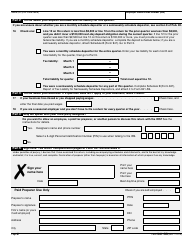

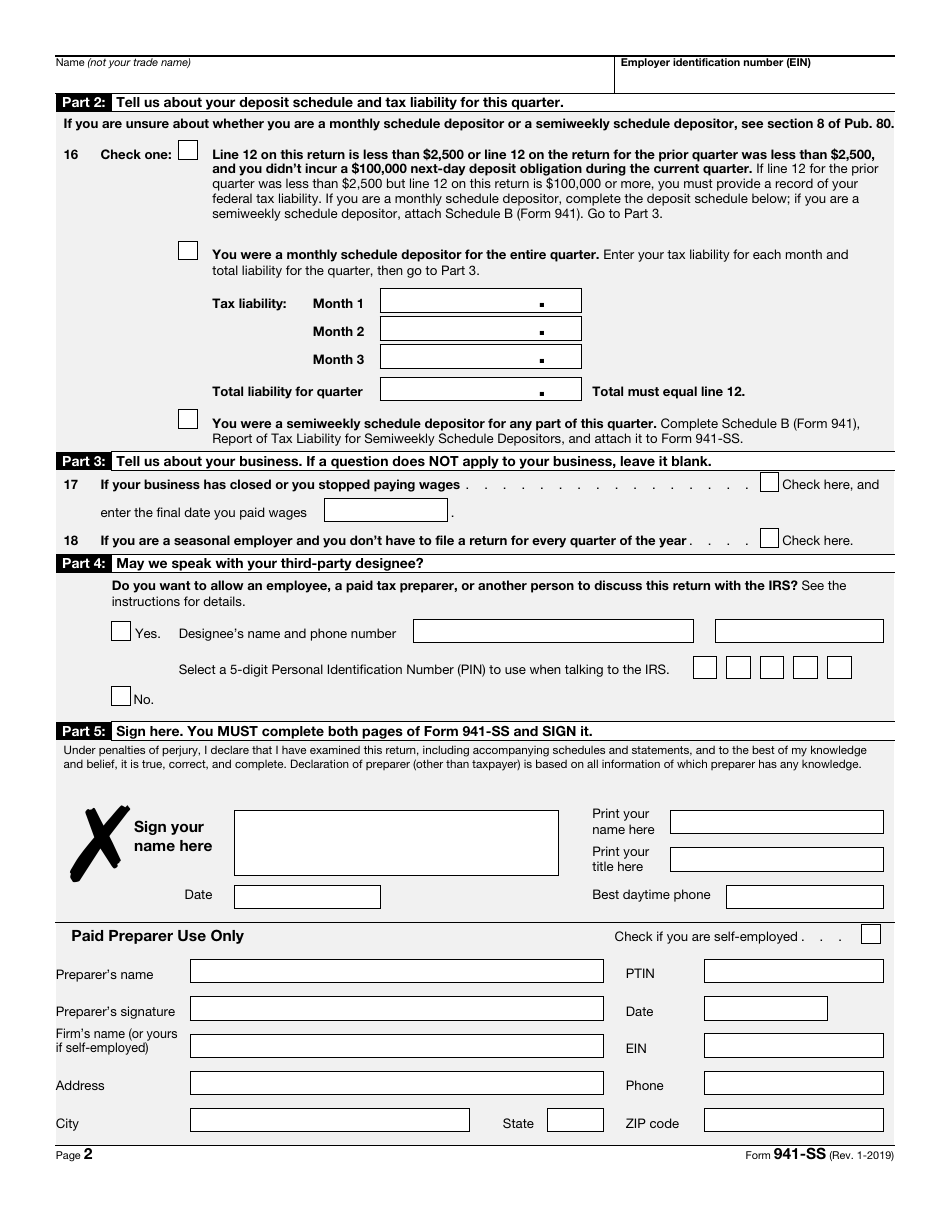

Part 2. Information about your deposits.

- Line 16. Check the applicable box and provide information about your tax liability, if it applies.

-

Part 3. Fill this part only if it applies to you.

- Line 17. If your business closed and you stopped paying wages, check the box and enter the date you paid wages for the last time;

- Line 18. If you are a seasonal employer, check the box.

-

Part 4. Third-party designee.

- If you want a third-party designee to discuss this form with IRS, provide their name, and phone number, assign a 5-digit Personal Identification Number (PIN) for contacts with IRS. Otherwise, check the applicable box and skip this part.

-

Part 5. Signature field.

- Print your name and title, provide your best daytime phone number, sign and date the form. If you are paid to prepare IRS Form 941-SS, fill the For Paid Preparer Use Only part. Check the box, if you are self-employed. Provide your name, the name of your firm, Preparer Tax Identification Number (PTIN), EIN and sign the form.

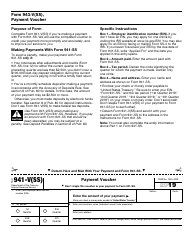

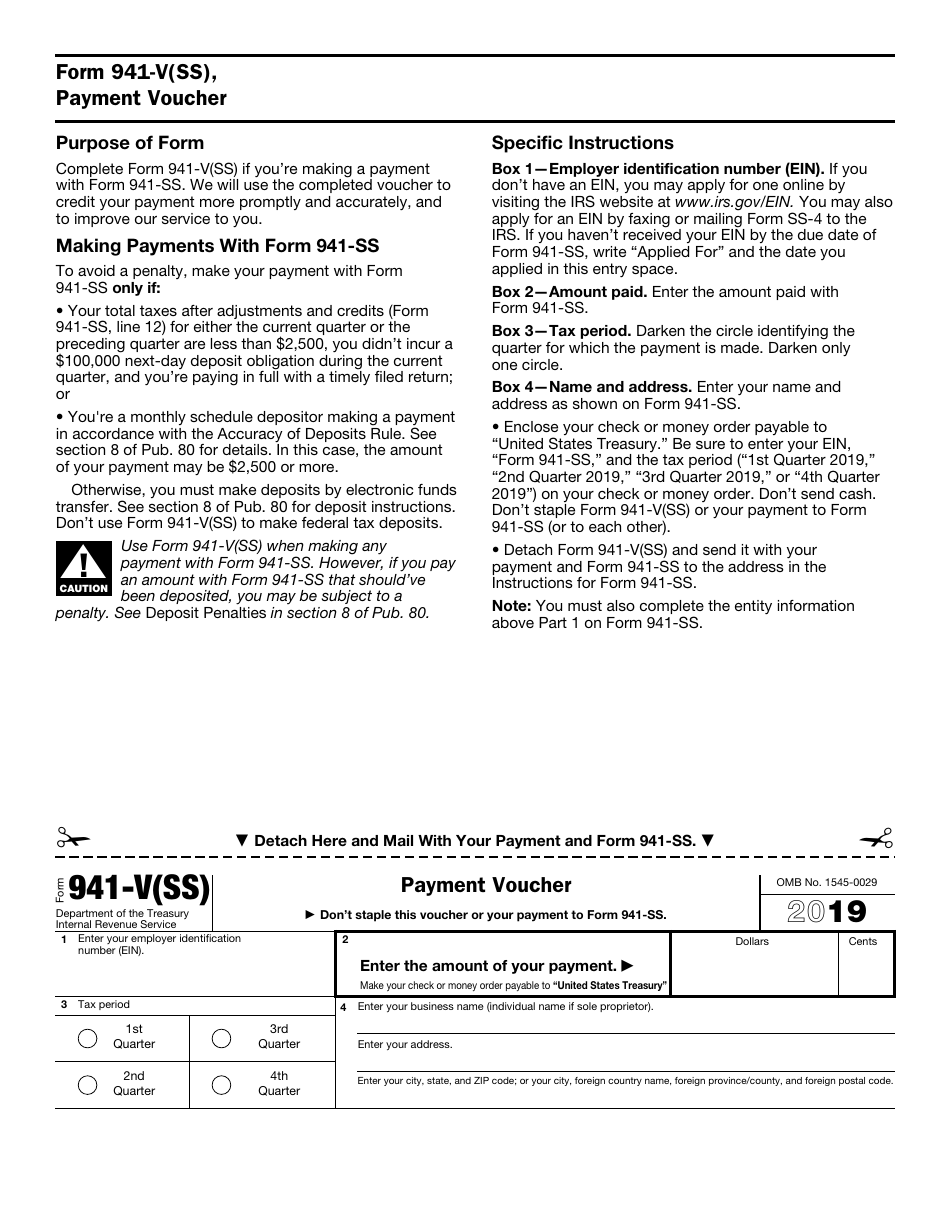

- Paying Voucher. If you are including the payment with your IRS Form 941-SS, fill the voucher, entering your EIN, amount of payment and address. Check the applicable box, indicating the quarter you are paying for. Do not staple the voucher to the form.

Where to Send Form 941-SS?

Form 941-SS mailing address depends on whether the payment is included with the form and the type of the organization filing the return. The complete list of the mailing addresses can be found in the official IRS-issued instructions.

IRS 941-SS Related Forms:

- IRS Form 941, Employer's Quarterly Federal Tax Return. This form is used for the same purpose as the IRS form 941-SS but used within all U.S. Territories.

- IRS Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund. This form is necessary if there is a need to correct mistakes on IRS Form 941-SS or IRS Form 941.