This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 941

for the current year.

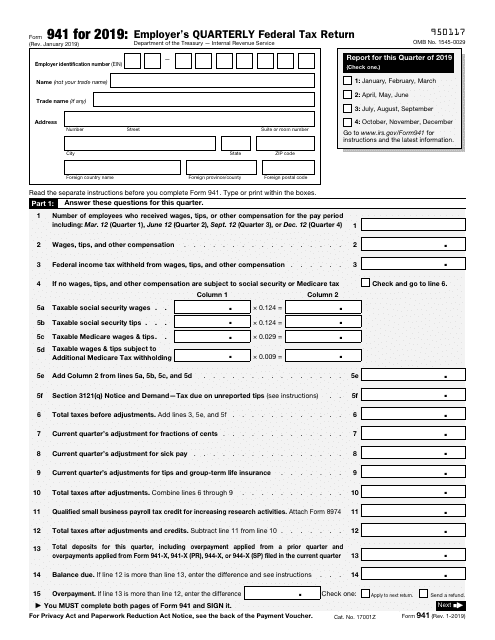

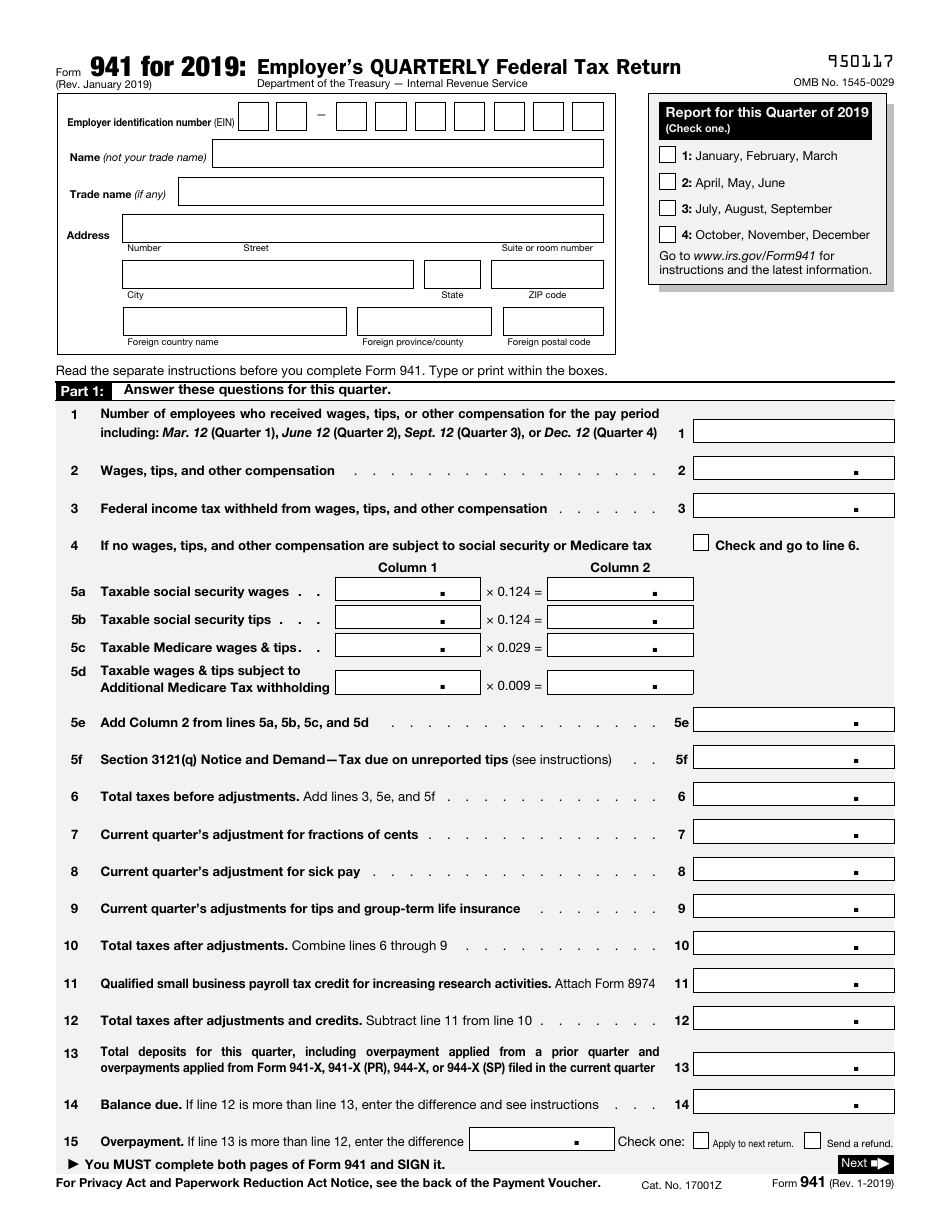

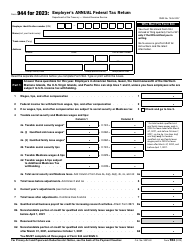

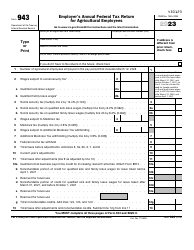

IRS Form 941 Employer's Quarterly Federal Tax Return

What Is Form 941?

IRS Form 941, Employer's Quarterly Federal Tax Return is a form used by employers to report income taxes, social security taxes or Medicare taxes withholding from employee's paychecks. This form is also necessary to pay the employer's share of social security or Medicare tax.

The most recent version of the Employer's Quarterly Federal Tax Return was issued by the Internal Revenue Service (IRS) on January 1, 2019 . A fillable version of the IRS Form 941 is available for download below.

If an employer pays wages subject to income tax withholding or social security and Medicare taxes, they must use IRS Form 941 each quarter. If they received a notification to file the form, they should file it annually, in which case a quarterly report is not required. Household employers are not required to file the form, either. Farm employers are not required to file the quarterly report for wages paid for agricultural labor and seasonal employers do not have to file the form for quarters during which they did not operate.

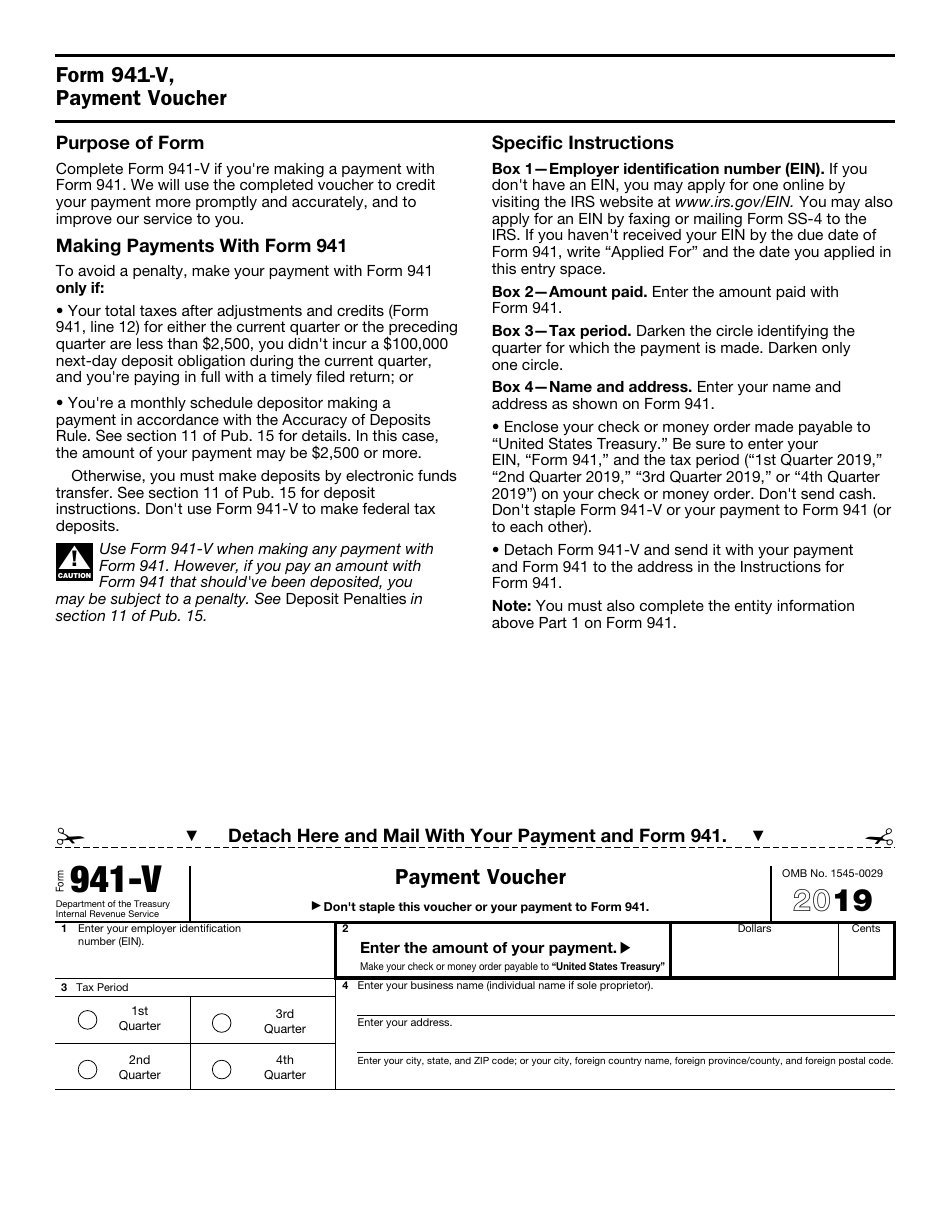

The form includes IRS Form 941-V, Payment Voucher . It is used to pay the employer's share of taxes. The voucher should be mailed along with the main form.

When Is Form 941 Due?

The form is due on the last day of the month that follows the last month of each quarter. Form 941 due date is April 30 in the first quarter, July 31 in the second quarter, October 31 in the third quarter, and January 31 in the fourth quarter.

The mailing address for Form 941 depends on the location of the business and whether the payment is included with the form. The mailing addresses can be found in the IRS-issued instructions for completing the return. The form can also be submitted electronically.

If the form is filed late, the IRS imposes a 5% penalty from the unpaid tax for each month the form is late. The maximum amount of the penalty is 25%. However, if the reason for late filing is considered reasonable by the IRS, the penalties may be avoided.

IRS Form 941 Instructions

The IRS provides official instructions for completing the form. Additional guidelines and a step-by-step walkthrough can be found below.

How to Complete Form 941?

-

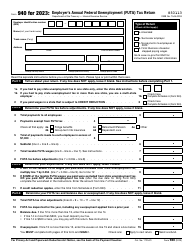

Check the applicable box, indicating the quarter the report is filed for;

-

Provide your Employer Identification Number (EIN), your name, your business trade name, if any, and your mailing address;

-

Part 1. Answer the questions for the reported quarter:

- Line 1. Enter the number of employees that received wages, tips or other compensations during the reported period. Do not include household employees, employees in a nonpay status for the pay period, farm employees, pensioners, or active members of the Armed Forces;

- Lines 2-4 are self-explanatory;

- Lines 5a-d. Enter the total amount of taxable wages or tips in Column 1, multiply it by the given number and enter the result in Column 2;

- Line 5e. Add numbers from Lines 5a-d;

- Line 5f. Enter the tax due from your Section 3121(q) Notice and Demand;

- Line 6. Enter the total amount of taxes before adjustments. To calculate this number, add numbers from items 3, 5e and 5f;

- Lines 7-9. Enter negative amounts of adjustments;

- Line 10. Enter the total amount of adjustments;

- Line 11. Enter the amount of credit from your Form 8974 and attach the form to the report;

- Line 12. Subtract the number from Line 11 from the Line 10 number and enter the received amount;

- Line 13. Enter your deposits for this quarter, including any overpayment from a prior quarter that you applied to this return;

- Lines 14-15. If the amount in Line 12 is bigger than Line 13, enter the difference on Line 14. In the opposite case, fill line 15;

-

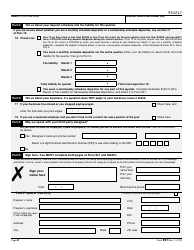

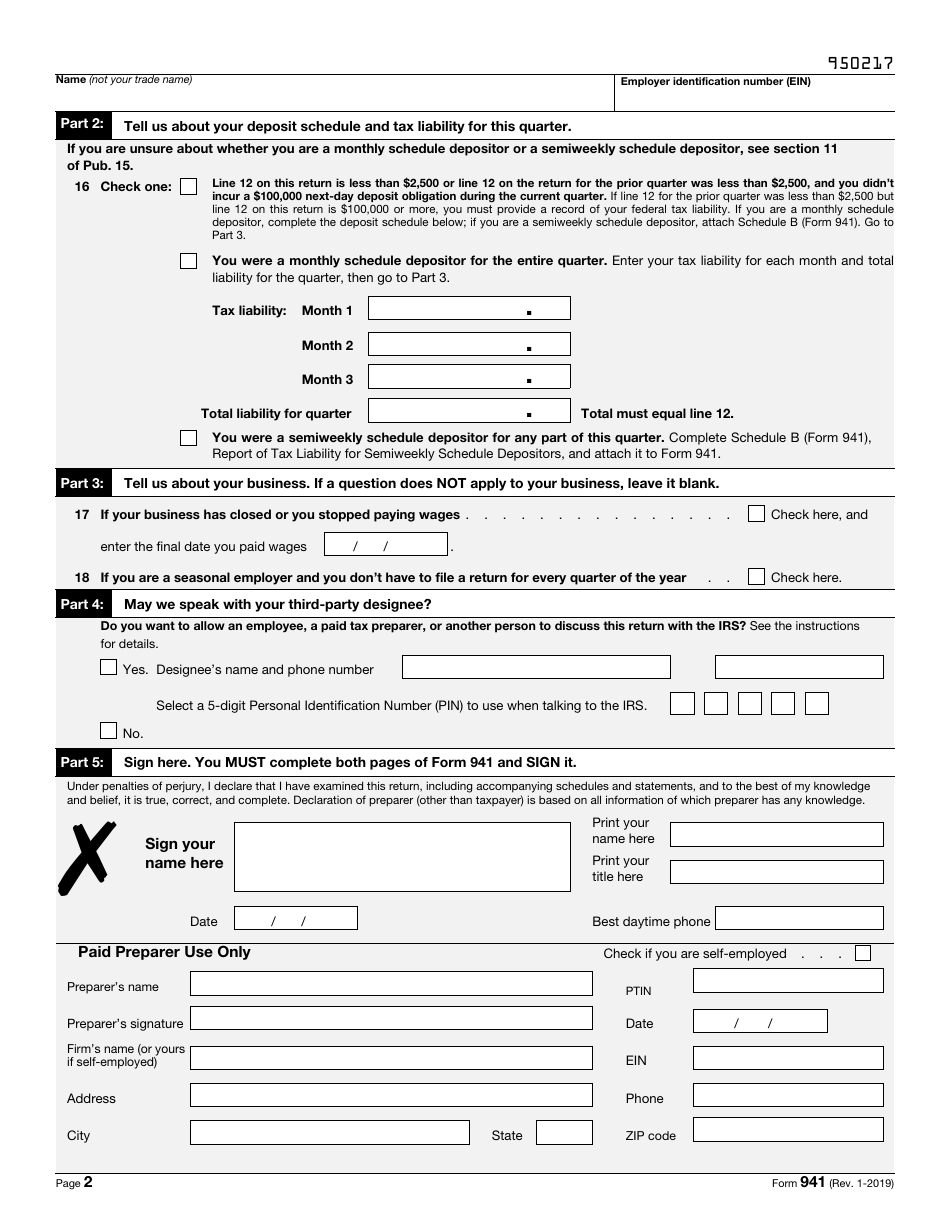

Part 2. Provide information about your deposit schedule and tax liability for the reported quarter:

- Line 16. Check the applicable box and provide additional information, if necessary;

- Part 3. Provide information about your business, if applicable;

- Line 17. Check the box, if your business has closed or you stopped paying wages and enter the final date you paid wages;

- Line 18. Check the box, if you are a seasonal employer;

-

Part 4. Indicate, whether you want to assign your third-party designee to discuss this form with the IRS and provide their name and phone number and select a 5-digit Personal Identification Number (PIN) to use when communicating to the IRS;

-

Part 5. Sign and date the form, print your name and title and provide your best daytime phone;

-

If you were paid to prepare IRS Form 941, fill the last part of the form. Check the box, if you are self-employed. Provide your name, firm's name, address, Preparer tax identification number (PTIN), EIN and sign the form;

-

If you are including a payment with your return, fill the payment voucher. Provide your EIN, tax period, the amount of payment in dollars and cents, business name and your address.

How to Amend Form 941?

If you found out that your return contains mistakes or lacks necessary information, file an IRS Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund.

IRS 941 Related Forms:

- IRS Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund. This form is used to correct mistakes in the previously filed quarterly report.

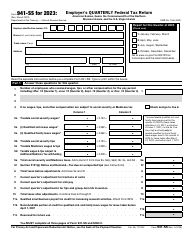

- IRS Form 941-SS, Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands. This form is used only by businesses located and operating on these territories.

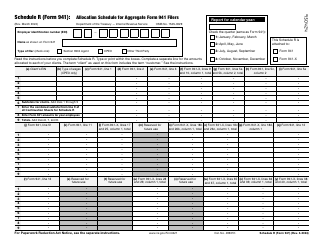

IRS Form 941 schedules include:

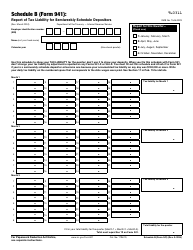

- Schedule B, Report of Tax Liability for Semi-weekly Schedule Depositors. This schedule is filled by semi-weekly depositors. If an employer has reported more than $50,000 of employment taxes in the lookback period or accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year, they are considered a semi-weekly depositor;

- Schedule D, Report of Discrepancies Caused by Acquisitions, Statutory Mergers, or Consolidations is used to explain discrepancies between Form W-2, Wage, and Tax Statement and Form 941;

- Schedule R, Allocation Schedule for Aggregate Form 941 Filers. This schedule is used by certified professional employer organizations (CPEOs) and agents approved under IRC section 3504 to allocate the aggregate information reported on Form 941 to each client.