This version of the form is not currently in use and is provided for reference only. Download this version of

CBP Form 5106

for the current year.

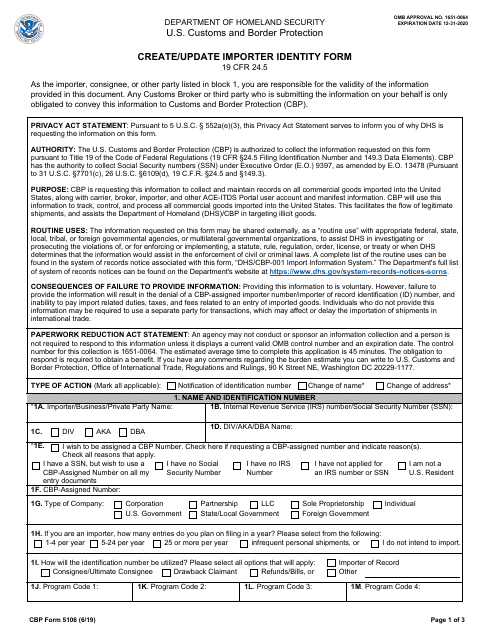

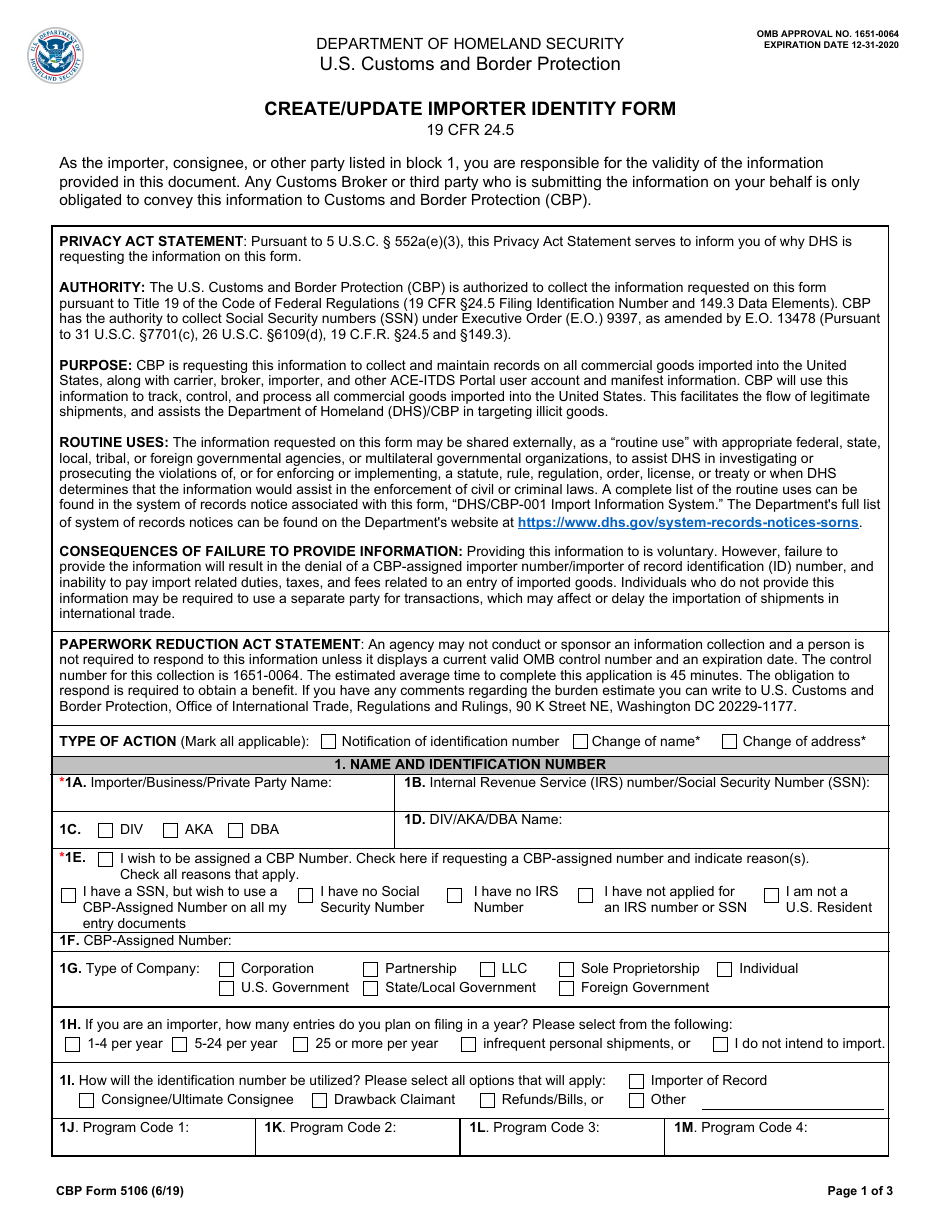

CBP Form 5106 Create / Update Importer Identity Form

What Is CBP Form 5106?

CBP Form 5106, Create/Update Importer Identity Form , is a document you fill out in order to establish or update an Importer Account with Customs and Border Protection (CBP). The latest version of the form was released on June 1, 2019 . You can download a CBP Form 5106 fillable copy through the link below.

What Is CBP Form 5106 Used For?

CBP 5106 Form is filled out by every person, government agency, business firm, or any other organization that files an import entry. The document is submitted with the first formal entry or request for services. The information provided via create/update importer identity form is used to enter a new importer into the CBP's database or correct the file of a registered importer. The document is required in the following cases:

- To establish a new Importer Account.

- To reactivate a voided importer number.

- To change the name or address indicated in the Importer Account.

- To update a legal designation.

How to Fill Out CBP Form 5106?

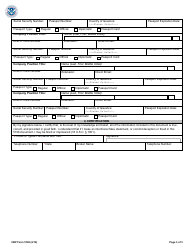

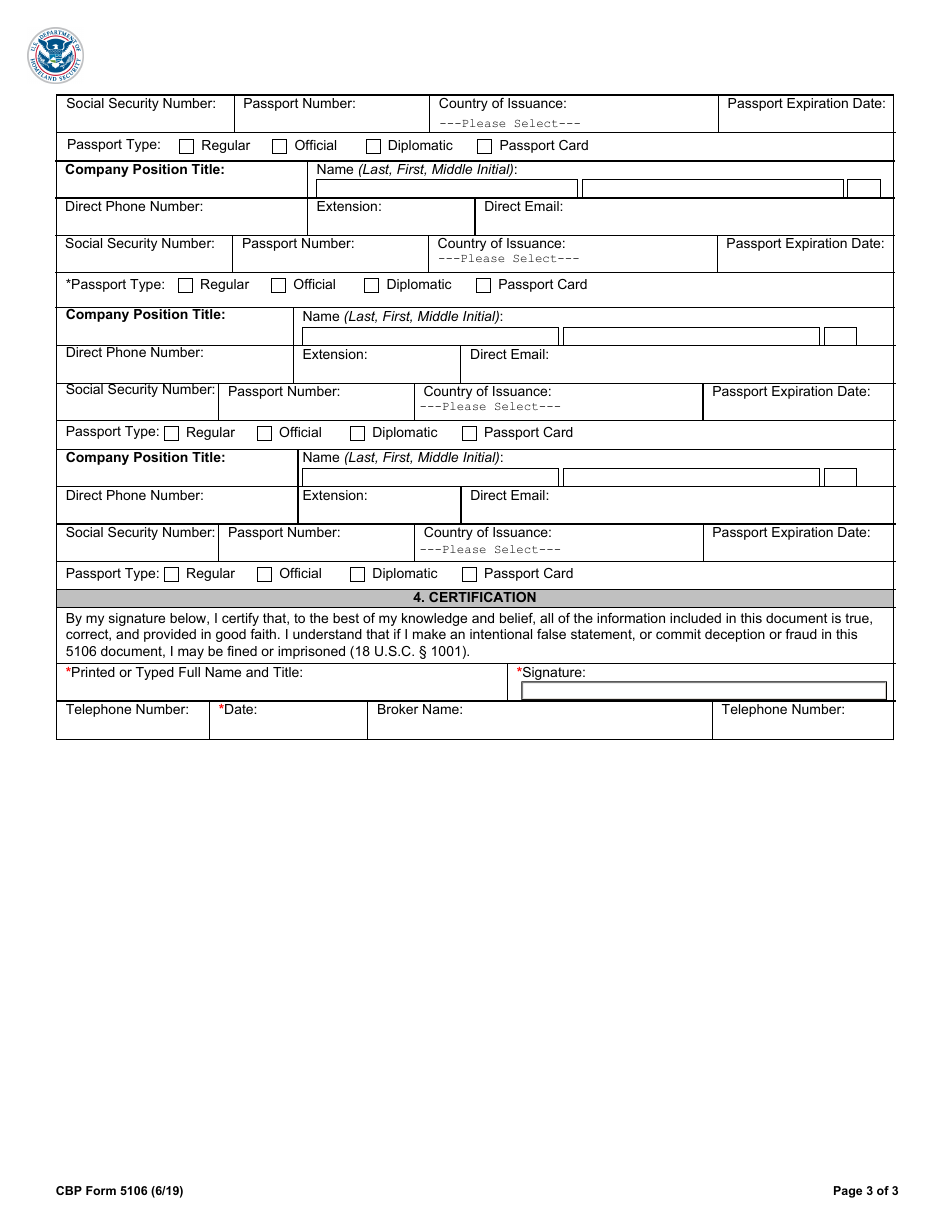

The CBP 5106 Form Instructions are provided on the third and fourth pages of the document. Read them carefully, detach them, and keep them for future reference.

The document consists of four pages. The first two are the form you need to fill out. All the boxes marked with a red asterisk are obligatory for completion. Complete the CBP Form 5106 as follows:

- Choose the reason you submit this form in "Type of Action." If you want to change something other than the name or address, leave this part blank.

- Provide all the required data about an individual or organization that will import goods into the U.S. or is seeking service or payment in "Section I, Name and Identification Number."

- Box 1B requires either an Internal Revenue Service (IRS) Number or Social Security Number (SSN). If you have neither, enter "None" in this box.

- If an importer is also known under another name (AKA), conducts business under another name (DBA), or is a division of another company (DIV), check the appropriate box in Box 1C. Fill out Box 1D only if you used Box 1C.

- Complete Box 1E only if you require a CBP-Assigned Number. If you already have an IRS employer identification number, it will be automatically used as your importer identification number and no CBP-Assigned Number will be issued.

- Fill out Box 1F if you already have a CBP-Assigned Number and request a change in the first box. Specify an estimate of entries you plan to import into the U.S. in Box 1H (for the importer record only).

- If you are an active participant of a CBP Partnership Program, indicate the program codes in Boxes 1J through 1M and leave Section III of this form blank.

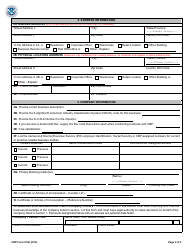

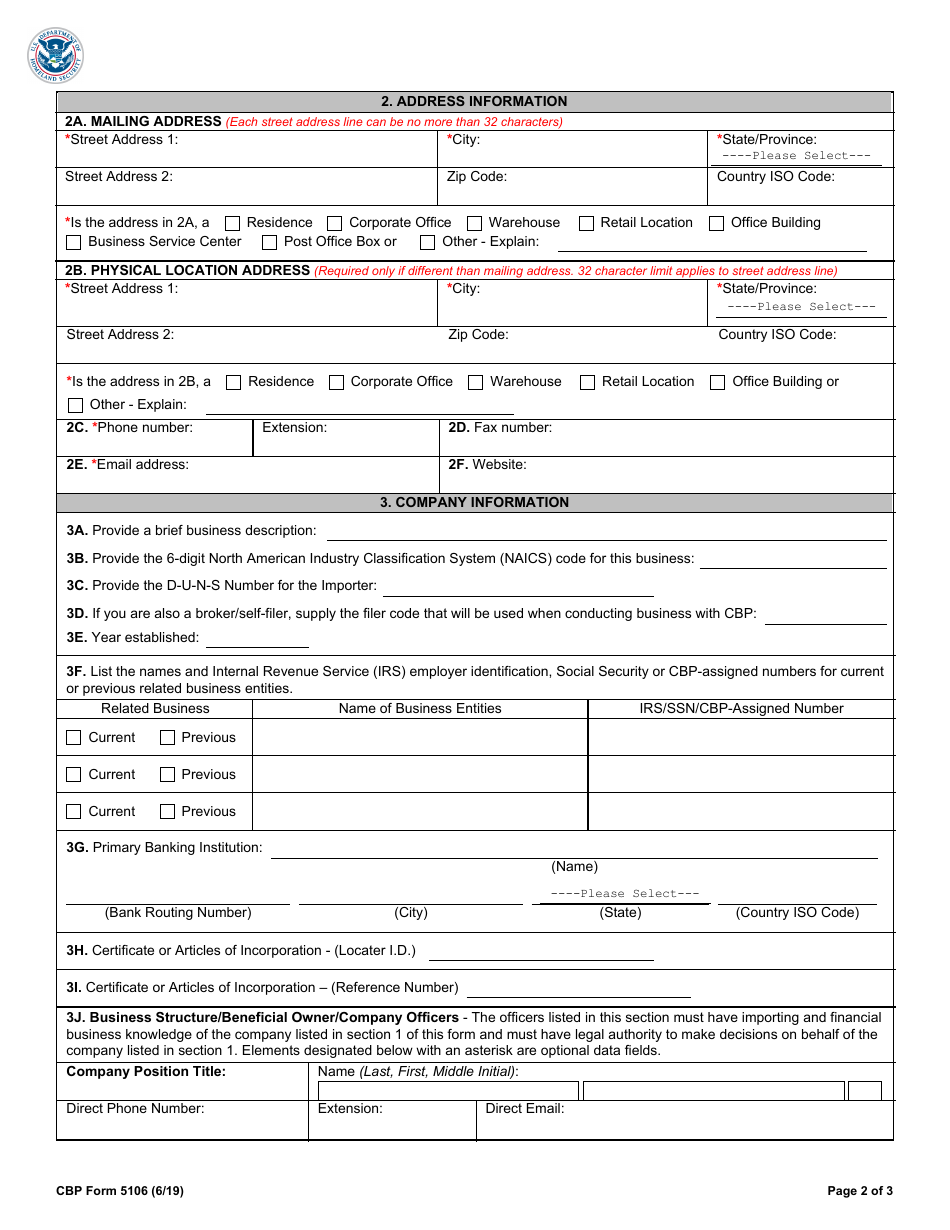

- provide your contact information in "Section II, Address Information."

- Provide a physical location or a P.O. box number in "Box 2A, Mailing Address." Do not forget to indicate city and state.

- Enter the physical address associated with you or your business in "Box 2B, Physical Location Address." A P.O. Box or Business Service Center are not valid addresses for this box. If your physical address coincides with your mailing address, you do not need to enter it again.

- Section III is optional. However, if you indicated in Box 1E that you have an SSN, but wish to use a CBP-Assigned Number, you are required to provide your name, SSN, and company position title in Box 3J.

Where to Submit CBP Form 5106?

Whether you establish your importer account, correct the present record, or reactivate your importer number, submit the completed CBP Form 5106 to your Port of Entry. Find the contacts of all Ports of Entry on the CBP official website.