This version of the form is not currently in use and is provided for reference only. Download this version of

SBA Form 159

for the current year.

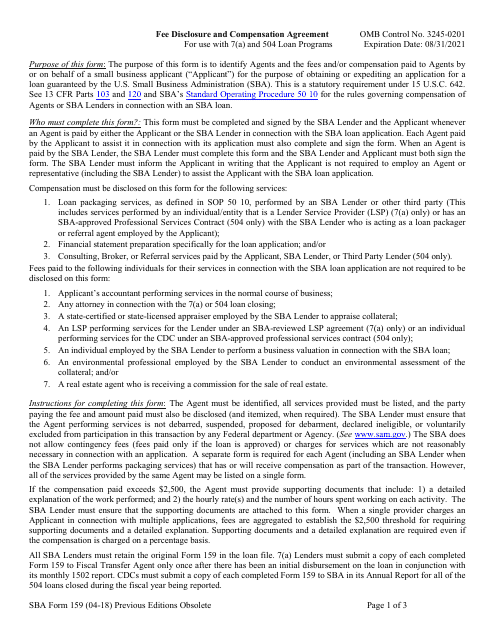

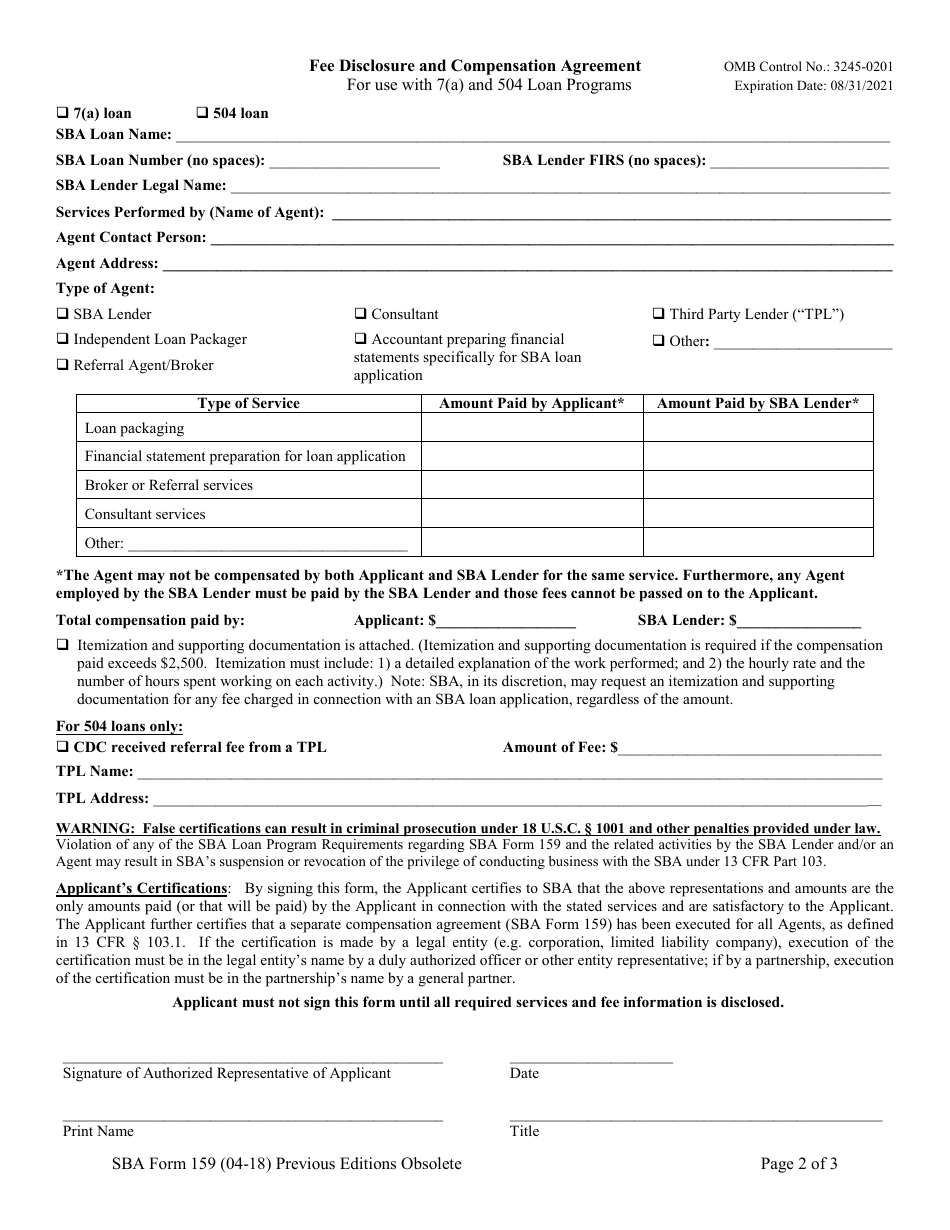

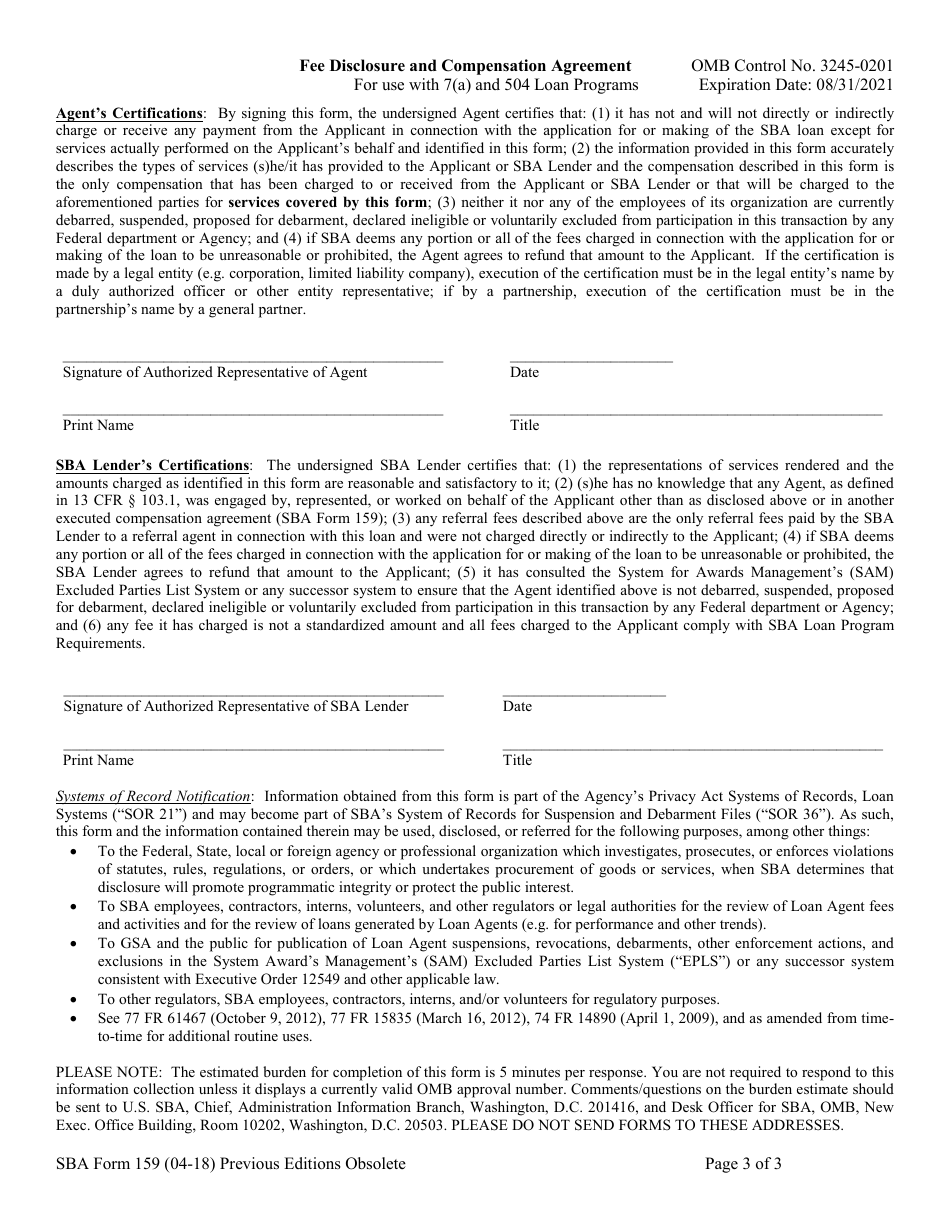

SBA Form 159 Fee Disclosure and Compensation Agreement

What Is SBA Form 159?

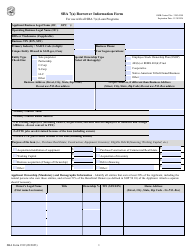

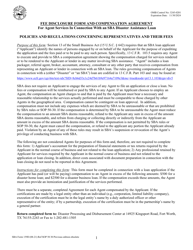

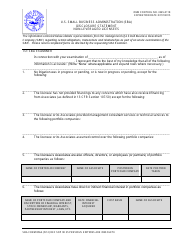

SBA Form 159, Fee Disclosure and Compensation Agreement is a form used to identify a third party agent hired by a small business owner for assistance in completing a Small Business Administration (SBA) loan application. The form is used with 7(a) and 504 Loan Programs and must be filed if an individual lender paid a fee to an agent for any assistance in completing their SBA loan application.

Loan packagers, accountants, brokers, consultants, and lawyers typically count as agents. The SBA might decide that the agent charged too much for their services and require the agent to provide a partial or full refund of all paid fees.

The latest version of the form was released by the SBA on April 1, 2018 , with all previous editions obsolete. An updated SBA Form 159 fillable version is available through the link below. The previously used SBA Form 159 (7a) is no longer hosted on the SBA website.

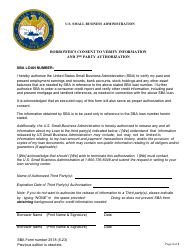

The SBA Form 159D (Fee Disclosure Form and Compensation Agreement for Agent Services in Connection With an SBA Disaster Assistance Loan) is a related form used to report using the services of an agent in connection with SBA Disaster Assistance loan applications.

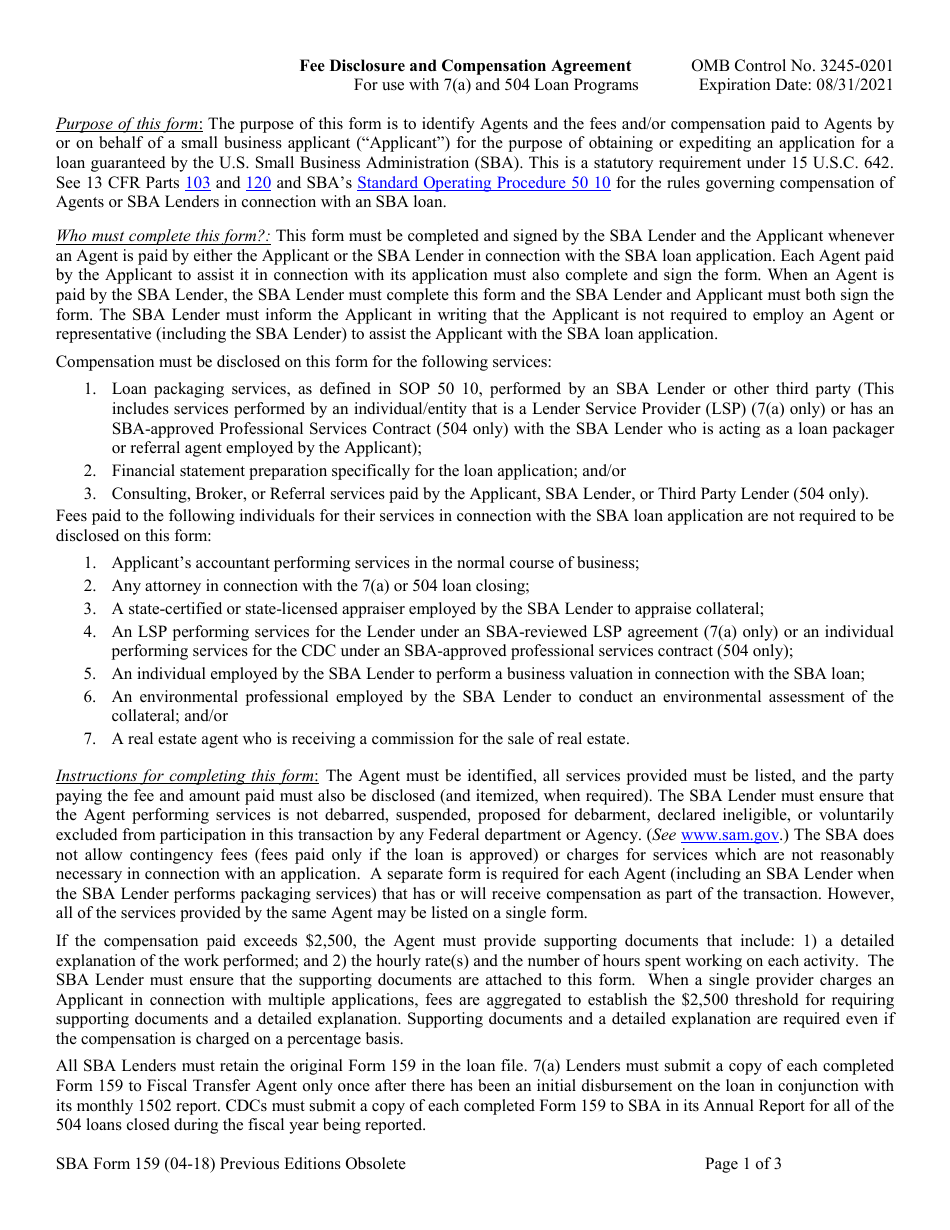

SBA Form 159 504 Program

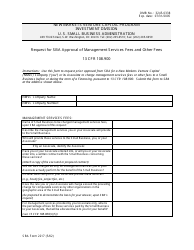

SBA 504 loans provide commercial real estate financing for owner-occupied properties. These loans require a 10% down payment by the small business owner and have funding amounts ranging from $125,000 to $20 million. The 504 loan program is run through Certified Development Companies - or CDCs. The CDC may act as a referral agent to a third party lender. In this case, the CDC should disclose any fees received from that third party lender.

The SBA Form 159 is a part of the paperwork required to apply for the SBA 504 loan. The other necessary forms include the SBA Form 1919, SBA Form 912 and the SBA Form 413.

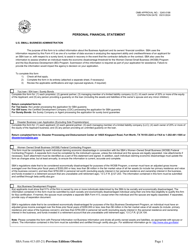

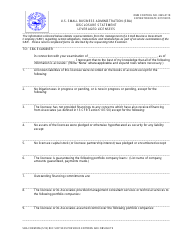

The SBA Form 1919 provides the Small Business Administration with information on the borrower. The SBA Form 912 is used to compile a personal history of the borrower to evaluate their trustworthiness. The SBA Form 413 is a personal financial statement used for evaluating the borrower's ability to repay the loan.

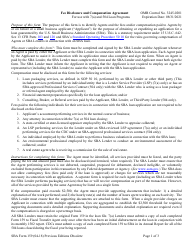

SBA Form 159 Instructions

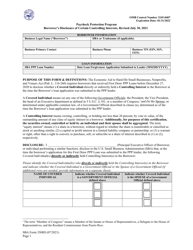

The form has to be filled out and submitted by SBA loan applicants that have hired an agent or accountant to help with applying for the loan. Each agent should be identified on a separate form. There are several categories of agents that do not need to be reported via the SBA 159:

- State-licensed and state-certified appraisers hired to appraise collateral with the loan;

- Environmental professionals evaluating collateral in connection with the loan;

- Real estate agents receiving commissions for the sale of real estate in connection with the loan;

- Lender service providers operating under an SBA-approved agreement;

- Individuals hired for business valuation;

- Attorneys hired for assistance with the 7(a) loan closing.

How to Fill Out SBA Form 159?

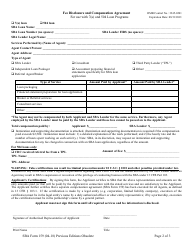

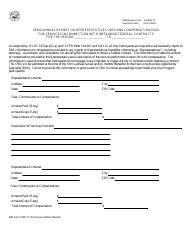

- The Borrower has to select the type of a loan they will be applying for (either the SBA 504 loan or the SBA 7(a) loan). The first three lines of the form require the Borrower's name from their loan application along with their SBA loan number and the Lender's FIRS. An SBA district office can be contacted for assistance with the FIRS ID;

- The next four lines require the Lender's legal name, the name of the agent performing the services, an agent's point of contact for further information and the agent's address;

- The next block of the SBA 159 - Type of Agent - requires specifying the agent's occupation. The blank chart below the checklist is for listing the amounts of money paid by the Borrower and their SBA Lender for each provided service;

- The agents may not be compensated for the same service by both the Borrower and the Lender. The agent has to specify the type of services rendered, the hourly rate and the number of billed hours for each service with payments exceeding $2500;

- The next block is filled out only by Borrowers applying for a 504 Loan. This block should contain information on any referral fees from third-party Lender received by the Borrower's CDC;

- The certification block requires the Borrower's full name, title, signature, and the date of filing the form.