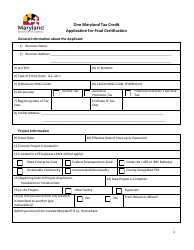

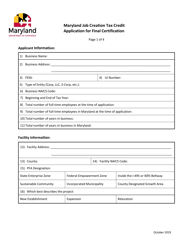

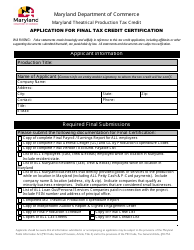

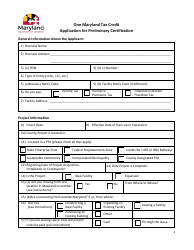

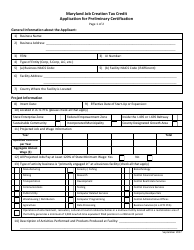

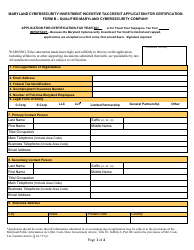

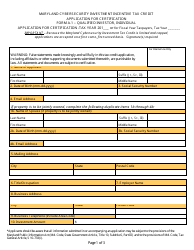

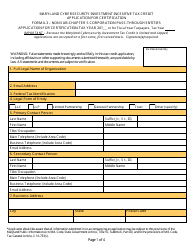

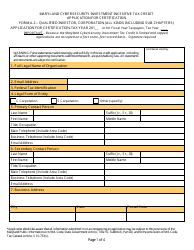

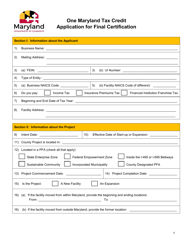

Application for Certification - Maryland Small Business Relief Tax Credit - Maryland

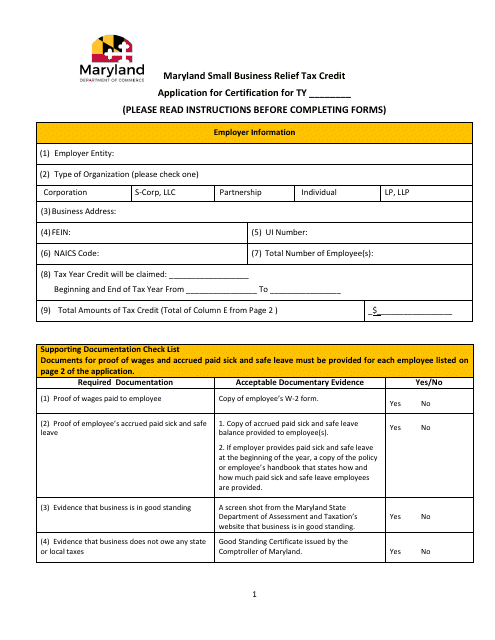

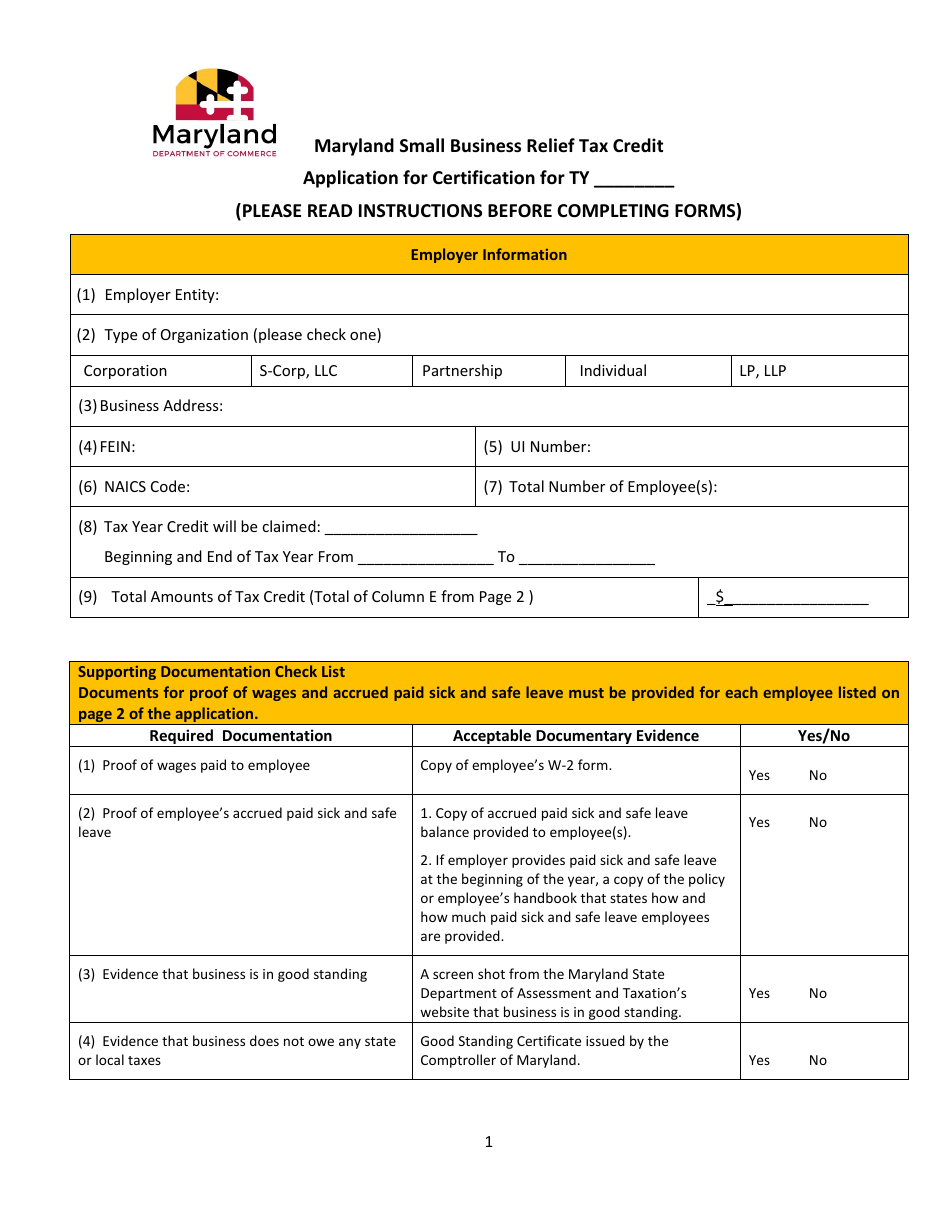

Application for Certification - Maryland Small Business Relief Tax Credit is a legal document that was released by the Maryland Department of Commerce - a government authority operating within Maryland.

FAQ

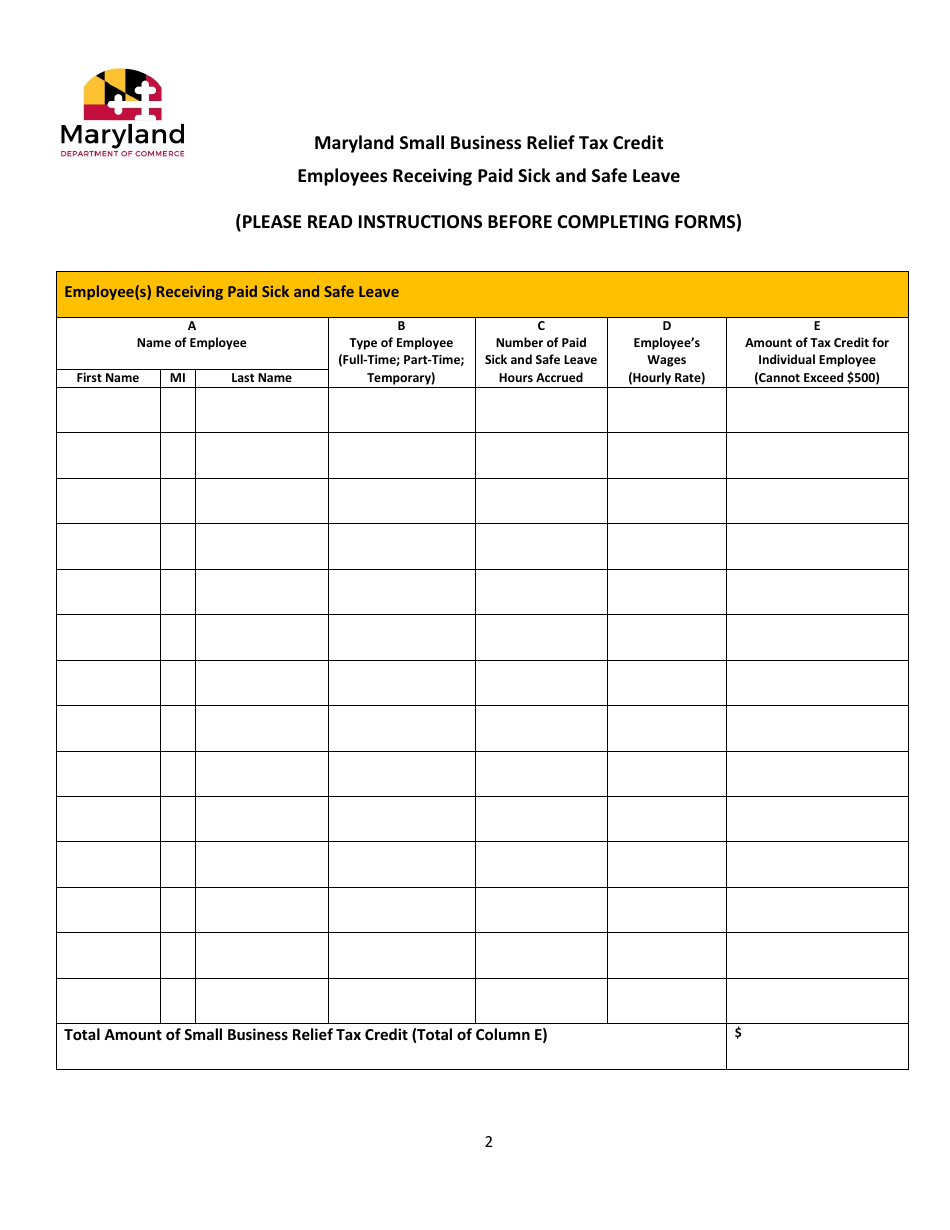

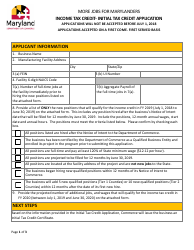

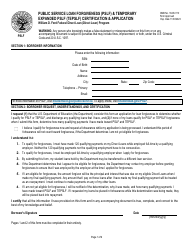

Q: What is the Maryland Small Business Relief Tax Credit?

A: The Maryland Small Business Relief Tax Credit is a tax credit program offered by the state of Maryland to provide financial assistance to small businesses.

Q: Who is eligible for the Maryland Small Business Relief Tax Credit?

A: Small businesses located in Maryland that have been adversely affected by COVID-19 may be eligible for the tax credit.

Q: What expenses does the tax credit cover?

A: The tax credit can be used to offset certain expenses, such as employee salaries and wages, rent or mortgage payments, and inventory costs.

Q: How much is the Maryland Small Business Relief Tax Credit?

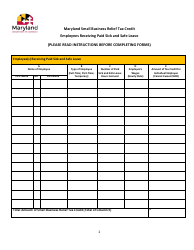

A: The amount of the tax credit can vary based on certain factors, such as the number of full-time employees and the amount of eligible expenses incurred by the business.

Q: Can I receive the Maryland Small Business Relief Tax Credit if I have received other COVID-19 relief funds?

A: Yes, you may still be eligible for the tax credit even if you have received other COVID-19 relief funds. However, you cannot use the tax credit to cover the same expenses that were already reimbursed by other funds.

Form Details:

- The latest edition currently provided by the Maryland Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Commerce.